30 June 2020

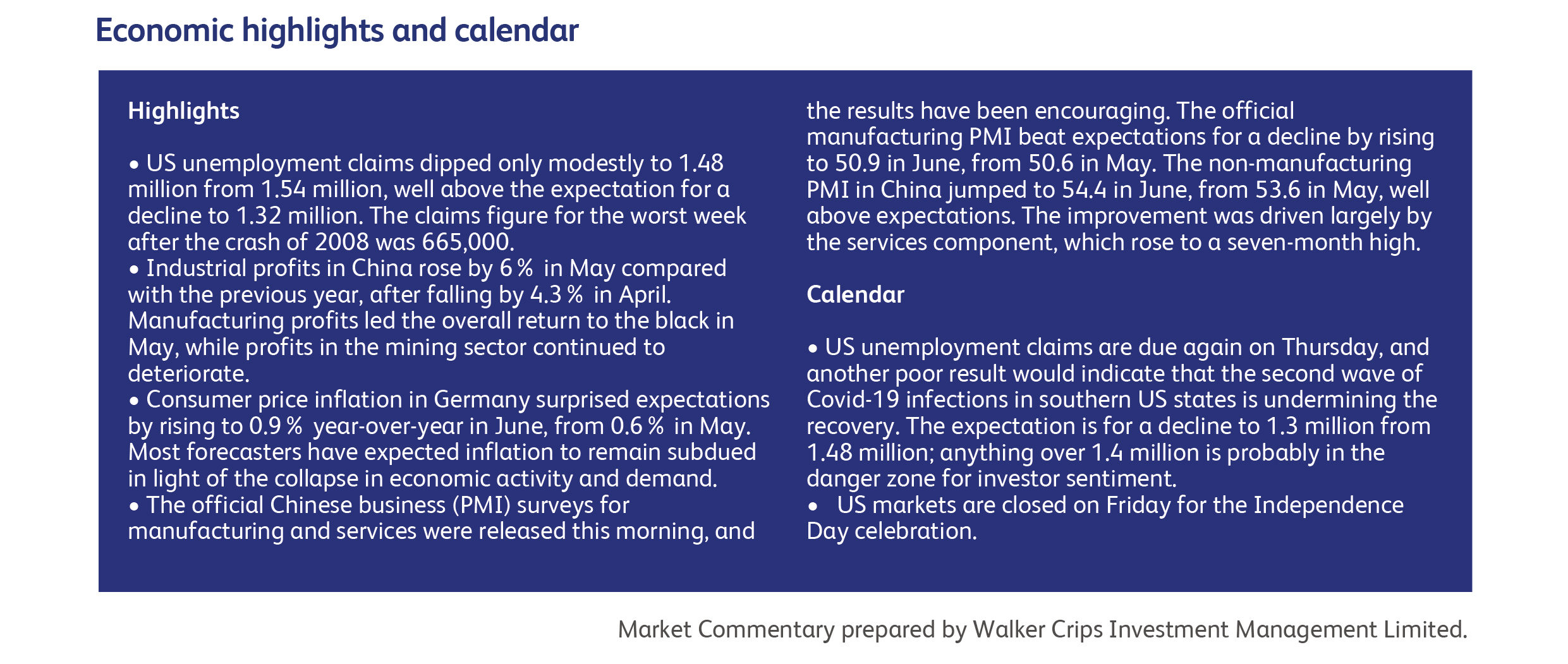

America’s patchwork response to the pandemic is, predictably, unravelling. With different states following different rules in the absence of credible federal leadership, the virus was never extinguished and, worse, was reawakened by premature reopenings. The seven-day moving average number of new cases rose in 37 states last week, with increases of more than 100% in Florida, Idaho, and Louisiana. New cases rose by more than 50% in Arkansas, Georgia, Nevada, Ohio, Texas and Wyoming. Texas, the second-most-populous state (29 million), now faces the prospect of surging mortality rates. Harris County, which includes Houston, declared an emergency, and instructions have been issued to shelter in place. The counties around Dallas, Fort Worth, Austin and San Antonio have all seen their case numbers at least triple since the reopening began. Progressively tighter restrictions are being imposed in states hit by the virus and could jeopardise the economic rebound from the initial wave. Indeed, the apparent slowing of the fall in unemployment claims may be due substantially to the surge in Covid-19 infections: unemployment claims in Arizona jumped by 31.8% last week. Thursday’s US unemployment data will be worth watching.

Meanwhile, the government of the populous and industrial North-Rhine Westphalia region in Germany was forced to lock down several districts in response to a resurgence of infections, and Australia’s second most populous state is considering the return of social distancing restrictions after reporting its biggest one-day rise in new coronavirus infections in more than two months.

