22 October 2024

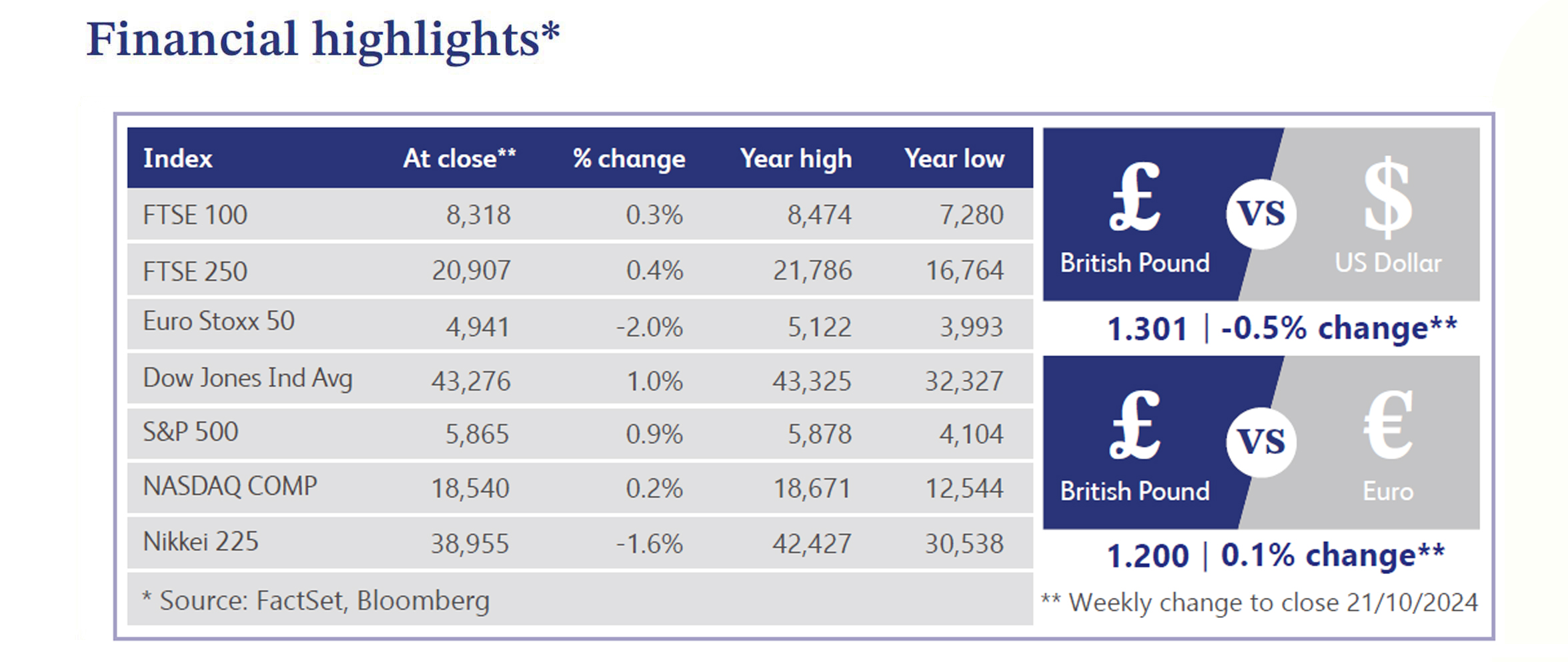

Last week's UK economic data painted a mixed picture ahead of the Bank of England's (“BoE”) November policy meeting. Inflation has dropped below the 2% target for the first time since 2021, reaching 1.7%, driven by lower energy costs and eased supply chain pressures. Meanwhile, a notable minimum wage hike has underpinned pay growth for low-wage workers, despite broader wage growth moderation. As the labour market is easing, economists increasingly expect a BoE interest rate cut, with markets pricing in a 90% chance of two 0.25% reductions by year-end. Retail sales defied expectations, rising 0.3% in September, driven by strong demand in electronics. While the BoE previously signalled potential rate cuts contingent on inflation trends, the cooling data has solidified expectations of a dovish policy shift in the coming weeks.

The upcoming 30th October UK budget is shaping up to be a pivotal moment, as Rachel Reeves navigates a challenging fiscal landscape with a £22 billion fiscal deficit. To address this deficit, proposals include raising employer national insurance contributions and increasing capital gains taxes on share sales, which could generate significant revenue. However, the proposals have faced pushback from business leaders and investors, with concerns over potential job losses and investment impacts being raised. The recent inflation decline below 2% has reinforced expectations for BoE rate cuts, potentially easing pressure on fiscal policy but also reducing tax revenue from inflation-related income. Meanwhile, the International Monetary Fund warned the UK of potential market backlash if debt stabilisation efforts fell short, adding urgency to Reeves’ fiscal plans.

