22 March 2022

Stock markets largely completed their recovery from the trauma induced by the conflict in Ukraine last week, and European markets are back to within 5-6% of their pre-war levels. This amount is approximately equal to a year’s return on an equity index, and seems reasonable given the war’s implications for energy consumption and inflation. US markets leapt ahead last week, especially the technology sector, as investors recovered some of their appetite for growth stocks. This also seems reasonable, given America’s distance from the conflict, its relative self-sufficiency in energy and the enormous increase in wealth its citizens have enjoyed during the pandemic. Private sector output in the US is 3.6% above its pre-pandemic level whereas, in the UK for example, it remains 3.5% below. That does not mean that the US is immune to economic wobbles, just that it will probably remain a relatively safe haven when compared with other developed-world countries.

The flipside of faster growth, however, is faster change in monetary policy. That was evident in US bond markets last week, where short-term yields suffered another violent lurch upwards. The catalyst was Federal Reserve Chairman Powell, whose comments at a conference seemed to imply that a 0.5% rate rise was on the agenda. Bond investors hate any kind of uncertainty in monetary policy, and the broad range of outcomes that the Fed is prepared to consider flies in the face of previous, consistent communications on policy by it and other central banks, where only a word here or there changes from month to month. It does not help that this uncertainty has been caused by central banks’ own misreading of inflation. Suffice to say, it’s unlikely that Chairman Powell will be attending many more conferences.

Having suffered from a tsunami of disasters last week, Chinese equity markets rallied by the most in their history. In the previous week, a combination of regulatory pressure on Chinese companies with American listings, a wave of Covid in the technology hub of Shenzhen and the province of Jilin, fears that the lack of vaccinations and acquired immunity in China make it ripe for a Covid disaster, and the prospect of western sanctions if China chooses to support Russia in its invasion of Ukraine, had sent some Chinese stock market indices below levels reached in 2006.

Last week, however, the tsunami was of good news, and included support from President Xi himself. Firstly, the top Chinese financial regulator issued a statement committing to stability in capital markets, supporting overseas stock listings, resolving risks in the property market and to completing the crackdown on the technology sector “as soon as possible.” The Nasdaq Golden Dragon Index of Chinese companies listed in America promptly rallied by 33%. The Hang Seng China Enterprises Index, comprising Chinese companies listed in Hong Kong, rallied by 20% in two days. Next, the central bank intervened to weaken the Chinese yuan, and the Chinese government distanced itself from the conflict in Ukraine. Finally, President Xi offered the prospect of a change in the country’s longstanding zero-Covid policy by committing to reduce Covid’s economic impact. Optimists described this as akin to Draghi’s “we will do whatever it takes” moment during the eurozone crisis. Pessimists pointed to China’s sluggish economy and problems in the property market. Realists, however, will be aware that statements by the Chinese government are what matters for Chinese investors. As if on cue, Chinese internet giant Alibaba, which had been the focus of the government’s regulatory ire, upped its share buyback programme to $25 billion, from $9 billion in the previous tranche.

Saudi Aramco, the world’s third largest company by value and the world’s biggest energy exporter, announced profits for 2021 of $110 billion. This was more than double the profits in the pandemic-affected prior year. Saudi Aramco’s share price has risen by 15% since the start of the war in Ukraine. The company expects to spend $40-50 billion in the current year as it seeks to raise production of crude oil by 8% over the next five years, and also to invest in natural gas and hydrogen assets.

The development of the hydrogen-energy business has been constrained by the fact that the production and distribution of hydrogen involves projects of a magnitude so large that only governments are capable of putting the infrastructure in place. The conflict in Ukraine may well turn out to be the catalyst that the industry needs. Last week, following a meeting between the German economy minister and the Norwegian prime minister, a feasibility study on the building of a hydrogen pipeline between the two nations was announced. The share prices of most hydrogen industry players have yet to respond materially to the Ukraine crisis, despite the conflict’s implications for the acceleration of the hydrogen industry across Europe.

