17 September 2024

The Bank of England ("BoE") is expected to hold interest rates at 5.00% this week, with economists forecasting further rate cuts in its November and December meeting, potentially bringing the year-end rate to 4.50%. Attention is also on the BoE’s quantitative tightening plans, as there are growing calls to increase the sale of short-dated gilts to boost market liquidity. Investors are watching whether the BoE will accelerate bond runoff next year, in response to a sharp rise in maturing bonds.

In July, UK economic growth stalled, with gross domestic product remaining at 0.0%, below the expected 0.2% growth. Modest gains in the services sector offset declines in production and construction. Economists see the slowdown as a natural cooling, following robust growth earlier in the year, and expect economic activity to moderate further in the second half as challenges mount for both businesses and consumers.

Labour market data for August showed a smaller-than-expected rise in the claimant count at 23.7 thousand, whilst the unemployment rate eased slightly to 4.1%. Wage growth moderated, with average weekly earnings excluding bonuses falling to 5.1%. Recruitment figures also indicated a slowdown, with fewer permanent job placements and weaker wage growth. Although grocery price inflation eased, household concerns about rising grocery and energy costs remain prevalent.

On the fiscal front, the Institute for Fiscal Studies proposed changes to the capital gains tax (“CGT”) system, advocating for CGT to be charged on second homes and business assets after the owner’s death. This potential reform could raise £2 billion annually for the Treasury but has prompted landlords and other investors to accelerate asset sales ahead of an anticipated tax raid.

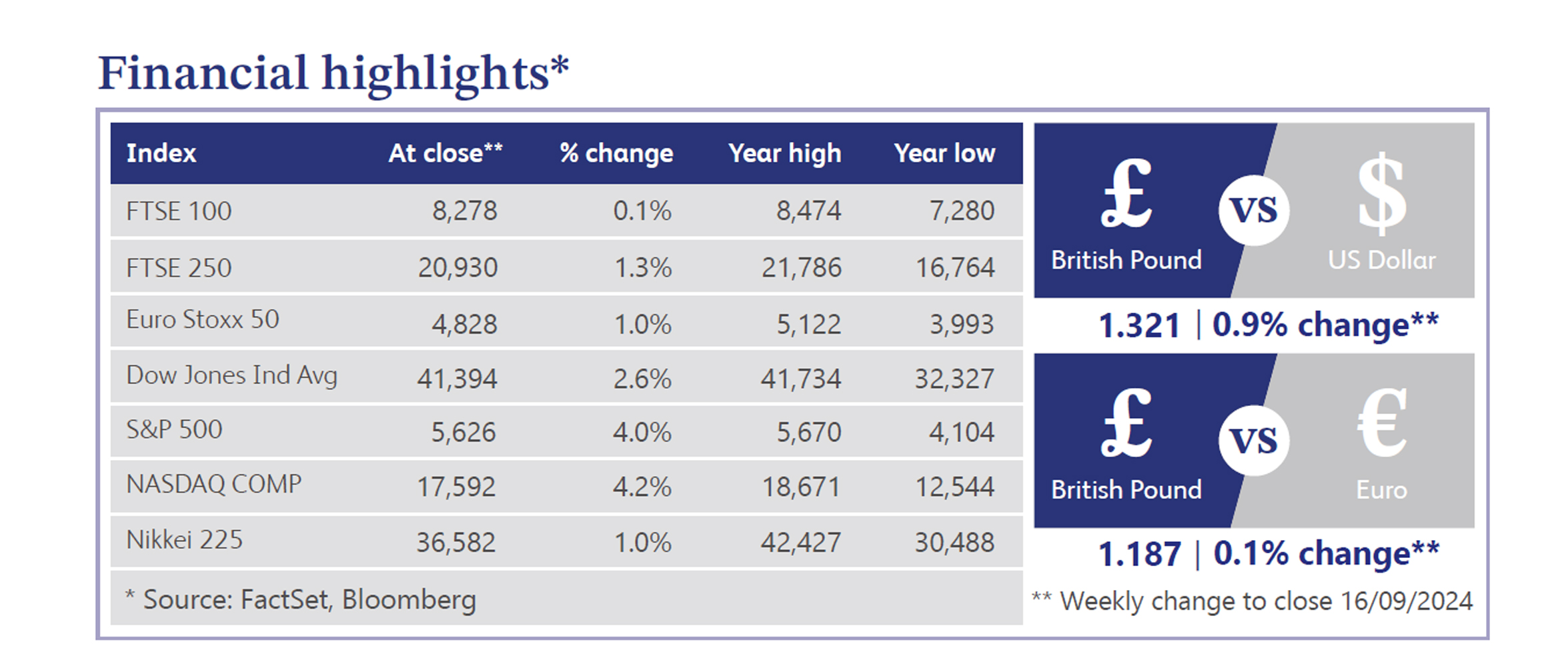

In global markets, the big story was the bounce in equities, driven by oversold conditions and positive developments in the artificial intelligence (“AI”) sector. Notable gains in tech stocks, including Nvidia and Microsoft, led the rally as bullish commentary from the Goldman Sachs Cornucopia Conference spurred optimism. Oracle also delivered well-received earnings, contributing to the broader enthusiasm around AI-driven growth.

