14 September

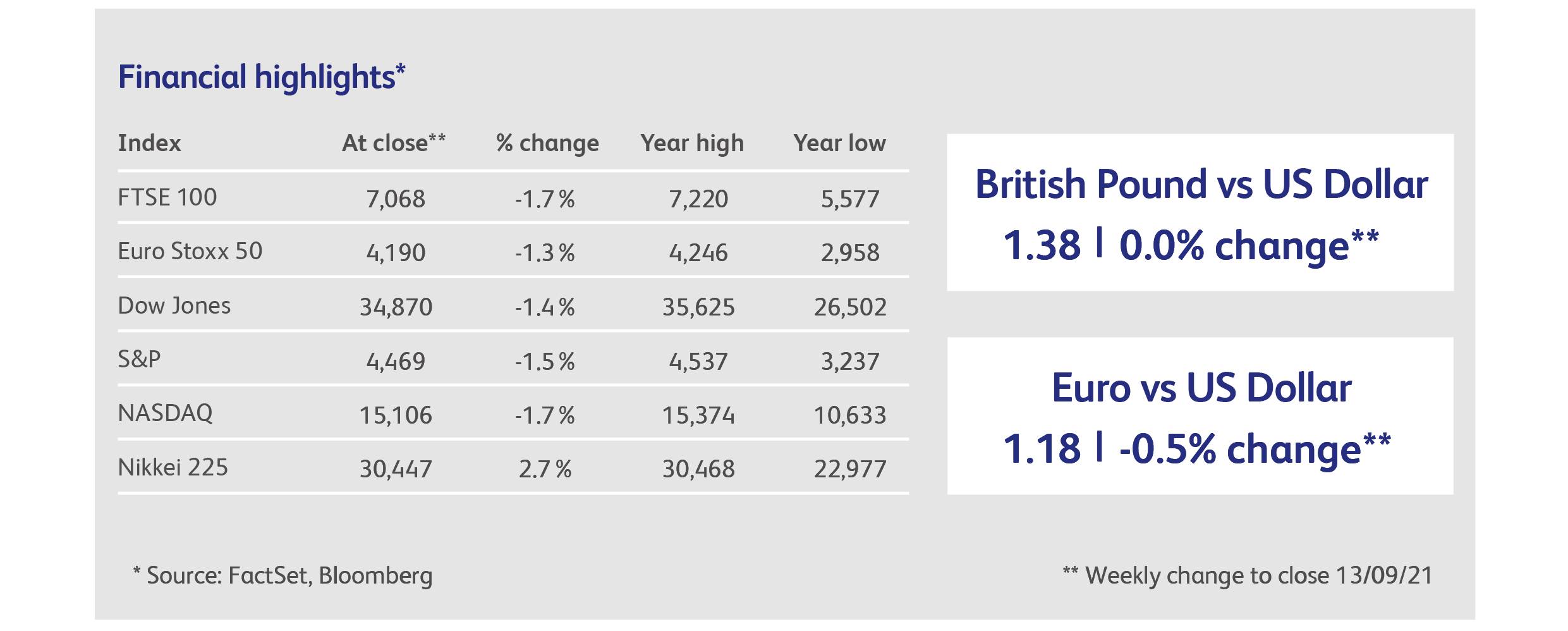

Stock markets went into the week having, seemingly, ignored a wave of bad news including rumours that the European Central Bank (ECB) would begin winding down its asset purchase programme, and also a disastrous US employment report. But it turned out to have been just a “Wile E Coyote” moment, as a delayed negative reaction set in, sending the FTSE 100 down over 2% in two days. The pain was felt mostly in the western world: European stock markets fell with the FTSE, and the American S&P 500 Index fell on every trading day of the week.

It may not have been a coincidence that the declines occurred immediately after the expiry of one of America’s most generous pandemic stimulus programmes. There is a reasonable chance that some stimulus money ended up in the stock market (and in cryptocurrencies) and, sure enough, the US Russell 2000 small-company index was hit hard, falling nearly 4% on the week. Bitcoin, meanwhile, fell 15%, though it was not helped by the botched decision of El Salvador’s government to make Bitcoin legal tender.

The ECB confirmed that it will reduce asset purchases, though President Lagarde refused to use the dreaded word “tapering”, and failed to give many specifics (see Economics: Highlights below). If even the most dovish central bank in the world is talking about tapering, it’s safe to assume that ship is sailing. Two Federal Reserve (“Fed”) governors sent shivers through the markets when they announced their intention to sell all their individual stock holdings in the next two weeks. While the decisions were reportedly based on the desire to avoid potential conflicts of interest, analysts have been noting for a while how heavily the most senior Fed officials are invested in stock markets. Fed Chairman Powell, for example, has disclosed tens of millions of dollars in exposure to S&P 500 and Russell 2000 index trackers.

