25 August 2020

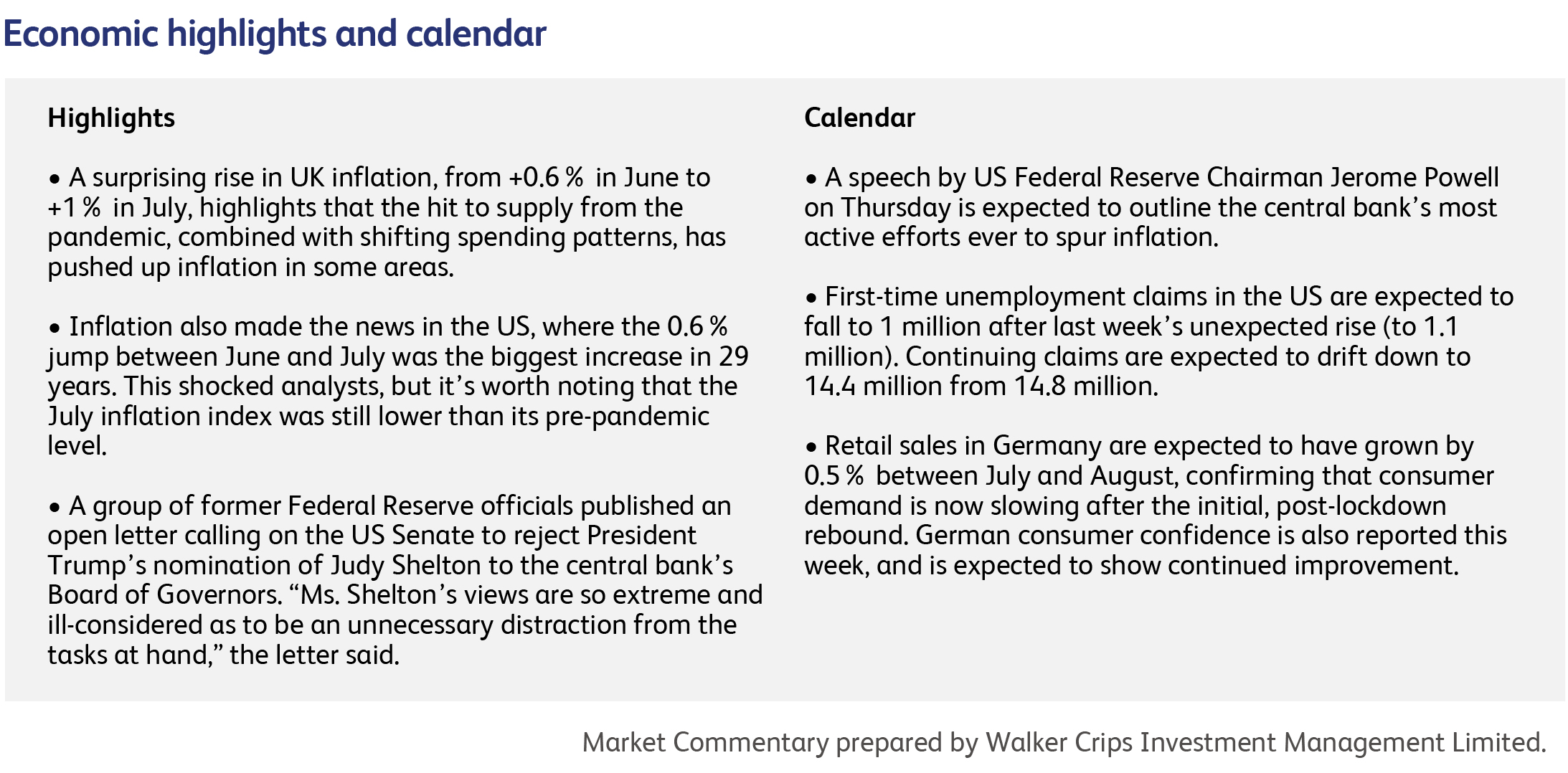

The latest round of global business activity surveys, covering the second and third week of August, confirmed that the recovery from the pandemic is occurring unevenly, in fits and starts, both within nations and across the world as a whole. Leading the pack was the UK, where both the manufacturing and, more importantly (because it is a far bigger part of the economy), the services sectors comfortably beat expectations. This suggests that the UK economy maintains its relatively strong pace of recovery from the lockdown-period. Given that the economy is still well below its pre-Covid level, there ought to be further scope for recovery. However, the experience of Europe, which is about a month ahead of the UK in dealing with the pandemic, suggests we should be cautious.

