30 July 2024

A Reuters poll showed most economists are expecting a Bank of England ("BoE") interest rate cut, with mixed UK data causing some to push expectations from August to September. The absence of comments from BoE Governor, Andrew Bailey, due to the election, has deprived the market of crucial signals. Despite a two-month high in the UK's purchasing managers index ("PMI"), driven by new business growth, uncertainty remains over the BoE's decision, with market odds of a rate cut at approximately 40%. Former BoE Monetary Policy Committee member Sushil Wadhwani suggested Labour should allow the BoE to set its inflation target to boost credibility and reduce borrowing costs. Ernst & Young has upgraded its UK economic outlook, predicting 1.1% gross domestic product ("GDP") growth in 2024 and stable inflation near the BoE's 2% target. However, the International Monetary Fund warned that higher growth is needed to avoid a fiscal gap.

UK Chancellor Rachel Reeves is preparing for a challenging Autumn Budget, with potential tax increases likely to be blamed on the previous administration. Reeves is also targeting a major growth initiative through pension reforms, particularly in defined contribution schemes, which could inject £8 billion into the economy. Also, in a bid to attract US investment, Reeves will visit New York in August to promote UK projects, following the launch of a £7.3 billion national wealth fund aimed at leveraging private investment. This visit will set the stage for an upcoming UK investment summit in October.

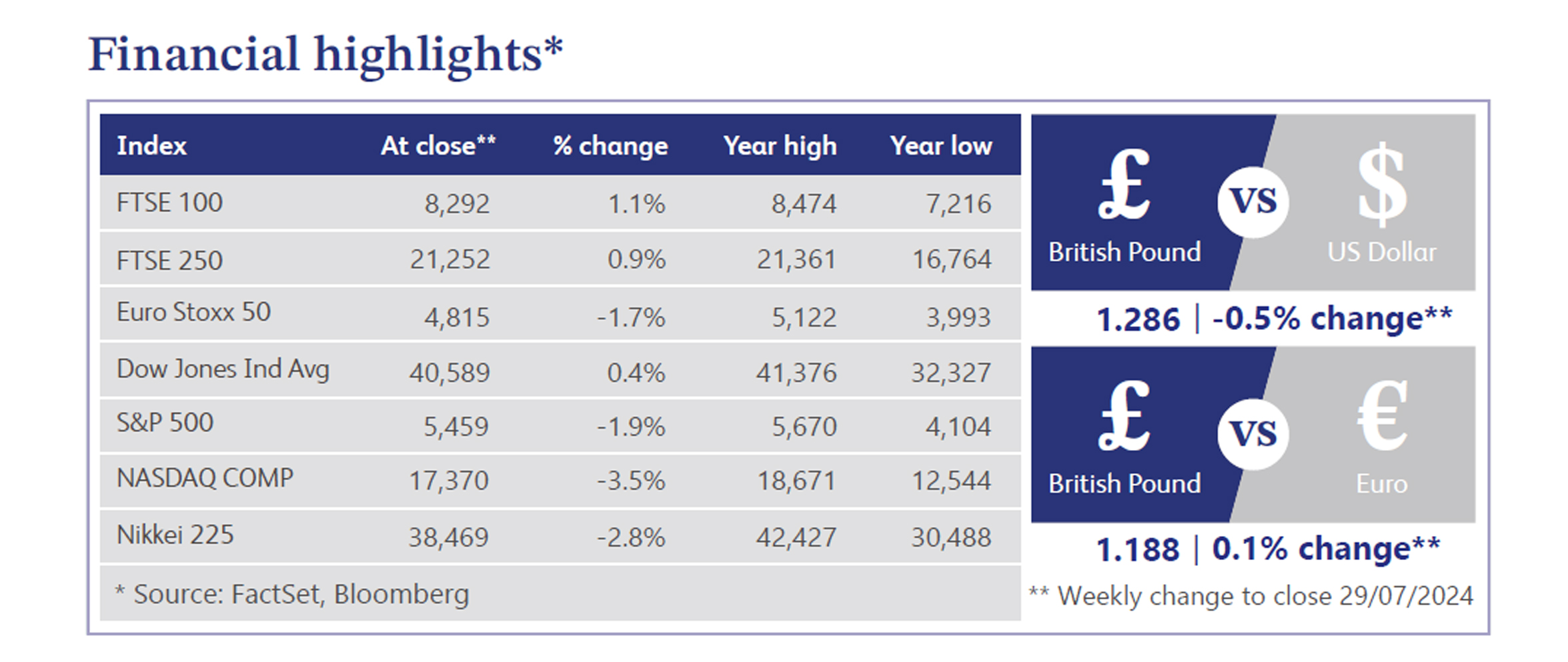

Amid fears of tax hikes, business owners are accelerating merger and acquisition activities, with a 71% increase in deals due to anticipated higher capital gains taxes. High net-worth investors are favouring private equity, with 80% planning allocations. Amundi, Europe's largest asset manager, predicts sterling will strengthen to $1.35 by year-end, despite caution from JP Morgan. This aligns with other banks, citing a brighter UK economic outlook and political stability. Sterling is set for its best month since November. However, UK large-cap funds saw significant outflows, with £2 billion withdrawn in June, contributing to a £77 billion outflow since 2022. Conversely, the UK is becoming a haven for global cash due to political stability and low borrowing costs. In the last week, US markets were mixed, with small caps and cyclicals outperforming, while big tech declined due to disappointing earnings. Economic data showed growth concerns with declining home sales and weaker manufacturing PMI, though services PMI improved slightly.

