29 June 2021

The last few weeks have seen a resurgence in trends that were observable earlier in the pandemic, but had been missing for a while. Foremost among them is the outperformance of the technology sector, with the US Nasdaq Composite stockmarket index having comfortably exceeded its all-time highs. Small-cap company indices have also revived recently, partly driven by speculation in some of the names most favoured by the online trading community. More conventional sectors of the market have trod water for a month or two but, importantly, have not sold off.

The market’s staying power, despite all-time high valuations and earnings forecasts, is prompting some strategists to reassess their investment rationales. The thinking goes that the pandemic has forced companies into a once-in-a-century frenzy of capital expenditure as they retool for the post-pandemic world. Much of the spending has focused on technological solutions to working-from-home problems, explaining the rally in technology (and related) stocks. As a result of this, the post-pandemic world will be more productive, and productivity is the magic ingredient that boosts economic growth, allowing company profits to settle at permanently higher levels. Importantly, this will break the cycle of muted economic growth caused by ageing populations, heavy debt burdens and a decade of corporate under-investment. Even better for investors: government and central bank stimulus has helped underwrite the cost of this transition, with the benefits going to shareholders.

But you don’t have to argue that “this time it’s different” in order to explain asset prices – a more prosaic explanation is that government stimulus money found its way into capital markets. Data on US household net worth published last week told us what markets have long since figured out: the pandemic has made the average consumer wealthier. The data shows that the poorest half of households saw aggregate household net worth jump by 36% during the first year of the pandemic, equivalent to an increase of about $700 billion spread across 64 million households. That’s not far off the $850 billion the US government spent sending stimulus checks to citizens over the same period. Wealthier households did even better, with gains driven by the boom in house prices and the rally in the stockmarket.

Another unintended consequence of the pandemic era has been a collapse in the birth rate. Nine months after the lockdowns started in the US, data for December show that US births dropped by 8% in a single month. That figure masks some regional variation: in California, the fall was 19%. Across the first year of the pandemic as a whole, the number of births in the US fell by 4%, the largest drop since 1973. It’s thought that couples were dissuaded from having babies due to a combination of factors: fear of going to hospitals, lack of family support for childcare, and worries about the economic impact of the lockdowns. The full demographic impact will be worse, due to the half-million deaths from Covid-19.

Facebook shares are likely to jump today, after a US judge dismissed two lawsuits filed by the US government and a cohort of states that sought to break the company up. The company had been accused of having a monopoly in social networking, but the judge ruled that no such monopoly had been proven by the claimants.

The UK’s Competition and Markets Authority started a formal investigation into fake product reviews on Amazon and Google. Actions by the CMA last year prompted Facebook, Instagram and eBay to ban individuals for buying and selling fake reviews on their websites.

Walt Disney is the latest victim of the strange behaviour in the US labour market, where employers are struggling to find workers and workers are unable - or perhaps unwilling - to find jobs. The company is offering $1,000 bonuses to new housekeepers and select kitchen staff at its Florida theme parks, just months after laying off 32,000 employees.

US consumers continue to spend their stimulus cheques on Nike apparel, as confirmed by the company’s latest results. Nike shares soared nearly 16% after the company reported a doubling of sales in its last fiscal quarter from the pandemic-affected period a year ago, and also raised revenue expectations for the coming year to over $50 billion.

Pandemic winners Fedex and UPS are struggling to satisfy investors’ high expectations. Fedex Corp’s shares opened down 5% after the Chief Executive blamed labour cost pressures for a disappointing earnings forecast. The company will address the wage squeeze by investing in 16 new automated facilities. Earlier this month, UPS shares had one of their worst days of the past year with a financial forecast that disappointed investors.