The news was not all bad, though. Early in the week, information on the Euro Zone economy’s performance in the second calendar quarter painted a better picture than expected, suggesting that GDP will have returned to its pre-pandemic level by the end of the current quarter. A frontrunner in the race to be the new Japanese Prime Minister unveiled a JPY15 trillion (£100 billion) spending programme, shielding Japanese equities from the damage seen around the rest of the world. Japanese stock market indices are now up 10% over the past two weeks.

Strong Chinese export data defied widespread expectations for a decline, suggesting that the fears of a slowdown in the Chinese economy might be overdone. China sentiment was boosted when President Biden and Chairman Xi Jinping spoke for 90 minutes; it was their first discussion since February. The Shanghai Stock Exchange index ended the week up more than 3%, and reached its highest level since 2015. Bizarrely, its Hong Kong-listed equivalent, the Hang Seng China Enterprises Index (which is more heavily utilised by international investors), is still very much in the doldrums – 25% below its February peak. Unfortunately, the Biden-Xi phone call turned out to be more negative than positive, as it was reportedly prompted by exasperation on Biden’s part of China’s refusal to engage seriously enough with the US government. Biden then followed up with the threat of a new investigation into Chinese subsidies and their damage to the US economy.

EasyJet shares fell 14%, to their lowest level since November last year, after the company announced plans to raise £1.2 billion in a rights issue. Part of the discomfort may have been due to management reporting that they had rejected an unsolicited takeover bid. The latest fund raising will take EasyJet’s total to £6.7 billion since the start of the pandemic, compared with the company’s current market value of £3.1 billion.

In another sign that the corporate world is losing patience with vaccine deniers, Morrisons will slash sick pay for unvaccinated workers if they need to self-isolate. “We are all in this together", said the Chief Executive. In probably its last set of results as a listed company (two takeover bids have been received), Morrisons reported pre-tax profits down more than a third in the first half the year, after incurring £41 million in Covid-related costs. The company is also caught up in the supply chain problems affecting British supermarkets at the moment.

Apple lost about $85 billion in market value in its biggest one-day decline since early May, after a US court ruled that Apple must allow consumers the freedom to use other payment methods when buying apps for their phones. Apple had previously demanded a healthy cut of any app purchases, thought to be worth $20 billion a year to the company. The $85 billion decline is bigger, in terms of market value, than the market values of 80% of the constituents of the S&P 500 Index. Apple’s loss was others’ gain, as smaller mobile app stocks such as Spotify Technologies, Match Group, Zynga, Roblox and Skillz gained on the news.

American basketball star Steph Curry became the latest celebrity to be signed up as an ambassador to the cryptocurrency platform FTX. “I’m excited to partner with a company that demystifies the crypto space and eliminates the intimidation factor for first-time users,” Curry said in his press release. The previous day he could be found on Twitter asking his 15 million followers, “Just getting started in the crypto game…y’all got any advice??”

Highlights

The UK post-lockdown economic rebound petered out in the middle of the year, and GDP managed only a marginal increase in July over the previous month, disappointing expectations for 0.5% growth. The Delta variant is the most likely culprit. Weakness was most evident in the education and health sectors, but output was flat in the service sector as a whole. The good news is that the recovery appears to have regained momentum since then: more recent August data, including the government’s Business Impact of Covid-19 survey, restaurant diner numbers, footfall at retail locations and transportation usage, have all picked up.

The European Central Bank left interest rates unchanged at its September meeting, but announced a reduction in the pace of asset purchases under its Pandemic programme. "This lady is not tapering" said ECB President Lagarde; instead, it is “recalibrating”. No new asset purchasing targets were given, leaving the market to fester over what this means in terms of Euros.

Calendar

Annual UK inflation for August is expected to have jumped to 2.9%, from 2% in July, boosted by the anniversary of the government’s Eat Out to Help Out scheme. Rapid increases in used car prices and other industrial goods are also likely to have contributed.

The shocking employment data for the US, reported for August, has put the weekly unemployment claims data back under the microscope, with investors likely to react negatively to a particularly weak reading. The expectation is for 320,000 claims, a slight uptick on last month’s figure of 310,000.

In a busy week for US data, the latest figures for industrial production, retail sales and consumer confidence are all due to be reported. The trend for each has been disappointingly weak over past few months.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.