12 April 2022

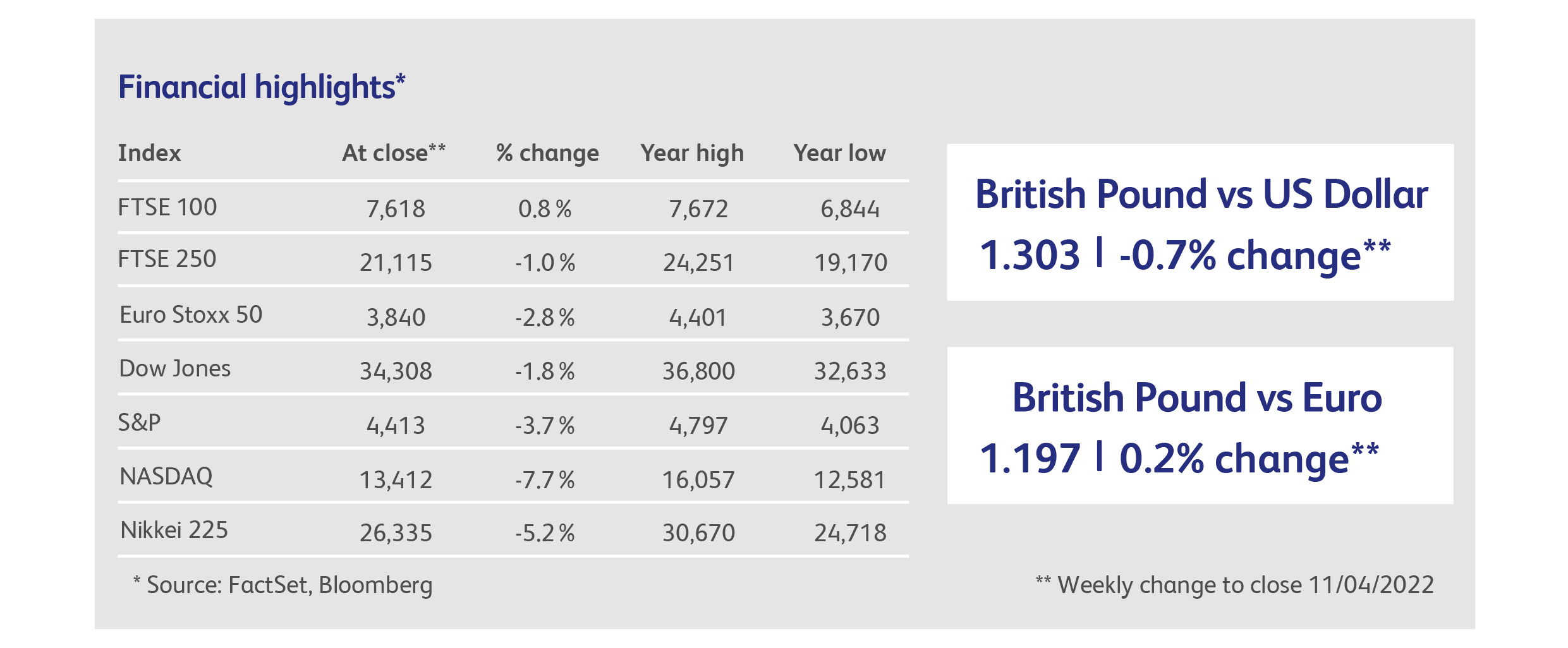

Stock markets initially threatened to continue their advance, before retreating to end the week lower. The initial setback was the US Federal Reserve or, more specifically, the written minutes of a Federal Reserve meeting that took place four weeks ago. Such is the scrutiny being applied to the change in interest rates by the Fed that the market was falling even before the minutes were published, and continued to fall afterwards even though they merely confirmed what was telegraphed at the meeting itself. Perhaps investors needed to see it in writing, such is the poor state of the Fed’s credibility. The technology- heavy Nasdaq Composite Index managed to decline by 8% from peak to trough during the week, and most equity indexes around the world followed to different degrees. These market characteristics were reminiscent of the start of the year, when a violent rotation sent growth stocks tumbling and stodgy, value stocks in hitherto unfashionable sectors soaring. The latter description fits the FTSE 100 very nicely, and it managed a 1% gain for the week, supported by banks, oil companies and pharmaceuticals.

Mixed in with fear of the Fed’s new battleplan were rumblings of an insurrection in France, where investors awaited the first round of the election with increasing trepidation. Polls showing Le Pen remorselessly closing the gap on Macron prompted political forecasters to fret that, perhaps this time around, the anti-National Rally vote will not coalesce around Macron. In the event, Macron was ahead by an uncomfortably slim margin that is unlikely to provide much respite for investors over the next two weeks. And stock markets were finally routed by an ambush in China, where the Omicron wave continues to grow despite a strict, weeks-long lockdown in Shanghai that has caused food shortages and, even, social unrest amongst its 26 million residents. The new news was that the lockdown has now spread to Guangzhou, a city of 18 million, after 20 cases were identified there.

Bond markets long since raised the white flag, but their surrender is looking increasingly disorderly. Developed-world government bond markets hit new lows for the post-pandemic era. Ten-year UK gilt yields rose to levels not seen since 2015, and now offer a yield to maturity of 1.85%. Given that central banks are now talking about running down, or even reversing, their bond purchase programmes, it’s hard to see where buyers are going to come from. At this rate of decline, at least it won’t be long before bond yields encourage some buyers who don’t work for central banks.

The volatile mix of news-flow played havoc with already-volatile commodities prices. Zinc closed at its highest level since 2006 as production sources for the metal continued to dwindle. Stockpiles were already low last year as industrial activity rebounded from lockdowns, but supply was further depressed when some European smelters became unprofitable due to inflation in energy prices. Palladium prices, which hit an all-time high in March, surged 10% after two Russian refiners were suspended by London’s metals exchanges. Iron ore, on the other hand, fell for five days in a row on fears that the lockdowns in China will slow demand and, for the same reason, oil’s explosive rally may have come to an end.

In an interview with the FT, Volkswagen’s management revealed a plan to move away from the decades-long focus on volume and market share towards quality and margins. As part of the plan, the company will drastically reduce its range of fossil fuel-powered cars in favour of electric models over the next eight years. Somewhat less optimistically, the company revealed that rising raw material costs have undermined its expectations for the profitability of its electric vehicles.

News that Warren Buffett’s Berkshire Hathaway Group has bought a $4 billion stake in Hewlett Packard sent Hewlett Packard’s shares up as much as 18% to a new record high. The stake in the printer and computer manufacturer follows Berkshire Hathaway’s large accumulation of shares in Occidental Petroleum, and suggests that the investment firm is seeing value again after a dearth of opportunities over the past few years.

JD.com’s billionaire founder has resigned as chief executive of the company, China’s second largest online retailer. He joins a long list of wealthy entrepreneurs who have taken lesser roles in the wake of the Chinese government’s efforts to curb the power of the technology sector. Until now, JD.com had been one of the few Chinese internet giants to avoid a direct hit from the authorities. The former CEO will now devote his time to guiding the company’s longer-term strategy and mentoring younger managers.

Chinese authorities formally started a campaign, announced last August, to address the abuse of algorithms used by internet companies to deliver content to users. The Cyberspace Administration of China will target larger websites, platforms and products using on-site inspections and submissions by the companies themselves.

Highlights

Calendar

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.