21 January 2025

The UK economy faced mixed signals this week as inflation slowed unexpectedly in December, dropping to 2.5%, the lowest since early 2021, driven by lower energy and food costs. This has heightened expectations for Bank of England (“BoE”) rate cuts, with the market pricing in three reductions this year. However, core inflation remained stable, and economic growth is stagnating, raising concerns about stagflation. Business confidence plunged to a two-year low amid higher taxes and weak demand, while large firms plan hiring cuts and scaled-back investments following the Chancellor’s £25 billion social security charge hike. UK trade growth prospects remain subdued, with Boston Consulting Group projecting just 0.7% annual growth until 2033, hindered by Brexit and global supply chain shifts. Retailers, facing rising taxes and wages, are hiking prices, adding to consumer pressures.

Chancellor Rachel Reeves faced mounting pressure amid market volatility and rising borrowing costs, defending her fiscal strategy as criticism grew. She has pledged to adhere to fiscal rules, calling them "non-negotiable," insisting global factors are driving financial turbulence. Reeves remains committed to revitalising the UK economy, promising bold growth plans despite a depreciating pound and economic headwinds. While her trade mission to China aimed to bolster business ties, Reeves is under scrutiny to detail a concrete path for repairing public finances. Prime Minister Keir Starmer backed his Chancellor, but market confidence hinges on delivering stability and effective fiscal reforms.

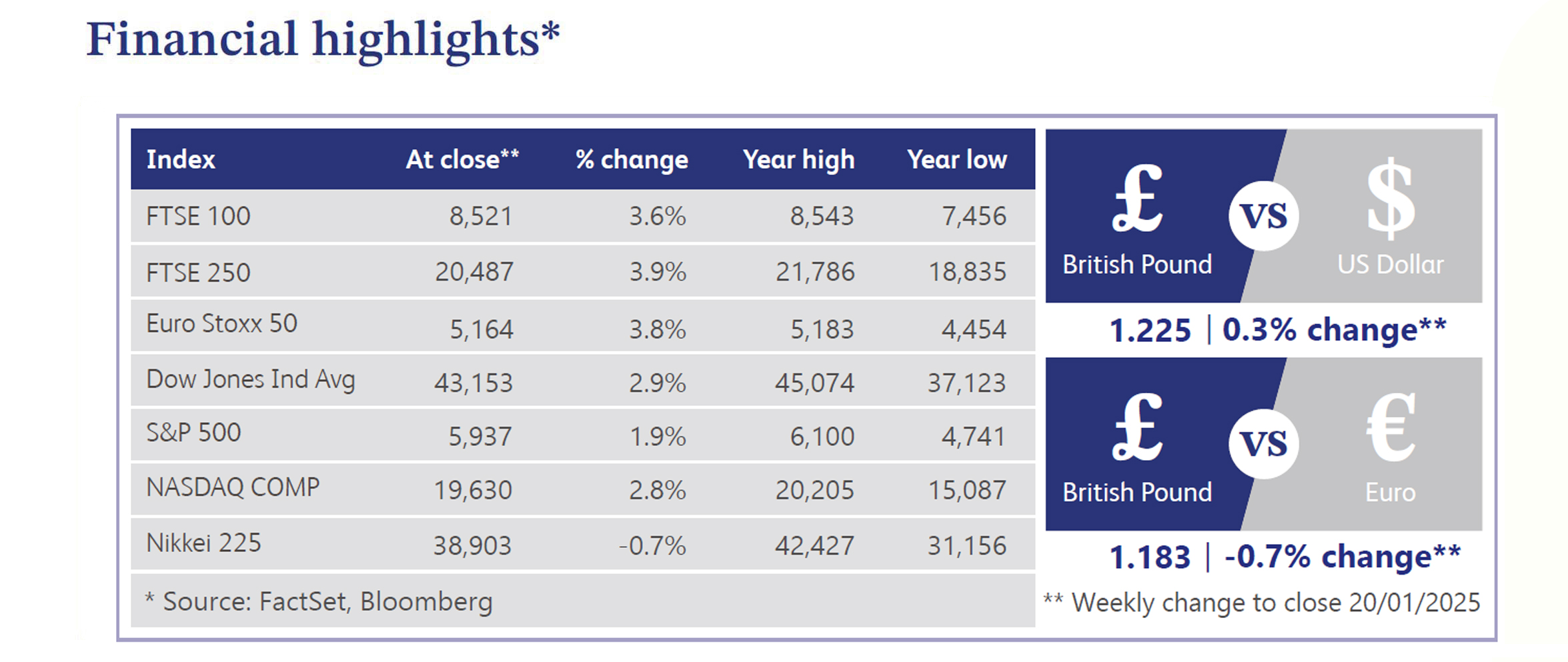

UK markets suffered a turbulent week, with sterling plunging as traders prepared for an additional 8% decline amid fiscal and economic woes. Concerns over high borrowing levels, sticky inflation and global market instability pushed the pound to underperform its developed-nation peers. Gilts also weakened, with the 10-year yield nearing its post-2008 peak of 4.92%, reflecting anxieties over inflation and the fiscal deficit. Weaker-than-expected retail sales further dampened sentiment, as December volumes fell 0.3%, undermining hopes for a strong Christmas season. Despite this, traders are slightly more optimistic regarding interest rate cuts, aiming to stimulate the stagnating economy and stabilise bonds.

