4 October 2022

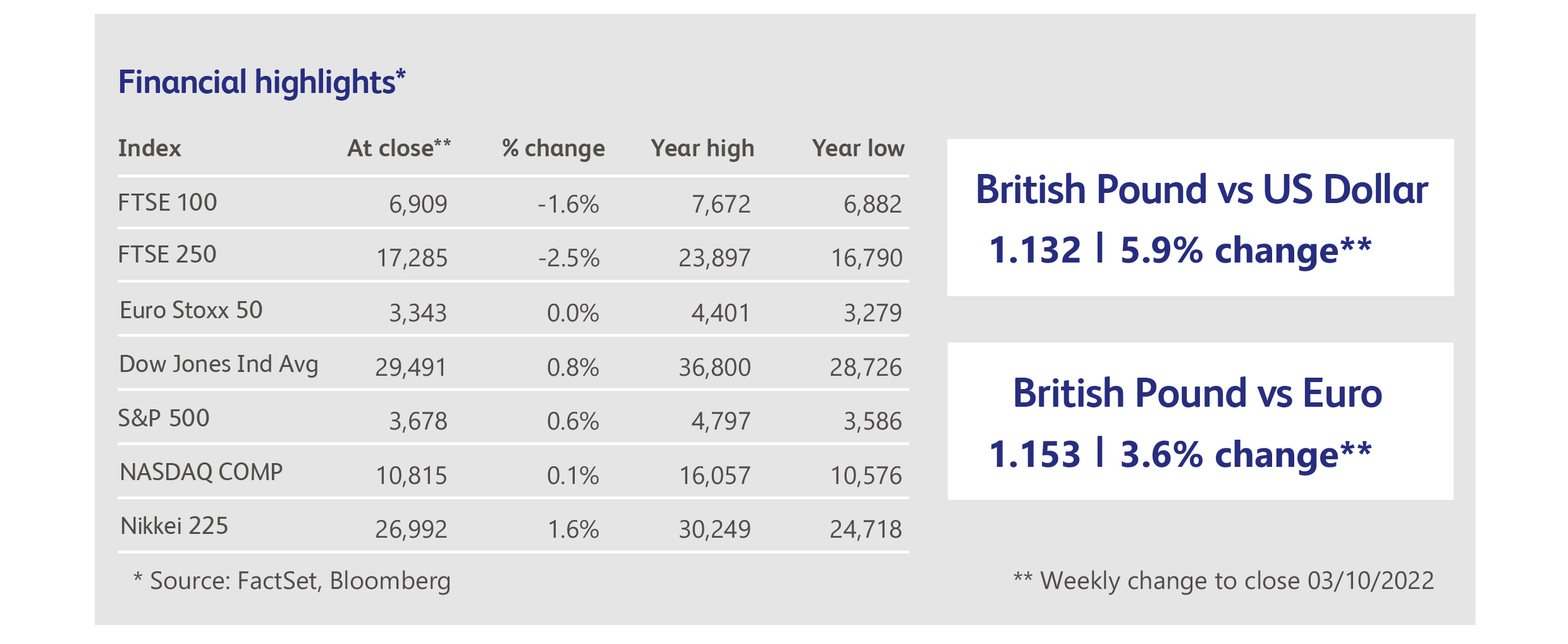

It was a week of unremittingly bad news that sent stock and bond markets to new lows for the year. The week opened with the furore over the government’s mini-budget still rippling through markets. British banks withdrew mortgage offers in response to the volatile environment for interest rates unleashed by the mini-budget and, in an unusual sign of international frustration, the mini-budget drew criticism from the International Monetary Fund, US central bank officials and the US government.

Events reached a climax when the Bank of England stepped in to prop up the market for British government bonds. Having approved a plan to relinquish £80 billion of gilts just a few days previously, the Bank dramatically reversed direction with a commitment to purchase another £60 billion. A £140 billion U-turn does not happen without good reason, and it subsequently turned out that the collapse in gilts threatened the stability of pension funds worth about £1 trillion, which were faced with the prospect of having to sell assets in order to remain solvent. These sales would have further depressed asset prices, prompting another loss of confidence in the gilt market and a potential downward spiral in British assets. The Bank’s intervention did the job, stabilising the gilt market and helping the pound to recover most of its lost ground. The fact remains, however, that the enormous UK pension industry has somehow managed to commit itself to strategies that could, under admittedly very unusual conditions, prompt a vicious circle of selling.

Market sentiment was already weak when news emerged that Nord Stream gas pipelines under the Baltic Sea had been damaged in what appeared to be an act of sabotage. Natural Gas prices jumped by 12% on the news, having drifted down over a period of several weeks. The motivation for the attack wasn’t clear, as it had already been assumed in most quarters that flows of Russian gas would dwindle to zero by the end of the year.

Markets were then battered by a series of profit warnings from the retail, automobile and semiconductor industries, plus a rare downgrade of Apple shares by analysts at Bank of America who follow the company, on the basis of their expectations for weaker consumer demand. This downgrade alone was enough to prompt a wave of selling of technology stocks that wiped hundreds of billions of dollars of market value from the sector. Apple’s own market value dropped by 5%, losing over $100 billion. Tesla shares fell by a similar amount after the company reported that deliveries of vehicles for the last quarter had underwhelmed expectations.

These events were followed by unexpectedly ugly inflation data from Germany that all but guaranteed a disconcertingly strong rise in Eurozone inflation as well. European Central Bank officials were very vocal during the week, confirming in speeches on multiple occasions the need to forcefully address inflation through robust rate rises. Voices that advocate a more cautious approach seemed to be in the minority.

Porsche shares initially rose by nearly 5% after their debut on the Frankfurt Stock Exchange, before falling back to slightly below the offer price. The Initial Public Offering valued the company at EUR75 billion and was the largest European listing in over a decade. The shares trade under the ticker P911.

The European retail sector came under pressure after profit warnings from Next, H&M and online retailer Boohoo Group. Next issued its second profit warning of the year and now expects full-year profit of £840 million, down from its previous guidance of £860 million. Sales in August “slowed significantly”, and the company expects inflationary pressures to continue to cause problems into next year, aggravated by the decline in the pound. Next shares fell about 10% on the news. H&M shares fell to 18-year lows after it reported profits for its third fiscal quarter down 86% following the company’s exit from Russia, combined with higher garment and transport costs. Boohoo shares fell nearly 20%, before recovering most of the lost ground, after it announced that revenue had fallen 10% in the first half of the year and is expected to keep falling due to weakening demand from customers. Product returns are also up significantly.

Shares in Nike slumped by 13%, leading to a sell-off in other global retailers of sports apparel, after the company reported that it had been forced to discount excess stock heavily, depressing profit margins. Sales in the company’s important Greater China region fell by 16% in the most recent fiscal quarter, but management expects improvement there as pandemic restrictions are being lifted.

BHP Group took advantage of the slump in the pound to announce the redemption of £600 million of long-term debt that was issued in 2015, and which was originally scheduled to be redeemed in 55 years’ time. The group said the redemption was prompted by its strong liquidity position.

Highlights

Calendar

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.