5 April 2022

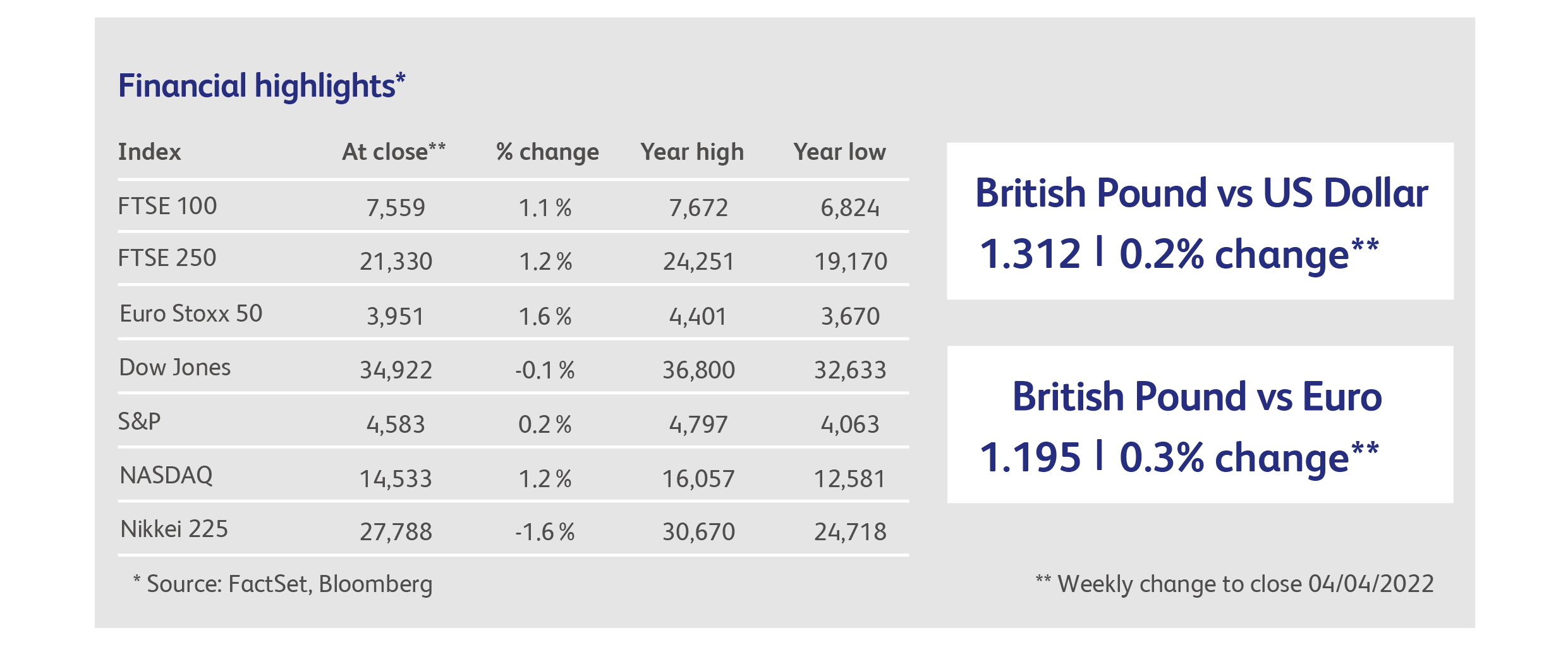

Stock markets largely completed their recovery from the Ukraine-war sell-off last week. However, not all markets are equal, with the very large companies comprising the S&P 500 stock market index and the FTSE 100 comfortably beating the performance of their continental European peers, and with smaller and mid-sized companies languishing everywhere. In the Far East, Japan’s Nikkei index has fared relatively well, and joins the lucky group of blue-chip indices which are down only a few percentage points for the year to date.

