1 October 2024

Last week saw the Bank of England (“BoE”) maintain a cautious tone on the future trajectory of interest rates. Governor Andrew Bailey noted that while inflation has made significant progress toward the BoE’s 2% target, a gradual approach to interest rate cuts is necessary to ensure sustainable price stability. His comments come after the BoE decided to keep rates unchanged last week, following a 0.25% cut in August. Expectations are now centred around a neutral rate of 3% to 3.5%, with Bailey indicating that near-zero rates are unlikely to reoccur barring a significant economic downturn.

Additionally, BoE Monetary Policy Committee member, Megan Greene, expressed her support for a gradual easing strategy but highlighted the persistent challenges in the services sector and ongoing wage pressure. Nonetheless, recent data from the labour market shows encouraging signs, with wage growth moderating to 4% in the three months to August, the lowest level since mid-2022. UK Purchasing Managers’ Index (“PMI”) data also pointed to a slowdown in the expansion rate, although business sentiment remains broadly positive.

Meanwhile, the Organisation for Economic Co-operation and Development (“OECD”) revised its UK growth forecasts upward, citing improvements in the economic outlook. The UK is now expected to be one of the top G7 performers in 2024, although inflation remains a concern. The OECD’s forecast remains in line with auditor KPMG’s latest economic projections, which also suggest that the UK’s growth will remain resilient despite potential headwinds from geopolitical risks and weaker consumer sentiment, as shown by the latest British Retail Consortium survey.

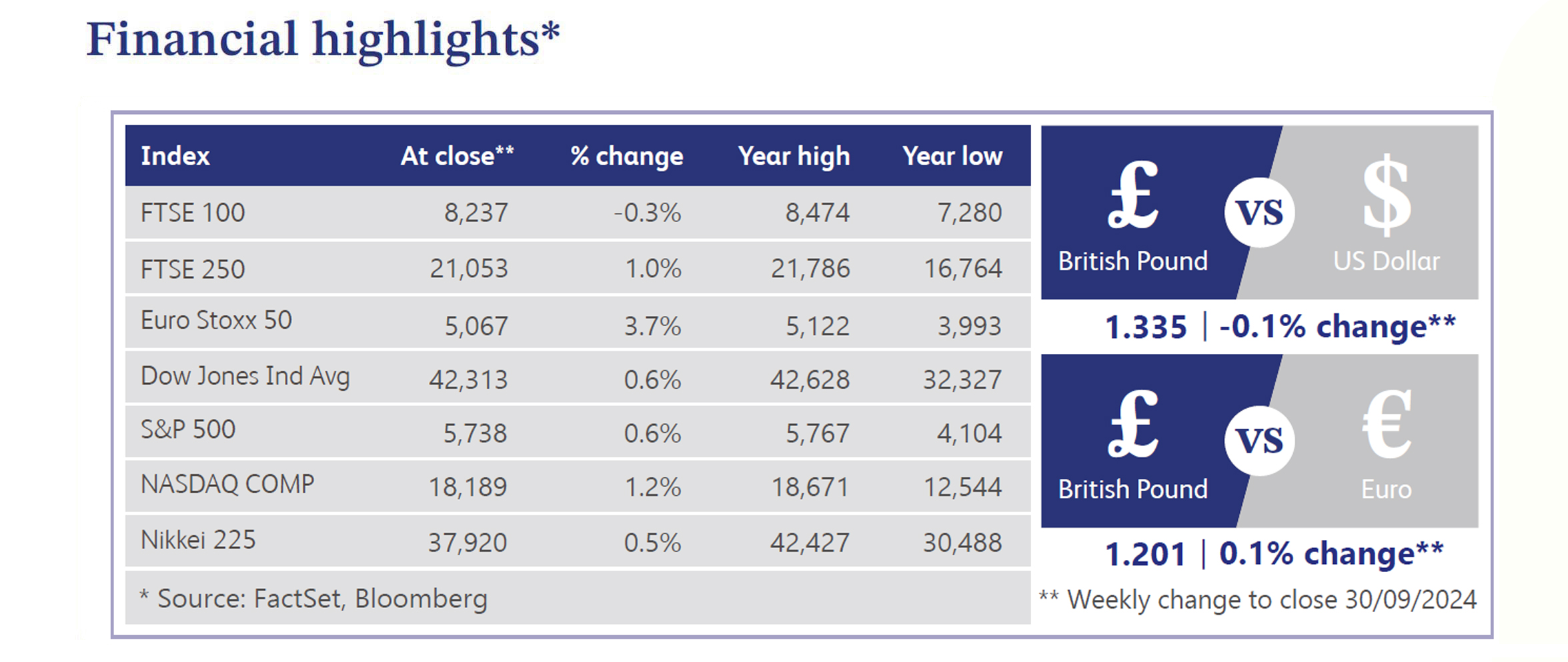

In equity markets, US indices posted gains for the week, driven by strength in technology and industrials. The S&P 500 reached a new all-time high on Thursday, while the tech-heavy NASDAQ saw notable performance from Tesla and Nvidia. The week’s big story, however, came from China, where the Hang Seng Index surged 13% - its best weekly performance in 26 years - on the back of aggressive stimulus measures. While these moves spurred investor optimism, concerns persist regarding the sustainability of China’s growth trajectory as core domestic demand remains lacklustre.