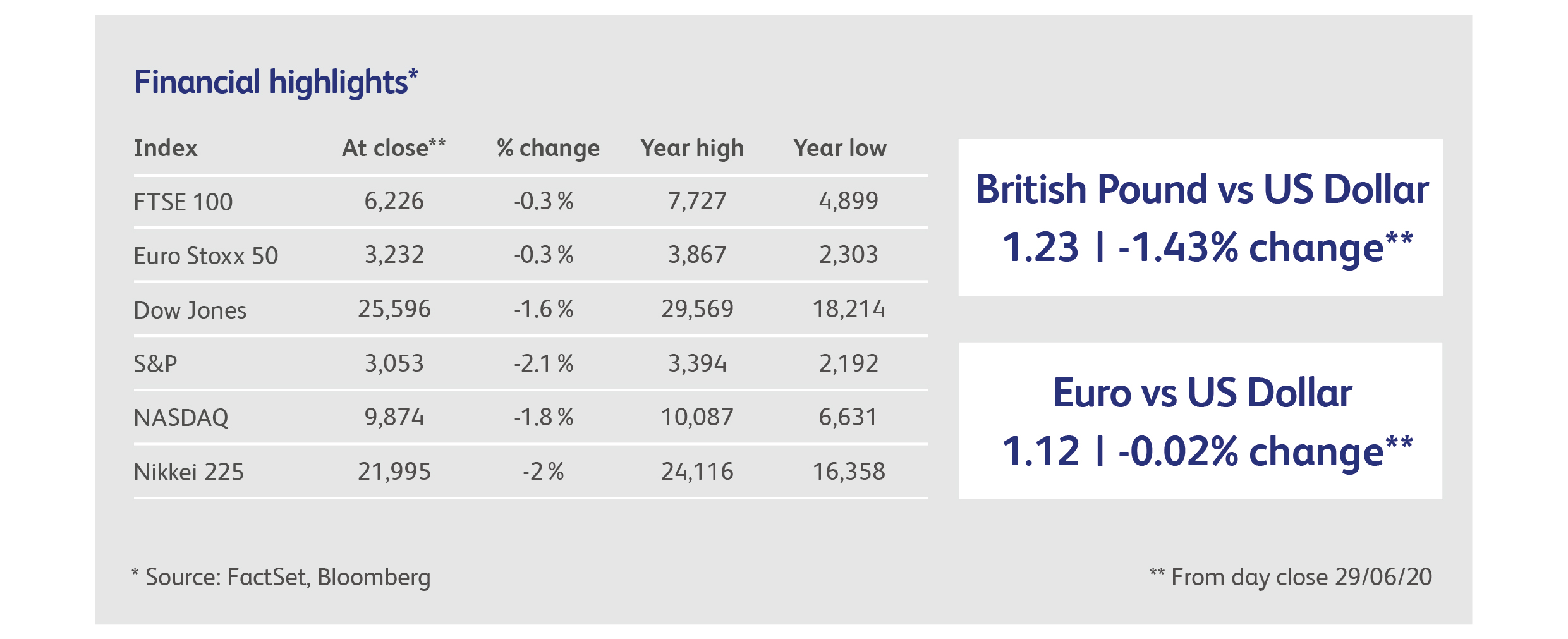

Anticipating slower growth, government bond yields fell significantly during the week, with 10-year Gilts touching their lows for the year at 0.15%. US Treasury yields reached their lowest in a couple of months. Currencies told a similar story, with safe havens outperforming and the US Dollar beginning to recover its losses. Equity markets fell, generally by several percentage points, before staging an unexpected, but partial, recovery. The critical question is whether the deteriorating medical data in the US will be enough to sour the sentiment in equities.

Fitch Ratings stripped Canada of its AAA status amid a spike in emergency spending for Covid-19, making it the first top-rated country to be downgraded by the ratings agency during the pandemic. The country is expected to run a bigger government deficit this year and emerge from the recession with much higher public debt ratios. Canada still has the top AAA rating with S&P Global Ratings, making it only one of two countries left in the Group of Seven to hold that status; Germany is the other.

Relations between the US and China continued to deteriorate. The Pentagon unveiled a list of companies allegedly owned or controlled by China’s military, opening them to increased scrutiny. The 20 companies included Huawei Technologies Co. and Hangzhou Hikvision Digital Technology Co., as well as a number of state-run enterprises. The Wall Street Journal reported that China has been threatening to pull back on purchases of US products under the Phase One Trade Deal.

In a potential early indication of post-pandemic political trends, French President Macron’s centrist party lost heavily in municipal elections, with the Greens joining with leftist allies to gain. The National Front party fared poorly overall, losing nearly half its seats, but did win in Perpignan - the first time it will be at the helm of a city of more than 100,000 inhabitants. While the mayors set policy on local issues from urban planning to education and the environment, the elections are seen more as a referendum on the government.

Chesapeake Energy, the poster child of the US shale oil revolution, filed for bankruptcy protection. The move comes as the company and industry more broadly has been rocked by a drop in oil and gas prices amid the coronavirus pandemic. Symbolising corporate America more broadly, Chesapeake’s management had recently shared a “retention bonus” of $25 million.

A number of large advertisers cut their advertising expenditure on Facebook in an attempt to force the website to limit hate speech and posts that divide and misinform, and also due to concern about adverts appearing next to inappropriate content. The boycotters include Unilever, Coca-Cola, Diageo and PepsiCo. Facebook shares shrugged off the problem, rising 2% the day after the news was announced.

Intu Properties, the British REIT that largely focuses on shopping center development and management has gone into administration. The company was not able to reach an agreement with its creditors to restructure its £4.5 billion debt. Its shopping centers will remain open under administrators KPMG as buyers are sought.

Nikola Corporation, the American hybrid truck design and manufacturing company, began taking deposits ranging from $250 to $5,000 for its Badger model electric pickup trucks. The company is trying to commercialise hydrogen-powered semis, and is aiming to produce a 300 mile battery only version and a 600 mile battery and hydrogen fuel cell version.

Uber Technologies Inc. has offered to buy the food-delivery service Postmates for about $2.6 billion. It is reported Uber began to put together a deal for Postmates after its attempt to buy GrubHub fell apart, with GrubHub eventually purchased by Just Eats.

Brazil and AstraZeneca have agreed a deal valued at $127 million to produce millions of doses of the Covid-19 shot AstraZeneca are developing with the University of Oxford. Brazil has been one of the hardest hit countries in terms of infections and deaths.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.