Banner.jpg)

9 August 2022

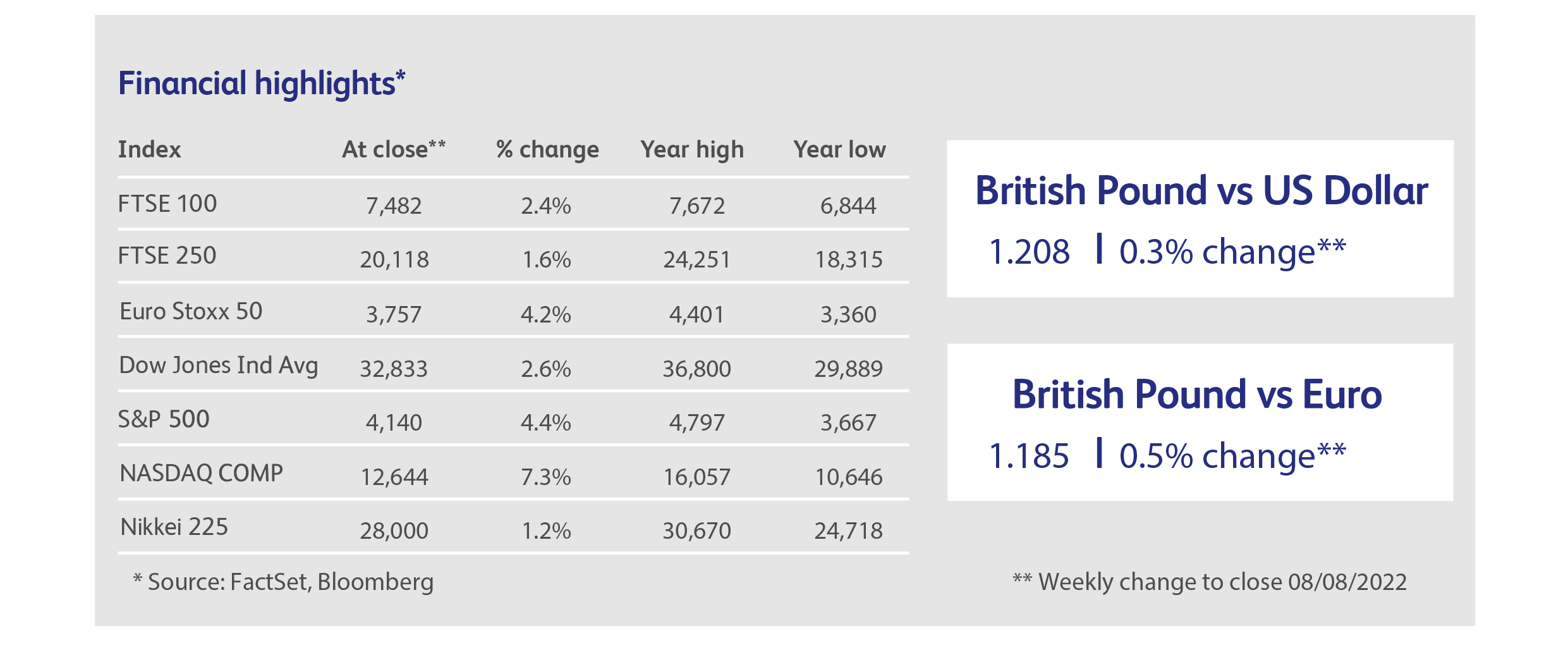

Last week saw a shift in financial markets' focus as the risk of a recession dominated the headlines. The immediate reaction to the Bank of England's (BOE) unprecedented warning that a recession is coming resulted in Sterling falling, with the yield on 10-year government bonds declining below the 1.9% level. Peak inflation forecasts revised up to 13% accompanied the most significant rate hike delivered since 1995, yet the reaction from stock indices was muted. The limited price action in equities could cement the view that markets continue to anticipate inflation peaking in October and are attracted to the idea of the BOE talking up additional rate hikes, as it demonstrates resolve to combat inflation forcefully. It is, of course, possible prices could rise higher and last longer than the BOE's forecast, and there have been questions raised around the recently-issued forecast for inflation to fall to the 2% target in 2025. Only time will tell whether predictions are accurate but what is certain is that the setting of monetary policy will remain challenging.

