22 June 2021

The Credit Crunch and European Debt Crisis taught central bankers to be absolutely, unambiguously clear in their guidance to capital markets because only their 100% commitment was enough to convince investors. Hence we had ECB Chairman Draghi’s famous catchphrase “the ECB is ready to do whatever it takes… And believe me, it will be enough”. During the pandemic downturn it had been a similar story, with all central banks unanimously talking up their actions. But that consensus is now unravelling: not just across countries, whose economic rebounds are moving at different speeds, but also within countries as central bankers find a way to talk down their previous commitments. The mixed message is beginning to jar with investors, as we saw from the various reactions to the US Federal Reserve bank meeting last week. Investors, who had been focused on the Fed’s $120 billion a month asset purchase programme, were blindsided by a sudden, more hawkish change in its expectations for interest rates. Moreover, although Chairman Powell went out of his way to avoid giving a date for “tapering” the asset purchases, it’s conventional wisdom that tapering comes before rate hikes.

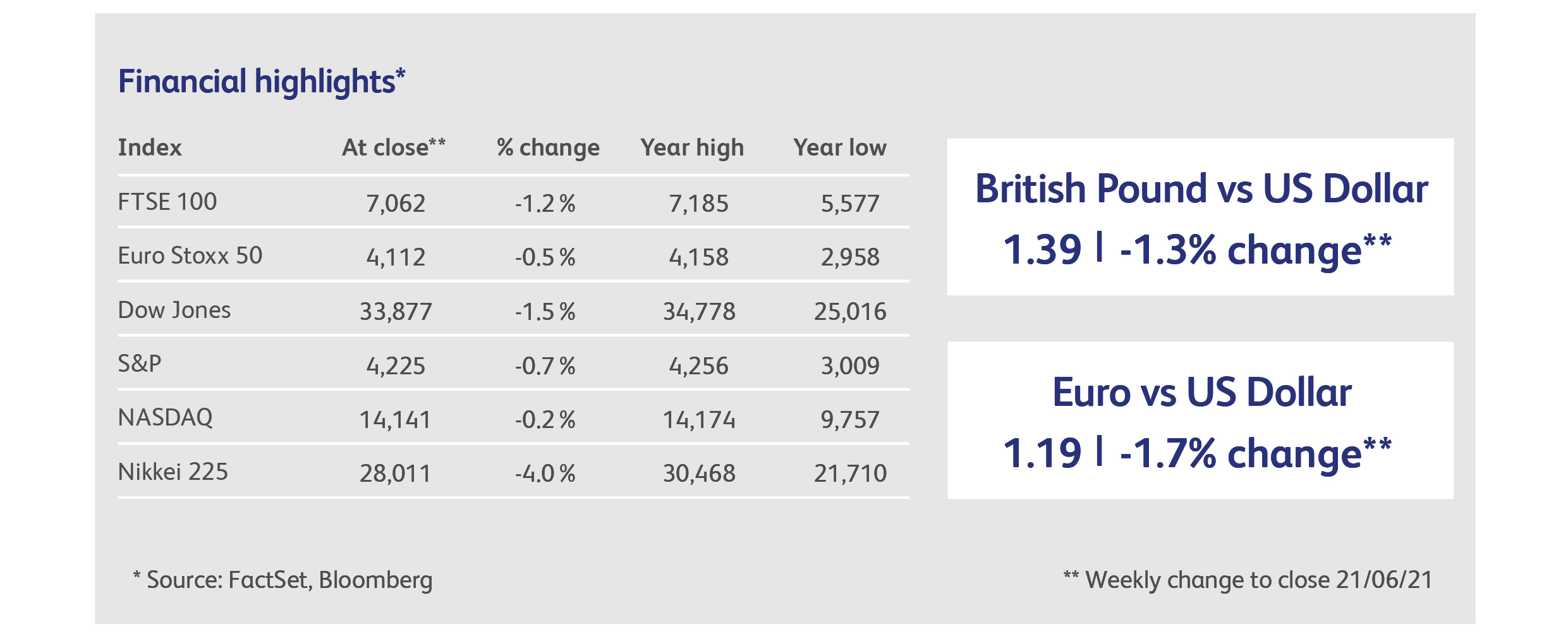

Immediately, the US dollar bounced off its five-year low, and headed north for the rest of the week (hence the pound’s 2% decline in two days). The initial reaction in US stockmarkets was negative but subdued, only to gather downward momentum as the week went on. By the end of the week, the Dow Jones Industrial Average had given up all its gains of the previous two months, and stockmarkets around the world had succumbed. US government bonds did not know what to do, dropping at first before rocketing to their highest values since February.

