23 April 2024

As inflation dynamics diverge between the UK and the US, the Bank of England ("BOE") is poised for potential interest rate cuts ahead of the Federal Reserve. Bloomberg reports that the momentum of lowering inflation in the UK, with further easing expected, bolsters the case for a summer rate cut. Despite warnings from BOE Monetary Policy Committee members Jonathan Haskel, Catherine Mann and Megan Greene about the likelihood of rate cuts, market dynamics suggest a shift in monetary policy could occur sooner due to the UK's distinct economic conditions.

However, the latest UK inflation data shows a less optimistic picture, easing to 3.2% year-over-year in March from 3.4%, but still above the consensus of 3.1%. Core inflation and ‘sticky’ services prices also suggest persistent inflationary pressures. This could potentially influence the BOE's cautious stance on rate adjustments. Market reactions have been mixed resulting in a reduction in the expected number of rate cuts for 2024. This reflects an increased uncertainty about the timing and commencement of the easing cycle.

Adding to the economic landscape, the International Monetary Fund (“IMF”) has revised down the UK’s growth outlook, citing risks of prolonged weak growth and stubborn inflation. They cite this as being due to the UK's exposure to oil and gas prices and labour market shortages. The IMF’s projections now show the UK economy growing by just 0.5% this year, reinforcing concerns about a sluggish recovery.

On the monetary policy front, BOE Governor Andrew Bailey remains optimistic about the disinflation process, aligning with forecasts despite recent data suggesting a slower pace. Bailey's comments indicate that significant drops in inflation are expected soon, which could validate the anticipated policy easing if inflation aligns closer to the BOE’s target next month.

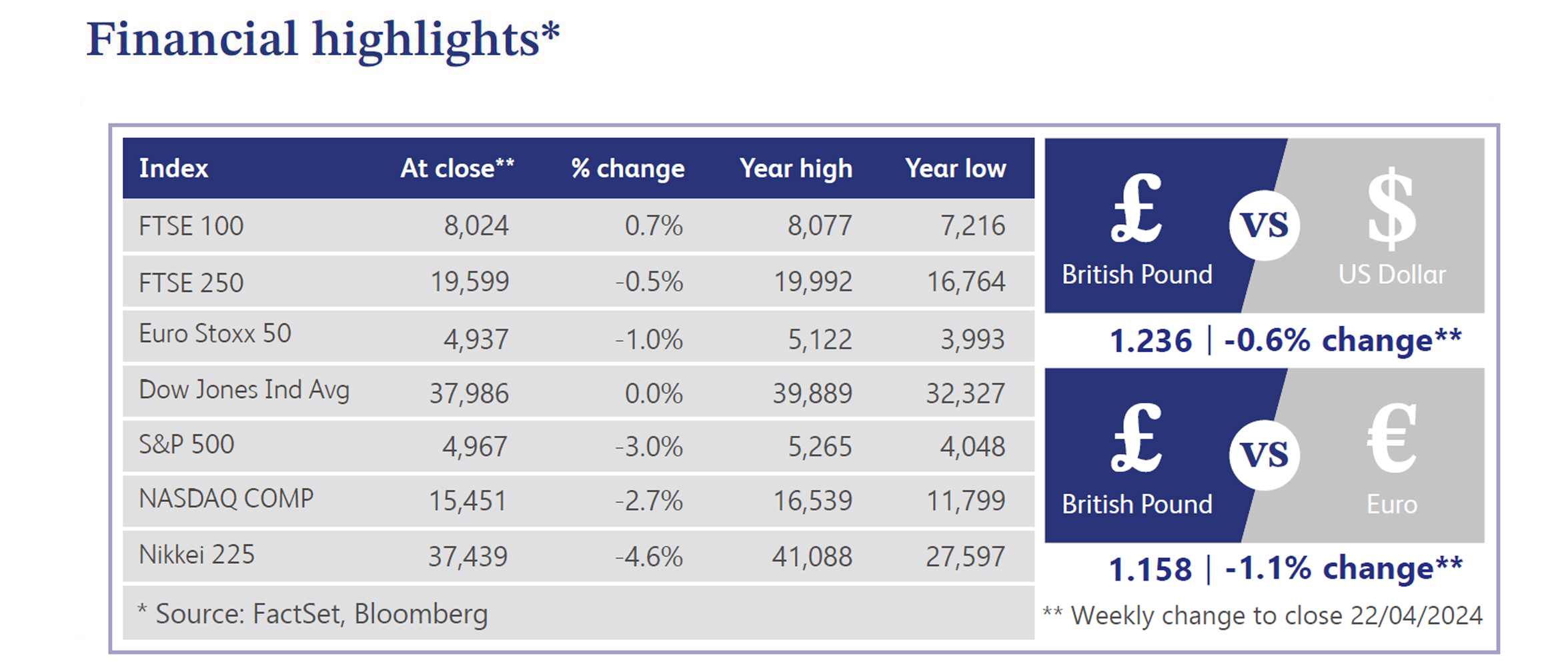

In the equities market, UK stocks show mixed signals. Analysts have raised earnings estimates for the FTSE 250, reflecting a more positive outlook compared to the international-facing FTSE 100. Meanwhile, UK pensions' divestment from local equities poses challenges that will potentially starve businesses in need of investment. Labour market updates also present a complicated picture; while unemployment has slightly increased, wage pressures remain firmer than anticipated.

As the UK navigates these complex economic and financial landscapes, the BOE's policy decisions in the coming months will be crucial in steering the economy towards sustainable growth. There will need to be careful monitoring of inflation, wage trends, and global economic conditions to shape the trajectory of monetary policy.

Mondi, the UK based company making sustainable packaging and paper, saw its share price surge by approximately 6.6% last week. The company announced last week that it is not intending to make an offer for DS Smith, another packaging business. Mondi’s board announced that following a period of due diligence, the transaction would not be in the best interest of its shareholders. The management team also reiterated its confidence in Mondi’s current compelling portfolio and future growth prospects, which positions the company in a strong position to deliver long term structural growth.

Dr Martens, the UK based designer and distributor of footwear under the Dr Martens Brand, saw its share price decline by 28.4% last week after the company announced its latest trading statement. The company reported that it will announce its full year 2024 results on 30th May, which are expected to be in line with previous guidance and consensus expectations. The announcement also included that 2025 will be a challenging period for the company as wholesale revenue in the US is expected to decline after the company’s autumn winter order book was significantly short. The company also announced that its Chief Executive Officer, Kenny Wilson, plans to step down and will be succeeded by the current Chief Brand officer Ije Nwokorie before March 2025. This was viewed as a very negative release by the company, resulting in the corresponding share price decline.

Dunelm Group, the UK based homewares retailer, announced its third quarter trading update last week which saw the company’s share price close the week 9.3% lower. The company announced that its total sales for the third quarter increased by 3% to £435 million compared to the third quarter in the previous year. This was despite market conditions in both homeware and furniture remaining challenging. The update also noted that trading conditions have continued to be volatile, with March in particular seeing softer levels of demand. This appears to have decreased investor confidence about future results, resulting in the share price decline.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.