10 August 2021

How concerned should investors be about the Delta variant of the Coronavirus? The main economic impact is likely to be felt in China, where the government has adopted its usual zero-tolerance approach. Lockdowns have been implemented in half of the country’s provinces despite case numbers so far of only 1,000 from a population of 1.4 billion, and with the majority of the population having already been vaccinated. Airline capacity in China dropped by a third in the last week. The restrictions will constrain an economy that was already slowing, China having long since passed the peak of its rebound from the pandemic.

It used to be the case that “when China sneezed, the rest of the world caught a cold”, but that was before western governments figured out that fiscal spending can be financed by their own central banks; now they have their own growth engines and the impact of slowing Chinese economic growth is only a mild inconvenience. Nevertheless, it’s worth pointing out that the US experience of the Delta variant is a source of concern. New coronavirus cases in the US rose to the highest levels since early February, and the death toll climbed 49%, its biggest weekly increase since December. It’s nigh-on impossible to square the US experience with the UK experience, where case numbers have declined despite the Freedom Day relaxation of rules on mask wearing, social distancing and building occupancy. Which version of the Delta variant will win out?

Nevertheless, economists are not too bothered by the impact of the Delta variant in the US, and are simply moving their expectations for the economic rebound from the third calendar quarter into the fourth. Such enthusiasm is partly a function of extremely bullish markets: it’s difficult not to get steamrollered by the market juggernaut into a “this time it’s different” mindset, and theories abound that we must be entering an age of supercharged growth. You can’t argue with the fact that, going into the pandemic, the value of the world’s stock markets was at an all-time high of $89 trillion - now they are valued at $117 trillion.