Internet companies will soon face a more rigorous regulatory environment in the UK, following the publication of proposed legislation that would give Ofcom the power to impose massive fines on companies and to prosecute senior management personally for failure to comply. The legislation aims to make internet companies more accountable for the material published on their platforms. Ofcom would also be given the power to enter offices, inspect equipment and data, and it would become a criminal offence to obstruct investigations. News content and journalism would be exempt from the new legislation.

In what is being labelled as the “dash for trash”, last week’s stock market rally saw a bounce in the share prices of early-stage technology companies. Once the darlings of the pandemic-inspired equity boom, these companies had fallen back to earth with a bump over the past six months. The rally may indicate that growth-stocks are back on the menu: the Russell 1000 Growth Index, an index of American growth stocks, rallied 10% during the week, while its value-orientated equivalent rose by only 5%.

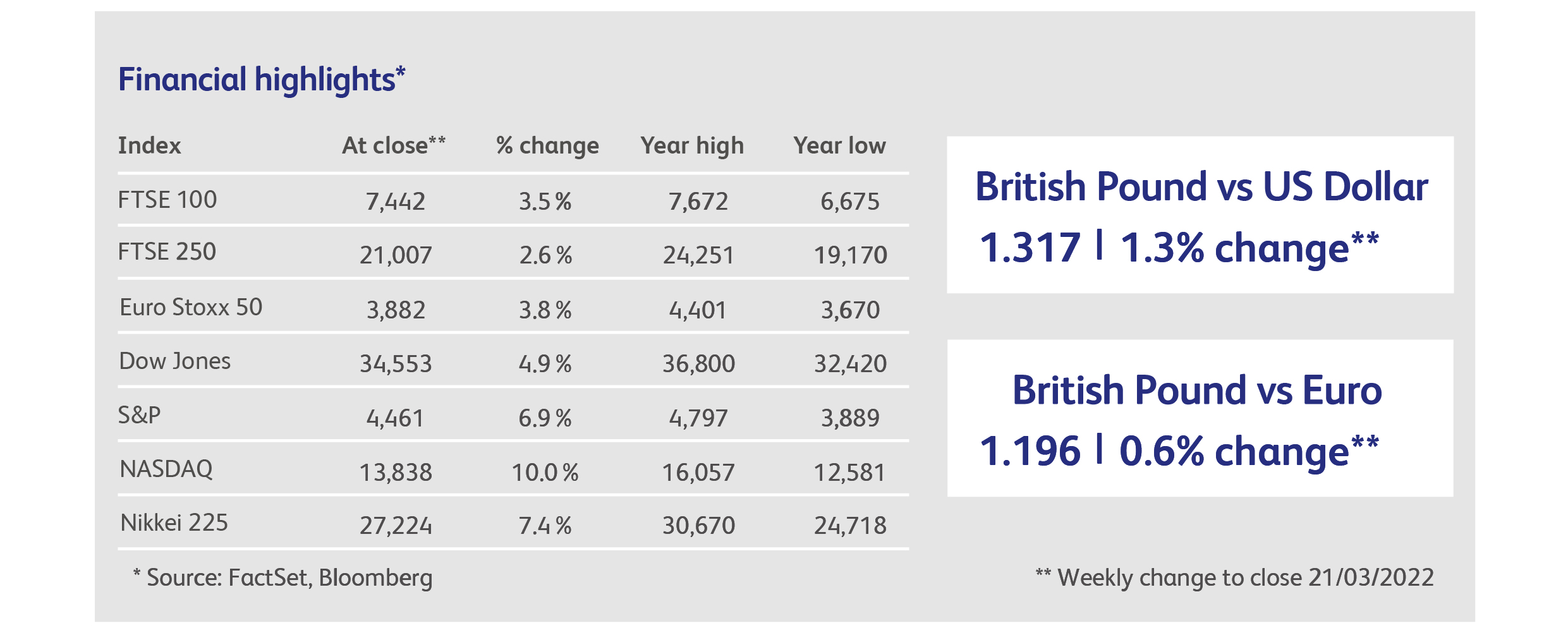

Highlights

Calendar

This publication is intended to be Walker Crips Investment Management's own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.