9 November 2021

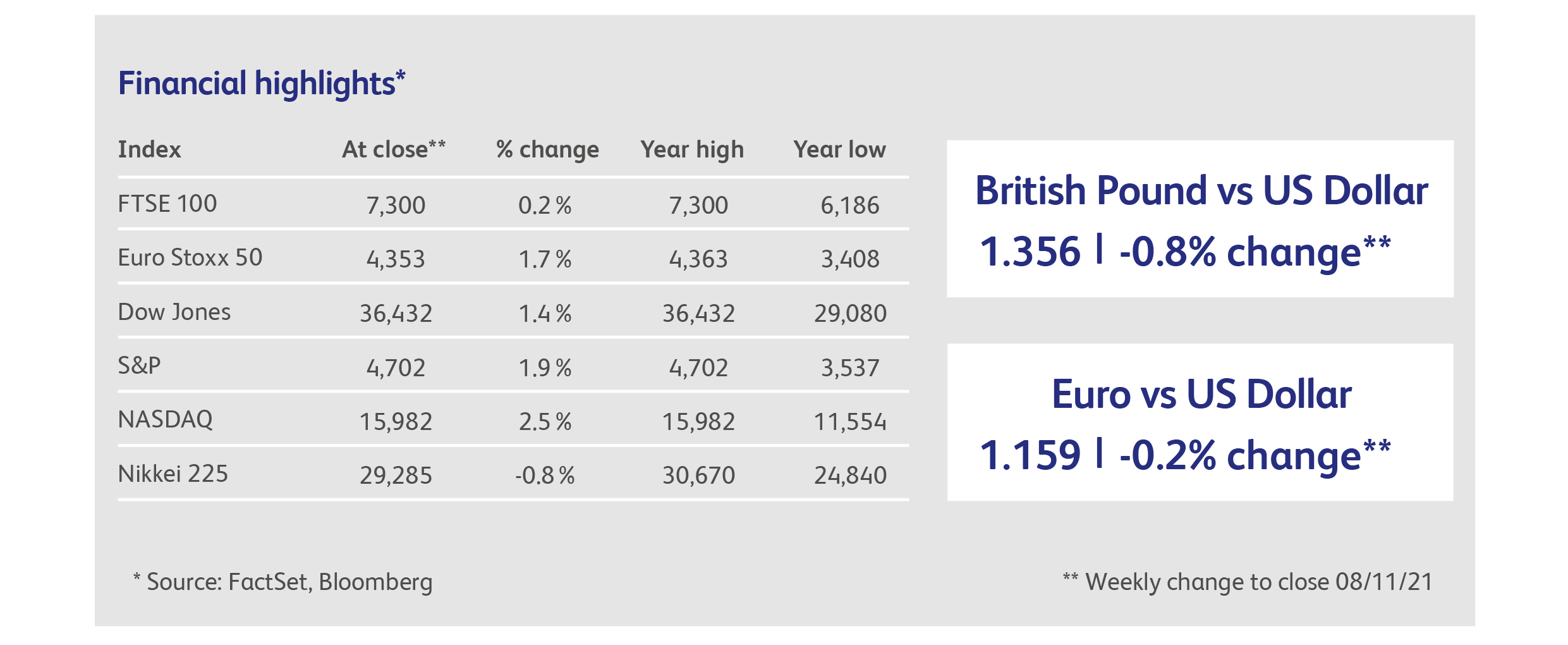

It has become quite common this year for stock markets to reach new all-time highs, and to do so without significant corrections along the way. This pattern was very much in evidence last week, as equities continued their amazing streak following October’s blip. The S&P 500 index rose to an all-time high for the seventh day in a row, and has broken so many records for undiluted optimism this year that market commentators have mostly given up highlighting them. Continental European stock markets were just as bullish, with the benchmark Euro Stoxx 50 index reaching new post-credit crunch highs for seven straight days. While most equity indices in the developed world have fared well over the past month, some have been more equal than others: UK equities have risen, but still significantly lag their pre-pandemic levels. The US stock market is now close to its all-time high in relative performance against the UK, and is trading at a 40% valuation premium, while European stock markets are trading at a 20% premium to the UK, a new post-referendum high.

If only the economic data would follow through on such lofty expectations, but it stubbornly refuses to convey much good news. Among last week’s hard economic data, manufacturing output in September posted month-to-month declines of 0.7% in the US, 1.4% in France and 1.5% in Germany, suggesting that supply-chain disruption has continued to worsen. German manufacturing output is, currently, a staggering 9.5% below pre-pandemic levels. Weakness in manufacturing was merely a nuisance when services activity was rebounding sharply after the lockdowns, but it will be more of a challenge as those tailwinds fade, and economists are fretting about the combination of declining rates of economic growth along with the sharp rise in inflation. It would be understandable if investors looked through this as being merely a temporary drag on growth, but it’s harder to see why it should be regarded as a positive.

In other US data, productivity declined in the third calendar quarter by the most in 40 years. The weaker productivity drove a surge in labour costs. This is worrying, because increased productivity is the key ingredient in offsetting wage inflation. Economists, however, have been quick to write this datapoint off as an outlier due to the Delta variant, and the consensus of opinion is that the longer-term picture is still one of higher investment leading to productivity gains in the post-Covid era.

The post-Covid era, however, is still some way off. Despite its success with vaccination programmes, Europe has once again become the epicentre of the pandemic. The number of cases and hospitalisations in the UK remain disconcertingly elevated as we head into winter and, in continental Europe, case numbers are rising noticeably. Germany, in particular, saw record case levels last week, not helped by the fact that sixteen million Germans have refused the vaccine. France is likely to reintroduce mask mandates this week. Ominously, even in Denmark, which has been a poster-child for successful management of the pandemic, cases and hospitalisations are spiking. China, meanwhile, is encountering its most significant outbreak of the Delta variant so far, with 19 of 31 mainland provinces affected. This is the widest spread of Covid cases China has seen since the initial outbreak in Wuhan in 2019.

The impact of the Bank of England’s shock decision not to raise rates rippled across the British stock market. Homebuilders Berkeley Group and Taylor Wimpey rallied on relief that higher mortgage costs would not dampen demand, and the commercial property sector bounced on expectations of lower financing costs. Among the losers were the banks, the beneficiaries of higher lending costs, with declines of 3-4% common across the sector.

The bizarre links between social media and US stock prices were on view again after a tweet by Tesla founder Elon Musk sent Tesla’s stock price down as much as 7%, for its worst day in eight months. Investors were spooked when Musk asked followers to vote on whether he should sell 10% of his holding in the company, and the response was a solid “yes”.

Announcements of profits for the third calendar quarter in the US are highlighting the gaps between pandemic winners and losers. Stay-at-home exercise company, and former pandemic-favourite, Peloton Interactive’s share price is heading back towards its pre-pandemic levels after a reduction in forecast sales for next year, which came only three months after its forecast had been raised. The shares fell nearly 40% on the news, and some analysts think it will now be 2024 before the company makes a profit.

Airbnb shares, on the other hand, were up by as much as 18% after the company reported that revenues grew 67% in the third calendar quarter and profits doubled. Only three months ago the company had warned that bookings for the third quarter would be lacklustre, and attributed the unexpected success to pandemic-induced changes in working behaviour.

Covid-19 vaccine manufacturer Moderna shocked investors with revenue and profit figures that fell far short of expectations, and warned that vaccine sales would not meet its $20 billion target for 2021. The company also lowered its forecast for vaccine production, sending the shares down 30%. Fortunately for investors, this is small change for a stock that is still 12 times above its pre-pandemic price.

Highlights

Calendar

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.