30 January 2024

Market News

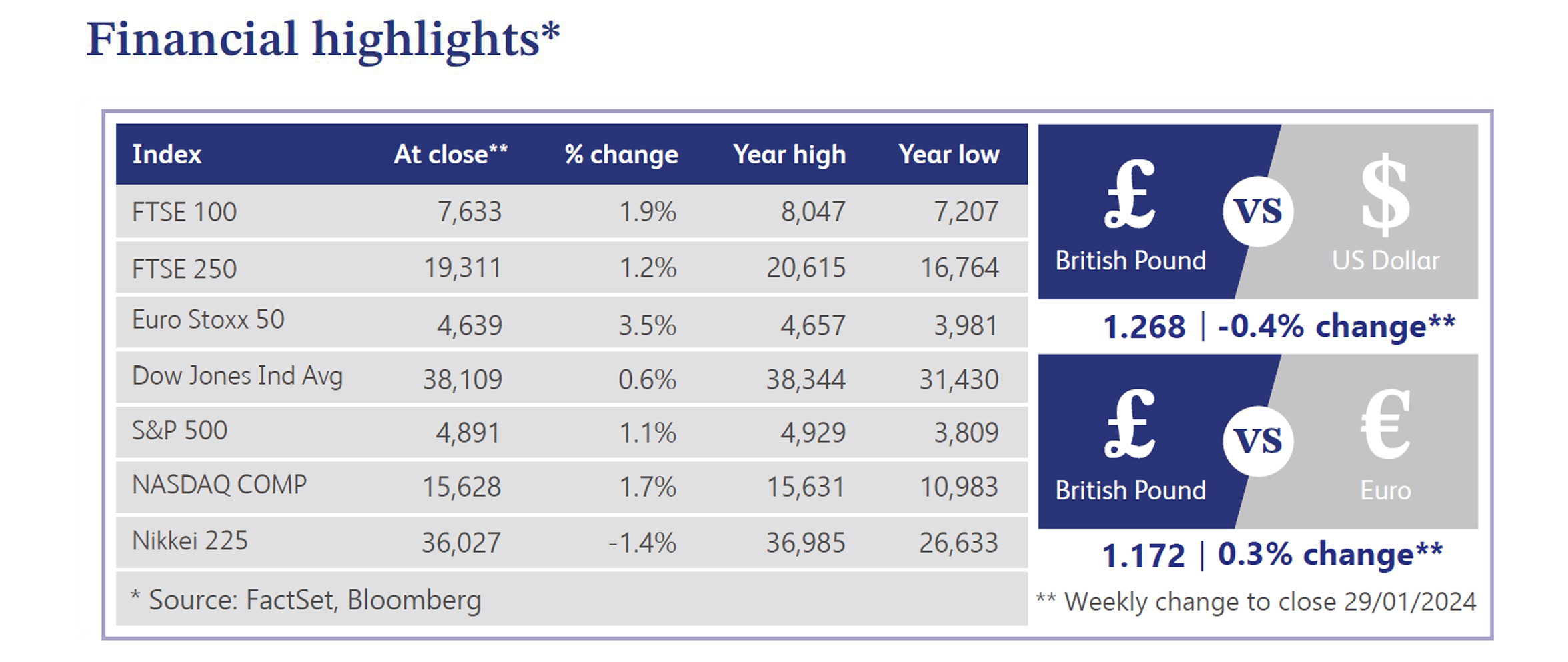

Last week, Bloomberg published an article detailing that the Bank of England ("BOE") should revise its inflation tightening bias or risk undermining the credibility of its own policy. Despite unchanged guidance since August, inflation has eased faster than expected, wage growth has softened and the economy has slowed. A delicate balancing act lies ahead for the BOE as it navigates through the Spring Budget and an impending general election later this year. With new economic forecasts expected in February, the BOE might recalibrate its policy communication to align with the evolving economic landscape.

An unexpected uptick in inflation and disappointing December retail sales have added complexity to BOE policy decisions. Previously, a smooth soft landing seemed likely, but recent data has led to volatility, prompting the market to scale back interest rate cut forecasts. Expectations for at least five rate moves have shifted to a forecasted year-end rate of 4% - 4.25%. However, a Reuters poll of economists suggests a close call on whether the BOE will cut rates in the second or third quarter of 2024. A slim majority of those polled now anticipate a potential rate cut before July, signalling a shift from the consensus in December, when rates were expected to remain unchanged until the third quarter. With headline inflation projected to fall back to the target by April, the BOE might pivot towards supporting growth.

UK Chancellor, Jeremy Hunt, hinted at major tax cuts in the Spring Budget, citing Treasury analysis that lower tax burdens lead to higher economic growth. However, the UK Treasury downplayed speculation about the scope for tax cuts in March, citing limited fiscal headroom. The Federation of Small Businesses’ UK Small Business Index indicates a dip in confidence in the fourth quarter of 2023, particularly in the hospitality and retail sectors, raising concerns about company closures. Insolvency specialist, Begbies Traynor, also reported a significant increase in firms in critical financial distress, emphasising the challenges faced by businesses with high debt burdens.