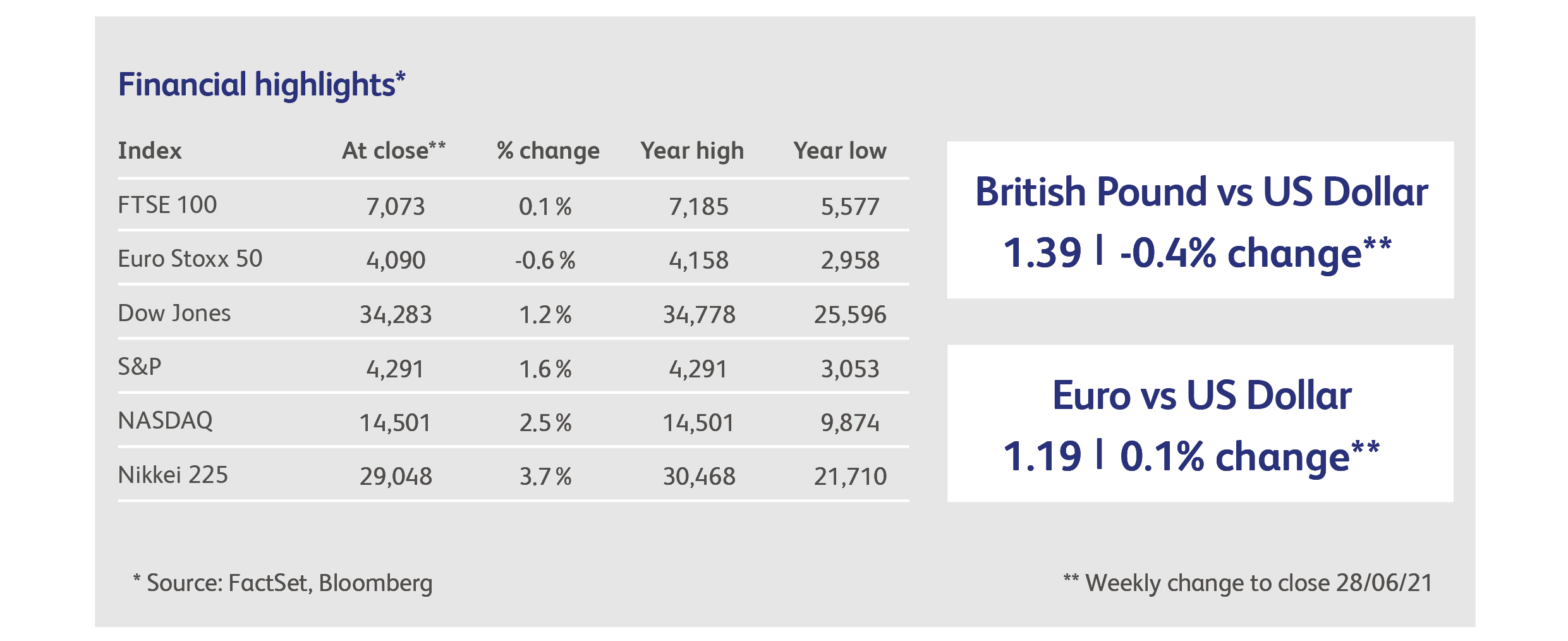

Highlights

The Bank of England reassured investors and added to a chorus of recent dovish comments by central banks when it warned against “premature tightening” of monetary policy, despite - simultaneously - increasing its forecast for inflation from 2.5% to 3% and revising up its forecast for GDP growth in the second quarter from 4.25% to 5.5%. The bank restated its intention to wait for clear evidence that inflation will stay above target for a sustained period before raising interest rates.

Business activity surveys for early June in the UK and EU diverged, with UK activity dipping below expectations as both service and manufacturing activity slowed (albeit slightly) from last month. EU activity surged above expectations, led by booming service sector activity in Germany, Italy and Spain as restrictions were eased further, offset by disappointing readings in France.

Calendar

Perhaps the biggest monthly market-moving datapoint is upon us, with the publication at the end of the week of US employment data. Recent months have disappointed expectations, falling well short of the million-or-so jobs created per month expected. This time, forecasters have reined in their expectations, and the average estimate is for 700,000 jobs to have been created in May. The risk is to the upside, with the recent trend for technology to outperform “bricks and mortar” companies at risk of reversing.

Chinese business activity surveys are expected to confirm muted growth in the manufacturing sector in June. The service sector should show better momentum, but the lack of a spectacular, post-pandemic rebound in China is likely to continue to bamboozle economists.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.