16 July 2024

The latest UK gross domestic product ("GDP") estimate showed a 0.4% expansion in May, surpassing expectations due to growth in industrial production, services and construction. Over the past three months, GDP grew by 0.9%, the strongest since January 2022, with services contributing significantly. This aligns with purchasing managers index data, highlighting the services sector's role in the economic recovery.

An update from auditing firm KPMG and the Recruitment and Employment Confederation showed UK pay is rising again. This could complicate the Bank of England’s (“BoE”) rate-cut plans. June data indicated increased permanent salary growth as firms attracted staff amid cost-of-living pressures, despite previous general election uncertainty and reduced worker demand affecting permanent hiring. BoE research also suggests UK wages may be rising faster than official data indicates, with pay growth at 6.5% in the first quarter of 2024.

Meanwhile, the UK government launched a £7.3 billion National Wealth Fund to stimulate infrastructure investment, aiming to leverage private sector capital amid constrained public finances. UK business leaders have shown cautious optimism about this strategy. Additionally, Prime Minister Starmer committed to increasing defence spending to 2.5% of GDP when financially feasible, aligning with commitments from other NATO countries. This follows an April analysis predicting defence spending at 2.32% of GDP for the 2024–2025 financial year under the prior Conservative government.

The British Chamber of Commerce reported improved UK business confidence and conditions in the second quarter, with 58% of firms expecting higher turnover and 38% noting increased domestic sales. Easing inflation has led fewer firms to anticipate price hikes. Despite better sentiment, most businesses are not boosting investment. The Institute of Chartered Accountants in England and Wales noted UK business confidence reached its highest level since the first quarter of 2022, driven by reduced inflation and wage growth, fostering optimism for consumer spending. Conversely, the British Retail Consortium and KPMG highlighted a sharp drop in UK consumer spending in June due to the cold weather.

