28 October 2020

It isn’t surprising that capital markets are showing some signs of stress. The second wave of the European pandemic is in its exponential growth phase, and lockdowns everywhere are falling short of the strict measures imposed in the spring. Western Europe's case numbers are still rising very quickly: apart from the Netherlands and Madrid, cases, hospitalisations, and deaths are increasing everywhere. France is now reporting more than two-and-a-half times as many new daily cases per million as the US, and the test positivity rate is 10% and rising, up from 1.2% in late July. The rate of increase of new cases and hospitalisations in the UK is slower than in most of continental Europe, but is still worrying, and it’s too soon to assume that the latest round of restrictions will bring down the new infection numbers.

But the real downside risk for markets emanates from the US, where stockmarket indices are still hovering close to all-time highs but the pandemic is already well into its third wave. Both the single-day number of US cases and the seven-day moving average hit new records over the weekend. If the current rate persists, Friday will see the first day with more than 100,000 confirmed new cases. Some of the latest increase in cases is due to increased testing, but the test positivity rate is now clearly rising quite rapidly, signalling an increased risk of undetected or uncontained outbreaks.

Perhaps US stockmarket resilience derives from the fact that the most severe outbreaks are still in relatively sparsely-populated states, but the number of states with both high levels of cases and rapid increases is rising. Over the past two weeks, the seven-day moving average number of daily new cases has risen in 47 of the 50 states. Seventeen states have reported increases in excess of 50% over the same period, with the biggest increases in Alabama (90%), Michigan (101%), New Mexico (94%), and Rhode Island (99%). The Dakotas and Wisconsin still have the highest number of cases per day, but their growth rates aren't quite so fast. A reminder: the Dakotas, Wyoming and Nebraska don't even have mask mandates.

US hospitalisations continue to increase steadily, and are on course to reach the peaks seen in the first and second waves - at just under 60,000 - in four weeks' time, if the recent rate of increase continues. Hospitalisations per case have been lower, so far, in the third wave than in the second - which, in turn, was lower than the first - possibly because older people are better protected than when the pandemic struck. However, hospital capacity is already stretched in some of the hardest-hit states, especially in rural areas. Expect to hear a great deal more about rationing of critical care and hospital capacity over the next few weeks as admissions continue to increase.

