24 May 2022

The week started promisingly enough, with the most hawkish comments yet from the US central bank failing to disrupt equity, bond or currency markets. In an interview with the Wall Street Journal, Federal Reserve chairman Powell said something that central bankers have not had to say for decades: that the Fed intends to raise rates until they slow economic growth, and that they are prepared to risk higher unemployment. He even raised the prospect of faster, more aggressive interest rate rises than the half-percent a month currently expected.

That markets were unfazed by his comments was a rare moment of stability, but it was not to last. A series of profits warnings by American companies sent stock markets into a tailspin, and the US indexes in particular to their lows of the year. First up was the computer networking giant Cisco Systems, whose management was unable to convince pessimistic investors that falling revenues were due to Chinese supply chain problems rather than a decline in spending among customers. But that was small beer compared with Walmart, the world’s biggest retailer, which warned that customers were switching from higher-margin discretionary purchases of goods to purchases of lower-margin essentials, such as food. Markets panicked on the news - seeing, for the first time since the inflation scare began, real evidence of a slowdown in consumer spending. Walmart’s profits warning was followed by similar announcements from a series of discount retailers in the US.

Things must be bad if even deep-discount retailers are having a hard time, and this news was all the more important because expectations for company profits had remained relatively resilient since this bear market began at the beginning of the year. As a result, the decline in asset prices during the year had been accompanied by a decline in valuations. This had offered a silver lining to investors, who could buy their favourite companies with their prospects unchanged, for less. That optimism is now in danger of subsiding, which was enough to send contagion across the Atlantic to European stock markets. Even the currently-mighty FTSE 100 fell 3% on the day.

Remarkably, however, markets then staged nearly a full recovery. Perhaps this was due to the hope that shoppers at Walmart may not carry enough economic heft to disrupt the entire economy. Moreover, sentiment appeared to be helped by an interest rate cut in China, followed by President Biden’s promise to address tariffs imposed on China, which was in turn followed by an announcement from the Chinese government of further stimulus measures. The global banking sector then surged following bullish comments by JP Morgan Chief Executive about the state of the economy and an upgrade to the firm’s profit expectations. “No recession is imminent”, seemed to be the message, and fears that banks would be hit by bad debts were banished.

Alas, this may not last. A profits warning by the owner of the internet messaging service Snapchat suggested that advertising expenditure is weakening. Whether this is restricted to the online advertising world is yet to be seen but, right now, investors are in the mood to shoot first and ask questions later.

The world’s largest retailer, Walmart, saw its share price fall by the most in nearly 35 years after reporting poor profits for the first calendar quarter and warning that profitability in the coming year will be below expectations. It was notable that revenue growth remained robust, but the mix of purchases was towards lower-margin grocery sales and away from higher-margin discretionary purchases. Moreover, the cost-base suffered from inflation in purchasing, transportation and labour costs. Walmart shares had been among the best performers in the US stockmarket until the profits warning, having risen since the start of the year, but they ended a tumultuous week down 17%. The day following Walmart’s meltdown it was the turn of Target Corp, another huge discount retailer in the US, to report similar problems and to suffer a similar fate, with the share price falling 25% in a single day. The contagion spread to the rest of the US retail sector.

Luxury goods makers appear to be weathering the inflationary storm better after Burberry Group and Richemont both announced strong results for the latest accounting year. Burberry’s move upmarket has been rewarded with better profits and operating margins, and the company announced a £400m share buyback programme. The only cloud on the horizon was a recent slowdown in China, due mainly to lockdowns, but investors were satisfied with the results and the stock price held its own in a difficult week. Richemont’s profits more than doubled and its revenues bounced by 46% from the previous year to a record high. Investors, however, had expected more, and even the promise of a special dividend could not stop a 13% decline in the share price. Richemont’s temporary exit from Russia has been painful, with management estimating that it has already cost the company EUR168 million.

Cisco Systems shocked analysts by raising the possibility of falling revenues in the current calendar quarter. Notwithstanding the temporary nature of the slowdown, which management attributed to supply chain blockages in China, investors sent the shares down 14%. Other computer-networking companies followed suit.

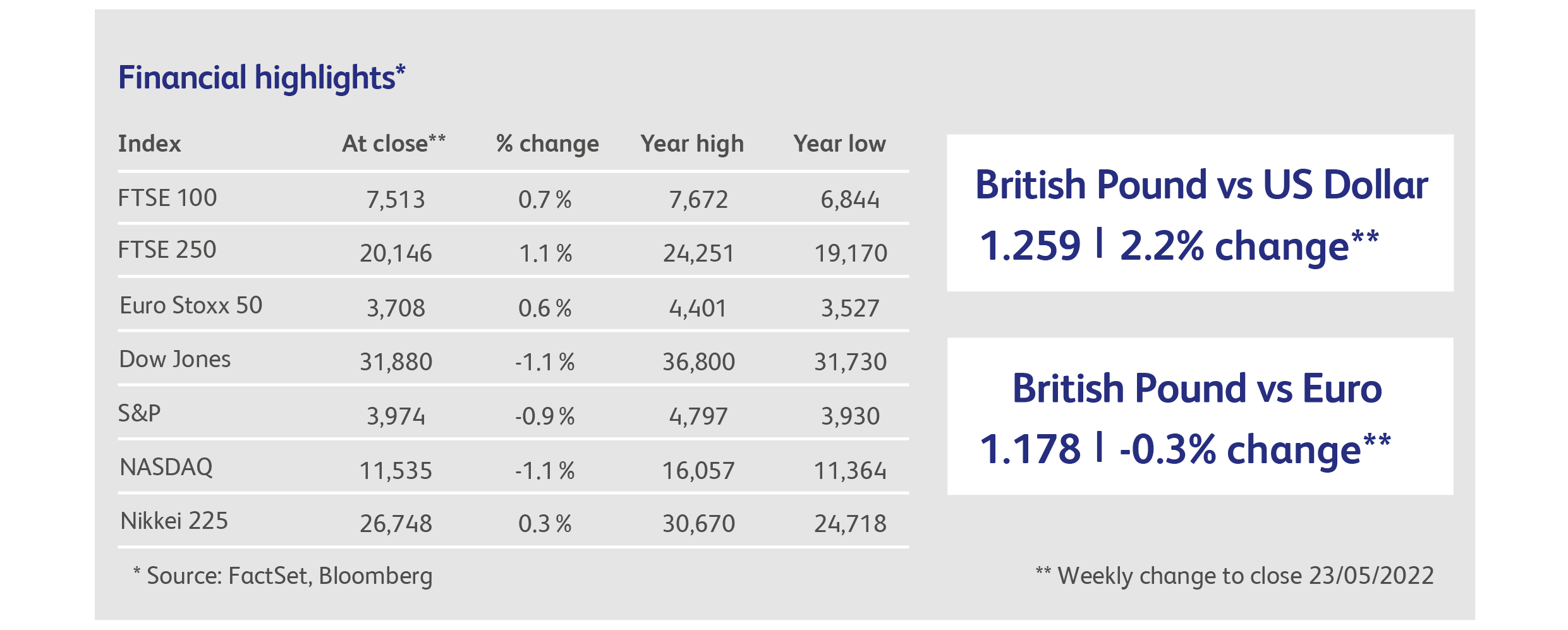

Highlights

Calendar

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.