13 February 2024

Market News

In a week of diverse developments, the Bank of England ("BOE") conveyed a nuanced stance on interest rates. Deputy Chief Breeden's speech on Wednesday suggested waning concerns about the necessity of future rate hikes as inflationary pressures ease. This sentiment resonated with the BOE's recent policy statement, indicating a potential review of the duration at current rate levels. Despite acknowledging receding inflation pressures, Breeden remained cautiously optimistic, emphasising the need for sustained evidence of inflation returning to target levels.

In stark contrast, Swati Dhingra, an external member of the Bank of England's Monetary Policy Committee, known for her dovish stance, raised concerns about downside risks for the UK economy. Dhingra advocated for an immediate rate cut, citing weak consumer spending as a significant red flag. Expressing scepticism about a demand-driven surge in prices amidst consumption challenges, Dhingra cautioned against the risks associated with a passive approach, highlighting the danger of overtightening.

On a positive note, the UK witnessed the strongest services sector performance since May 2023, with the final Services Purchasing Managers Index ("PMI") reaching 54.3 compared to a prior reading of 53.4. This marked the third consecutive month of expansion, supported by increased new orders and improved client confidence. Recession risks subsided, and looser financial conditions contributed to a heightened willingness-to-spend. Despite strong wage pressures, lower fuel costs and raw materials mitigated upward pricing, resulting in the slowest rise in charges since September.

However, the labour market painted a tighter picture than expected, according to data from the Office for National Statistics. Unemployment stood at 3.9% in the three months to November, lower than the prior estimate of 4.2%. This unexpected contraction might influence the BOE's policy stance, although policymakers have already noted evidence of a slowing market.

In the realm of investments, Calastone showed UK investors pouring £2.01 billion into equity funds in January, the highest influx in three years, demonstrating renewed confidence. This rush back into equities was predominantly directed towards US funds. On the M&A front, data from PwC showed the UK lagged globally, with the number of deals declining by 17% in 2023, signalling apprehension among investors in light of economic uncertainties.

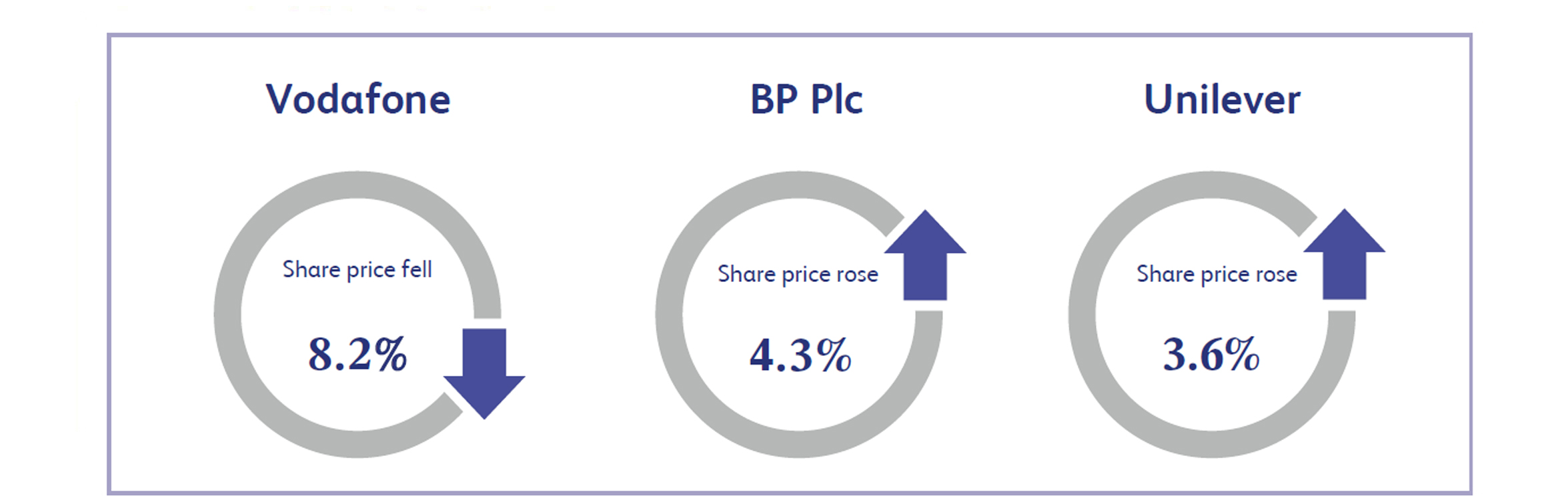

Vodafone Group Plc, a UK based telecommunications company, saw its shares close the week approximately 8.2% lower after the company announced its latest quarterly results. The company reported a decline in its total revenue figures, showing approximately €11.4 billion in the third quarter of 2023 in comparison to last year’s figure of approximately €11.6 billion. However, the results generally looked solid, but a negative market sentiment coupled with a number of still-lingering uncertainties contributed to the negative share price performance.

BP Plc, a provider of energy products and services, announced its final quarter results last week which saw its share price close the week approximately 4.3% higher. The company reported an operating cash flow of $9.4 billion in the fourth quarter of 2023, compared to the third quarter figure of $8.7 billion. The company also announced it has reduced its net debt to $20.9 billion, down from the previous year's $21.4 billion. As a result of the strong performance, the company also announced a share buyback of $1.75 billion before it announced first quarter results for 2024, alongside committing to announcing $3.5 billion of buybacks for the first half of 2024.

Unilever, a UK based consumer goods company, saw its share price close the week approximately 3.6% higher after the company reported its latest quarterly results. The company reported revenue of €59.6 billion, slightly below consensus estimates of €60 billion. However the company reported continued strong cash generation and the board therefore approved a share buyback programme of up to €1.5 billion to be conducted throughout 2024. The company expects to commence this in the second quarter of 2024.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management's own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.