14 December 2021

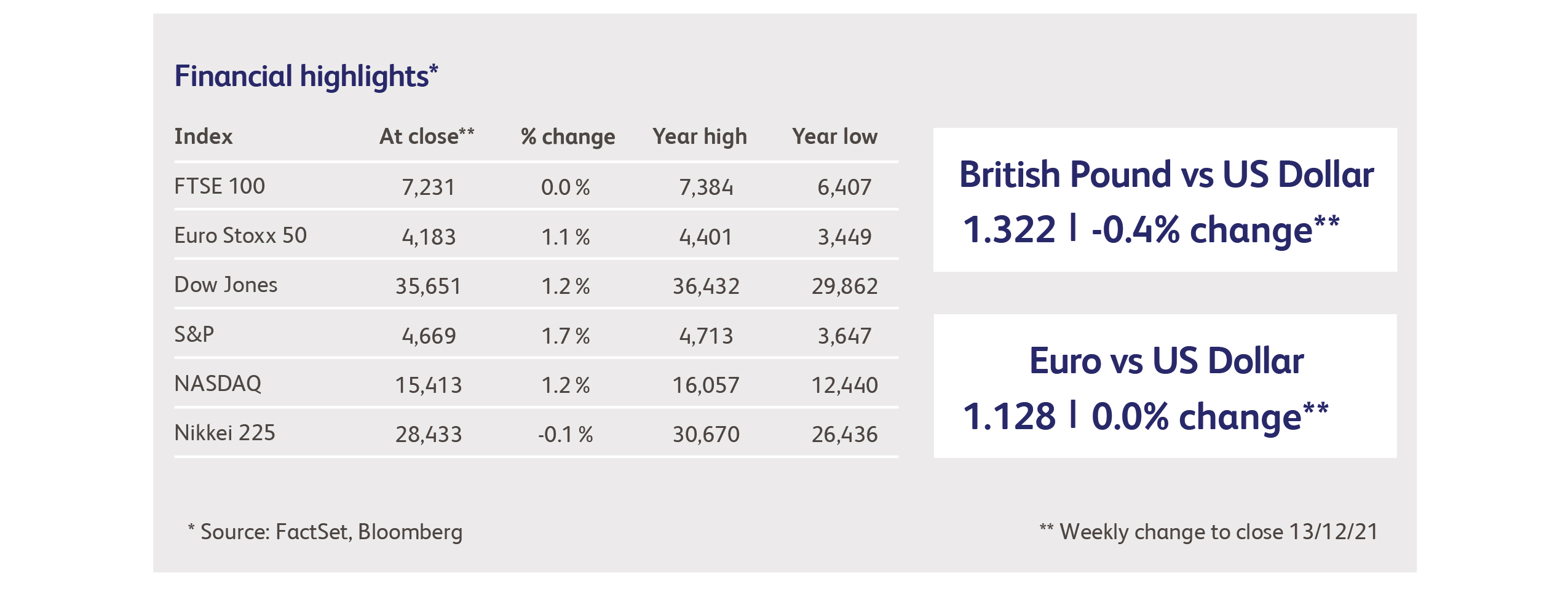

Stock markets completed a fairly solid rebound from the initial Omicron sell-off, but it’s hard to pay much attention to recent performance with so much uncertainty ahead. Omicron is so infectious that, by the end of the next week, its likely trajectory in some countries should be fairly well-established. Although Omicron cases may be milder than previous variants on average, hospitals may still be overwhelmed if Omicron spreads so quickly that even a low rate of hospitalisation generates large numbers of admissions.

The next week also promises meetings by all the world’s major central banks, with many expecting a change in tone towards a tougher monetary stance. First up is the US Federal Reserve, following hot on the heels of data showing that US inflation continues to rage. Last week’s data revealed that inflation hit 6.8% in November in the world’s largest economy, up from 6.2% the previous month. The last time inflation was this high, US government bonds yielded 14%. Currently they yield 1.4%. The Fed has already binned the idea of inflation being “transitory” and has indicated a likely acceleration in the winding down of asset purchases. The worry is that the Fed takes away the punchbowl with an unexpected change of tone, or even a rate rise.