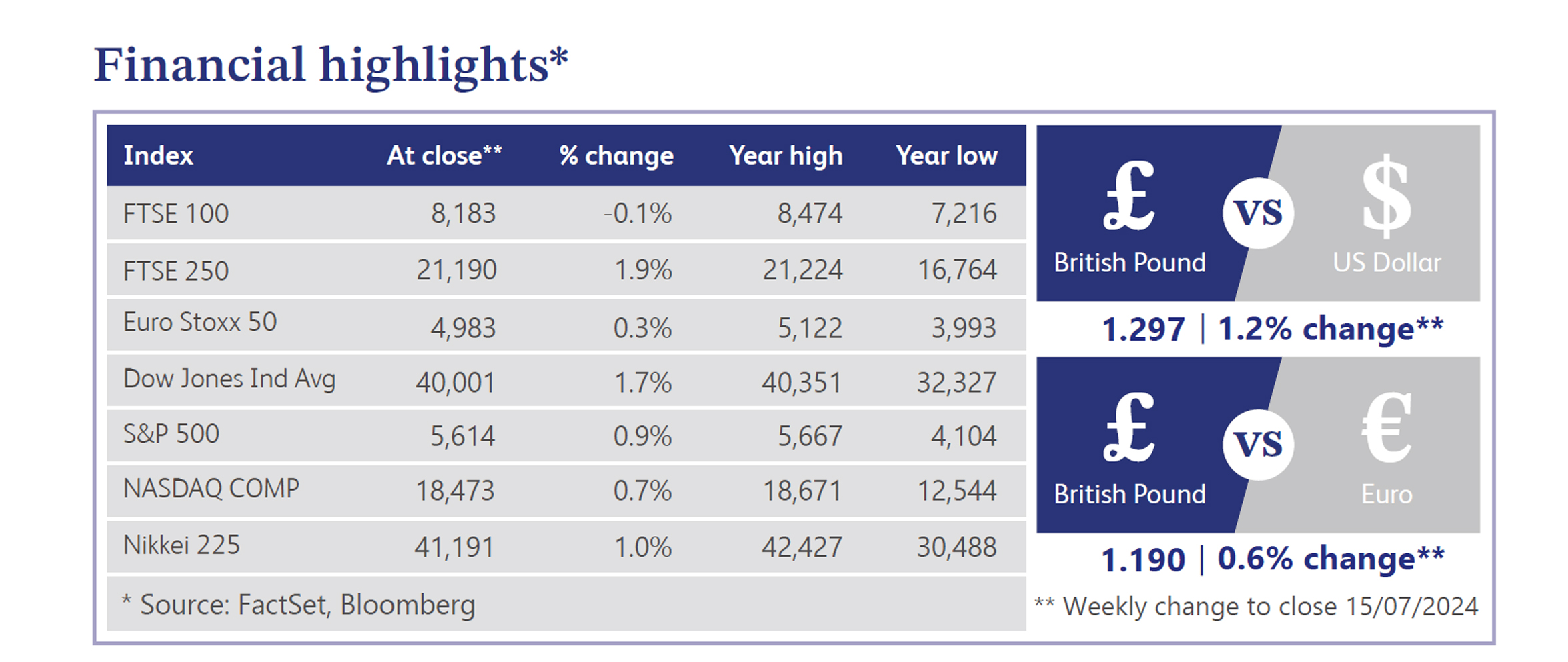

US equities rose this week, with small-caps and the equal-weight S&P 500 outperforming as investors rotated out of big tech stocks like Meta (-7.6%) and Netflix (-6.2%) following a cooler-than-expected consumer price index report. The S&P 500 reached all-time highs, with sectors such as Real Estate Investment Trusts ("REITs"), precious metals miners and hospitals leading gains. Treasuries strengthened, the dollar weakened, gold gained approximately 1% and West Texas Intermediate ("WTI") crude fell approximately 1.1%. Market sentiment shifted ahead of the second-quarter earnings season, with analysts noting mixed economic signals, including a dovish tilt from Federal Reserve Chair Powell's testimony and concerns about consumer resilience and labour market stability. The FedWatch odds for a September rate cut rose to 88%.

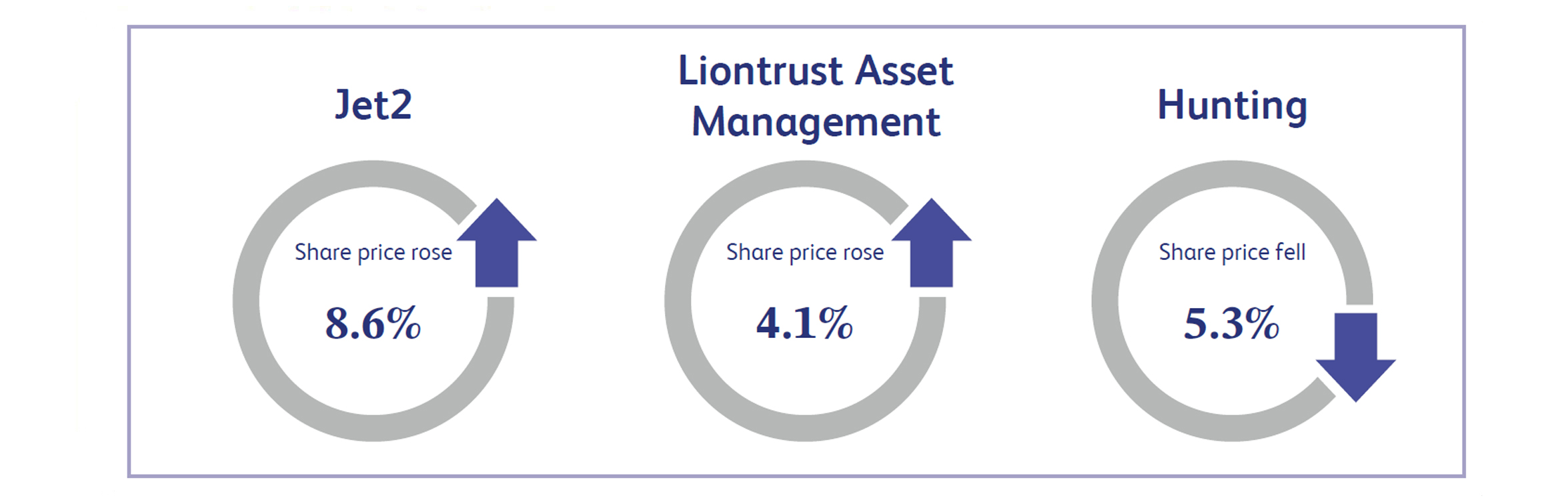

Jet2, a UK-based leisure travel company, saw its share price rise by 8.6% last week after reporting strong full-year results. Revenue increased to £6.3 billion from £5 billion in the previous year, and earnings per share rose 37% to 185.9 pence. The final dividend per share increased 34% to 10.7 pence. The company also confirmed its confidence in future growth by exercising the remaining 36 purchase rights of its Airbus order, securing 146 A321neo aircraft deliveries through 2035. Analysts believe Jet2 is well-positioned for further sector growth.

Liontrust Asset Management, a UK-based fund management company, saw a 4.1% share price increase last week after its latest trading announcement. Assets under management and advice were £27 billion, down 2.8%, with net outflows of £900 million in the quarter. CEO John Ions stated that Labour's landslide general election win should bring stability, benefiting financial markets. He also mentioned that falling inflation and expected interest rate cuts could attract international investors back to the UK.

Hunting, a UK-based energy equipment manufacturer, saw its share price drop 5.3% last week after announcing its half-year results. The company reported a sales order book of $700 million, up from $565 million on 31st December 2023, supported by $231 million in orders from Kuwait Oil Company. Earnings before interest, tax, depreciation, and amortisation (“EBITDA”) are expected to be $59 million - $61 million, surpassing expectations and up 22% from the previous year. Despite strong results, investors remained concerned about the sustainability of upgrades and potential profit-taking.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.