8 September 2020

The past week has seen a dizzying rally followed by a sudden rout in the markets, particularly in technology stocks. The Nasdaq Composite fell more than 6% in two days last week after hitting fresh highs. During this time Apple Inc.’s market capitalisation overtook the entire value of the FTSE 100, but then fell approximately 8% in one day later in the week, wiping $180 billion off the value of the company! While Tesla Inc. - which has returned 400% year-to-date, and 479% since its low on the 18th of March – fell 9% in one day on Thursday and is down 16% over the past week.

The interesting feature of the tech stock rally in particular has been the high level of activity in the options market. There has been an explosion in bullish call option contracts, driven mainly by retail traders. Retail investors, it seems, have been following a simple strategy of buying calls on the shares they own in the hope of forcing the sellers to purchase the same stock as a hedge – creating an ensuing feedback loop that drives everything higher. Data from the Options Clearing Corp. complied by Sundial Capital’s Jason Goepfert show retail investors have shelled out $40 billion in call premiums in a month. In particular, options interest in the FAANG group has ballooned at one of the fastest clips ever. Apple Inc. calls averaged more than 3 million per day and Tesla Inc.’s daily call volume headed towards 2 million. Apps such as Robinhood have made it easier for retail investors to access these markets, helping to partially explain the increased volatility in the markets.

