24 September 2024

The Bank of England ("BoE") has left policy unchanged in the short term. Still, it may accelerate rate cuts in the final quarter of 2024 with weakening economic momentum, cracks in the labour market, and softening manufacturing outputs signalling a need for further easing. However, persistent inflationary pressures, especially in core and services prices, keep policymakers cautious. Market expectations of rate cuts are rising, with economists predicting the bank rate could fall as low as 3% next year. BoE's Catherine Mann remains cautious on a rapid rate cut cycle though, advocating for maintaining restrictive policy to curb inflationary behaviour. Meanwhile, fiscal concerns grow as the BoE's quantitative tightening programme will cost the UK Treasury billions. Despite these challenges, hiring across more sectors has picked up, reflecting some resilience in the economy.

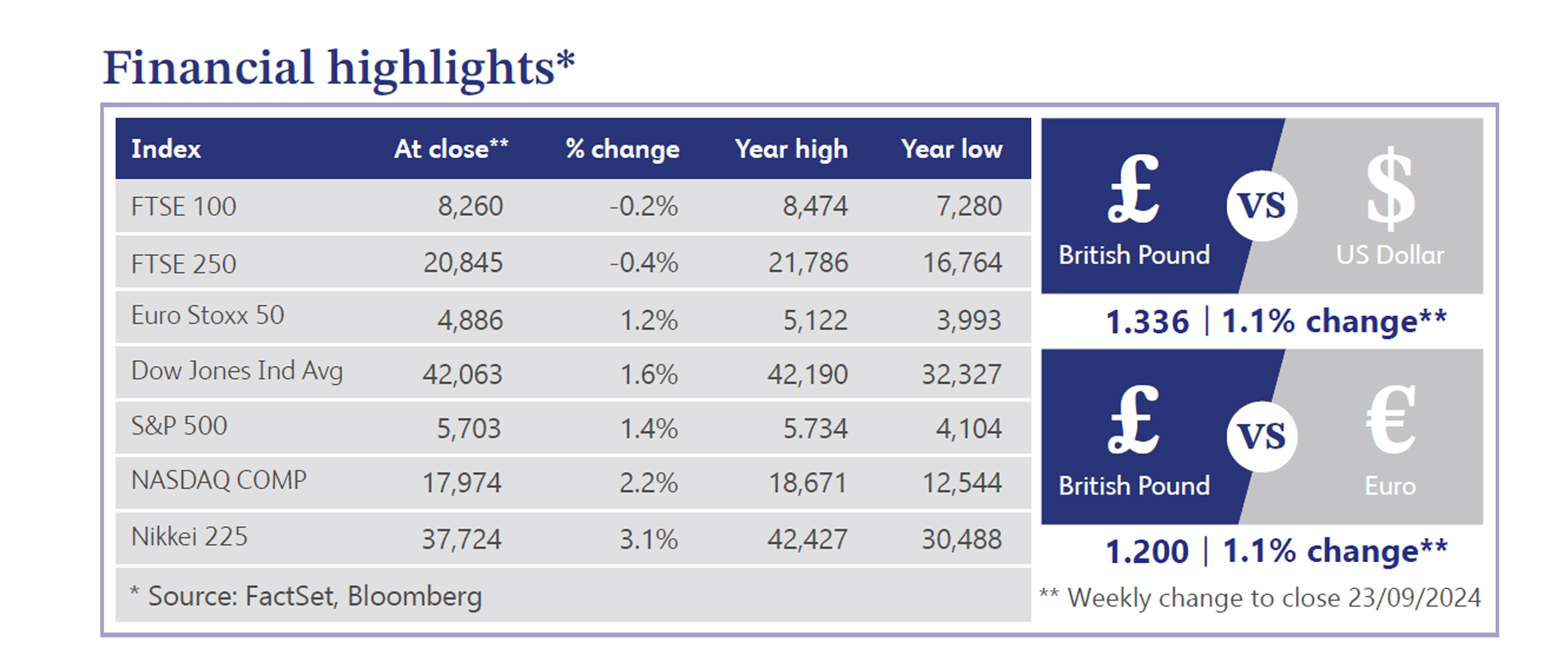

The Organisation for Economic Co-operation and Development ("OECD") has issued a warning that the UK must take significant action to stabilise its public finances, highlighting the pressures of rising costs in health, pensions and climate change. A group of economists echoed this sentiment, urging Chancellor Reeves to relax current fiscal rules that hinder investment, arguing that underinvestment has led to stagnation and economic decline. Meanwhile, Prime Minister Starmer has assured that the upcoming budget will prioritise growth without neglecting the £22 billion fiscal gap. On the other hand, Sterling has outperformed, hitting a two-year high after the BoE maintained the base rate at 5%. Investor sentiment has improved, with Bank of America reporting a net bullish position on UK stocks for the first time in three years.

The Federal Reserve (“Fed”) kicked off its long-awaited easing cycle with a 0.50% interest rate cut, more aggressive than many analysts anticipated. Fed Chair Jerome Powell emphasised the Fed's commitment to preventing economic overheating, leaving the door open for faster cuts if the labour market weakens. Economic data reinforced optimism for a soft landing, with retail sales exceeding expectations, manufacturing indices turning positive, and jobless claims hitting their lowest level since May. Housing data also beat estimates, and homebuilder sentiment rose in September. US equities posted gains for the week, with the S&P 500 reaching a fresh all-time high before trimming gains, with stocks buoyed by the Fed’s dovish pivot and data supporting a soft-landing narrative. Despite optimism, some concerns linger, including weak industrial earnings, elevated valuations, and geopolitical uncertainties ahead of the US presidential election. Nonetheless, analysts pointed to the potential for continued strong equity performance following easing cycles and resilient consumer spending.