US House Speaker Nancy Pelosi's visit to Taiwan increased global geopolitical risks. However, sentiment recovered with Treasuries and the Yen selling off as it became apparent that armed responses would be restricted to military drills. On Thursday, the crude oil price recorded its most significant weekly decline since early April after data showed unexpected increases in US crude and gasoline inventories. The rise in gasoline inventories could result from a drop in gasoline demand due to record prices at the pump. The Organization of the Petroleum Exporting Countries (OPEC) decided to raise oil production by just 100,000 barrels a day next month versus increasing output by 648,000 in July and August. The decision to increase by a smaller amount could be interpreted as a bearish sign, as releasing fewer barrels may suggest lower demand in a recession scenario. On the other hand, reports in US papers suggest OPEC's decision was taken to snub US President Joe Biden following his trip to Saudi Arabia. The White House had hoped the trip would increase supply, with spare capacity helping the global economy.

Markets interpreted US Jobs data released on Friday as a double-edged sword. Numbers revealed a strong US labour market that defies recession fears, but supports bigger Fed rate increases. US employers added 528,000 jobs in July, outstripping economist forecasts which predicted only 250,000 jobs would be added. The Eurozone unemployment rate remained steady at 6.6%, but the youth unemployment rate increased to 13.6% in the euro area, up from 13.3%.

According to figures released on Friday by FactSet (an American financial data and software company), 87% of S&P 500 companies have reported second-quarter earnings, with 75% beating earnings per share forecasts and 70% beating revenue estimates. It is a similar picture in Europe and Japan. On the surface, these earnings and revenue surprises look promising but appear to be at odds with GDP data. US GDP figures released this week showed the US economy contracted for a second consecutive quarter, and two straight quarters of decline meet one of the criteria for a technical recession. It is perhaps more meaningful to look at FactSet figures that point to S&P 500 earnings per share growth for the second calendar quarter coming in at 6.7%. If this is the case, it will mark the lowest earnings growth rate reported by the index since the fourth quarter of 2020, according to FactSet.

HSBC announced an increase in adjusted profit before tax of $6 billion, up $0.7 billion (13%) versus the second quarter 2021. Results also laid out plans to reinstate the quarterly dividends with the expectation that the dividend per share will reflect materially higher expected returns by targeting a return on tangible equity of at least 10% in 2023, when dividends are expected to resume. Increases are helping returns on tangible equity in net interest income and improving lending margins on the back of rising interest rates. It has long been anticipated that banks will make more money as interest rates rise by charging more on lending and maintaining low interest rates on deposits. The more significant the difference between interest charged on loans (asset) and interest paid on deposits (liability), the greater the chance of increased profits hitting the bottom line. This is less likely to play out well under a recession scenario as demand for assets (loans) could fall, and if the cost of living crisis worsens and prevents consumers and businesses from being able to repay debts, asset values could be written down.

It has also been thought that insurance companies are also likely to benefit from rising interest rates based on the premise they collect premiums and can invest proceeds at higher rates. Moreover, higher interest rates could increase the Solvency Coverage Ratios providing potential spare capacity to return capital to shareholders. The latest results from Direct Line revealed its Solvency Capital Ratio was broadly unchanged so no benefit could be derived there and premiums collected have not increased in line with claim costs for breakdowns resulting in the company announcing a 47% fall in operating profit, which was not unexpected given the profit warning issued in July.

Having just reported its first ever decline in profits, Meta Platforms, parent of Facebook and Instagram, borrowed $10 billion. The cash is expected to fund its vision of the so-called Metaverse, an online world in which people are hoped to spend a great deal of time and money, but some believe it will just be used to fund share repurchases. The debt issue included a 40-year bond offering an additional 1.65% above US government bonds.

Highlights

Calendar

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.