Next it will be the Bank of England and the European Central Bank, which face similar inflation problems but whose economies have already dropped to a lower gear in the face of Delta and Omicron. Despite the government’s recent imposition of stiffer anti-Covid measures, markets are pricing a 35% probability that the Bank of England hikes rates in December, and are still of the view that the Bank will raise rates four times in 2022, to 1% by the end of the year. Any softening of these expectations will adversely affect sterling, which has already fallen by 7% against the US dollar over the last six months. The ECB meeting is the least likely to produce fireworks.

The reasonably calm week for the major stock markets indices belied the roiling waters underneath. The penchant for US retail investors to use index trackers means that the highest-value companies receive the largest amounts of investors’ money, propelling them to ever greater heights. Analysts at Bank of America estimated that investors poured nearly $900 billion into global equity funds in the year to November, more than the combined total over the past 19 years. Trackers captured 88% of these flows. This “momentum effect” flatters index performance when compared to the performance of index components. For example, the S&P 500 hit an all-time high last week, yet the average company in the index has fallen 19% from its highs of the year. The effect is even more extreme among technology stocks - the Nasdaq Composite is down about 5% from its recent all-time high, but the average company in the index is down nearly 40% from its highs of the year. Simply put, there is still a lot of speculative money chasing indices and tech behemoths. Only last week, a three-times leveraged fund tracking the Nasdaq 100 stock index saw record inflows, of $1.5 billion, in a single day. Apple alone now represents nearly 3% of the value of all the world’s stock markets combined, and the top five US technology companies represent over 10% of the world’s stock market value.

Investors were reminded of the crisis in China’s property sector when government officials took over the running of Evergrande, China’s second-largest property developer. Separately, the company was formally placed in default by ratings agency Fitch. $84 billion of Evergrande debt is coming due for repayment in the next year, with implications for the huge Chinese property market, the shadow financing sector, suppliers and capital market-creditors. The collapse of Evergrande had briefly threatened to destabilise global equity markets in September.

Despite their expertise at exploiting impulse purchases on smart phones, Amazon is under no illusions that its warehouse staff should not be using their own smart phones while on the job. For years the company has required staff to leave their mobile phones in lockers before heading to work, but the collapse of an Amazon warehouse last week that killed six people, plus the need to know of severe weather warnings in some states, has fuelled a backlash among employees.

Prompted by the seizing-up of semiconductor supply chains, governments have come to realise that access to semiconductors is a matter of national security. The world’s largest maker of semiconductors, Taiwan Semiconductor Manufacturing Co, is bowing to those political concerns and plans to build a factory in Germany. The company has already announced plans to build factories in America and Japan.

Following the departure of its co-founder the week before last, Twitter suffered another PR failure when the Indian Prime Minister’s Twitter account was hacked. In a sign of the times, the hackers put out a tweet saying that India had officially adopted Bitcoin as legal tender, and that the country would be distributing Bitcoins to its citizens.

Daimler Truck Holding, the truck manufacturing division spun off from Mercedes cars after a century of operating under the same roof, enjoyed a 16% rally on its first day of trading.

Highlights

US inflation continued to rocket higher, rising to 6.8% in November from 6.2% the previous month, propelled by energy, food and the increasing cost of rent - which is, in turn, driven by rapid increases in house prices and wages. New and used car prices also continue to rise: new car prices are now 12% above their pre-pandemic level, and used car prices are up by an incredible 47%. The cost of hotel rooms has risen by 9% since the pandemic began.

UK GDP growth underwhelmed expectations in October, rising by only 0.1% from the previous month versus expectations for a 0.4% rise. As in September, what growth there was, was largely due to the health sector. A big drop in construction is thought to reflect a shortage of raw materials, and a drop in energy sector output may have been caused by the weather. Expectations for GDP growth for next year slid further on the news, and are now down a percent from the start of the year.

Calendar

Business activity surveys in Europe for the first two weeks of December will show the extent of the impact of reinstated virus restrictions. All sectors of the economy in all the major European countries are expected to show a slower pace of activity. It’s a different story in the US, though, where business activity is expected to have picked up in December in both manufacturing and service sectors.

The UK rate of inflation in November is expected to have risen to 4.7% from 4.2% in October, exceeding the Bank of England’s own forecast. It is likely to have been driven by increases in the cost of fuel, tobacco, food, used cars and clothes.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.