Meanwhile, US equities rebounded last week, with the S&P 500 and Nasdaq posting solid gains after a weak start to the year. Broad-based buying drove strength, with notable gains in banks, homebuilders, energy and small-caps, while pharma and retail lagged. Treasury yields eased as December Consumer Price Index (“CPI”) and Producer Price Index (“PPI”) reports signalled moderating inflation, supporting expectations for potential Federal Reserve (“Fed”) rate cuts later this year. Retail sales showed resilience, bolstering confidence in consumer spending, while housing stats and permits beat forecasts. Despite lingering uncertainties around “Trump 2.0” policies, dovish Fedspeak and improving inflation trends sustained optimism about disinflation and earnings growth heading into 2025.

UK house prices experienced their fastest growth since September 2022, driven by improving sentiment and rising buyer inquiries, according to the Royal Institution of Chartered Surveyors. However, growth remains uneven, with affordability constraints continuing to weigh on broader market dynamics despite the recent recovery in activity.

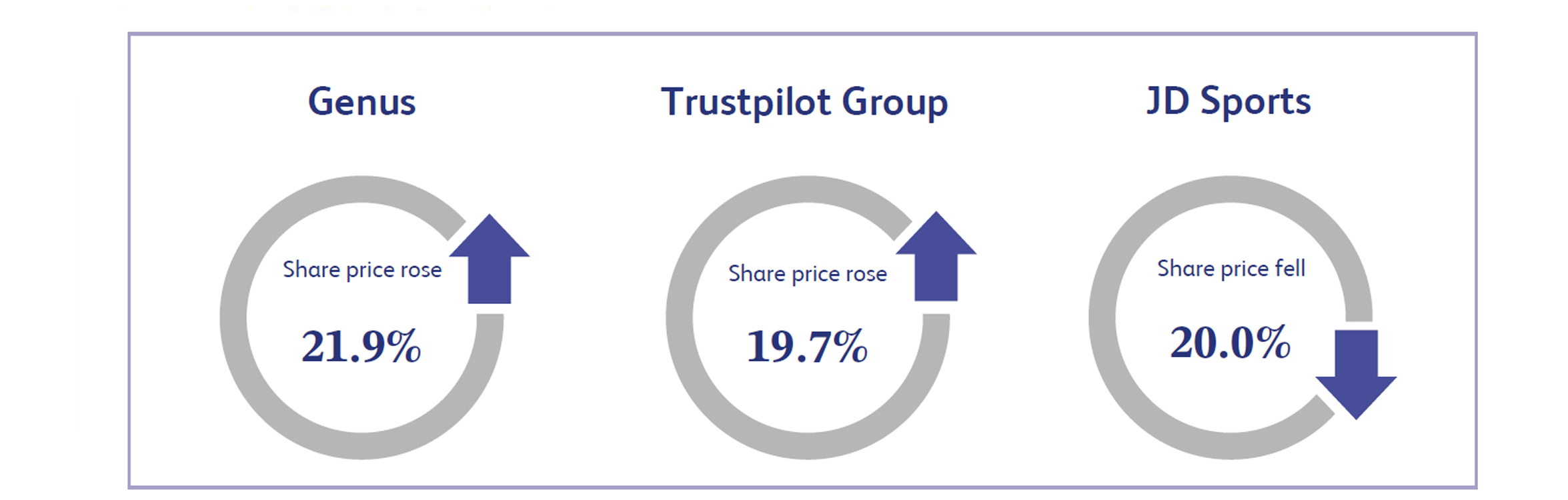

The animal genetics company, Genus, saw its shares surge 21.9% after the company announced it expects adjusted pretax profit for the first half of fiscal 2025 to exceed market expectations, forecasting at least £35 million. Additionally, for the full year, the board anticipates profit to hit the upper end of the consensus range. This upbeat outlook reassured investors about the company’s strong performance and growth trajectory, driving significant confidence in its financial stability and future prospects.

Shares of Trustpilot Group soared 19.7% last week, driven by a strong trading update. The company, which engages in the digital platform that brings businesses and consumers together, projected adjusted earnings before interest, taxes, depreciation, and amortisation (“EBITDA”) ahead of the $22.2 million consensus and forecasted 18% revenue growth, surpassing the expected 16%. Bookings rose 23%, highlighting robust performance in key markets, particularly North America. Trustpilot expects $211 million in revenue for 2024, a significant jump from $176 million in 2023. This positive outlook reassured investors about the company’s growth trajectory and profitability.

JD Sports, retailer and distributor of sports fashion wear and outdoor clothing, saw its shares plunge 20% last week after the company slashed its full-year profit guidance, citing challenging market conditions. While strong Christmas sales provided some support, lacklustre November performance and restrained organic revenue growth weighed on results. JD’s decision to avoid heavy promotions to protect margins drew criticism as it failed to offset weak demand. Analysts warned of investor frustration under Chief Executive Officer Regis Schultz and highlighted the potential takeover risks, as the share price nears pandemic lows.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management's own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.