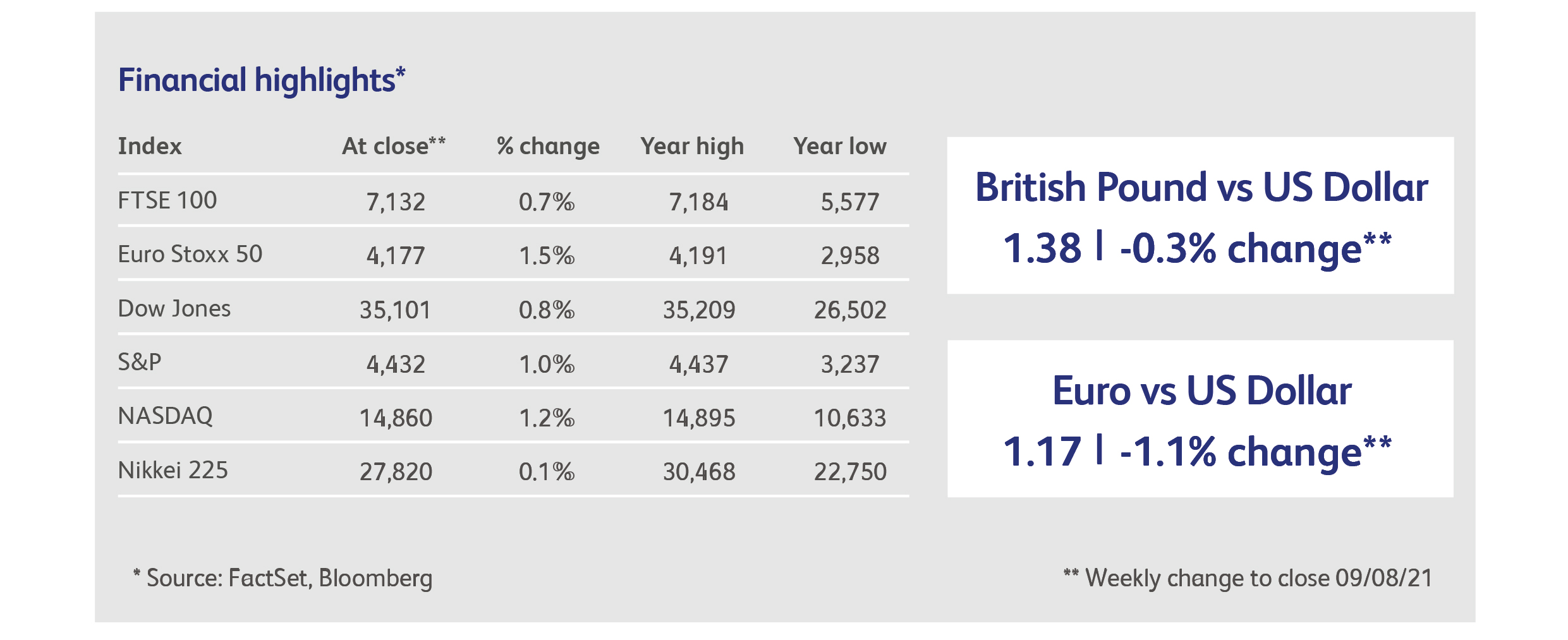

More recently, outperformance has been getting harder to find as many of the world’s stock markets have trended sideways or downwards for the last few months. Among the former category are the goliaths of the FTSE 100 and the Dow Jones Industrial Average, as well as the minnows of the small-cap US Russell 2000 index. In the latter lies most Asian and Emerging Market markets, which have been declining since their peak in February.

The technology sector has been outstanding recently (the Nasdaq Composite index is up nearly 7% over the last two months), and is turning from a pandemic-winner-but-rebound-loser into an all-weather outperformer. Europe has been a surprisingly strong performer, driven by the Italian and French stock markets (up 2% and 4% respectively over the last two months). Within Europe, smaller companies have fared best, presumably in the expectation of a resurgence of domestic economic activity. The same applies to the UK. They may also have benefited from a desire to find companies not already at sky-high valuations.

Robinhood Markets, the online trading firm that has done more than any other to stimulate the speculative juices of small-town American investors, became both hero and victim of its own success in the first week after it went public. The firm has become synonymous with pumping and dumping of micro-cap stocks in America, most notably by investors using on-line chat forums to gather the support of co-investors when planning a raid. Following an - initially - disappointing market debut, a wave of buying by private individuals sent the company’s market value from $29 billion to $65 billion. This was followed by a 28% retrenchment, after some of the firm’s biggest investors filed regulatory disclosures to sell 98 million shares (14% of the company). Unlike most initial public offerings, Robinhood shareholders were not inconvenienced by the usual six-month lockup period.

JP Morgan and Goldman Sachs occupy one end of the working-from-home spectrum: they intend staff to return fully to the office, and have criticised Zoom (video) calls for lacking the creative spark and camaraderie of face-to-face contact. However, the last three decades have shown that fighting technological trends is not a winning strategy, at least not if you want to escape the fate of the dinosaurs. Other companies’ strategies are making the two banks look increasingly outdated. KPMG’s British staff will be required to work in the office only two days a week. Unilever’s Chief Executive anticipates “never going back to five days a week in the office”. Staff at Ocado have been allowed to work wherever they want in the world for one month a year. At the other end of the spectrum, Twitter’s employees have been told they can work from home forever.

Chinese internet giant and biggest e-commerce company Alibaba Group Holding has warned investors that it will no longer enjoy a tax break granted to the country’s internet sector, and that it expects its tax rate to rise from 8% to 20% in future. The tax hikes are expected to apply to most Chinese internet companies, and is part of the government’s wider regulatory crackdown.

Highlights

Calendar

UK GDP in June is expected to have continued its rebound, growing by 0.7% from the previous month. The accommodation and food services sector probably led the way again, supported by a rise in output in the arts, entertainment and recreation sector, as most firms in this sector reopened only after the May 17th unlocking. However, as has been the case in Europe, manufacturing activity and industrial production are expected to have slowed their rate of growth from the previous month.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.