9 January 2024

Market News

The first week of the new year unveiled a mixed outlook for the UK economy as surveys of economists published in the Financial Times and The Times portrayed a consensus on sluggish growth in 2024, teetering on the edge of a technical recession. Analysts anticipate gross domestic product growth between 0% and 1%, with a looming general election adding a layer of uncertainty. The Bank of England (“BOE”), while expected to cut interest rates, is likely to tread cautiously as the battle against inflation continues. According to The Times survey, economists foresee at least two rate cuts in 2024. Concerns about business investment persist with hopes resting on pre-election giveaways and an increase in real disposable income.

The Institute of Directors called for an early rate cut from the BOE as the Economic Confidence Index took a sharp hit in December, falling to -28 from -21 previously. Business executives' perception of the wider UK economy remained negative, contrasting with growing confidence in their own businesses. Looking at inflation, Bloomberg Economics forecast that the UK will reach its 2% inflation target by spring, which is expected to allow the BOE to begin its eagerly anticipated rate-cutting cycle. Based on this, Bloomberg Economics’ forecast is that the BOE is likely to pivot towards rate cuts in May, with an expectation of further easing to take interest rates to 4% by the end of the year. Meanwhile, the grocery sector witnessed a notable shift, with UK grocery price inflation experiencing its fastest decline on record in December. The figures from Kantar showed a significant drop from 9.1% in November to 6.7% in December, aligning with a broader trend of easing food inflation. This decline is the fastest month-on-month drop since Kantar started tracking prices in 2008.

The housing market demonstrated a mix of positive and concerning signals. Homeowners saw relief as lenders, including Halifax and Leeds Building Society, swiftly slashed fixed mortgage rates at the beginning of the year. The article in The Times reported that one of Halifax’s largest rate deductions was by 0.83% on a two-year fixed deal from 5.64% to 4.81%. Mortgage approvals in November surpassed expectations, reaching 50,100, signalling increased demand and fitting in with a more optimistic narrative. However, challenges loom as fixed-rate deals expire, potentially burdening homeowners with a £19 billion rise in mortgage costs. Despite this, December brought positive news for house prices with a third consecutive monthly increase, defying earlier predictions of a correction.

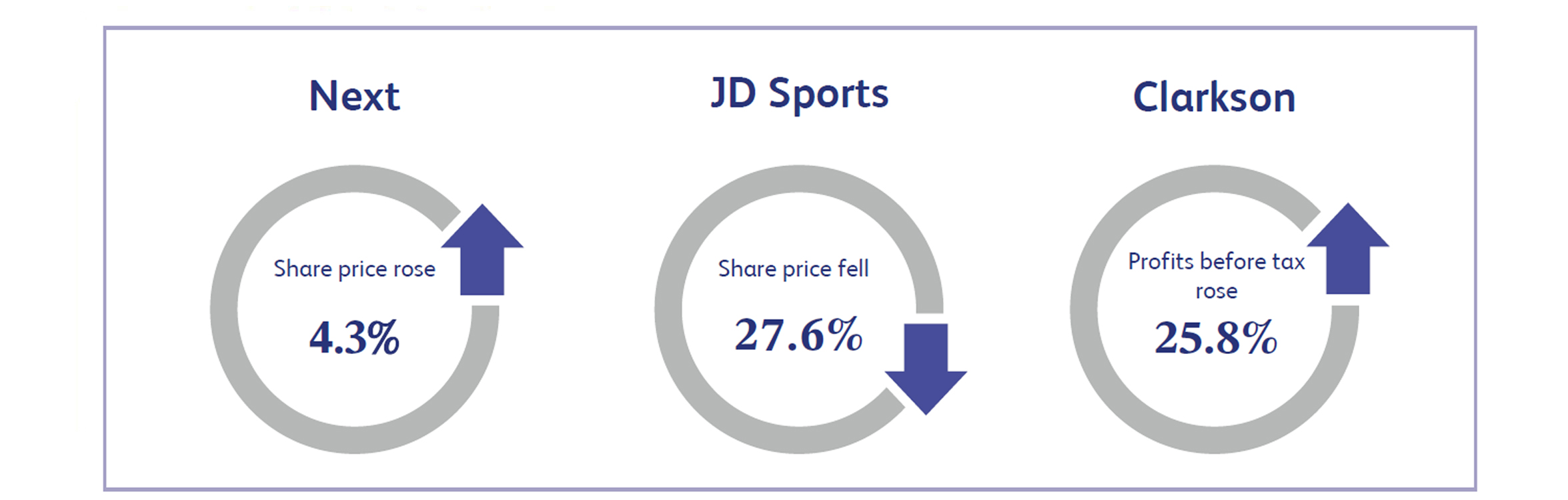

Next, the UK clothing, homeware and beauty product retailer, saw its share price increase by approximately 4.3% last week. The company announced that, in the nine weeks to 30 December, full price sales increased by 5.7% when compared to last year - £38 million better than the company’s previous guidance of an increase of 2% for the period. This led to an increase in the company’s full year profit before tax guidance by £20 million to £905 million.

JD Sports, the UK multichannel retailer of sports, fashion and outdoor brands, released its latest trading statement last week which saw its share price close the week approximately 27.6% lower. The company’s update saw a downgrade to its full year profit before tax guidance which is now expected to be between £915 million and £935 million, compared to previous guidance of £1.04 billion. Management also reported a weaker market, with more sales coming from promotional items than the company anticipated, reflecting caution from consumers. The negative market sentiment and downgrade in profit guidance was viewed negatively by analysts, resulting in the company’s share price tumbling.

Clarkson, the provider of integrated shipping services, saw its share price increase by approximately 10% last week after the company announced its interim results. The company announced strong profit before tax figures of £53.1 million, an increase of 25.8% compared to last year’s £42.2 million. The company also saw a 35% increase in its earnings per share to 133.5 pence, alongside an increase in its interim dividend to 30 pence per share, compared to last year's 29 pence.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.