The commodity space saw mixed results. Gold rose 0.8%, hitting new record highs, as the US dollar weakened against major currencies. In contrast, crude oil prices were down nearly 4% amid speculation that Saudi Arabia could ramp up production, overshadowing concerns over heightened geopolitical tensions in the Middle East.

In the UK, the housing market showed signs of recovery in the second quarter, with total spending on house purchases exceeding £350 billion. This recovery was driven by an increase in mortgage debt as net mortgage approvals hit the highest levels since September 2022. The City of London’s office market returned to pre-COVID levels of activity, highlighting the sustained confidence among global investors in UK real estate. The commercial real estate market also attracted notable investments, with Legal & General and Schroders positioning themselves for a US market recovery by expanding their real estate teams.

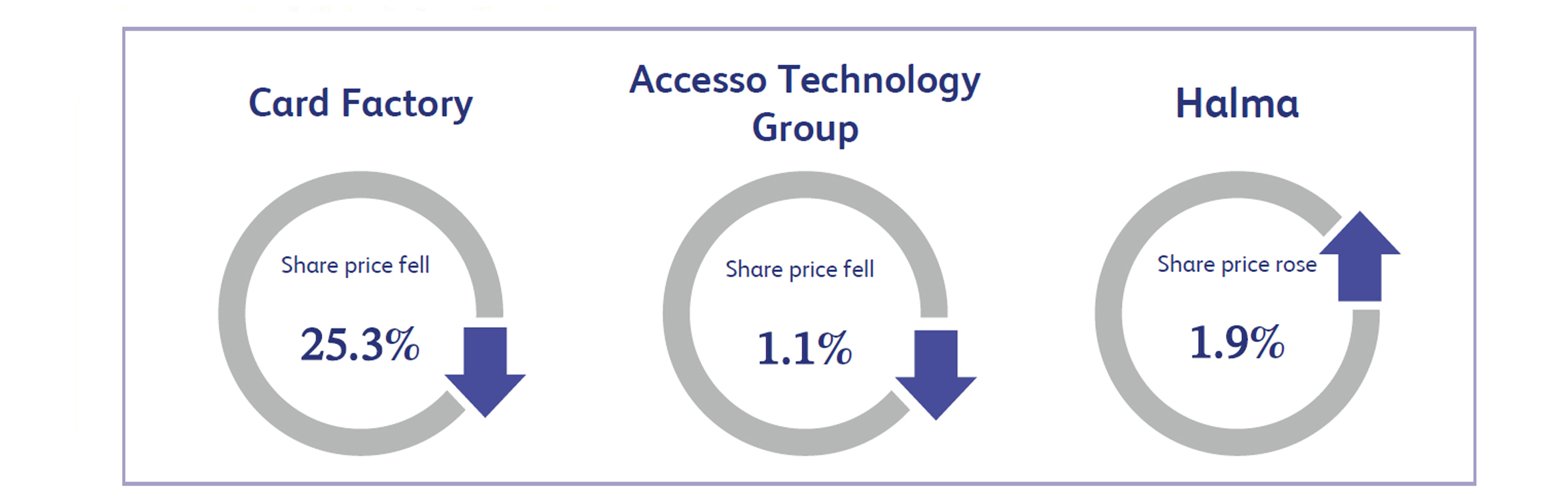

Card Factory, a UK-based retailer of greeting cards and celebration essentials, experienced a sharp decline in its share price last week, falling 25.3% following the release of its latest half-year results. While revenue rose 5.9% year-on-year to £233.8 million, operating cash flow dropped significantly by 51.8% to £17.5 million, down from £36.3 million in the previous period. Profit before tax was also lower, coming in at £14 million, a 43.3% drop compared to £24.7 million last year. The decline was attributed to rising costs, particularly the impact of the increased National Living Wage, higher freight expenses, and the timing of strategic investments. These pressures weighed heavily on the outlook, leading to a sharp sell-off as analysts expressed concerns over the company’s ability to manage these headwinds.

Accesso Technology Group, an attractions and leisure industry technology provider, saw a 1.1% decline in its share price last week, after reporting its half-year results. Revenue increased by 5.2% to $69.2 million, while gross profit rose 9.1% to $52.7 million. The company’s net cash position also improved significantly, up 99.2% to $18.3 million. These results were largely in line with market expectations, which led to a relatively subdued reaction in the share price.

Halma, the global leader in life-saving technology, saw its share price edge up 1.9% last week following its latest trading update. The company reaffirmed its full-year guidance, expecting strong organic revenue growth and an adjusted earnings before interest and tax margin of around 21%. Halma also highlighted its ongoing acquisition strategy, completing four deals in the first half of the financial year within its safety sector for a total consideration of £85 million. Management indicated that the acquisition pipeline remains robust across all three of its sectors, which reinforced investor confidence and provided a modest lift to the stock.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.