8 October 2024

Lloyds' Business Barometer indicated a dip in UK business confidence in September, the lowest level in three months. The data suggests businesses are cautious about the broader economic outlook but still expect strong trading, highlighting concerns over inflation, investment, and potential fiscal policy changes ahead of the upcoming budget. Bank of England ("BoE") Chief Economist, Huw Pill, struck a cautious tone on the rate outlook, warning against cutting interest rates too quickly or too far. He stressed the need for a gradual withdrawal of monetary policy restriction, citing concerns over wage data and services price inflation. In contrast, Governor Andrew Bailey suggested that the BoE could cut rates more aggressively if inflation data continues to improve, leading economists to predict rate cuts at every meeting until May 2025.

UK markets are facing heightened uncertainty amid warnings about increased government borrowing and political tensions over Brexit negotiations. The Institute for Fiscal Studies ("IFS") raised concerns that boosting borrowing to fund public investment could come with significant risks. While the possibility of allowing £53 billion in extra borrowing might provide some fiscal flexibility, markets are closely watching how this would impact the UK’s fiscal position. Whereas on the Brexit front, Prime Minister Keir Starmer faced internal government splits over a potential new Brexit deal, with debates surrounding a youth mobility scheme and its impact on migration, alongside other EU-UK negotiation challenges.

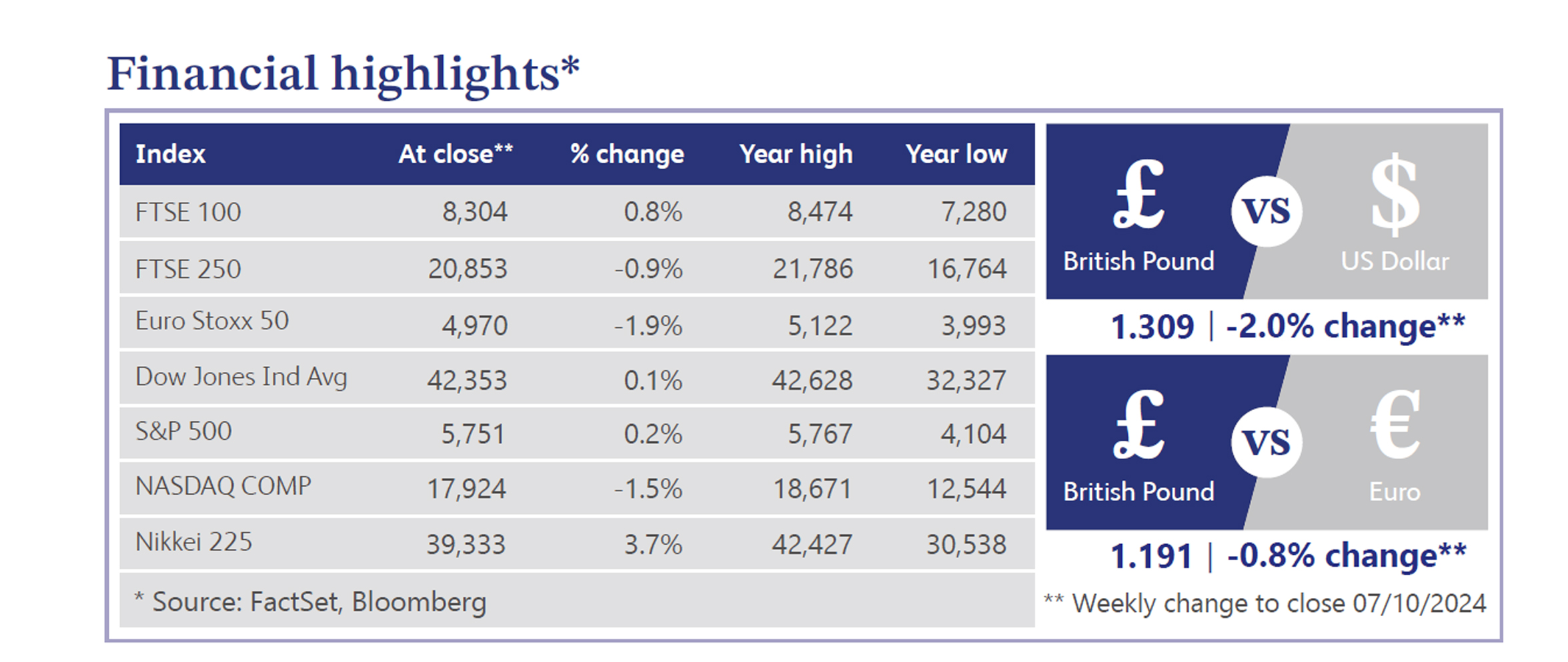

UK investment bank, Peel Hunt, has warned of a slowdown in UK capital markets ahead of key event risks such as the UK budget and the US election. However, it remains optimistic about a recovery in London initial public offering activity next year. Sterling has steadied after dropping sharply due to escalating Middle East tensions, as investors flocked to safe-haven assets like the dollar. Additionally, BoE Governor Andrew Bailey’s recent remarks on potential faster rate cuts triggered a notable drop in sterling against both the dollar and the euro. Moreover, UK Prime Minister Keir Starmer is facing challenges attracting international investment amidst regulatory concerns and infrastructure doubts.