The UK buy-to-let market faced a downturn, with landlords purchasing just 10% of homes sold in the first half of the year, the lowest since 2010, according to Hamptons. Despite rising yields, higher borrowing costs and policy changes are deterring investment, worsening the rental supply shortage and driving up rents. Additionally, the Institute for Fiscal Studies warns that 370,000 homeowners may fall into arrears as high interest rates force many to refinance expiring fixed-rate deals, straining household finances further.

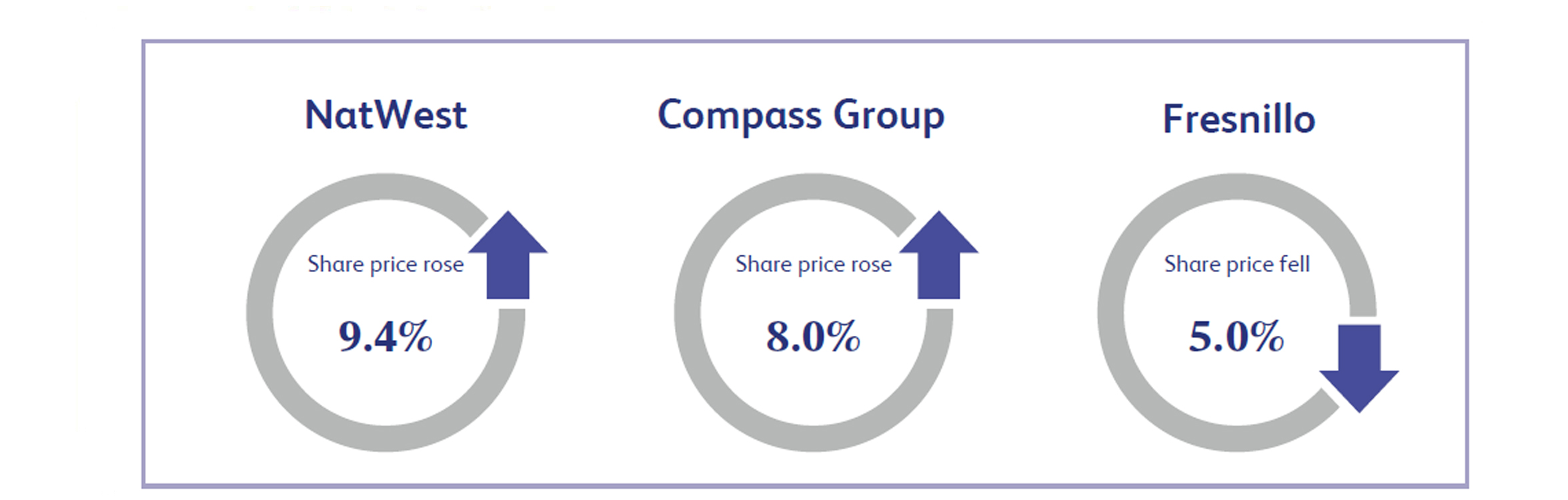

NatWest, the international banking and financial services company, witnessed its share price increase by approximately 9.4% last week following its announcement of raised guidance for the year and a strategic acquisition. The bank's second-quarter performance exceeded expectations, with total income of £3.66 billion surpassing the consensus estimate of £3.41 billion, and a net interest margin of 2.10% ahead of the anticipated 2.01%. NatWest also raised its full-year income forecast to £14 billion, up from the previous range of £13 billion to £13.5 billion, reflecting the benefit of higher interest rates and lower impairments. Additionally, NatWest announced a deal to acquire £2.5 billion of prime UK residential mortgages from Metro Bank, further supporting its strategic growth priorities.

Compass Group, the foodservice company, saw its share price increase by approximately 8% following a strong third-quarter trading update that exceeded expectations. The company reported organic revenue growth of 10.3%, driven by net new business wins and volume growth, which offset moderated pricing in line with inflation. The group's robust performance across all regions and a promising pipeline of new business opportunities further supported investor confidence. Additionally, Compass raised its full-year forecast, expecting underlying operating profit growth above 15% and organic revenue growth above 10%.

Fresnillo, the precious metals mining company, saw its share price decrease by approximately 5% last week due to gold production disappointing in the second quarter, despite strong silver production. While the company reported an 8% quarterly increase in silver output, driven by better mining grades and recovery rates, gold production fell short of expectations due to lower grades at the Herradura operation in Mexico. This shortfall in gold output, a critical revenue driver, overshadowed the positive silver production results. Additionally, Fresnillo's shares have underperformed its senior gold and silver peers by about 20% this year, contributing to a lack of market confidence despite an expected substantial rise in earnings before interest, taxes, depreciation and amortisation ("EBITDA") for the first half of the year caused by higher precious metal prices.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.