18 April 2023

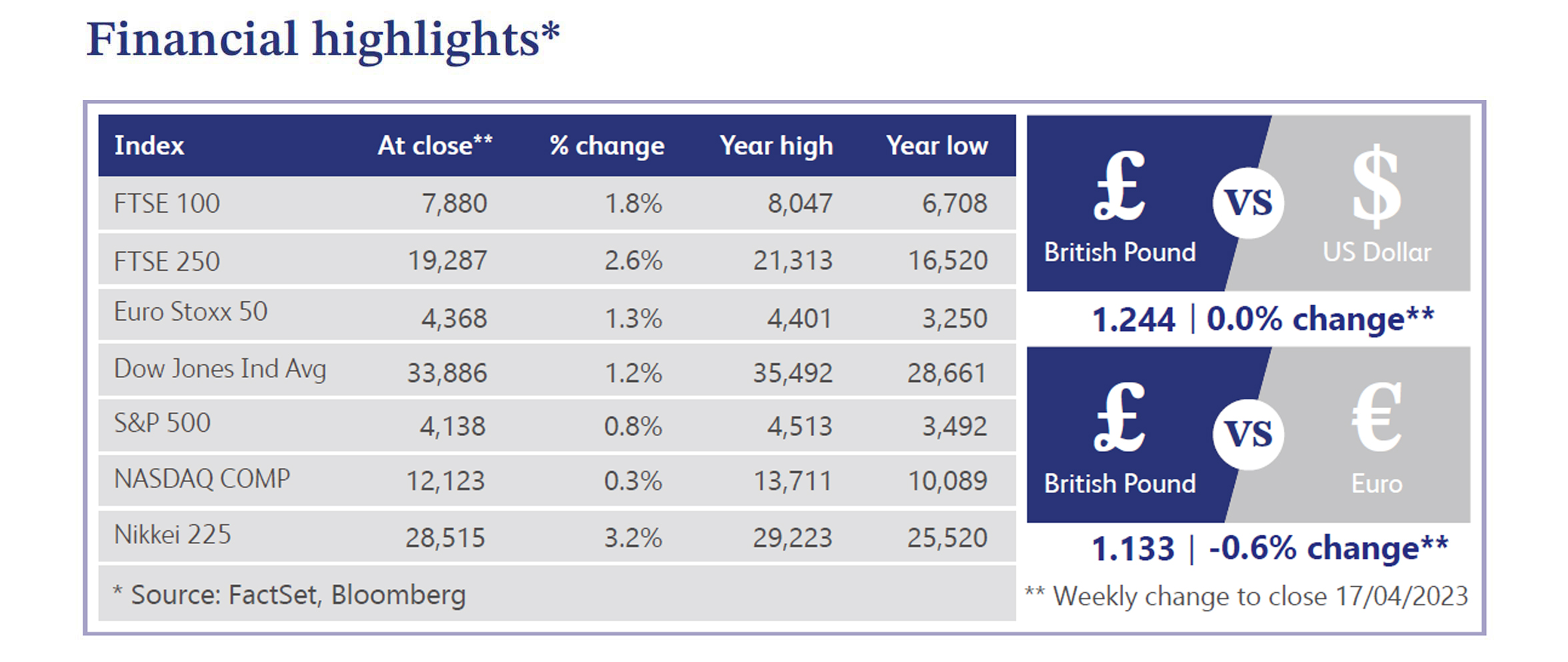

The UK stock market saw gains last week as the FTSE 100 index climbed by 1.8%. It was announced that the UK economy stagnated in February as Gross Domestic Product (“GDP”) showed zero growth, largely as a result of the widespread industrial action which led to a disruption in productivity. GDP was below expectations of a 0.1% increase and even further below January’s 0.4% growth figure. The largest contributor to negative growth in services came from teacher strikes and was partly offset by growth in the construction sector. There have been concerns over growth in the UK in recent months, but it appears to be slowly easing as the International Monetary Fund (“IMF”) predicted that the UK’s economy would decline by 0.3% in 2023, which is less than its previous forecasts. However, upward revisions in GDP and improving global economic conditions have given increased confidence that a recession in the UK is less likely, with the focus shifting towards identifying signals for an anticipated rebound.

US markets also ended higher last week as slowing growth signals showed inflation pressures were declining a little more than expected. The Labour Department announced the Consumer Price Index (“CPI”) only rose 0.1%, marginally below expectations as the year-over-year rate was 5.0%. The US also saw the start to its quarterly earnings season as major banks including JPMorgan Chase & Co, Wells Fargo and Citigroup all topped market expectations. This provided confidence in the economy as the banking crisis has been an area of focus in recent months. But these quarterly earnings eased fears of a continuation as large banks showed positive results.

