6 August 2024

The Bank of England ("BoE") recently made its first rate cut in over four years, stirring cautious optimism about the UK's economic future. Although BoE Chief Economist Huw Pill acknowledged an improved outlook, he noted the growth rate remains modest at around 1% annually from 2024 to 2026. The narrow 5-4 vote for the rate cut underscores persistent inflation risks. Surveys show a slight decline in firms' expectations for wage growth and inflation. The BoE's survey revealed expected wage growth fell to 4.1% and the one-year-ahead consumer price index dropped to 2.5%. Similarly, the Citi/YouGov survey showed stability in one-year inflation outlooks and a minor rise in long-term expectations, reflecting the BoE's increased confidence in disinflation.

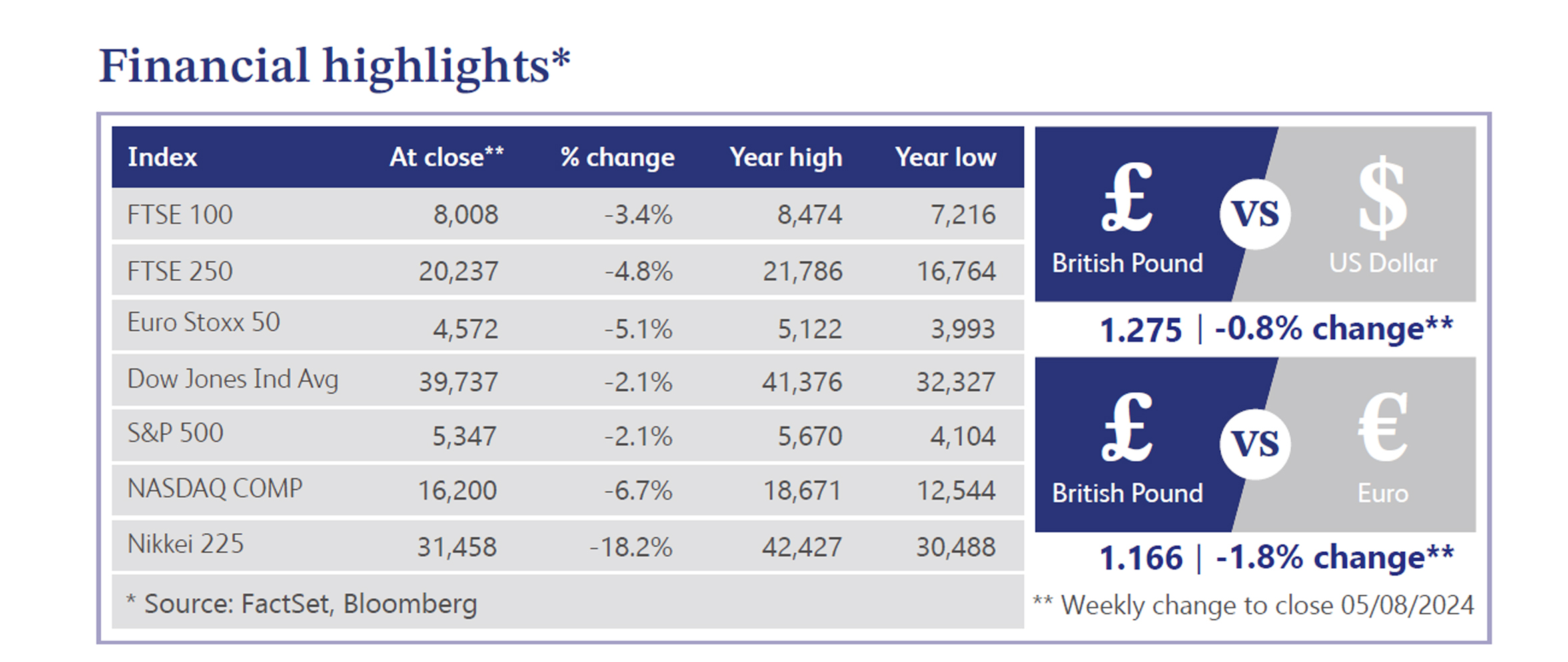

The BoE's annual report disclosed a significant government transfer of nearly £45 billion to cover recent losses, raising concerns about monetary policy sustainability. Despite fiscal challenges, the BoE's rate cut has positively influenced market sentiment. However, optimism is tempered by the recent decline in sterling. UK Chancellor Reeves hinted at possible tax increases in the October budget, despite pledges to keep major taxes unchanged. Acknowledging a £22 billion funding gap due to a public sector pay rise adds to fiscal pressures. A Deloitte survey revealed increased optimism among UK Chief Financial Officers, with post-election risk appetite rising and expectations for corporate revenues at a two-and-a-half-year high. However, companies remain cautious, focussing on cost reduction and cash flow improvements.

