7 March 2023

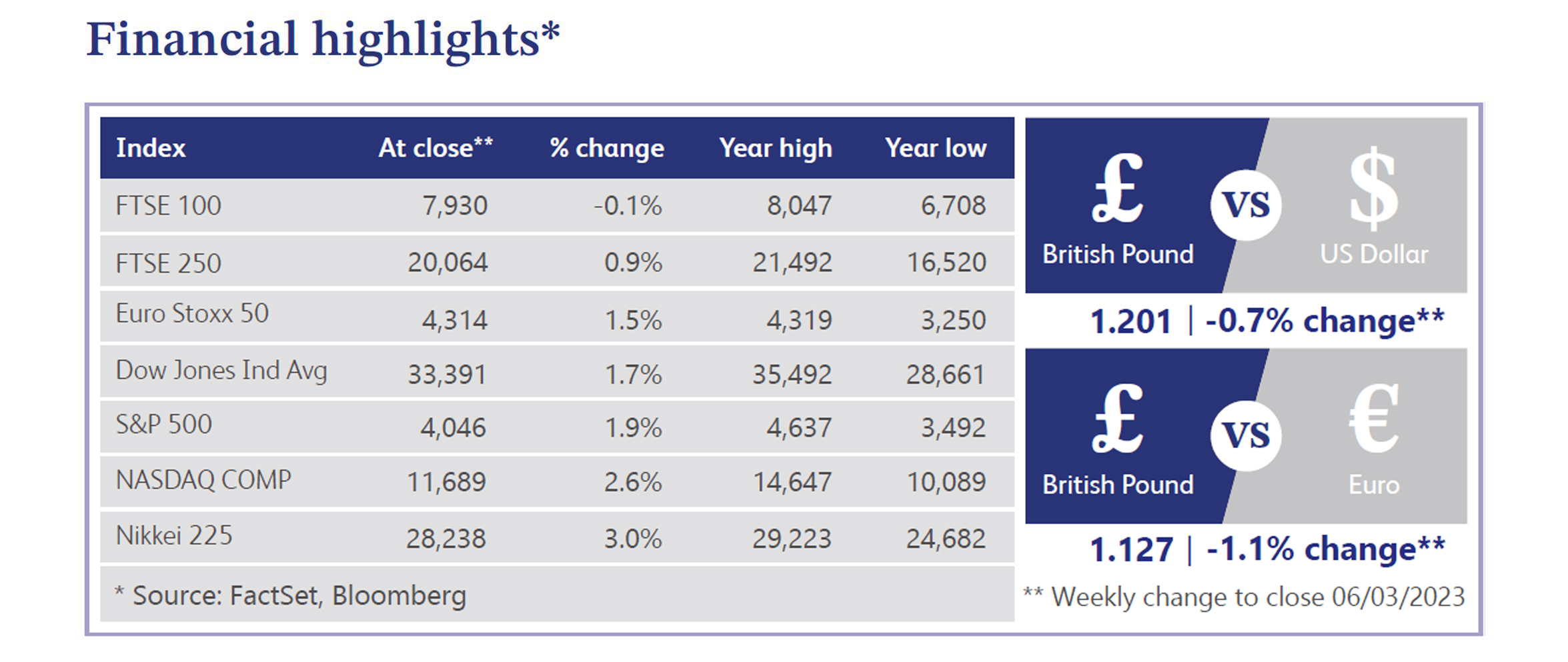

In the US, the S&P 500 closed 1.9% higher for the week, regaining some of ground lost through February where it declined by 2.6%. There were a number of important economic reports in the week, however their mixed nature meant there was a lack of noteworthy catalysts for performance. The Institute for Supply Management's (ISM) manufacturing Purchasing Managers' Index (PMI) came in higher in February at 47.7 (previously 47.4) and was slightly ahead of median forecasts of 47.6. It does, however, remain in contraction territory, as levels below 50 indicate slowing activity. The ISM's services PMI fell slightly to 55.1 (previously 55.2), but came in above median forecasts of 54.3 and remains in modest expansion. The most surprising data point of the week was the 8.1% jump in pending home sales in January (previous month 1.1%), far ahead of median forecasts of 0.9%. Lawrence Yun, chief economist at the National Association of Realtors' attributed the jump to the dip in mortgage rates over the new year and indicated that "home sales activity looks to be bottoming out in the first quarter."

In the UK, the FTSE 100 fell slightly through the week, closing down 0.1%. Andrew Bailey, the Bank of England (BoE) Governor, warned that policymakers may still have to raise interest rates above 4%, but also that another hike is not certain. In his speech, he stated that "at this stage, I would caution against suggesting either that we are done with increasing the Bank rate, or that we will inevitably need to do more." He added that a decision would be data dependant. Meanwhile, BoE data showed that the number of loans for house purchases approved by British lenders in January fell to the lowest level since 2009, with net mortgage approvals falling to 39,637. Although slightly higher than forecasts for around 38,500, it remains the fifth consecutive monthly decrease in approvals - December's upwardly-revised number was 40,540.

While in China, the official manufacturing PMI data rose to 52.6 in February, up from 50.1 in January. February's reading marks the highest since April 2012 as domestic activity picked up. Both new orders and production were strong as supply and demand recovered, but raw materials remained in contraction. Yi Gang, the People's Bank of China (PBOC) Governor, signalled at a press briefing on Friday that the central bank could cut the reserve requirement ratio for banks to support the economy. He also indicated that China would keep the yuan exchange rate "basically stable" this year, Reuters reported. The PBOC also said it sought to maintain credit growth and sufficient liquidity, while upholding its commitment to financial risk management and market-orientated foreign exchange policies.

Rightmove, the UK's largest online real estate property portal, announced results last week and posted a rise in full-year operating profit as they indicated "resilient traffic despite a significantly less frenetic property market than 2021." Operating profit was up 7% at £241.3 million and revenues at £332.6 million were up 9% in the year ending 31 December 2022. The company said customers continued to increase their use of digital products and to upgrade their packages.

British house builder, Persimmon, warned on profits in an announcement last week, after a spike in mortgage rates hit the company. The company went on to say it delivered a "very strong performance" in 2022, with 14,868 new home completions, compared to 14,551 the year before, representing a 2.16% increase.

The luxury sports car maker Aston Martin Lagonda reported a 26% jump in full-year revenues last week after increasing output and record total average selling prices. Lawrence Stroll, Executive Chairman said "Despite the operating environment, we ended the year with significantly improved growth, margin enhancement and positive free cash flow in Q4, exiting 2022 with the strongest order book in many years."

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.