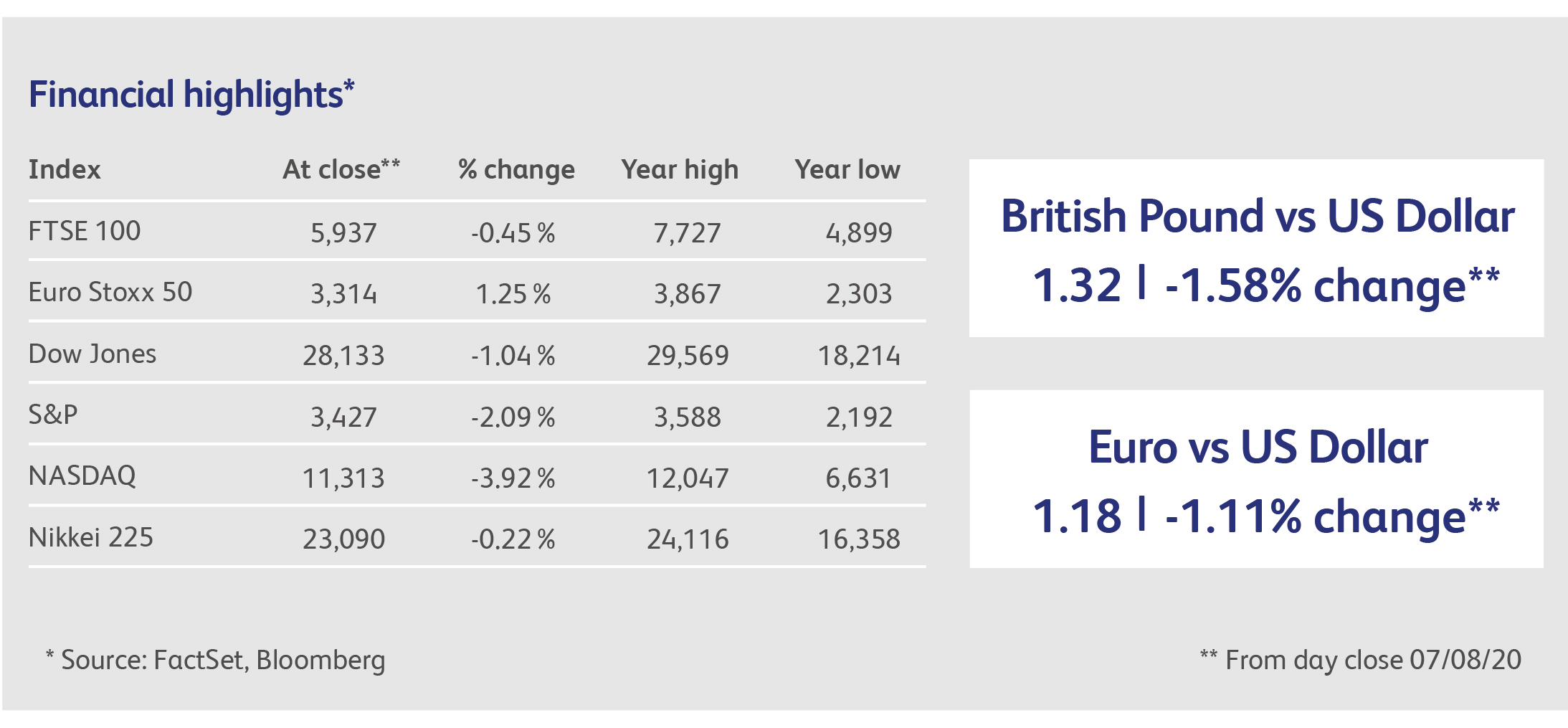

One notable feature of the equity market sell-off was that it did not coincide with a broader panic in other assets. Bond markets barely moved and, in currency markets, the dollar gained a little against other G10 currencies but, unusually, lost ground against several emerging market currencies that are usually sensitive to shifts in risk sentiment, such as the South African rand and Mexican peso. That is in sharp contrast to both the first quarter market collapse and the smaller correction in early June, when equity market falls were part of a much wider pattern of risk aversion.