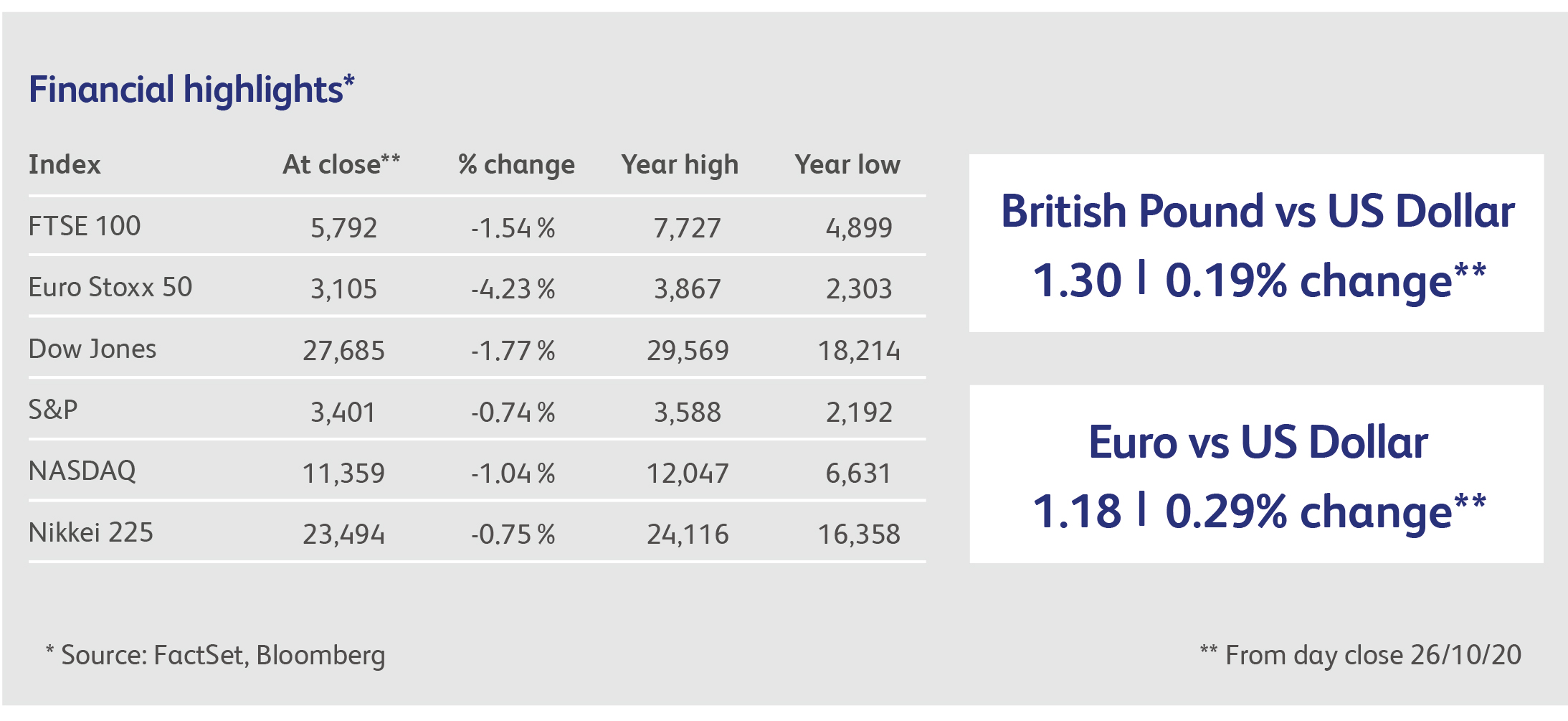

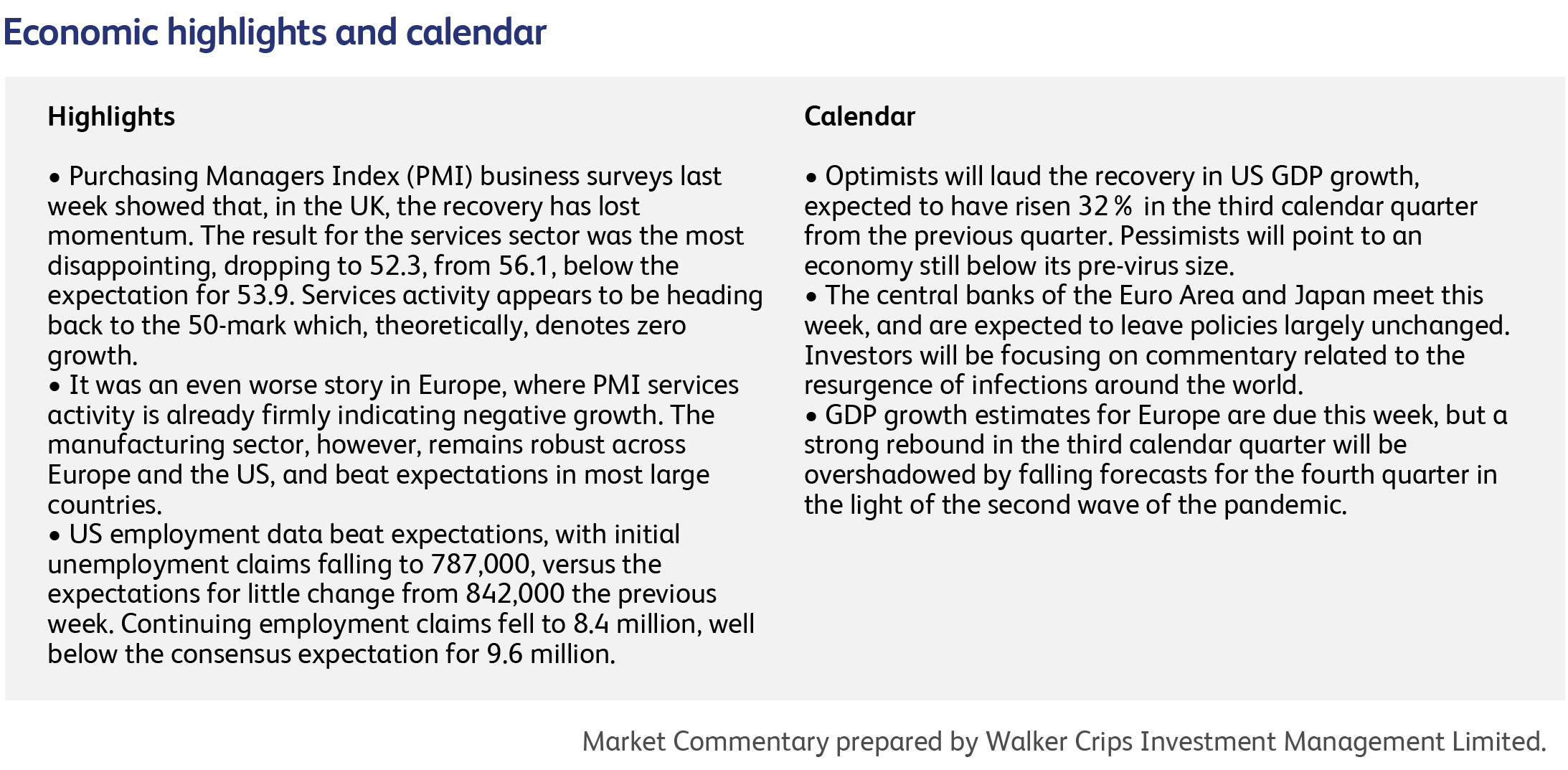

Sporadically positive economic data in the US just about offers enough to sustain market optimism, especially if one focuses on the rapidity of the recovery, and on how the economic data is still, mostly, far behind pre-pandemic levels. Airline passenger numbers continue to grind upwards and retail sales have bounced to beyond the pre-Covid peak. The housing market is buoyant. Economic growth for the third quarter will show a strong acceleration from the second quarter. As we saw earlier in the year, however, this may not matter if enough consumers simply choose to hunker down.

If you didn’t know that the built-in search engine in your Safari browser is actually Google, the US government’s antitrust case against Google has revealed it. Google’s deal with Apple is the biggest example of how Google pays providers to make its search product their default option on browsers, phones and other devices. Nearly half of Google search traffic in 2019 came from Apple products, according to the lawsuit. The Department of Justice cited estimates that Apple receives $8 billion to $12 billion annually from Google through the agreement.

