17 December 2024

The Bank of England ("BoE") is expected to maintain a cautious approach to rate cuts in the coming months, with a Reuters survey showing a 10% chance of one happening this week. Investors also predict three rate reductions in 2025, totalling 0.75%, so a more measured path than the European Central Bank’s (“ECB”) anticipated 1.5%. However, the BoE faces challenges from sticky inflation and elevated neutral rate estimates, with policymakers signalling a lower bound near 3.5%. Meanwhile, UK economic indicators painted a mixed picture last week. GDP contracted by 0.1% in October, job vacancies sharply declined and insolvencies are rising amid cost pressures. Consumer confidence remains weak despite slight improvements. Public inflation expectations have also edged higher, complicating the BoE’s policy outlook. With businesses cautious about growth and labour shortages hindering productivity, the UK economy could close 2024 in contraction, highlighting the fragile state of the recovery.

The UK’s fiscal outlook is under scrutiny as Prime Minister Keir Starmer embarks on a six-month government spending review. Ministers have been tasked with finding 5% budget savings, reflecting fiscal challenges amid rising demands for military spending and public sector reforms. Chancellor Rachel Reeves has pledged an “iron fist” against inefficiencies, prioritising housing, defence and economic growth. Meanwhile, trade policies remain a focal point. Economists predict minimal tariffs from the US, mitigating potential economic disruption. Starmer’s visit to the Gulf, which targeted a lucrative trade deal with the Gulf Cooperation Council, could boost credibility after the criticised October Budget. More domestically, businesses have voiced concerns over the impact of tax hikes on investment and the government’s ambitious plans for new homes faces challenges over land availability and labour shortages. Together, these developments underscore the delicate balancing act in managing fiscal policy and economic recovery.

The UK market faces significant challenges, with digitalisation investment lagging behind global peers. Meanwhile, the UK’s Initial Public Offering (“IPO”) market continues to struggle, ranking 20th globally, with total listings falling 9% to $1 billion this year. London is facing growing competition from other markets, coupled with liquidity issues and reduced participation from UK investors. On the other side, US equity markets posted a mixed performance last week, with major indices mostly lower. The Russell 2000 lagged, while the Nasdaq gained on big tech strength, led by Google on quantum computing optimism. Sectors such as industrial metals, biotech and banks underperformed, while China tech, trucking and off-price retail outperformed. Treasuries weakened with a steeper yield curve, whereas the dollar strengthened and gold rose. November’s Consumer Price Index (“CPI”) was aligned with forecasts, solidifying December rate cut expectations at nearly 100%.

The UK housing market showed strong momentum in November, with the Royal Institution of Chartered Surveyors (“RICS”) survey reporting the highest price gauge in over two years. The house price balance rose, while buyer enquiries improved by 12%. Though agreed sales were flat, longer-term sales expectations remain optimistic. Rightmove forecasts a 4% rise in UK house prices in 2025, with London outperforming.

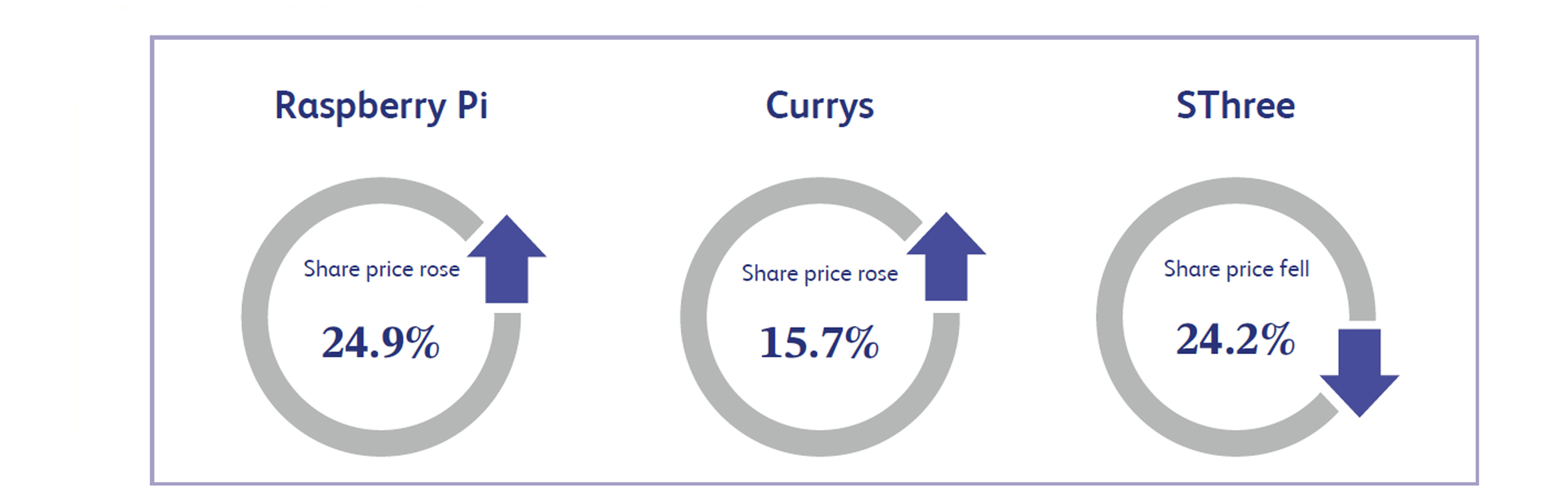

Raspberry Pi, designer and developer of compute modules, saw its share price surge 24.9% last week following the announcement of a strategic partnership with Italian tech firm SECO. This agreement will integrate SECO's Clea Internet of Things software with Raspberry Pi’s operating system and bring a human-machine interface product based on the Compute Module 5 to market. Industry analysts view this as a key growth opportunity, enabling Raspberry Pi to engage larger original equipment manufacturers and expand its addressable market. Collaboration on edge Artificial Intelligence (“AI”) and image recognition further supported long-term prospects and investor confidence.

Currys, retailer and services company, saw its share price rise 15.7% last week after a strong first half performance, with growing profits, improved cash flow and increased UK market share, despite budgetary pressures. Analysts attribute this success to a structural market shift driven by the rise of AI-powered laptops, which have created a compelling new product category. As AI functionalities expand across devices, demand for high-performance hardware is driving sales, positioning Currys to benefit from consumers upgrading to more powerful technology to harness these advancements.

SThree's share price dropped 24.2% following a disappointing trading update revealing a 9% year-on-year decline in net fees, including a sharp 26% fall in fourth quarter. SThree, provider of specialist staffing services, forecasted 2025 pretax profit at £25 million, significantly below 2024's £67.4 million, citing ongoing political and macroeconomic uncertainty, particularly in Europe. Despite meeting expectations for 2024, the cautious outlook weighed heavily on investor sentiment, dragging down shares. Analysts remain optimistic about SThree's long-term prospects, highlighting its focus on Science, Technology, Engineering and Mathematics (“STEM”) recruitment and cost controls as key factors positioning it for recovery when conditions improve.

The Market Commentary will return for 2025 on 14th January. Merry Christmas and Happy New Year!

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management's own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.