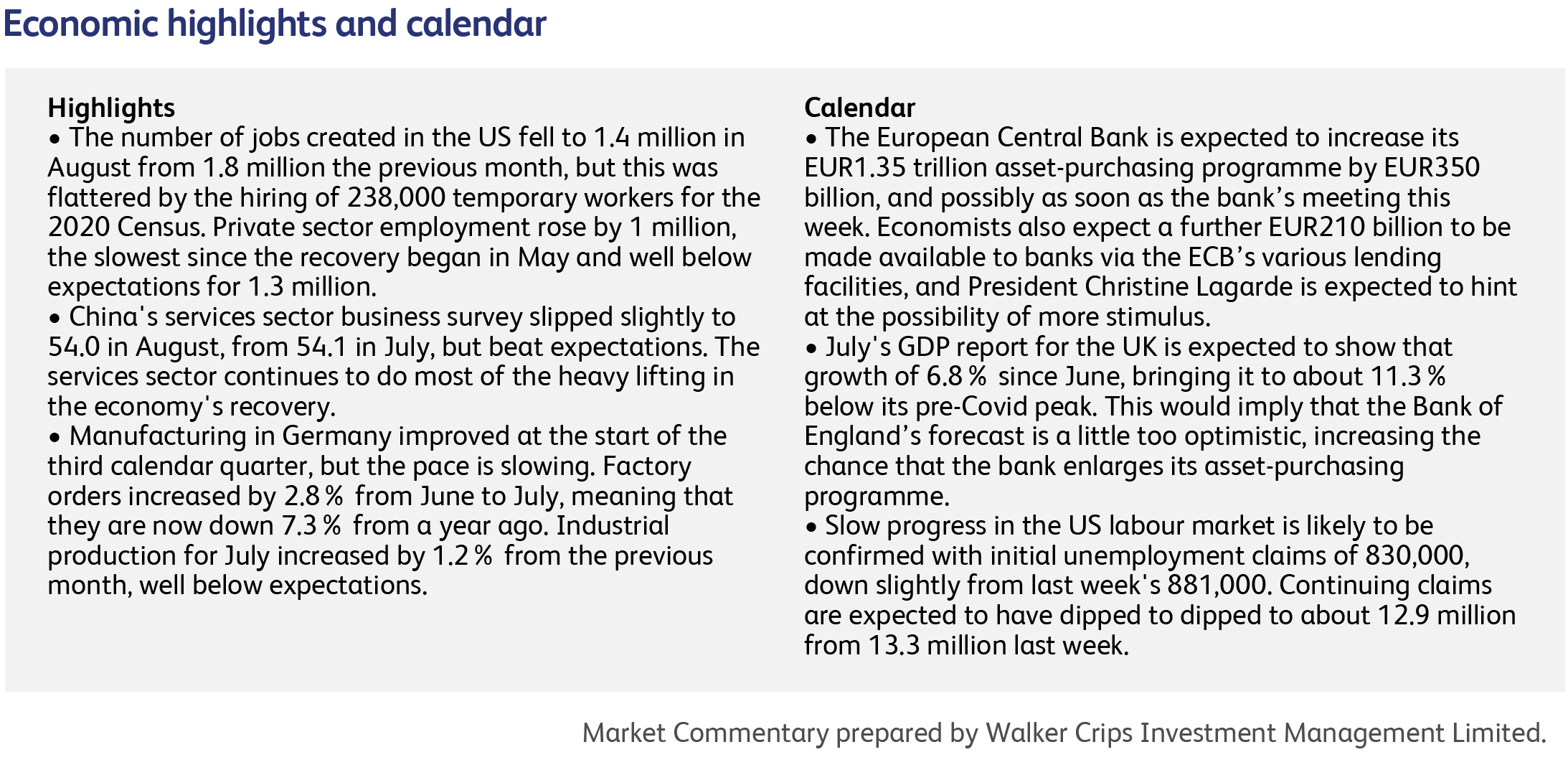

The French budget deficit, which widened to EUR151 billion in July (up from EUR109 billion in the same month last year), is heading towards 8% of GDP, and this is before the recently announced EUR100 billion public investment programme in green capital expenditure. Amounting to 4% of French GDP, the plan, named "Relaunch France", offers a foretaste of the kind of government planning that will be required to navigate the post-pandemic landscape. The plan targets the transition to renewable energy in rail transport and other public infrastructure, and also aims to make existing commercial and residential building more environmentally-friendly using a mix of tax cuts, wage subsidies and direct public investment. A long-term job-retention programme is a key part of the initiative, including retraining for furloughed workers, indicating that the government fears that a substantial share of jobs lost as a result of the pandemic may not return. The job-retention programme will include an incentive bonus for firms hiring young workers.

Despite Germany’s outstanding success in containing Covid-19 compared to many other countries, nearly 40,000 people poured onto the streets of Berlin to express outrage at the government's handling of the crisis. The crowd appears to have consisted of a mix of supporters of the populist Alternative for Germany party (AfD), pandemic denialists, anti-vaxxers, far-right agitators, libertarians, nationalists, and affiliates of the Reichsbürger movement, which claims that the German government created after World War II is illegitimate. Some of them called on Putin and Trump to "liberate" the country. Sterling weakened following rumours that the British government would effectively repudiate certain provisions of the Brexit withdrawal agreement related to state aid and Northern Irish customs declarations. Ironically, this agreement was negotiated by the current Prime Minister and every Conservative member of parliament voted in favour. If true, the UK would be breaching an international treaty in order to remove customs declarations that the Prime Minister promised would not exist, before signing a treaty enshrining them and, afterwards, denying their existence. Potential trade partners will be taking note.

The US-listed Canadian multinational e-commerce company Shopify Inc. has been one of the biggest winners of the recent retail shakeout as it has seen its revenue double to $714.3 million in the second quarter. According to the Commerce Department, in the second quarter US e-commerce sales increased by 37% to $200 billion. Many small businesses have had to open online stores as a result of the coronavirus pandemic, helping to accelerate online sales to levels that weren't expected for years. Shopify Inc. offers online retailers a suite of services including payments, marketing, shipping and customer engagement tools and charges sellers a monthly fee, taking a percentage of every transaction on its platform.

In a major boost to Samsung Electronic Co.'s quest to become a key 5G supplier the South Korean firm has signed a $6.65 billion contract with Verizon Communications Inc. for network equipment and services. The agreement primarily covers 5G infrastructure, though it broadly includes network-equipment sales, installation and maintenance, and runs through the end of 2025. According to market research firm Dell'Oro Group Samsung ranks No.4 among 5G network sales with about 13% of the total market, trailing the top three of Huawei Technologies Co., Ericsson AB and Nokia Corp. With the launch of Apple Inc.'s first 5G-enabled phone this year, adoption of 5G technology is expected to expand significantly and this deal could help Samsung's credibility with carriers as it seeks to fulfill its aim to capture one-fifth of the global 5G market by next year.

According to a report in The Wall Street Journal, the Japanese multinational conglomerate SoftBank Group Corp. bought nearly $4 billion of shares in tech giants such as Amazon.com, Microsoft Corp., Netflix Inc. and Tesla Inc. and options tied to around $50 billion worth of individual tech stocks. The size of this bet means the company could win big or lose a sizable down payment for the options if the technology company share prices drop. Investors reacted negatively to the news on Monday as shares in SoftBank Group dropped 7%.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.