There is still significant discussion about whether central banks will ‘pivot’ to end interest rate hikes in the near future. It appears that the market is anticipating that towards the back end of 2023 we can expect to reach the ‘pivot’, but that is providing there are no further surprises between now and then. Central banks remain committed to controlling inflation through policy measures, but signs are strengthening regarding global economies heading in the right direction to allow for rate cuts.

China experienced a volatile week as softer-than-expected inflation led investors to rethink their growth expectations. China has been identified as a potential area for strong growth after it abolished its “zero-Covid” policy, which had put major restrictions on economic growth. The strength of the economic recovery is being questioned as investors look to revise forecasts based on the latest information.

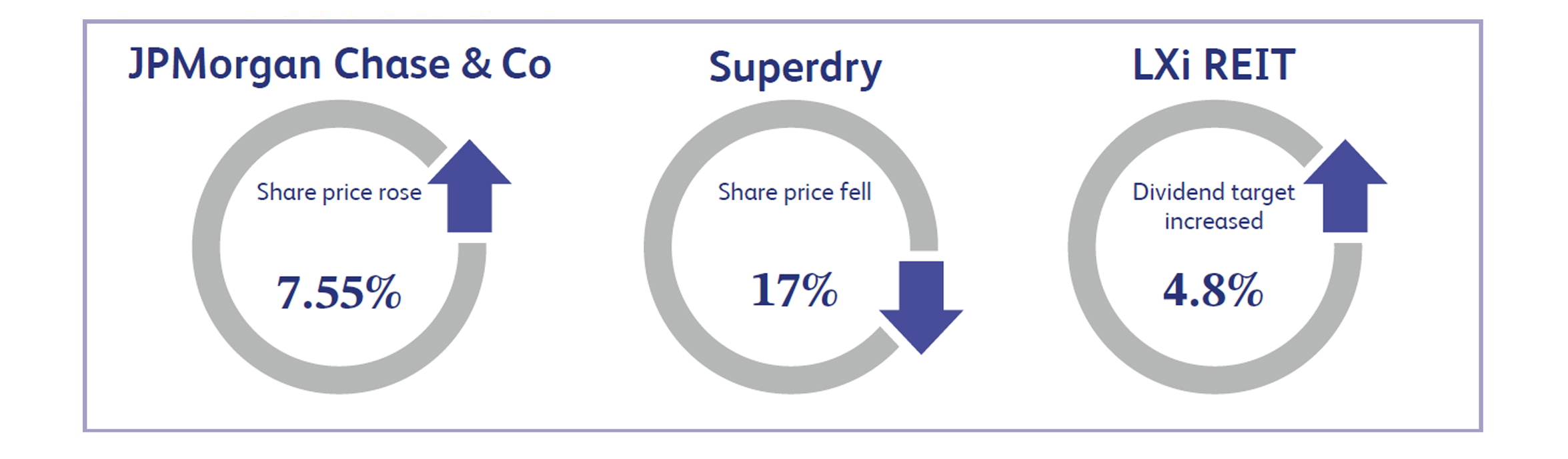

JPMorgan Chase & Co announced its results last week which were eagerly anticipated by investors, eager to gain further insight on the ongoing ‘global banking crisis’. JPMorgan reported record revenue for the first-quarter of 2023 and earnings per share of $4.10 compared to analyst estimates of $3.37. These results gave increased confidence in leading global banks despite the lingering concerns within the banking sector as a result of the collapse of Silicon Valley Bank and Credit Suisse. JPMorgan’s share price increased approximately 7.55% after announcing their results.

Superdry last week withdrew its full year profit guidance citing a challenging trading environment and disappointing retail sales in February and March. The board also confirmed that it is considering an equity capital raise of up to 20% of its issued share capital. The company now expect revenue for 2023 in the region of £615 million to £635 million compared to £609 million in 2022, which is largely flat. Superdry has been struggling in recent years, but the board appears to be confident that the brand remains strong. The company has identified cost savings of more than £35 million which it believes will help it over the long term. However, the market did not appear to be as convinced as shares tumbled approximately 17% on the announcement.

LXi REIT is a well-established closed-end real estate investment company with a focus on building a secure, resilient and diversified portfolio of UK commercial property assets let or pre-let on very long-term, inflation linked leases. The company recently announced the signing of a £565 million loan facility with a syndicate of banks, as well as a new dividend target. The bank facility included a £200 million five-year revolving credit facility, a £115 million five-year term loan and a £250 million three-year term loan. The announcement of the new loan facility allowed LXi REIT to increase its dividend target to 6.6 pence per share which would be a 4.8% increase for the 2023 financial year. The shares increased by approximately 4.28% last week as markets appeared to respond positively to the final step in the refinancing programme.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.