A lot is riding on the credibility of central bankers but they have given themselves too much to do. On one hand, asset purchase programmes keep bond prices high and interest costs low, which is essential if governments are to refinance their accumulated debt cheaply. On the other, as these programmes were put in place to stimulate economies floored by lockdowns, surely there’s no need for them anymore? And then there’s the risk of inflation if economies are over-stimulated; central bankers have been keen to ignore this, but it would surely end the party.

Mixed messages are inevitable, and markets are going to have to continually deal with the risk that asset purchase programmes (about $300 billion a month globally) may get wound down. Optimists argue that financing costs will remain very attractive even after tapering takes place, not least because the reduction in government bond-buying will be more than offset by a reduction in government bond issuance. But this will be occurring at the same time as the withdrawal of governments’ economic stimulus programmes, which have been another massive source of support for capital markets. The elephant in the room is capital markets themselves: having been rescued from the Credit Crunch and European Debt Crisis, and recently the pandemic, by waves of central bank and government support, the hope is that no central banker really wants to test their resilience.

Banks were in the spotlight last week after several downbeat trading statements. The largest US bank, JPMorgan Chase & Co, got the ball rolling when its Chief Executive warned that trading revenue in the second calendar quarter would be 38% below its level of a year ago. A similar message from Citigroup sent its stock spiralling downwards. By the end of the week, Citigroup had fallen 14% and the US banks had led the entire global banking sector down.

Ignoring the rapid escalation in anti-China sentiment among US (and G7) politicians, Microsoft Corp was rumoured to be planning four new data centres in China by early next year to add to the six it already has. Microsoft has been lured by the massive growth in cloud-computing services as Chinese businesses, caught out by the pandemic, rush to the cloud.

The Bank of Japan added to the global support for environmentally sustainable project funding, with a new programme to help banks increase climate change-related loans. More details will be revealed in July, but it will probably involve cheaper costs of financing for the banks involved.

Recent declines in commodities prices suggest that the glow of the reopening of the global economy is fading. One agricultural commodities index had its worst daily decline since 2009 last week, but platinum, nickel and copper have also now corrected more than 10% from their peaks. Lumber prices have fallen nearly 50% from their peak as the US housebuilding boom ran out of steam.

Highlights

It was the UK’s turn for inflation to surprise to the upside, with consumer price inflation increasing to 2.1% in May, up from 1.5% in April, and well above the Bank of England’s forecast of 1.8%. Price hikes by catering and hairdressing services businesses reopening after the lockdown were among the key drivers.

Chinese industrial production, investment and retail sales all slowed more than expected in May, confirming a negative economic trend that has been brewing for a few months. Industrial production is facing headwinds, partly from the inability to source components, and infrastructure investment had already been slowed by a clampdown on local government debt issuance.

Officials at the US Federal Reserve bank increased their estimates for inflation and brought forward their forecasts for rises in interest rates. Despite this, Chairman Powell was reluctant to say when the Fed would start reducing its asset purchase programmes.

Calendar

The risk is of a hawkish surprise from the Bank of England at its meeting this week, and investors will be looking for any hints that the Monetary Policy Committee is expecting to raise the Bank Rate in 2022.

The week will end with a near-guaranteed disappointment, as US personal incomes are likely to have fallen 2.8% in May, thanks to the end of the direct payments to households made under the Covid relief bill.

Business activity surveys for early June are expected to maintain the positive momentum from last month in the UK, thanks to the "Step Three" reopening. June’s survey fully includes the reopening of indoor dining and entertainment activity. European business activity is expected to have gained momentum, as restrictions were eased further during the month.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.