Giving investors in the $3 trillion global food and drink sector reason for pause, the British government has proposed curbing junk-food advertising, banning the promotion of some sugary and fatty foods, and forcing cafes and restaurants to put calorie labels on more products. As the pandemic throws a spotlight on the importance of a healthy diet, governments beyond the UK may choose to impose more anti-obesity measures, impacting the way that makers of fizzy drinks, breakfast cereals, chocolate bars, and ready-to-eat meals do business. In 2018, a study found that, of the 21 largest food and drink companies in nine markets, only 31% of products met the “healthy” threshold. Just 14% of the products analysed met the nutritional standards to be marketed to children. Ferrero Group, Mars, Meiji Holdings, Mondelez International, and Suntory Holdings, the makers of confectioneries, drinks, and snacks, were ranked at the bottom.

Consolidation in the US semiconductor industry is continuing to gather pace as Advanced Micro Devices Inc. (AMD) agrees to buy rival chip maker Xilinx Inc. in a $35 billion all-stock deal. The deal still must pass regulator scrutiny in the US and abroad, but if it goes through would be one of the biggest among chip makers. In purchasing Xilinx, AMD would gain a foothold in areas where it's a small player or entirely absent, including telecommunications infrastructure and defense - Xilinx chips are used in the US's latest combat plane the Lockheed Martin Corp. F-35 Joint Strike Fighter.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.