5 May 2023

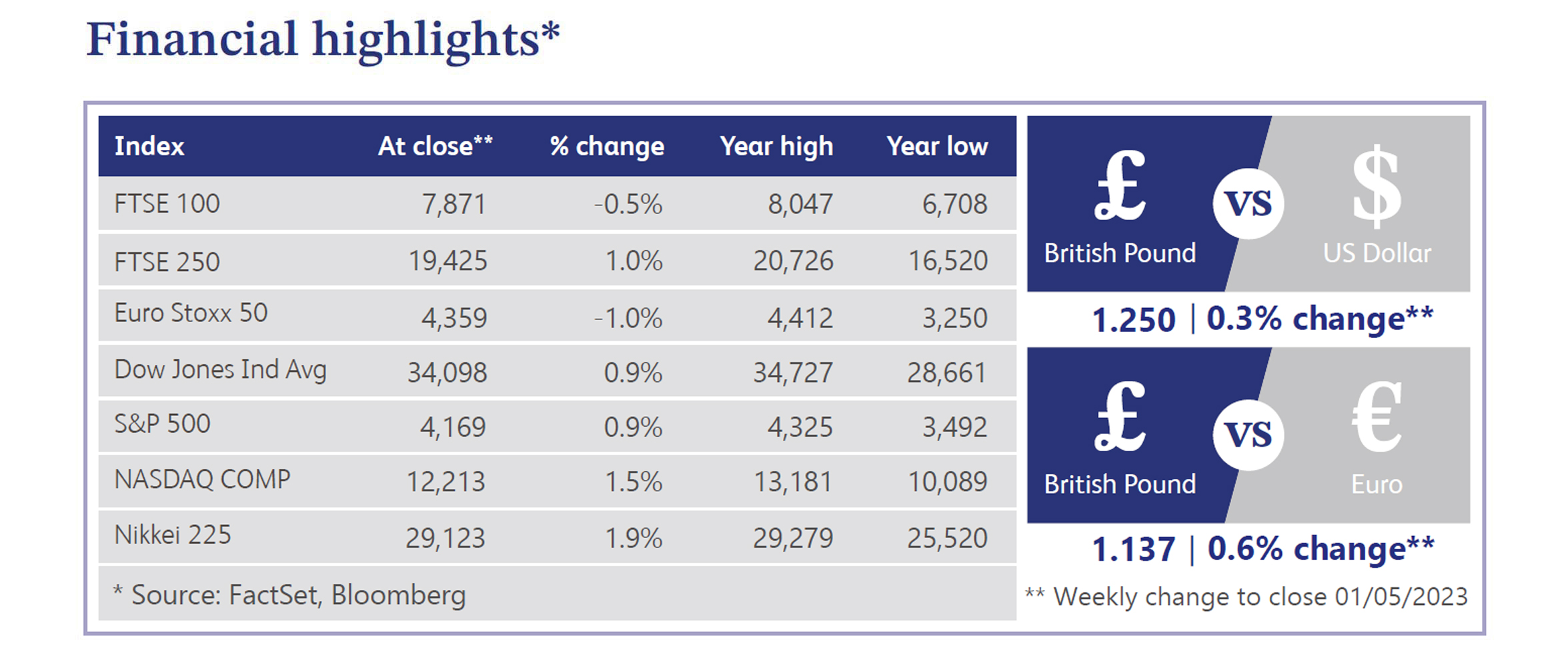

Earnings season in the US was in full swing last week as it was one of the busiest weeks for quarterly earnings reports. Several mega-caps outperformed, contributing significantly to the S&P 500’s gain of 0.9% last week. Meta Platforms, the parent company of Facebook, was in the headlines after surging approximately 14% on the announcement of better-than-expected earnings. Microsoft and Apple also saw an increase in share price after strong earnings reports. However, cyclical sectors generally performed badly as manufacturing activity came in below expectations and indicated that factories were cutting back on production in April. The banking sector also saw renewed stresses as the collapse of First Republic Bank was announced. Regulators took possession of First Republic Bank and it was later announced that JPMorgan Chase acquired all of First Republic Bank’s deposits, including those that are uninsured and a substantial majority of assets. The collapse of First Republic Bank is the second largest in US history, even larger than the collapse of Silicon Valley Bank which we saw earlier this year.

In the UK, the FTSE 100 declined 0.5% as fears remained in Europe that further rate hikes might lead to an economic recession for European countries. The resurgence of worries regarding the US banking system after the collapse of First Republic Bank led to increased fears that the global economy is not out of the woods yet. Investors therefore remain cautious and want to maintain a prudent approach as markets continue to analyse more economic information. The global economy remains extremely difficult to navigate at present due to the amplified reaction from market participants as a result of short-term noise caused by fear and uncertainty. Markets however, are beginning to see the impact of monetary tightening measures used by central banks which should in turn result in the lowering of inflation soon. Markets are therefore waiting patiently for more confirmation of this from economic data, and until then a cautious sentiment is likely to remain. A rebound is still largely anticipated, but there is a lingering emphasis on timing as markets await more conviction from economic data.