Last week, US equities showed modest gains with the S&P 500 and Nasdaq both extending their winning streak to four weeks. Friday's strong September jobs report fuelled optimism around economic resilience and supported the soft landing narrative, pushing stocks higher after a midweek dip. The bond market saw yields spike, hitting their highest levels in a month after the jobs report, while oil surged 9.1% amidst Middle East tensions, and the dollar posted its best week since September 2022, rising 2.1%.

Nationwide's latest data reveals UK house price growth hit a two-year high in September, with annualised growth at 3.2% and prices now only approximately 2% below their 2022 peak. Zoopla noted a sales boost from lower mortgage rates, while UK construction activity surged in September, marking its fastest expansion in two-and-a-half years. Falling borrowing costs and income growth outpacing price rises have improved affordability, however, concerns linger over how Labour’s first budget and potential tax reforms, such as changes to capital gains tax, could dampen the fragile recovery, particularly for second homes.

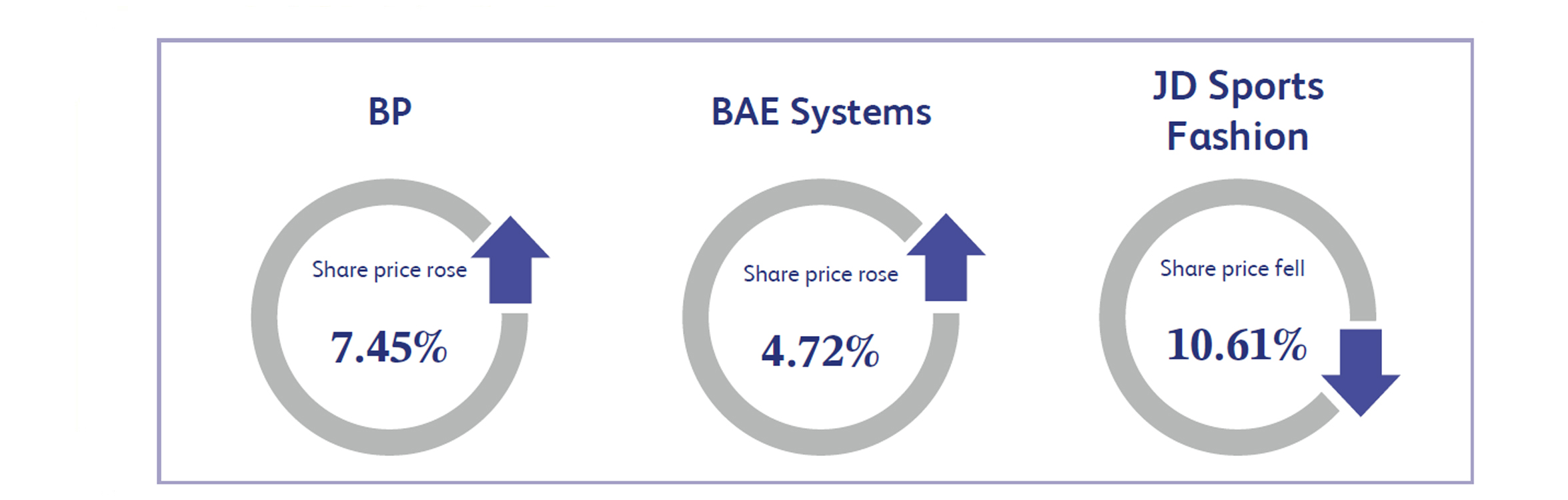

The oil and gas company BP saw its share price surge 7.45% last week, largely driven by a combination of rising oil prices and positive market sentiment around energy sector developments. Oil prices experienced significant gains amid escalating tensions in the Middle East, which raised concerns about potential supply disruptions. The Organisation of the Petroleum Exporting Countries (“OPEC”) and its allies also issued warnings that further supported the upward trend in crude prices. Additionally, energy delivery company Enbridge Inc’s $700 million investment in crude oil and natural gas pipelines for the Kaskida oil development in the U.S. Gulf of Mexico, buoyed investor confidence in BP, which stands to benefit from higher energy prices and increasing demand.

BAE Systems, the defence products and services provider, saw its share price rise by 4.72% last week, driven by positive developments in defence contracts and escalating geopolitical tensions. The company secured a $92 million U.S. Navy contract to build propulsors for the Virginia-class submarine programme, enhancing its strong defence portfolio and signalling continued demand for its advanced military technologies. Additionally, heightening geopolitical tensions, particularly following reports of Iran launching missile strikes against Israel and the U.S. preparing to defend its ally, sparked a surge in defence stocks, further fuelling the rise in its share price.

JD Sports Fashion, a retailer and distributor of sports fashion wear and outdoor clothing dropped 10.61%. This fall was primarily due to concerns surrounding its trading performance and the impact of currency fluctuations. Despite the company's trading results for the first half being in line with expectations, the unchanged guidance range raised investor concerns about its ability to navigate external challenges effectively. A significant factor contributing to the decline is the adverse effect of foreign exchange headwinds. As the pound strengthens against the U.S. dollar and the euro, JD Sports is experiencing reduced profit margins, which has likely led to a sharp sell-off in the stock, reflecting a cautious sentiment among investors regarding the company’s short-term prospects.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.