3 September 2024

Last week was characterised by a mix of cautious optimism and looming challenges, with markets reacting to both economic data and political developments. UK retail prices fell for the first time in nearly three years, dropping by 0.3% in August due to heavy discounting by retailers amid poor summer trading conditions and ongoing cost-of-living pressures. Non-food prices were the main driver, falling by 1.5%. Meanwhile, the Confederation of British Industry’s (“CBI”) survey showed retail sales declined for the third consecutive month, with expectations of continued weakness in September. In the financial sector, City job openings are expected to see a slight recovery following a post-election slump. Despite cost pressures in the services sector, UK business confidence has remained strong, with optimism about the economy at its highest level since 2015, although investment plans have softened.

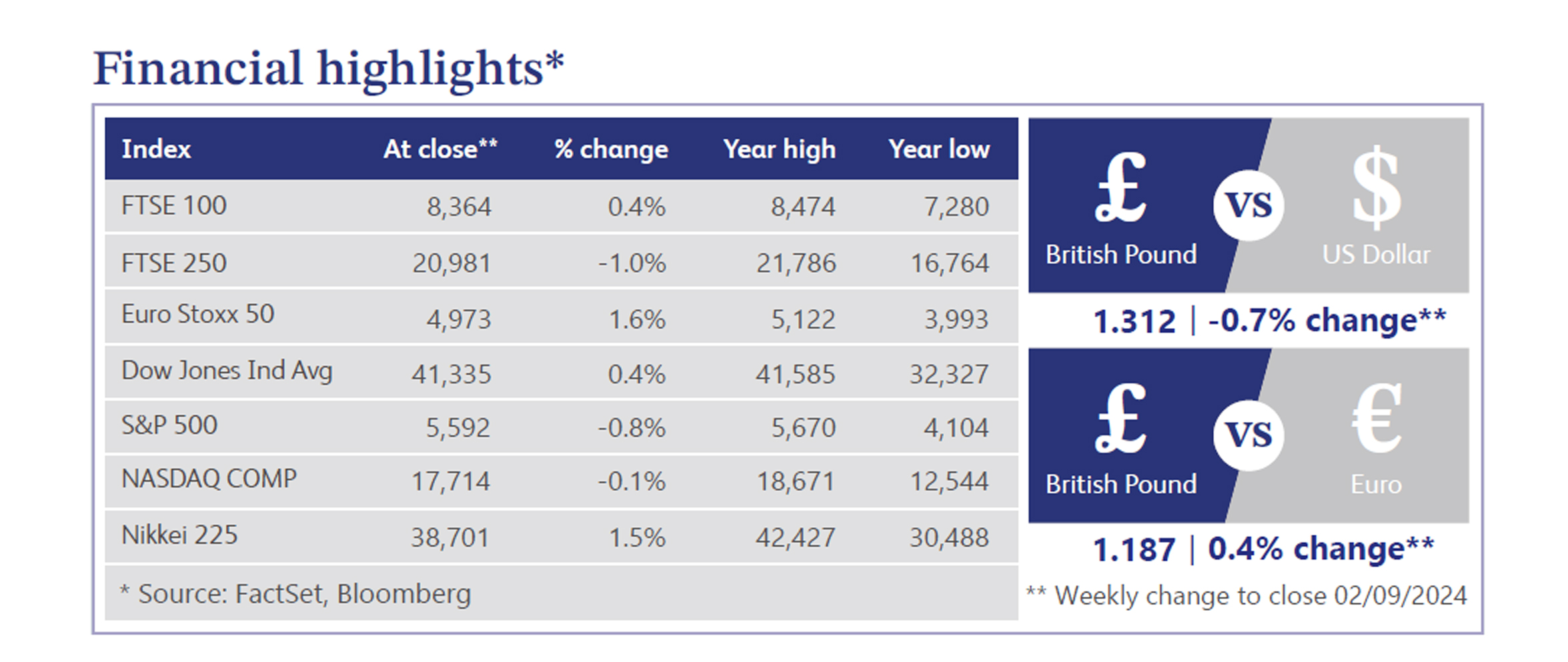

UK Prime Minister Keir Starmer has warned of a "painful" autumn budget, signalling potential tax increases and spending cuts due to a £22 billion shortfall in public finances. Starmer emphasised that those with the "broadest shoulders" will bear the heaviest burden. This has sparked concerns among businesses and wealthy households, with some already taking preemptive measures. Chancellor Rachel Reeves has instructed government departments to find significant savings, while speculation grows about potential increases in capital gains tax, inheritance tax and fuel duty. Despite these challenges, the government remains committed to supporting households with rising energy costs amid growing public pressure. Meanwhile, sterling has surged to its highest levels in over two years against the dollar and outperformed the euro, driven by expectations that the Bank of England (“BoE”) will cut rates more slowly than the Federal Reserve and European Central Bank. However, this rally leaves the currency vulnerable to negative news or shifts in risk appetite, particularly if the UK economy underperforms.