Planned redundancies in the UK have surged as firms focus on cost-cutting amid weak demand and higher interest rates. While the level of redundancies remains historically low, the data signals concerns about the economic landscape. Signs of a peak in UK wage growth emerge, with pay awards holding at their highest level in over 30 years in the final quarter of 2023, but easing in early 2024 as inflation eases due to prior BOE tightening and weaker demand.

UK firms may become vulnerable to takeovers in 2024, according to a Deutsche Numis survey, as British firms and investors express optimism about the outlook. The survey indicates a potential uptick in merger and acquisition activity, with optimism prevailing despite recent challenges. However, concerns arise about the Chancellor of the Exchequer’s plan for 99% mortgages, seen as a risk to financial stability. Senior banking sources suggest this could prompt the BOE to make lenders increase their capital buffers to limit risks, highlighting potential headwinds in the housing market.

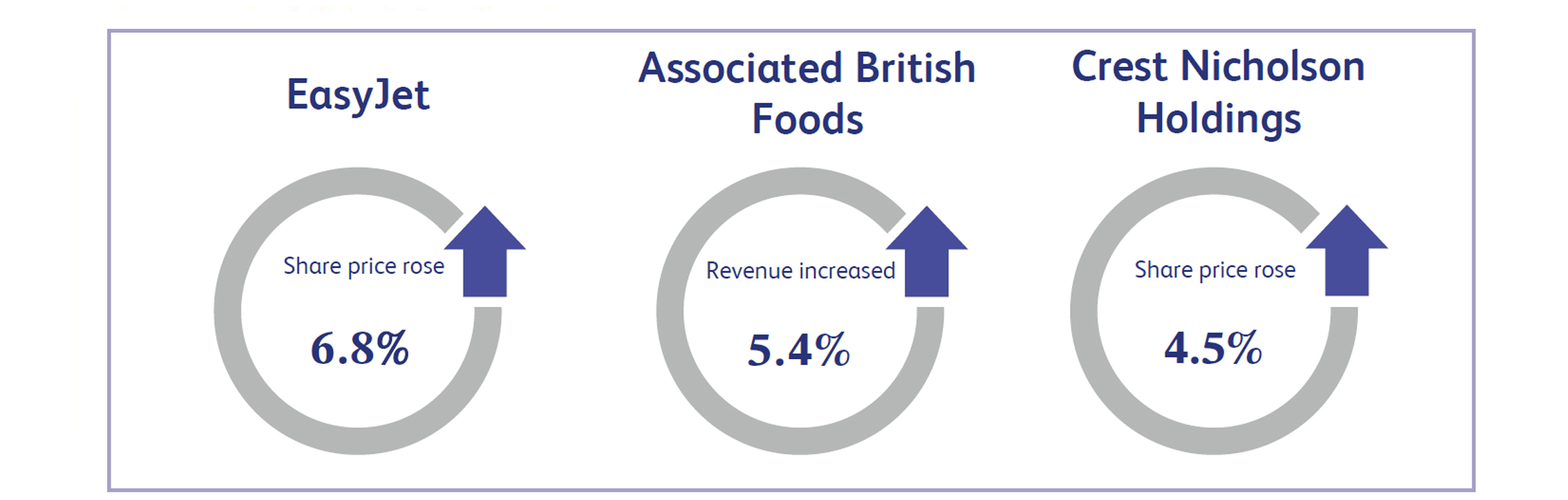

EasyJet, the multinational low-cost airline, saw its share price increase by approximately 6.8% last week after the company announced its first quarter results for 2024. The company reported a loss before tax of £126 million, an improved figure in comparison to last year’s loss of £133 million. It should be noted that this was despite the ongoing conflict in the Middle East which had reduced demand for flights. Overall, analysts view this as a very solid update, hence the strong share price performance as a result.

Associated British Foods, the British multinational food processing and retailing company, reported its latest trading update last week which saw its share price close the week approximately 6.5% higher. The company reported revenue of approximately £6.9 billion, a 5.4% increase at constant currency in comparison to last year’s figure. The company is making good progress in profitability and cash generation whilst providing consistent cash returns to shareholders via buybacks and dividends.

Crest Nicholson Holdings, the UK-based property developer, saw its share price close the week approximately 4.5% higher after reporting its latest quarterly earnings. The company reported revenue of £657.5 million, a decline of approximately 28% in comparison to last year's figure, largely as a result of a difficult economic environment. This was generally in line with analyst expectations, with the retirement of CEO Peter Truscott being a key focus of the update. Analysts appear optimistic about the succession planning for the company, resulting in the increased share price.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.