30 April 2024

Last week saw economists divided over the timing of the anticipated interest rate cuts by the Bank of England (“BOE”). A Reuters poll revealed a division between forecasts for a June cut and a delay until the third quarter. Despite inflation easing to 3.2% year-on-year in March, slightly above the expected 3.1%, persistent service prices and wage growth may delay the BOE’s monetary easing. The International Monetary Fund’s recent downward revision of the UK's growth outlook further complicates the BOE's decision-making, emphasising the need for a cautious approach amid prolonged weak growth.

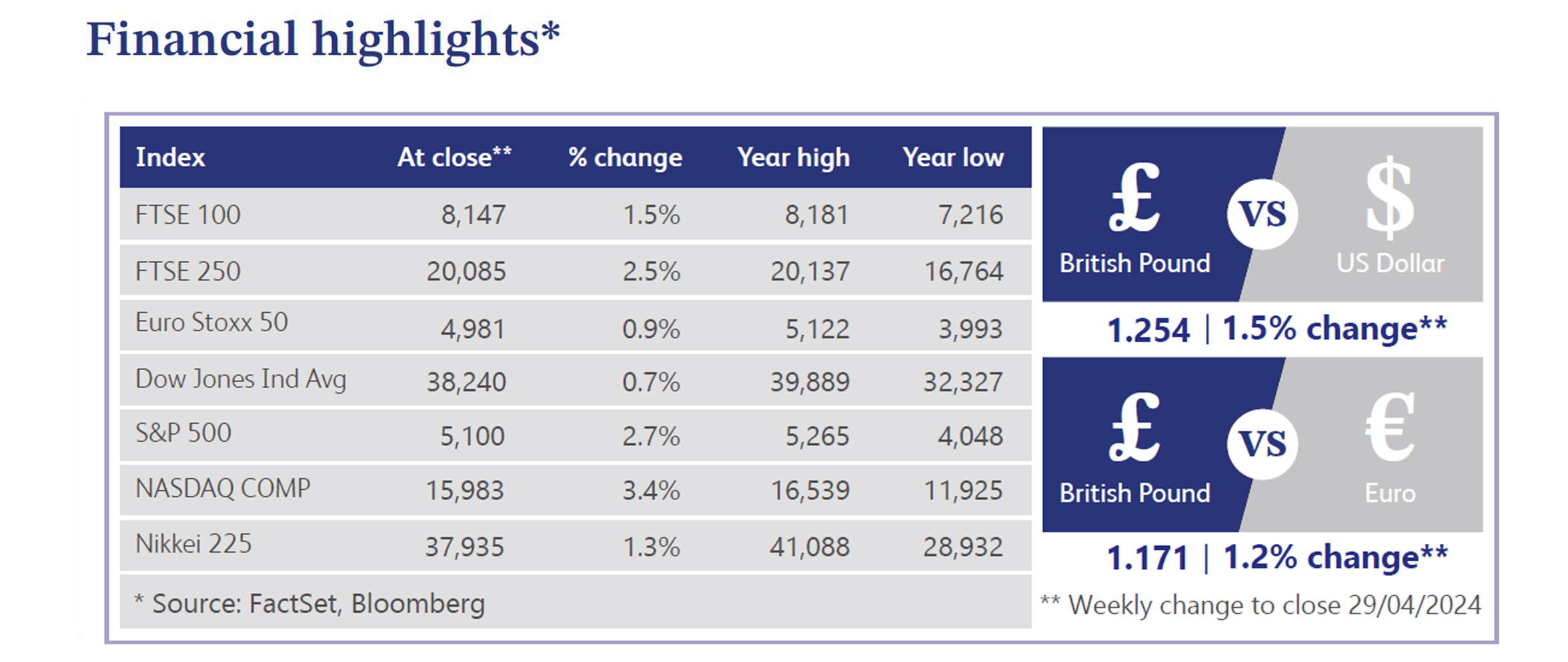

Simultaneously, global markets, particularly in the United States, have shown signs of resilience and optimism. The S&P 500 experienced a notable rebound this week, rising more than 2.5% and significantly narrowing a previous 5.5% month-to-date decrease. This resurgence was driven largely by corporate earnings, with reports from 158 S&P constituents, including several key technology giants. In general, corporate earnings were well-received and aligned with expectations for solid first quarter earnings growth. The blended earnings growth rate for the index currently stands at 3.5%, closely matching forecasts from the end of the previous quarter. This positive sentiment in the US could influence global market dynamics and impact the BOE’s rate decision timeline, contrasting with the more cautious approach driven by domestic economic indicators.

Grocery price inflation in the UK continued its downward trend for the 14th consecutive month, offering some relief to consumers. This easing in food prices, combined with strengthened domestic demand and the anticipation of upcoming interest rate cuts, has significantly lifted business confidence, now above pre-Covid levels according to a recent survey by the Institute of Chartered Accountants in England and Wales.

In the equities market, the outlook is mixed. London's potential loss of key listings, like Shell, to more lucrative markets, such as New York, highlight ongoing challenges in maintaining its global financial hub status. This concern is exacerbated by threats of foreign takeovers and listing defections, underscored by recent mergers and acquisitions activity and the continuing net redemptions from funds focused on London-listed stocks.

Despite these challenges, UK economic indicators point to a gradual recovery, with the services sector driving growth despite manufacturing slowdowns. Meanwhile, public sector borrowing figures have exceeded forecasts, emphasising ongoing fiscal pressures as the government contends with inflation-driven spending.

In the UK housing market, a surge in optimism has pushed asking prices to near-record levels, with Rightmove indicating a strong market driven by demand for high-end, family-sized homes. This uptick in the housing sector, along with the broader economic indicators, will also play a role in shaping the BOE's policy decisions in the coming months as it seeks to balance supporting economic growth and controlling inflation, while keeping an eye on global economic trends and their implications for the UK.

Anglo American, the British multinational mining company, saw its share price surge by approximately 21.3% last week. The company announced that it had received an unsolicited non-binding and highly conditional all share takeover proposal from BHP Group of £25.08 per share, valuing the company at £31.1 billion. If the deal were to be accepted, it would create the world’s largest miner and copper producer. However, Anglo American rejected the bid, stating that it significantly undervalued the company.

NatWest Group, the UK retail bank, announced its first quarter results last week which saw its share price close the week 11.1% higher. The company reported net interest income of approximately £2.7 billion, beating analyst expectations of approximately £2.6 billion. NatWest also announced a total income of £3.5 billion compared to a consensus estimate of £3.4 billion. The management team also reaffirmed its 2024 guidance which provided some more certainty to investors, resulting in the share price increase.

Barclays also announced its first quarter results last week, which led to its share price increasing by approximately 10%. The company announced that its total income increased to approximately £7 billion for the first quarter, beating analyst expectations of approximately £6.9 billion. Barclays also reported strong profit before tax figures of approximately £2.3 billion compared to analyst expectations of £2.2 billion. The company’s results beat expectations on a number of key metrics, alongside providing positive guidance for the outlook of the company.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.