China’s stock market indices have also recovered most of their recent losses, helped by domestic political support, and only this week both the Chinese government and central bank committed to policies that prioritise economic stability. Given China’s many problems, including a sharp economic slowdown and a worrying wave of the Omicron variant, it’s perhaps surprising that investors would have been as well off this year holding Chinese stocks as they were in European blue-chips.

There have been other notable success stories within Emerging Markets, driven by the return to favour of oil companies and other exporters of commodities. Latin American stock markets have had their best start to a year since 1990, surging by over 20% across the board. Investors have been further helped by a strengthening in Latin American currencies, which have stabilised as a result of the solidifying effect on government finances of the hard currency flowing in to pay for commodities. The Brazilian Real, for example, is up 18% against the dollar for the year to date. All this has prompted talk of a renaissance for Latin American equities, driven by an economic super-cycle in commodities. If that’s true, investors can take further comfort from the fact that, following another lost decade in Latin America, there is still plenty of upside for both equities and local currencies from current prices. Latin American equities are trading at valuations a third below their average of the last 10 years, and that average is itself fairly low by comparison with other regions of the world. The upside for currencies is also impressive; despite its recent rally, the Real has lost two thirds of its value against the US dollar over the past decade.

For bond markets it was a case of “another week, another inflation shock”. This time in the Eurozone where economists, who thought their forecasts had finally gotten ahead of raging inflation, were surprised again by March’s figure showing a jump to 7.5%, from 5.9% in February. The average of expectations had been for a rise to 6.6%, missing by nearly a full percentage point. Rampant energy inflation was the main culprit, with prices rising 45% from a year ago. With the impact of the war in Ukraine likely to result in slower economic growth, stagflation was already a racing certainty in the short-term, and this latest data exacerbates the problems faced by the European Central Bank, which is caught between under-reacting to inflation and giving up its tight control of government bond markets. Investors, meanwhile, had been hoping for a softening of monetary policy in the light of the Ukraine war, but this now looks much less likely. The best hope now is for a ceasefire in Ukraine; otherwise, European markets could be in for even more volatility until inflation finally subsides, probably towards the end of the year.

Shares in Twitter enjoyed their biggest one-day gain ever, rising 27% after it was disclosed that Tesla founder and CEO Elon Musk had taken a 9% stake in the company. Musk himself, however, has been partly responsible for the 50% decline in Twitter’s stock price over the past several months: he regularly accuses its management of infringing his right to free speech and, only last month, he threatened to start his own social media platform.

Meanwhile, Donald Trump’s attempt to start his own social media platform, following his eviction from Twitter, is running into trouble. Downloads of his so-called “Truth Social” app have fallen by 95%, and it was reported that two of the venture’s senior managers have resigned. Shares in the Special Purpose Acquisition Company, or SPAC, that Trump intends to merge with, have fallen by 32% over the last month, having peaked in early March at an implied valuation of $4 billion. Meanwhile, SPACs themselves came under threat as the US market regulator, the Securities and Exchange Commission, proposed a new set of rules designed to reign in the tendency of SPACs to over-hype the prospects of the companies they merge with.

Shares in Apple, the world’s largest company by market valuation, briefly touched the all-time high reached in early January following a remarkable, 11-day rally. Investors ignored a report about production cuts, as well as news that Apple was among a number of technology firms that had been conned into providing customer data to hackers masquerading as government officials. Meanwhile, Apple announced that it is expanding into payment processing technology and infrastructure for its own financial products. That news sent the share prices of some of Apple’s service providers down as much as 10%. Apple shares, on the other hand, are now up for the year to date.

A notable theft occurred in the cryptocurrency world, which is often touted for the security and robustness of its “blockchain” technology. This time, $600 million was stolen from the “Ronin Bridge”, one of thousands of pieces of software that let investors convert currency tokens from one cryptocurrency into another. The price of Ronin’s own cryptocurrency promptly fell by over 20% after the breach was disclosed. Apparently, it took six days for the theft to be spotted.

Highlights

Calendar

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.