US equities posted a mixed performance in a low-volume week ahead of the Labor Day weekend. Big tech was mixed, with Nvidia notably down 7.7%. Nvidia's earnings report was a key focus, showing strong results but causing shares to drop due to concerns over falling gross margins and spending. Economic data releases were mixed but generally aligned with expectations, with some positive surprises in personal spending and income. Oil markets were volatile, initially rising on supply concerns but reversing gains amid news that OPEC (the Organisation of the Petroleum Exporting Countries) will likely stick to planned production cuts in October.

UK banks are preparing for a lending surge in the housebuilding sector, driven by the government's plan to build 1.5 million homes over the next five years. Despite a slowdown in development loans in 2023 due to high interest rates, optimism is growing, particularly in the build-to-rent and student housing sectors. The housing market is showing signs of recovery, with increased listings and buyer demand, as reported by Zoopla. BoE data also indicates a rise in mortgage approvals, signalling resilience in the market, while Nationwide reports house price growth at its highest since December 2022, despite subdued activity by historical standards.

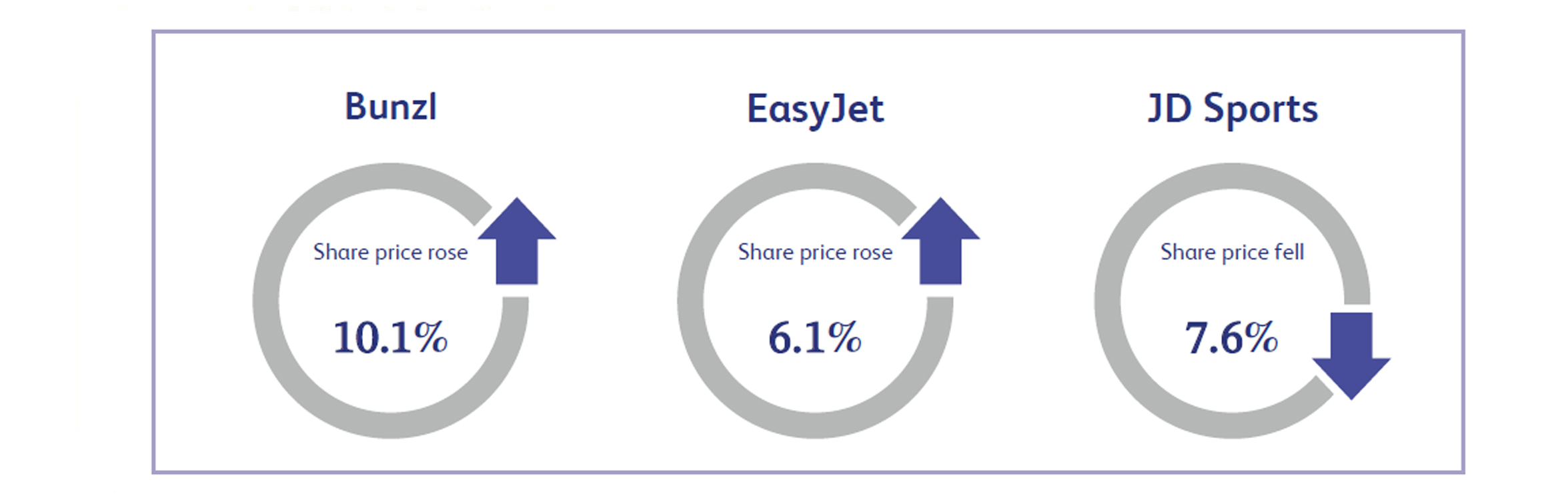

Bunzl, a wholesale distributor, saw its share price rise by 10.1% following robust first-half results and announced a new capital allocation strategy. The company reported a 3.9% increase in adjusted operating income and upgraded its 2024 profit forecast, driven by improved margins and acquisitions. Bunzl’s new strategy includes a £250 million share buyback programme with a further £200 million buyback expected next year. Alongside this is a commitment to invest £700 million annually in acquisitions and capital returns over the next three years. Despite declining revenue and profit attributable to equity holders, the market reacted positively to the enhanced dividend and capital return plans, pushing shares to a record high.

EasyJet, the low-cost airline and holiday provider, saw its share price rise by 6.1% following positive news from Ryanair, which upgraded its summer fare outlook. Ryanair's CEO Michael O'Leary indicated that fears of double-digit declines in fares had diminished, with a more moderate decrease now expected. This improvement in fare expectations reassured investors about the European short-haul market's stability. The positive sentiment surrounding Ryanair’s updated forecast buoyed EasyJet and other rivals, as it suggested that the pressure on summer fares was easing. This led to increased confidence and a significant boost in EasyJet’s share price.

JD Sports, the sports and fashion retailer, saw its share price fall by 7.6% amid mounting pressure on UK retail stocks due to ongoing sector weakness. Despite a rebound in retail sales in July, August data from the CBI Distributive Trade survey highlighted a third consecutive month of declining sales, albeit at a slower rate. Retailers face a weak outlook and are struggling with poor trading conditions, exacerbated by the cost-of-living squeeze. JD Sports, which had recently benefited from a positive second-quarter update and bullish analyst commentary, became the biggest underperformer as the retail environment deteriorated. Negative sector sentiment and increasing retailer caution overshadowed recent gains, leading to a significant drop in the company’s share price.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.