13 August 2024

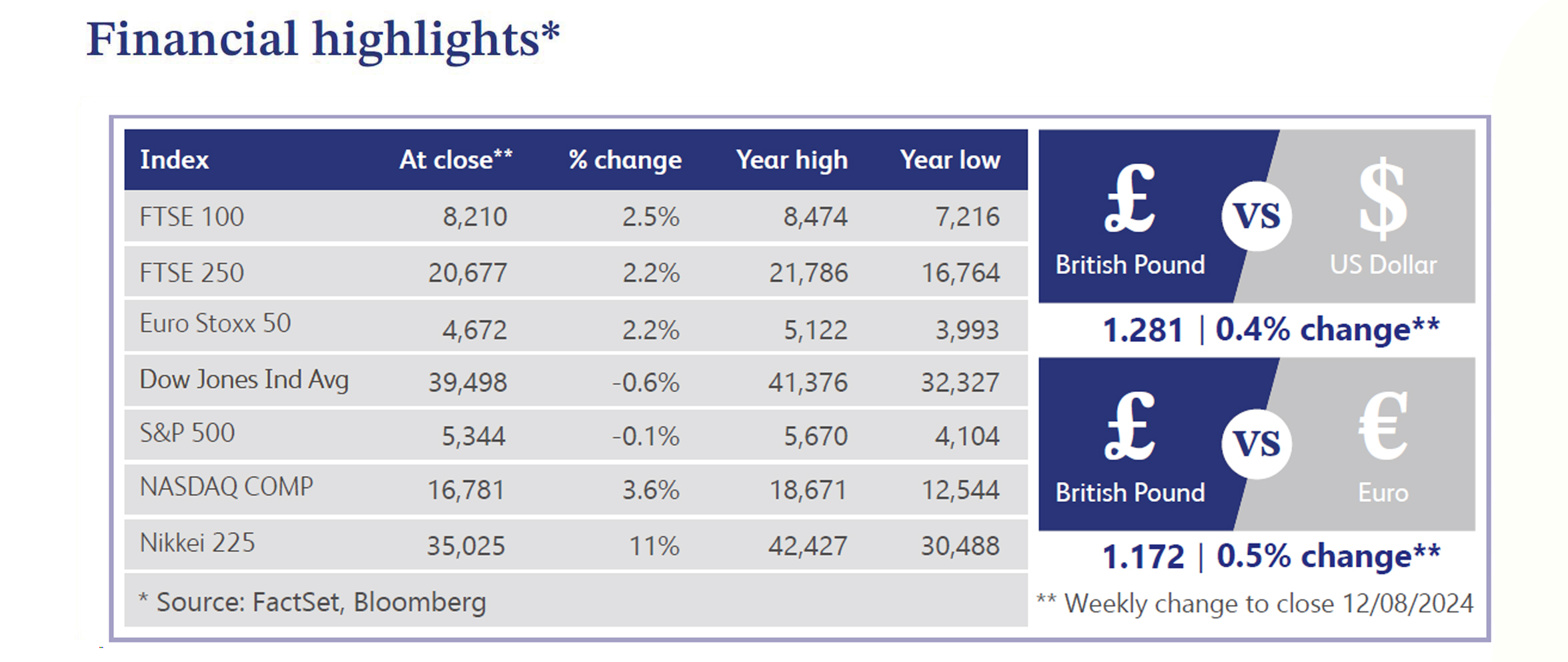

Last week saw various economic developments, including the National Institute of Economic and Social Research (“NIESR”) publishing its forecast, predicting a slower interest rate cut cycle by the Bank of England (“BoE”) than the market expects. NIESR anticipates that economic recovery will accelerate, prompting the BoE to maintain higher interest rates for a longer period. The BoE's interest rate is expected to decrease gradually, reaching 4.6% in 2025 and 4.1% in 2026, before bottoming out at 3.1% in 2028. Additionally, economists are divided on the BoE's next rate cut, with mixed views on the timing and size of potential easing, though domestic inflationary pressures seem to be receding.

In other economic news, the UK economy grew more than expected in 2022, with gross domestic product revised upward to 4.8% by the Office for National Statistics, reflecting resilience despite impacts from global events. The services sector saw its fastest growth since May 2023, driven by strong demand and increased business confidence, while hiring signals in London's financial sector were mixed, with some industries showing strong demand for permanent workers despite a decline in financial services vacancies. Meanwhile, UK retail sales remained weak, though slightly improved from June, and a survey by KPMG and the Recruitment and Employment Confederation indicated a slowdown in wage growth as demand for staff declined.

According to real estate software firm MRI Software, UK high streets experienced a significant drop in footfall last week, with a 4.8% decline attributed to riots across England and Belfast, peaking at a 7.5% drop on Wednesday as shoppers avoided potential unrest. Meanwhile, the Institute for Fiscal Studies warned Chancellor Rachel Reeves against altering debt rules to increase fiscal space, arguing that it wouldn't change the underlying issue of government borrowing. The NIESR cautioned that the government's growth target of 2.5% would be unattainable without an additional £50 billion in annual investment, projecting sluggish growth without substantial fiscal intervention.