Attention turned to this week’s Federal Reserve (“the Fed”) meeting, where debate continued over whether the Fed would opt for a 0.25% or 0.50% interest rate cut. Inflation data was mixed, with core consumer price index readings slightly hotter than expected, though market sentiment suggests a broader disinflationary trend remains in place. Meanwhile, US consumer sentiment improved, hitting its highest level since May, signalling resilient demand despite concerns over inflation.

In the UK, housing market sentiment showed signs of recovery, with the Royal Institute of Chartered Surveyors' house price balance turning positive in August for the first time since October 2022. This rebound was fuelled by lower mortgage rates following the BoE’s rate cut last month. However, homeowners are bracing for higher mortgage payments into 2027, as fixed-rate mortgage holders will face upward pressure on repayments when they come to refinance.

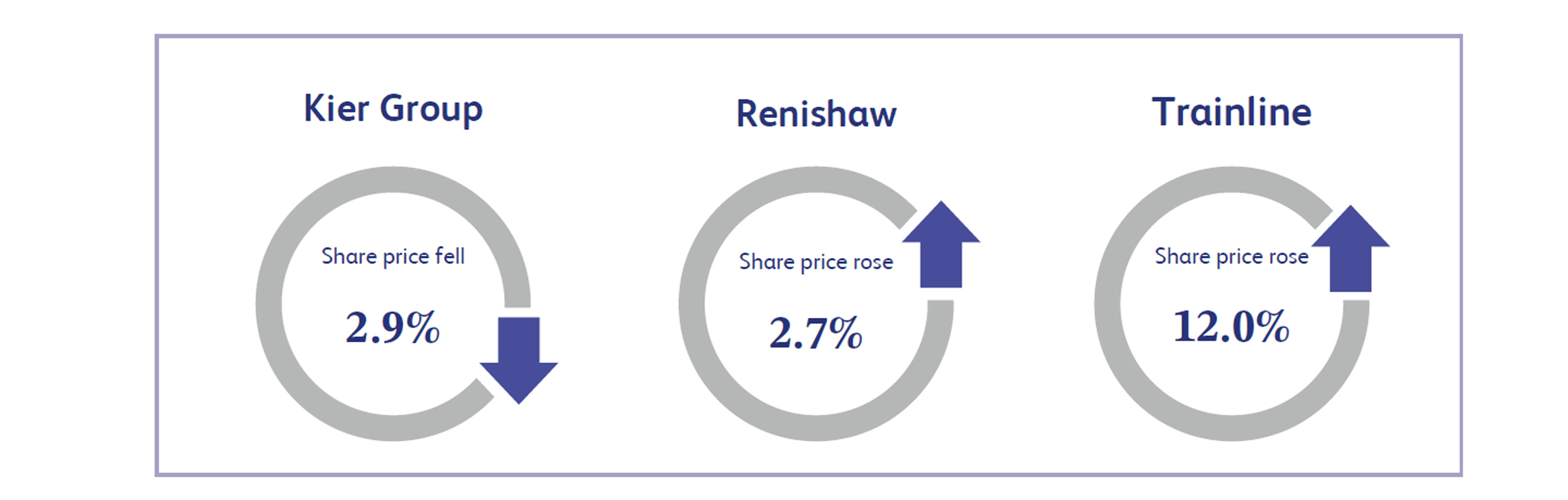

Kier Group, an infrastructure and construction firm, reported its full-year financial results last week, causing its share price to close around 2.9% lower. While the company saw an 18% increase in revenue to £4.0 billion, up from £3.4 billion last year, this growth slightly missed analyst expectations, contributing to the negative share price reaction. Management, however, highlighted a robust and growing order book of £10.8 billion, offering strong multi-year revenue visibility.

Renishaw, a supplier of precision measurement and production systems, saw its share price rise approximately 2.7% following the release of its full-year results. The company posted a modest revenue increase to £691 million, compared to £689 million the previous year. Management noted improving demand for its encoder products in the semiconductor and manufacturing sectors, and expressed confidence in achieving solid revenue growth for the financial year 2025.

Trainline, the rail and coach travel platform, had a particularly strong week, with its share price surging by 12% after announcing impressive half-year results. Ticket sales for the first half reached £3 billion, up from £2.6 billion last year, driving a 16% rise in total revenue to £229 million. These results exceeded analyst expectations, contributing to the significant rally in the company’s share price.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.