22 February 2022

The stand-off in Ukraine produced a conventional rush for safe havens last week, with bond markets benefiting across the whole spectrum from the additional demand and stock markets wobbling. Precious metals were among the few positive sectors within equity markets and gold, in particular, is now back to its highs of the past year. Traders’ screens were mostly red, however, with travel and leisure, banks and, surprisingly, oil and gas companies among the biggest losers. It would seem that investor fear trumped the ability of banks and oil companies to escape the ravages of inflation, Covid and war, or that investors were taking profits on the most positive performers in their portfolios for the year to date.

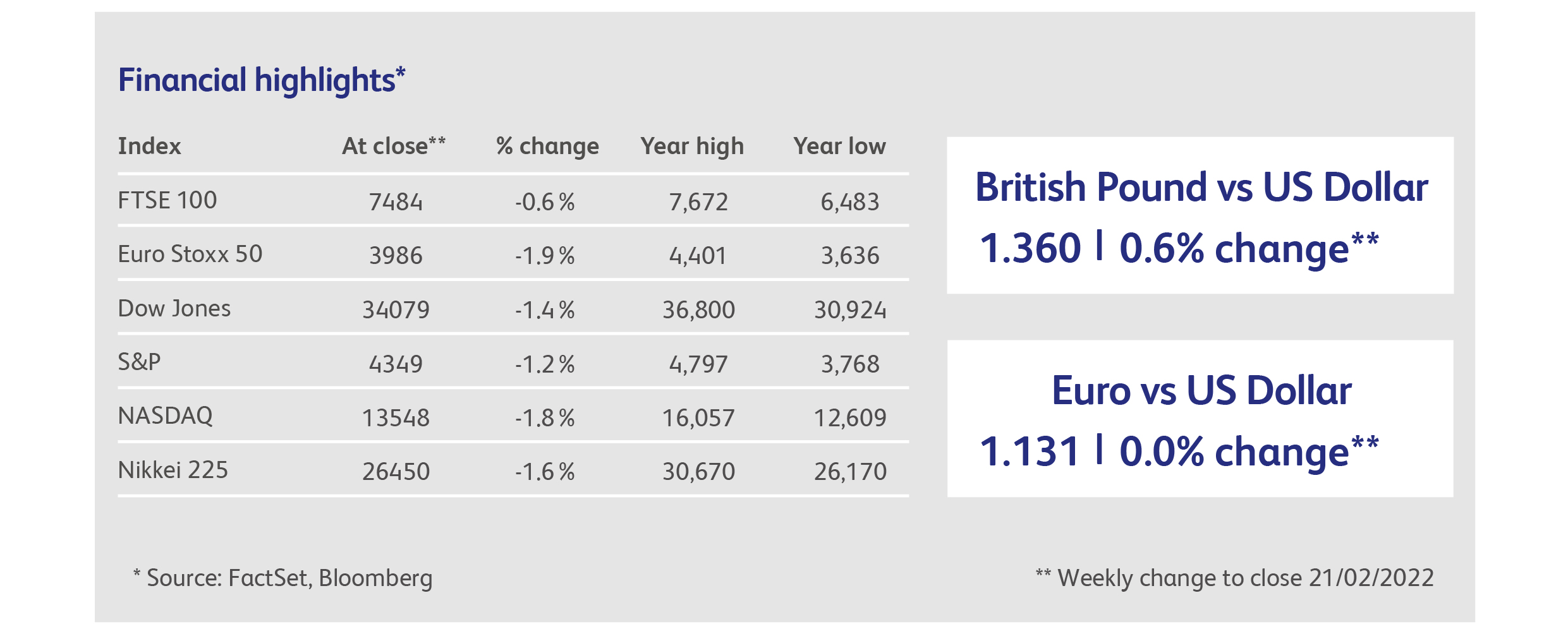

As a result, the bank and oil-heavy FTSE 100 struggled to maintain its relative outperformance, falling on the week. Much more pain was in evidence below the mega-cap stocks, with the middle-sized companies making up the FTSE 250 now down 11% for the year. The FTSE 250’s European counterparts, which make up the Euro Stoxx Mid Index, are only down half that amount, raising the spectre that the longstanding British stock market discount is back. Nevertheless, in the FTSE 100 at least British investors can boast a blue-chip index that is one of the few positive performers this year.