US equities declined over the week, recovering slightly from Monday's sharp drops, which marked the S&P's worst performance since September 2022 and the Nasdaq's worst since October 2022. The decline was sparked by a weaker-than-expected July payroll report, raising concerns about a hard landing and potential Federal Reserve (“Fed”) actions. Despite the turbulence, the S&P ended the week less than 6% below its mid-July record, though the Nasdaq remained in correction territory. Sector performance was mixed, with big tech mostly lower except for Meta Platforms, which gained 6.1%. Treasuries weakened slightly, oil prices rose 4.5% and market discussions focused on economic resilience, Fed actions and ongoing challenges.

UK construction activity surged in July, with the S&P Global Construction purchasing managers index reaching 55.3 versus 52.2 previously, its fastest increase in 26 months, driven by new orders and growth across all sectors. Halifax reported a 0.8% rise in UK house prices, the highest annual growth rate since January 2024, supported by potential BoE rate cuts and lower mortgage rates.

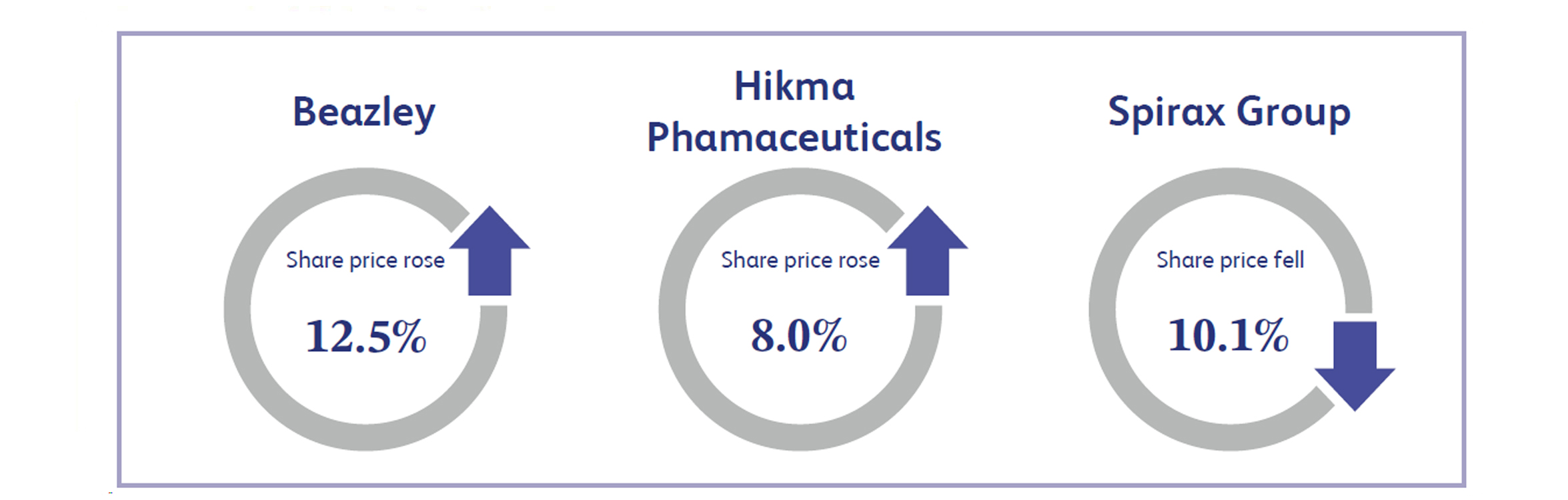

Beazley, the specialist insurance business, saw its shares rise by about 12.5% last week, following its first-half results announcement. The company reported a record profit before tax of $728.9 million, nearly doubling last year’s $366.4 million. Additionally, Beazley updated that its $325 million share buyback program, announced in March 2024, is on track for completion by year-end. These impressive results and updates were well-received by investors.

Hikma Pharmaceuticals, the developer of branded and non-branded generic pharmaceutical products, saw its share price rise by about 8% last week following the announcement of its first-half results. The company reported revenue of approximately $1.57 billion, marking a 10% increase from last year’s $1.43 billion, and earnings per share of 102 cents, up 73% from 59 cents previously. These strong results led management to raise their full-year revenue and profit forecasts, a move that positively impacted the company’s share performance.

Spirax Group, the thermal energy management and fluid technology solutions company, saw its share price fall by about 10.1% last week following the release of its half-year results. The company reported revenue of £827 million, a 3% decline from last year’s £850.8 million, and noted that organic growth was limited to 1% due to a weak economic environment in key markets. Although management anticipates stronger growth in the second half of the year, they do not expect a significant recovery until late 2024. This outlook raised concerns about the full-year performance, contributing to the decline in the share price.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.