12 December 2023

Market News

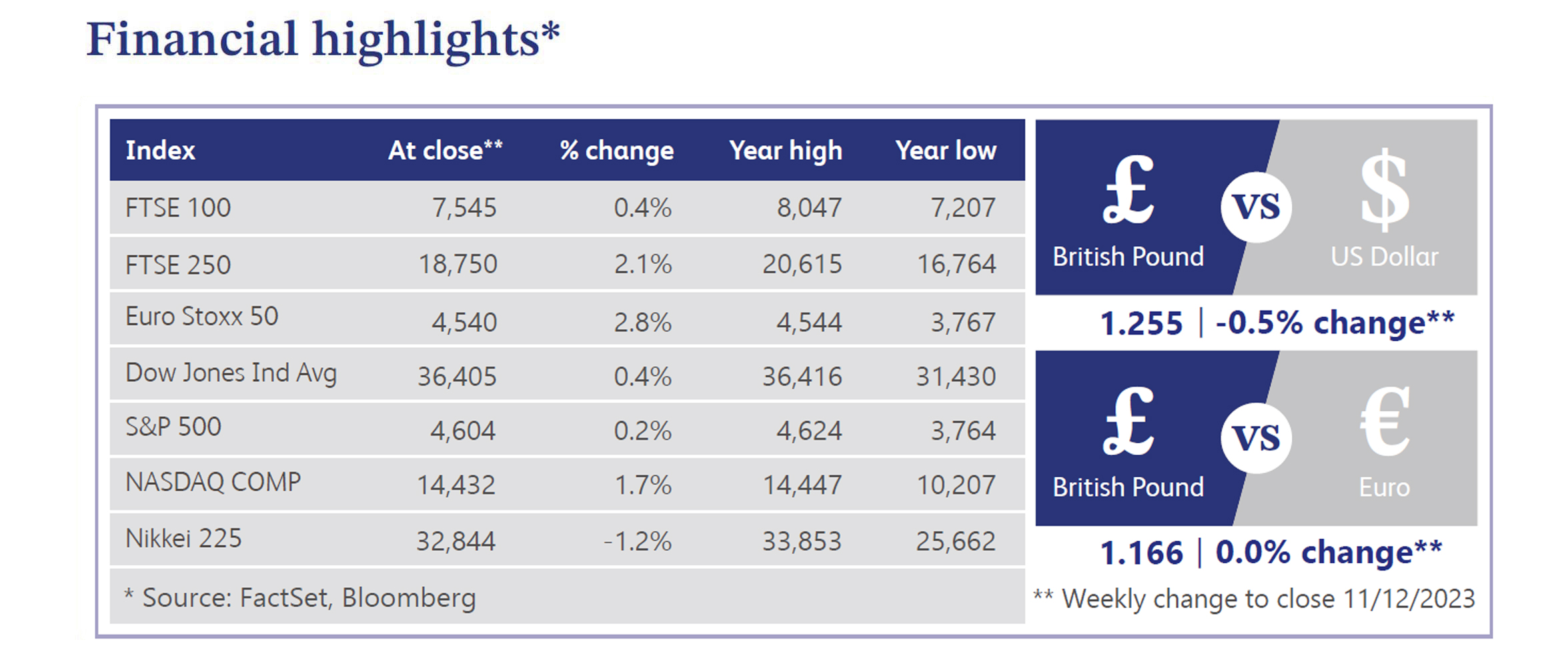

The UK economy shows promising signs of stabilising following the recent economic slowdown induced by soaring inflation and successive interest rate hikes. At the Bank of England’s (“BoE”) upcoming monetary policy committee meeting this week, the committee is expected to keep interest rates on hold as wage growth remains relatively high and inflation levels remain elevated. The British Chamber of Commerce highlighted that the UK economy will continue growing until the end of 2025, albeit at extremely low levels. The report highlighted prolonged higher interest rates, trade barriers and limits on consumer spending as headwinds which present a low growth environment. A Reuters poll indicates a split among economists regarding the timing of the BoE's potential rate-cutting cycle, with opinions varying on both the initiation and eventual levels of rate cuts.

Fitch Ratings has maintained its "negative" credit outlook on the UK, citing uncertain prospects for fiscal consolidation. Despite Moody's recent upgrade, Fitch's decision signals ongoing concerns about policy predictability, potentially jeopardising the UK's AA- rating. Meanwhile, the BoE Financial Stability Report highlighted a challenging risk environment with subdued growth, geopolitical tensions and the full impact of higher rates yet to materialise.

