11 May 2021

It was another week of whack-a-mole markets, in which the full panoply of post-pandemic zaniness was on display. First up, US Treasury Secretary (and former Federal Reserve chair) Janet Yellen threw the cat among the pigeons when she suggested that interest rates might have to rise over time, if needed, to cool an overheating economy. It was rather an obvious statement for an ex-central banker to make, but this is a subject that capital markets are very sensitive to, and the reaction was a bit like the mention of “he who shall not be named” at a Hogwarts’ feast. The technology-heavy Nasdaq Composite index ended the day down 1.9%, while the US benchmark S&P 500 index was 0.7% lower. Just in case we hadn’t figured out the power that “Mr Market” holds over politicians in the US, Yellen issued a “clarification” later in the day and markets perked up.

But that was nothing compared to the main event on Friday, when the US reported that only 266,000 jobs had been created during the month of April, versus the 1 million that had been expected. It was the largest shortfall between expectation and reality that this data series has ever produced. At the same time, the unemployment rate rose to 6.1% from 6.0%, confounding expectations for a significant decline, to 5.8%. These are probably the most watched economic datapoints for the health of the world’s biggest economy and, instead of slumping, were expected to roar ahead, heralding the beginning of the end of the pandemic.

What can we infer from the data? The details show that employment growth slowed across the economy in April, with zero job gains in construction, a fall in manufacturing and a muted increase in private services. On the face of it, this is completely at odds with other data which suggests that the demand for labour is very strong and that firms are even finding it hard to recruit people. One reaction was that the massive, pandemic-inspired swings in the jobs data are masking a creeping recession in the US. Another explanation is that the enhancement of unemployment benefits by $300 a week in the latest Covid relief programme (enacted in March) seems to have deterred people from taking a job. After all, if the benefits are due to expire in September, but jobs will be just as easy to find then as they are now, why take a job today?

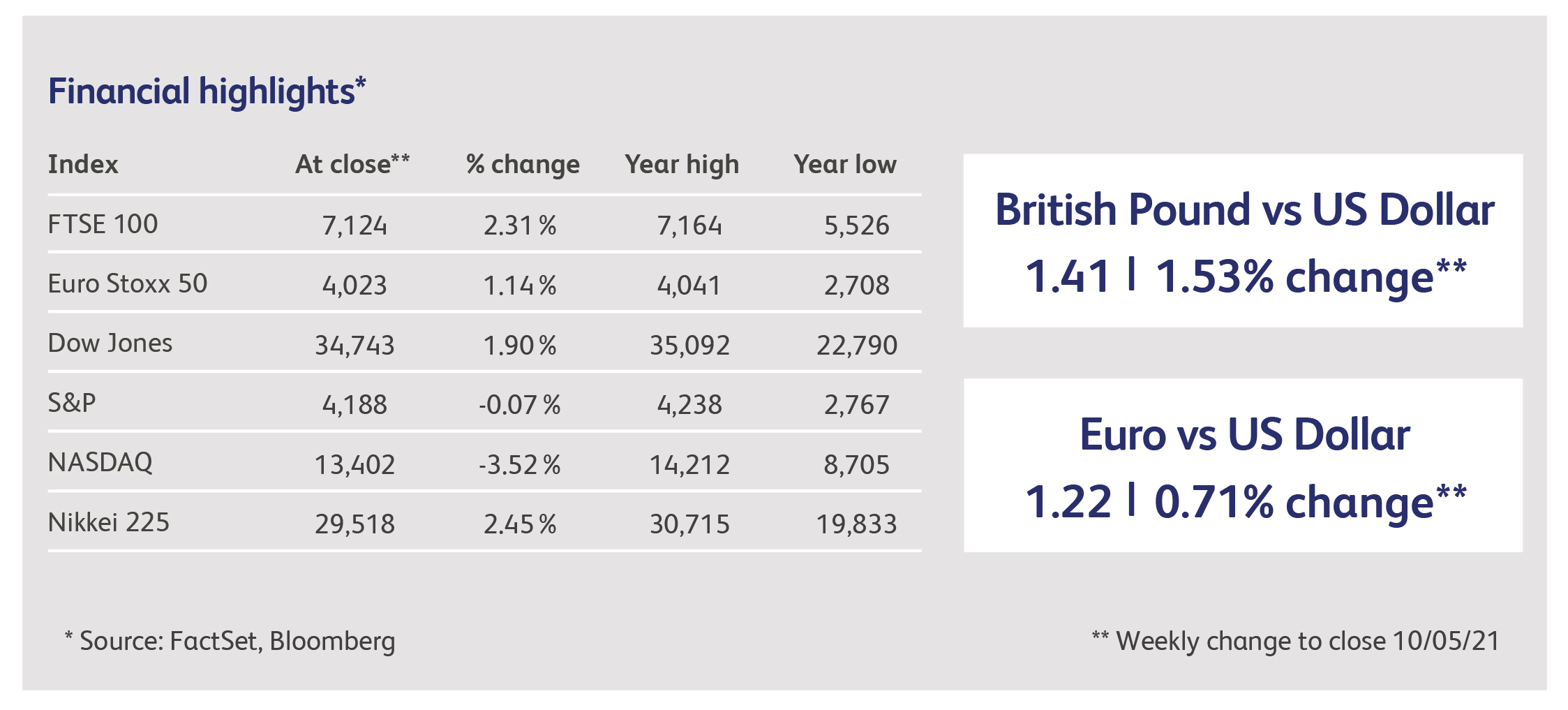

The market reaction was equally ambiguous. Initially, there was an immediate negative reaction. Traditional safe havens, such as gold and government bonds, rallied. In fact, gold immediately rallied by an impressive $24 an ounce. Equities all over the world mostly fell, with the old-economy Dow Jones Industrial Average falling by about half a percent. However, the Nasdaq actually rose by about twice that amount, suggesting that investors still believe that what’s bad for the post-pandemic economy is good for technology companies. Strangely, it only took about an hour for investors to disregard the news entirely, and for the US government bond yields to return to their previous level. The Dow Jones Industrial Average was even more forgiving, rising far beyond its prior level to end the day at a record high. Even more strangely, the Nasdaq did not reverse course and ended the day up 0.8%. To summarise a manic Friday: US employment growth may have collapsed - but everything’s good, everywhere.

In the midst of a broad sell-off in Chinese technology stocks, the share price of Chinese e-commerce giant Meituan fell 15% over two days after the CEO posted a classical poem on social media about book burning by a Chinese emperor during the Qin dynasty, which some regarded as a veiled criticism of the government. A day later, the company was accused of putting misleading content on its app, and of making it difficult for customers to obtain refunds, by the Shanghai Consumer Council, a consumer advocacy group.

American video game developer Roblox Corp. has reported its first quarter revenues, which have more than doubled, as the company continues to benefit from pandemic induced demand for at-home entertainment. However, the company posted a nearly 82% wider loss in the period linked to higher costs to support its growth and expenses tied to its direct listing. Founded in 2004, Roblox operates a free online platform on consoles, computers and mobile devices that features millions of games made by its users.

The Joint Enterprise Defense Infrastructure (JEDI) cloud-computing project is now under threat as Pentagon officials are considering pulling the plug on it. The JEDI contract, valued at up to $10 billion over 10 years, was awarded to Microsoft Corp. in 2019 over Amazon.com Inc., and its has been mired in litigation from Amazon since. The contract is also facing criticism from lawmakers because of its single-vendor, winner-take-all approach not being appropriate for a mammoth enterprise like the Department of Defense.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.