Goldman Sachs predicted a rebound in UK Gilts following an anticipated "Gilt-friendly" budget, recommending investments in 2-year and 30-year bonds due to potential BoE rate cuts, but urging caution on 10-year bonds amid increased government borrowing. Some, however, see the upcoming US election as a bigger factor for Gilt markets than the UK budget. Budget fears are prompting Britons to withdraw more from pensions, seeking tax-free cash ahead of potential pension reforms. It was a relatively quiet week in the US, though a few key developments stood out. Economic data supported the soft/no-landing narrative, highlighted by robust September retail sales and lower-than-expected jobless claims. Earnings also played a key role, with S&P 500 companies showing blended earnings per share growth of 3.4%, slightly below earlier expectations. Banks performed well, while artificial intelligence remained a positive theme. Meanwhile, China’s stimulus updates and easing geopolitical concerns provided some optimism.

UK landlords are selling rental properties at a record pace ahead of the upcoming budget, with 18% of homes for sale previously available to rent, according to Rightmove data. This surge is driven by fears of potential tax changes and upcoming Energy Performance Certificate regulations requiring a minimum energy rating of C by 2030.

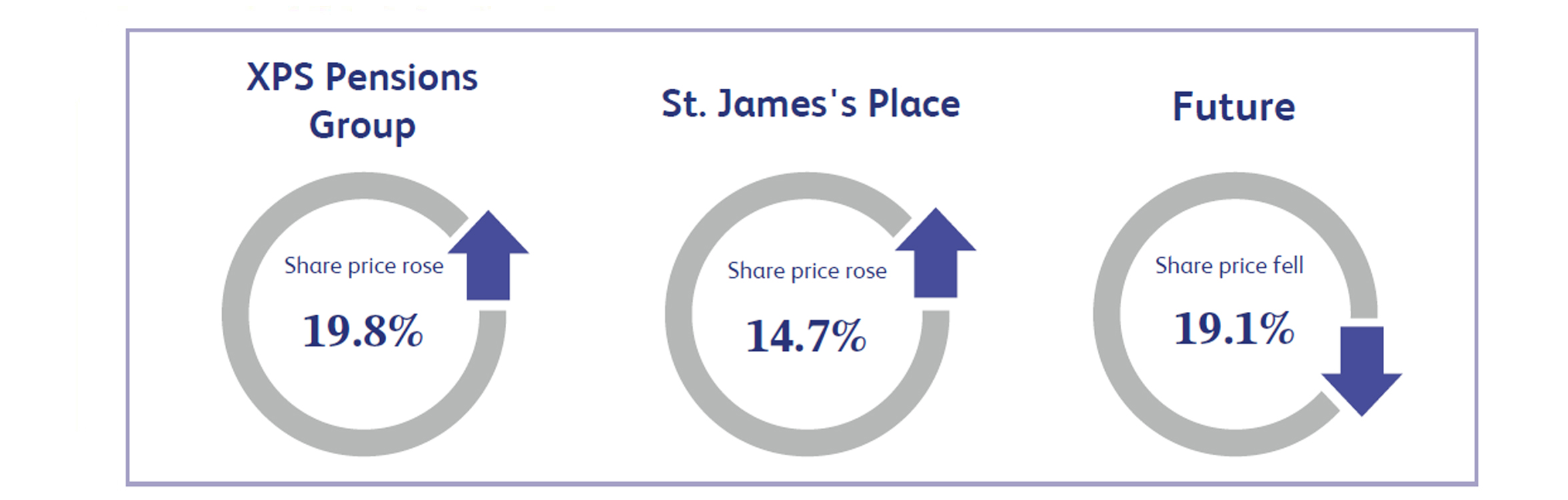

XPS Pensions Group engages in the provision of employee benefit consultancy and related business services. Its share price surged 19.8% after the company reported a strong fiscal first-half performance, with a 23% year-on-year increase in revenue from continuing operations. The firm expressed confidence that its full-year results would surpass previous expectations. This upbeat outlook, alongside robust revenue growth, boosted investor sentiment, driving up the stock price. The positive performance highlighted the firm's ability to navigate current market conditions effectively and capitalise on the ongoing demand for pension-related services, which further fueled optimism about XPS's future growth prospects.

St. James's Place, the UK wealth management business, saw its share price rise 14.7% after reporting better-than-expected net flows in its third-quarter update. The results reassured investors about the company’s recovery, showing that increased client inflows offset higher withdrawals. RBC Capital Markets highlighted that while clients were withdrawing slightly more, they remained loyal, which supported fund growth. The results demonstrated St. James's Place's resilience and ability to grow funds under management, despite facing challenges over the past year.

Future, which engages in the publishing of special-interest consumer magazines and websites, saw its share price drop 19.1% following the unexpected departure of its Chief Executive Officer (“CEO”), which was perceived negatively by investors. Despite the company's recent efforts to improve margins and shut down weaker segments, the CEO's exit raised concerns. This sharp fall in the price highlighted investor uncertainty, questioning whether the departure indicates potential issues ahead or a better opportunity elsewhere. The departure casts doubt on Future's turnaround strategy, especially since the CEO had been guiding the company through its Growth Acceleration Strategy.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.