Calastone has reported that November witnessed UK investors returning to equity funds after months of net selling. While equity funds experienced inflows of £449 million, fixed income funds saw modest increases and money market funds continued to attract cautious investments.

Despite the broader economic weakness, a survey by UK recruitment consultant Robert Half reveals that UK workers remain confident in the stability of their roles. The Jobs Confidence Index reached its highest level since the first quarter of 2022, reflecting optimism about prospects. However, a shift in foreign ownership is noted, with Office for National Statistics data showing a record high of 57.7% foreign ownership of UK-listed firms, signalling evolving investor preferences.

In the property market, Rightmove predicts a 1% fall in average house prices next year, coupled with a slump in construction output. S&P Global's UK Construction PMI indicates the third consecutive decline in business activity, with residential building particularly affected. However, a record share of first-time buyers opting for longer mortgage terms and the latest Halifax data hints at resilience in the housing market. The average two-year fixed-rate mortgage has dropped below 6%, marking a notable shift in the mortgage market. Lenders have responded to changes in BoE rate expectations, reflecting the market's anticipation of the timing of the first interest rate cut.

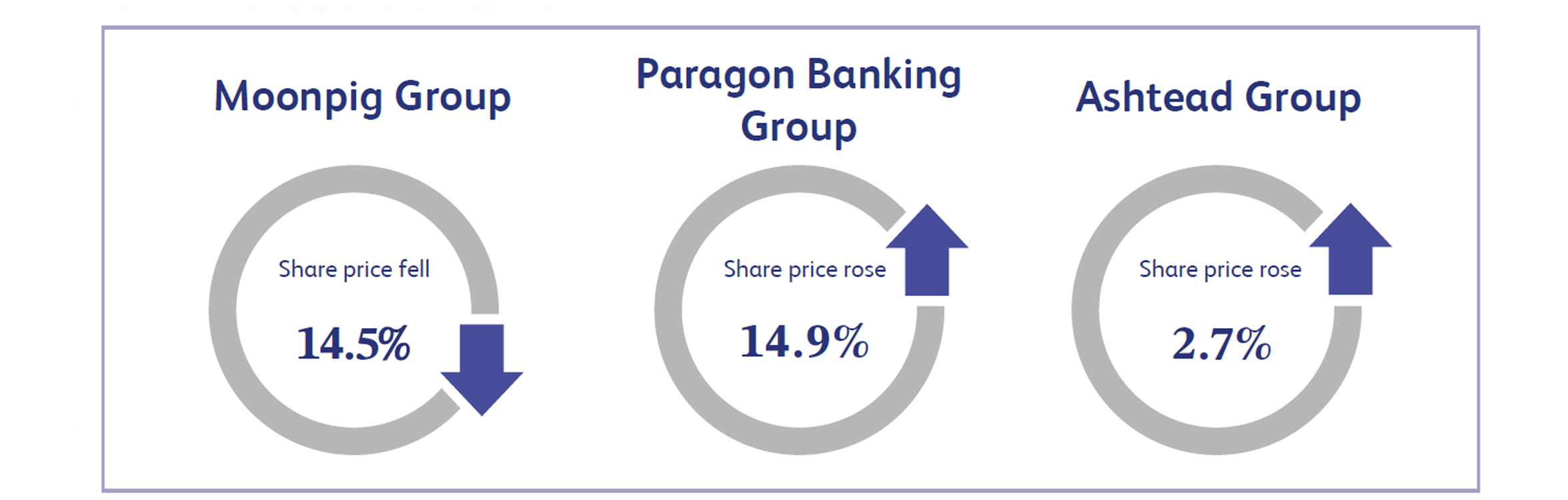

Moonpig Group, the online greeting card and gifting platform, announced its first half results last week which saw its share price close the week approximately 14.5% lower. The company announced revenues of £152.1 million for the period, a 7% increase from last year's figure of £142.8 million. Overall, the results appeared positive. However, the company did not make any material changes to future forecasts, which has not been viewed positively by investors.

Paragon Banking Group, the UK-based specialist bank, saw its shares close the week approximately 14.9% higher after announcing its full year results. The company announced an approximate 30% increase in its dividend to 37.4 pence per share, compared to 28.6 pence per share a year ago. Alongside this, Paragon also announced a further share buyback of £50 million for the 2024 financial year.

Ashtead Group, the international equipment rental company, announced its first half results last week with revenues increasing by 16% to $5.6 billion, compared to $4.8 billion a year ago. The company also announced a 5% increase in its dividend alongside a 12% increase in operating profit to $1.5 billion, compared to $1.3 billion a year earlier. The company’s shares closed the week approximately 2.7% higher.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.