Recent data shows a mixed UK labour market picture. The Adzuna Job Market Report highlighted a nearly 20% drop in job vacancies in June, indicating recent economic growth hasn't yet boosted hiring. The number of job seekers per vacancy has increased while retail sales have continued to struggle, with the Confederation of British Industry reporting a second consecutive month of declining annual sales. Unfavourable weather and market uncertainty are key factors, with retailers expecting continued order cutbacks. The housing market remains stable, with consistent mortgage approvals of around 60,000. Reports from Zoopla and Nationwide suggest a slow property market recovery, with modest house price and sales activity increases.

Globally, sentiment is dominated by growth and recession concerns, highlighted by weak US employment and manufacturing data. The nonfarm payrolls report fell short of expectations, and unemployment rose, intensifying economic slowdown fears. This has increased expectations of a Federal Reserve rate cut. Middle East tensions have also impacted markets, with geopolitical events driving oil price volatility. Despite this, corporate earnings have shown resilience, with the S&P 500 seeing a blended second-quarter earnings per share growth rate of 11.5%. Additionally, the Japanese yen strengthened against the US dollar as the Bank of Japan increased its interest rate to approximately 0.25%. This led to a significant sell-off of Japanese equities, with the Nikkei 225 closing the week about 4.7% lower and selling momentum continuing into Monday. Weakening US data and Japanese equities have sparked recession fears, with several global equity indices experiencing downward momentum.

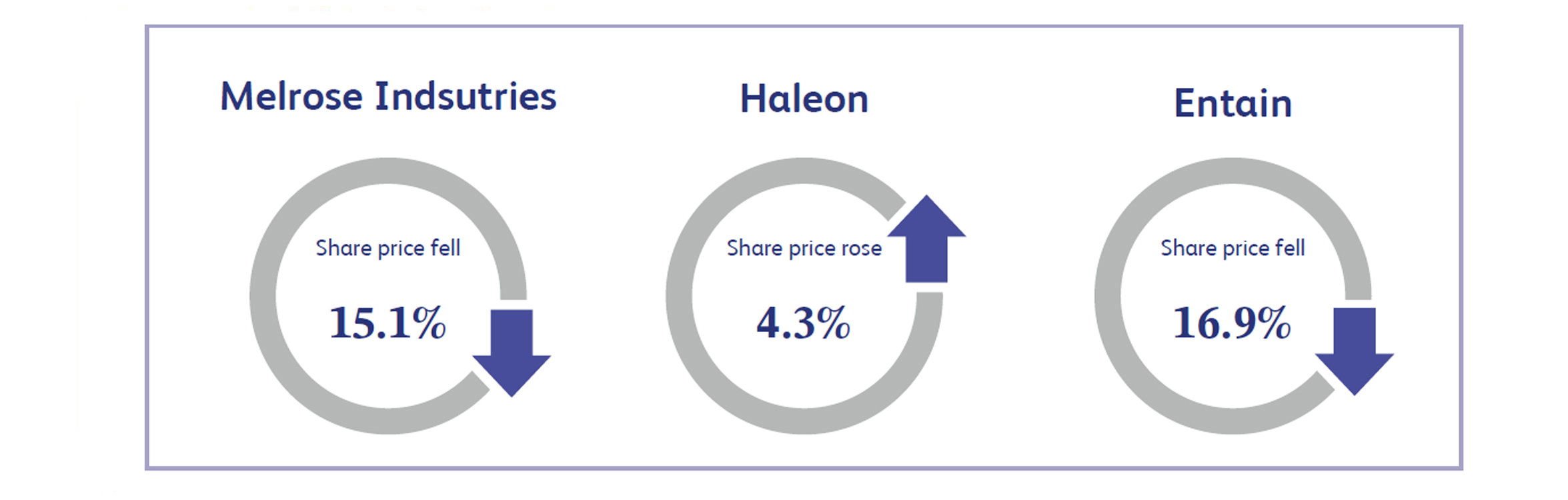

Melrose Industries, a UK-based aerospace company, witnessed a share price decline of approximately 15.1% last week after the company reported its half-year results. The company reported revenue of approximately £1.7 billion, an increase of 12% in comparison to the previous year. The company also held its full-year 2024 and 2025 profit guidance. It appears the selling pressure was largely due to concerns related to industry dynamics, with some airlines mentioning overcapacity, pricing challenges and resuming retiring fleet.

Haleon, a consumer healthcare company, saw its share price increase by approximately 4.3% last week as the company reported its first-half results. The company reported that its revenue for the period was approximately £5.7 billion, in line with analyst expectations. Haleon also reported that adjusted earnings per share was £9, approximately 2% above consensus estimates of £8.82.

Entain, an international sports-betting and gaming company, announced its half-year financial results last week, leading to a 16.9% drop in its share price. The company reported $1 billion in revenue, a 6% increase from the previous year. Despite the revenue growth, Entain indicated that 2024 will be another investment year, projecting a higher loss in earnings before interest, tax, depreciation and amortisation ("EBITDA") and delaying its $500 million EBITDA target from 2026 to an unspecified future date.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.