The results from the European business surveys showed a slump in the services sector far worse than anticipated. Combined with the lacklustre result in Friday’s European consumer sentiment survey, these data suggest that the European recovery is on the verge of stalling. It’s worth noting that the deceleration in activity is occurring even while consumers are charging ahead with purchases of retail goods, suggesting that pent-up, post-lockdown demand for consumption can co-exist with a broader deterioration in the economy. In Asia, meanwhile, Japan’s service sector survey also retreated from its July level; indeed, Japanese new orders, output and employment all registered steeper declines than in July.

These mini-business cycles appear to be related to the ebbing and flowing of the virus data and, in particular, the risk of lockdowns. UK business activity is still buoyed by the re-opening of the economy. European weakness in the services sector is likely to be linked to the re-imposition of travel restrictions in response to the second wave of Covid-19 cases. Japanese weakness may have been partly due to Japan’s own second wave and, in particular, local states of emergency declared in Okinawa and Aichi prefectures (though these would have been offset by government subsidies to promote domestic tourism). Business activity was strong in the US, and has gained momentum as the second wave recedes. The states at the leading edge of the second wave (Arizona, California, Florida, and Texas) have all recorded big declines in cases and hospitalizations. However, the trend in new daily cases in the US is far higher than in Europe, even now. This means that the virus continues to circulate widely so the risk of new outbreaks, especially in institutional settings like schools and universities, is still very real. Fear of a recurrence of the virus, even in states which have fully re-opened, will continue to hold down the recovery in the US as it is doing everywhere else.

Last week’s new all-time high for the US stockmarket’s S&P 500 Index suggests that investors, at least in some industry sectors, are not concerned by the economic side-effects of the pandemic. But if a once-in-a-century disaster does not discourage them, what will? As it happens, another once-in-a-century risk is just round the corner: the US election. The process for determining the winner in a US presidential election is governed by norms, not by laws. The potential for shenanigans is great, conflicts have happened before and, this time around, will be exacerbated by an explosion in postal voting. President Trump is already challenging, if not threatening, the postal service and the electoral process and, with a dismal future ahead should he lose, he is unlikely to observe behavioural norms.

Co-founder and former executive chairman of Alibaba Group Jack Ma's Ant Group Co. has filed listing documents for initial public offerings in Hong Kong and Shanghai. This is kicking off a process that could see the Chinese financial-technology giant go public in the coming months. They are planning to list on Shanghai's year-old STAR Market as well as Hong Kong's stock exchange. Ant Group Co. operates Alipay, a third-party mobile and online payment platform, which is popular in China and used by many Chinese citizens for a range of financial transactions.

The price-weighted S&P Dow Jones Industrial Average Index is getting a makeover with the addition of Salesforce.com Inc, Amgen Inc and Honeywell International Inc and the removal of Exxon Mobil Corp, Pfizer Inc and Raytheon Technologies Corp. Apple Inc.'s planned four-to-one stock split, which was announced last month, prompted the changes as it would have given the information technology sector a smaller representation in the price-weighted Index. The S&P also said in an announcement about the changes "They also help to diversify the index by removing overlap between companies of similar scope and adding new types of businesses that better reflect the American economy."

The American global investment business Blackstone Group Inc. has agreed a $2.29 billion deal with Japan's Takeda Pharmaceutical Co. to buy its consumer health-care business. Takeda incurred debts in its $58 billion acquisition of Shire Plc last year and is looking to divest $10 billion of its assets to pay it down. This private-equity acquisition will see Blackstone buy a business that includes energy tablets and other products that generated more than ¥60 billion in revenue in the year ended March 2020.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.