They are joined in this by investors in Emerging Markets, where some of the largest Chinese technology company constituents have been bouncing back after a disastrous 2021. Special mention should also be given to the Indian equity market, whose spectacular post-pandemic performance has eclipsed allcomers. The S&P BSE Sensex Index, for example, which tracks companies listed on the Bombay Stoch exchange, is nearly 40% above its pre-pandemic level. Only the technology sector in the developed world can boast that kind of performance.

Globally-speaking, index levels have become a poor guide to the chaos that is going on underneath, at the individual company level. Sectors and stocks that had been the darlings of the markets since the pandemic started are experiencing very divergent paths. Taking the S&P 500 Index as an example, the share prices of Apple, Alphabet (owner of Google) and Amazon have fared relatively well, and are all down less than 10% year to date. Contrast their fortunes, however, with Netflix, the Covid-vaccine supplier Moderna and Meta Platforms (formerly Facebook), whose share prices are all down more than 35% year to date. Netflix and Meta are both below levels reached prior to the pandemic. Much of this divergence has been due to the extreme reactions of markets to reported company profits: investors have been punishing the share prices of companies that underperformed revenue and earnings expectations by the most in a decade.

At the margin, it seems that fundamentals in the short-term are weakening. Despite, or more likely because of, a spectacular set of results for the fourth calendar quarter and record profit margins, the rate at which analysts are upgrading their estimates for company profits has slowed. For company profits to continue growing briskly from these levels, consumers will have to start splurging some of the trillions of dollars in excess savings they have accumulated during the pandemic. The evidence for this is tenuous, however, either at a macro-economic level or, it now seems, at the level of individual companies. Could it be that the record profits of the last 18 months were the product of a once-in-a-lifetime $30 trillion government stimulus, and are unsustainable?

Facebook owner Meta Platform’s share price fell another 6% during the week, as fears grew surrounding the imminent Irish ruling on the technology’s industry’s transfers of data from the EU to America. Meta has already indicated that it would be unable to offer Facebook and Instagram services in the EU if the transfers are deemed to be illegal. The company has lost nearly $500 billion in market value since September as its share price has fallen 46%. The $251 billion in market value lost on February 3rd, the day it released its latest results, was the biggest ever one-day loss for an American company. Ironically, the company had spent $20 billion in stock buybacks during the fourth quarter of 2021, when its stock price was over 50% higher.

Canadian ecommerce giant Shopify’s market value has fallen by a mere $130 billion but that represents a 61% fall from its November peak. The company’s share price fell an additional 18% after it announced that the “Covid-triggered acceleration of ecommerce… in the form of lockdowns and government stimulus will be absent from 2022”. Notwithstanding that, Shopify had still beaten analysts’ expectations for revenue and earnings in the fourth calendar quarter of 2021.

Online streaming services continued to cause problems for shareholders. Paramount Global (formerly ViacomCBS) shares plunged 17% despite adding 7 million subscribers to its Paramount+ streaming service in the fourth quarter. Its online streaming competitor AMC Networks fell a similar amount and for a similar reason: the increasing cost of developing content in the online streaming universe. Both company’s shares are now well below their pre-pandemic levels, despite having spiked by several hundreds of percent during the pandemic.

Italy’s government debt showed the problems confronting the European Central Bank as it seeks to combat inflation without prompting a sell-off in the bonds of less credit-worthy governments. The yield on Italian 10-year government bonds reached 2% during the week, and its premium over benchmark German government debt is only about a percentage point below the level that has been associated with crises in the past. These problems cast doubt on the ECB’s ability to reduce its bond-buying programmes in order to combat inflation.

Highlights

Calendar

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.