The UK housing market regained momentum in September following the Bank of England’s rate cut, with average asking prices rising by 0.8% after a 1.5% drop in August, according to Rightmove data. This increase is double the seasonal average, reflecting renewed confidence among both buyers and sellers. Rightmove attributed the activity to a new government and the BoE's first rate cut in four years. Meanwhile, the Office for National Statistics noted an 8.4% annual increase in private rents in August, with London rents up 9.6% and average rent in the UK reaching £1,286 per month. Recent reports from Nationwide and Halifax suggest that house prices are rising again due to easing mortgage rates.

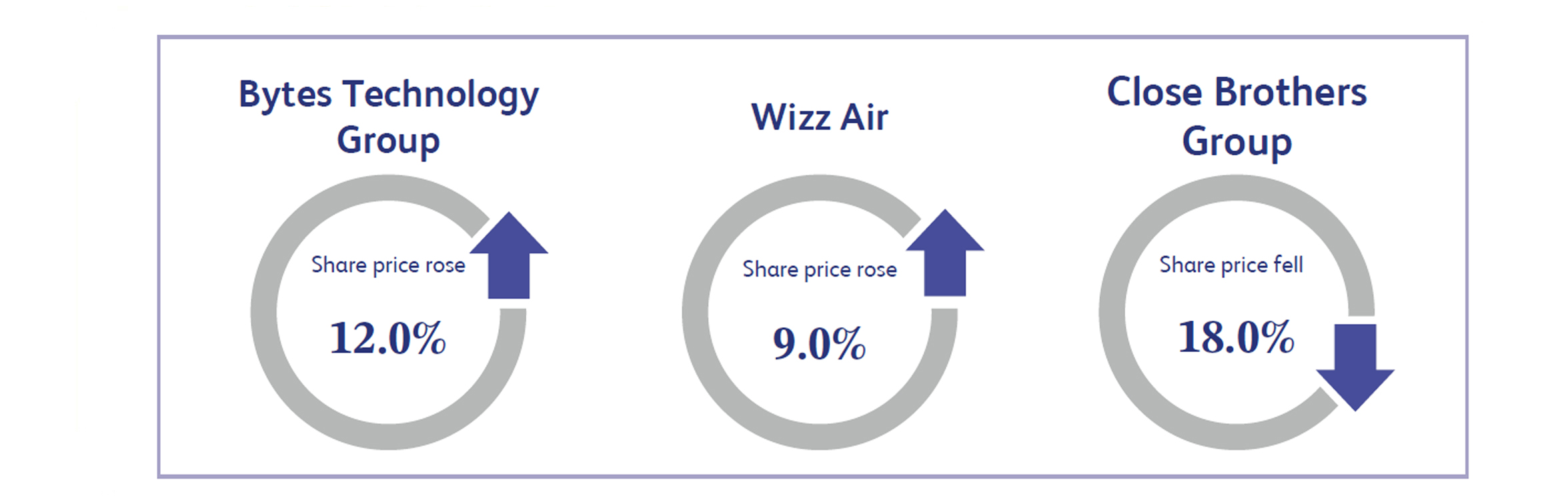

Provider of IT software and solutions Bytes Technology Group’s shares surged 12% following the announcement of double-digit profit growth for the first half of fiscal 2025, signalling strong market confidence in the company's performance and growth prospects. It reported around 13.5% growth in both gross invoiced income and adjusted operating profit, with a 9% increase in gross profit. Chief executive officer (“CEO”) Sam Mudd expressed confidence in the company's ability to capitalise on the demand for cloud computing, cybersecurity and artificial intelligence. Whereas, analysts highlighted the company's robust performance, driven by its comprehensive IT solutions, particularly in partnership with Microsoft, and high customer satisfaction. UBS initiated the coverage with a buy rating, further boosting investor sentiment, and contributing to the stock's sharp rise.

Wizz Air, a passenger air transportation operator, saw its shares rise 9% following positive momentum in the airline sector, sparked by comments from Ryanair's CEO about improved booking trends and reduced need for price discounts. This optimism aligns with Wizz Air's own expectations, as Wizz Air’s CEO Jozsef Varadi indicated the airline anticipates a 15-20% growth in passenger volume next year. The launch of new low-cost routes to the Middle East, particularly from Europe to the UAE, is expected to further enhance growth prospects. Varadi expressed confidence that the Abu Dhabi route could exceed the overall growth expectations, signalling a strong recovery and increasing demand in the travel market. This combination of favourable market sentiment and Wizz Air's strategic expansion plans has fuelled investor enthusiasm, leading to a notable rise in the airline's stock.

Close Brothers Group operates as a merchant banking group. Its share price fell 18% after announcing the sale of its wealth management unit, Close Brothers Asset Management, to Oaktree Capital for up to £200 million. The drop was fuelled by a 15% miss in earnings per share and a modest revenue growth forecast of 2.2% per annum, lagging behind the UK banking sector's 3.7%. While the sale aims to strengthen the firm's capital position, concerns remain about the ongoing FCA review of past commission arrangements. Analysts are reassessing their recommendations, indicating that investor confidence may be waning amidst regulatory challenges and market uncertainty.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.