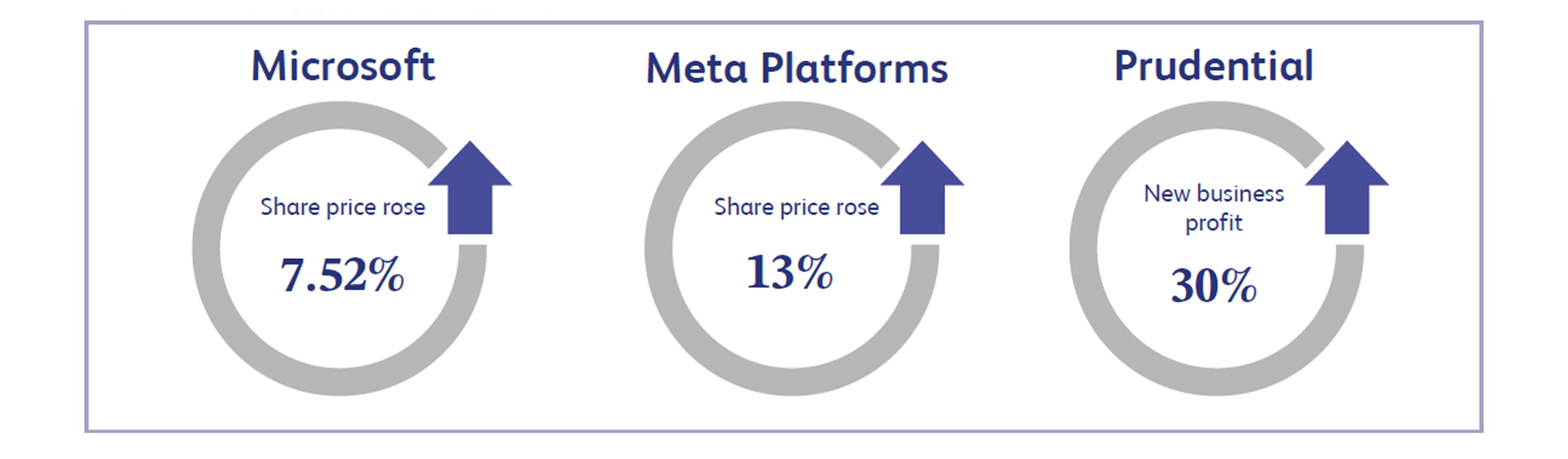

It was a big week for Microsoft with the announcement of third quarter results alongside the announcement that the proposed $68.7 billion acquisition of Activision Blizzard had been blocked by the Competition and Markets Authority (“CMA”). The CMA expressed concern that Microsoft’s proposed acquisition of Activision Blizzard would harm competition in the fast-growing cloud gaming market. It appears that Activision Blizzard intends to work with Microsoft to appeal this decision. Microsoft’s third quarter results beat analyst expectations on both the top and bottom lines which led to the share price increasing approximately 7.52% last week. Microsoft’s announcement focused on the early feedback from the artificial intelligence demand that the company has had so far. Microsoft explained that this will be an area of focus for investment with the expectation that this will help improve customer transformation and in time result in strong revenue growth.

Meta Platform shares surged nearly 13% last week after the company announced first quarter earnings for 2023. The company reported an unexpected increase in sales for the first quarter and also issued better than expected guidance for the current period. Revenue came in at $28.65 billion, beating expected figures of $27.75 billion. Meta CEO Mark Zuckerberg announced in February that 2023 would be the company’s year of efficiency and these results are showing impressive progress being made in Meta’s restructuring project. Zuckerberg announced in first quarter results that Meta is becoming more efficient and can therefore build better products faster, allowing Meta to obtain a stronger position to deliver their long-term vision.

Prudential announced a jump in first quarter sales largely due to the relaxing of COVID restrictions in China, increasing the share price by approximately 5.21% last week. Prudential provides life and health insurance and asset management with a focus in Asia and Africa. Annual premium equivalent sales for Prudential were up 35% to $1.56 billion due to increased cross border traffic from the Chinese Mainland and higher domestic demand in Hong Kong, as well as growth in many of its other business units. Prudential also announced new business profit increased 30% to $743 million. The outlook for Prudential remains positive as a focus remains on continuing to grow in order to meet long-term objectives.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.