18 February 2025

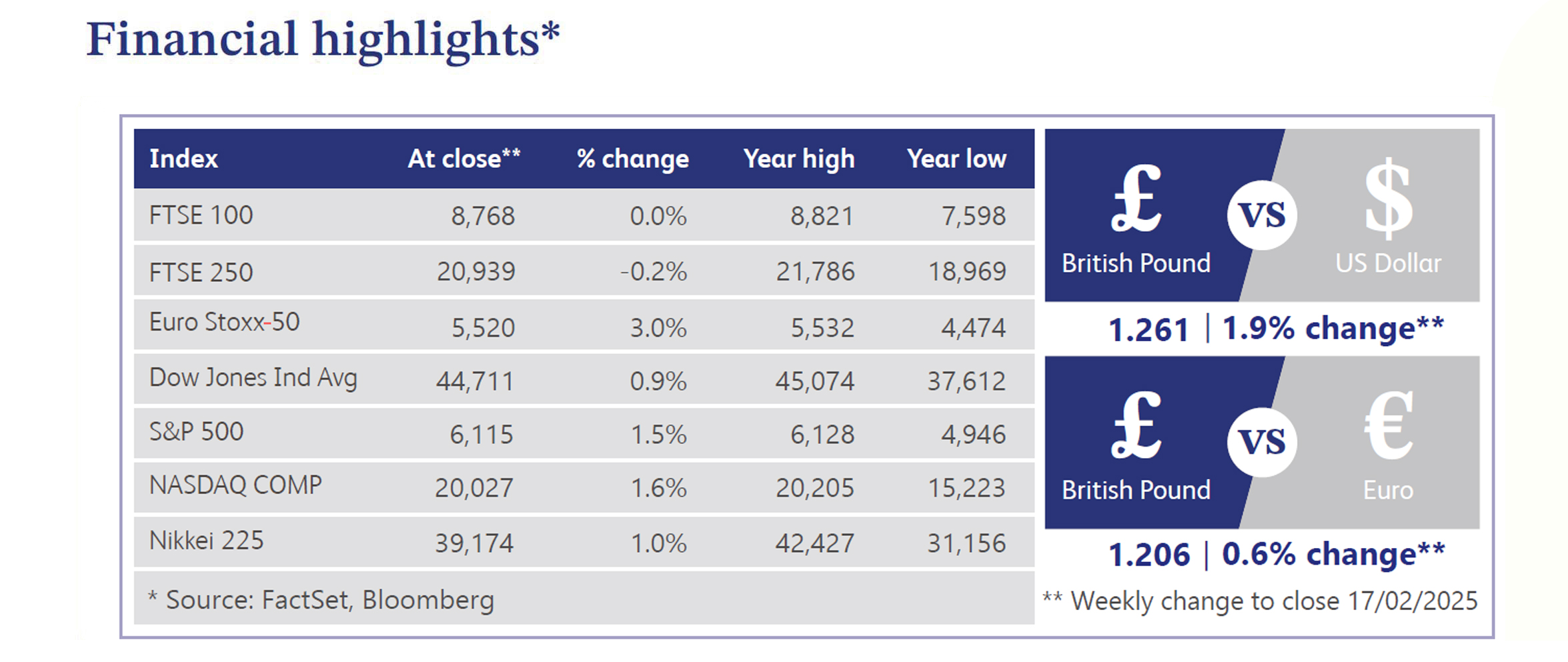

The UK economy faced mixed signals last week, with the Bank of England ("BoE") rate cuts struggling to filter through to borrowing costs, partly due to US market influence. Chief Economist Huw Pill warned against assuming inflation is conquered, advocating for a cautious policy approach. Meanwhile, the labour market has weakened significantly, with job vacancies falling at their fastest pace since 2020. Consumer confidence remained shaky, with fears of unemployment dampening spending. However, retail sales surprised positively, driven by health and beauty trends. Gross Domestic Product (“GDP”) data showed unexpected growth of 0.1% in the fourth quarter, defying recession expectations, while housing activity stalled. Despite economic uncertainty, chief executives remained optimistic about business prospects.

The UK’s fiscal landscape was in focus last week, with Chancellor Rachel Reeves meeting bank chiefs to explore growth strategies, including potential Individual Savings Account (“ISA”) reforms. However, building societies warned changes could increase mortgage costs and risk exposure for savers. Meanwhile, fiscal pressures intensified as Office for Budget Responsibility (“OBR”) forecasts indicated spending cuts may be necessary due to weaker growth and rising borrowing costs. The government faced criticism over its tax crackdown, with Members of Parliament claiming £5.5 billion in tax evasion losses. The UK refrained from retaliating against Trump’s proposed steel tariffs in the hope of an exemption, as surveys suggested 30% of UK manufacturers could be affected, while China signalled its readiness to strengthen economic ties with the UK.

UK markets saw strong demand for bonds, with Britons buying the most gilts in four years. Trading volumes surged as investors capitalised on high yields and tax advantages. The UK also sold a record £13 billion in 10-year bonds, attracting £140 billion in orders, reflecting confidence in future rate cuts despite fiscal concerns. Meanwhile, in regulatory developments, Business Secretary Jonathan Reynolds suggested merging or scrapping some regulators to boost growth, while the Competition and Markets Authority is set for reforms to become more business-friendly.

Elsewhere, US equities rebounded, led by Big Tech, with the Nasdaq outperforming as NVIDIA and Apple surged. Artificial Intelligence (“AI”) optimism, rate reprieve, hedge fund buying and hopes of a Ukraine truce supported gains. However, hotter-than-expected consumer price index (“CPI”) data pushed rate-cut expectations to the second half of the year. Treasury yields fell, the dollar weakened and gold hit record highs. Federal Reserve Chair Jerome Powell reiterated the need for further inflation control, while Trump’s tariff plans added uncertainty. Retail sales declined due to cold weather, though jobless claims signalled labour market resilience. Middle East tensions resurfaced as Israel weighed strikes on Iran.

The UK is set to miss its homebuilding target, delivering only half of 300K planned homes due to affordable housing bottlenecks. Meanwhile, mortgage rates fell below 4% as competition among lenders increased. First-time buyers rebounded, making up 54% of mortgage-backed purchases, driven by improved affordability and market stability.

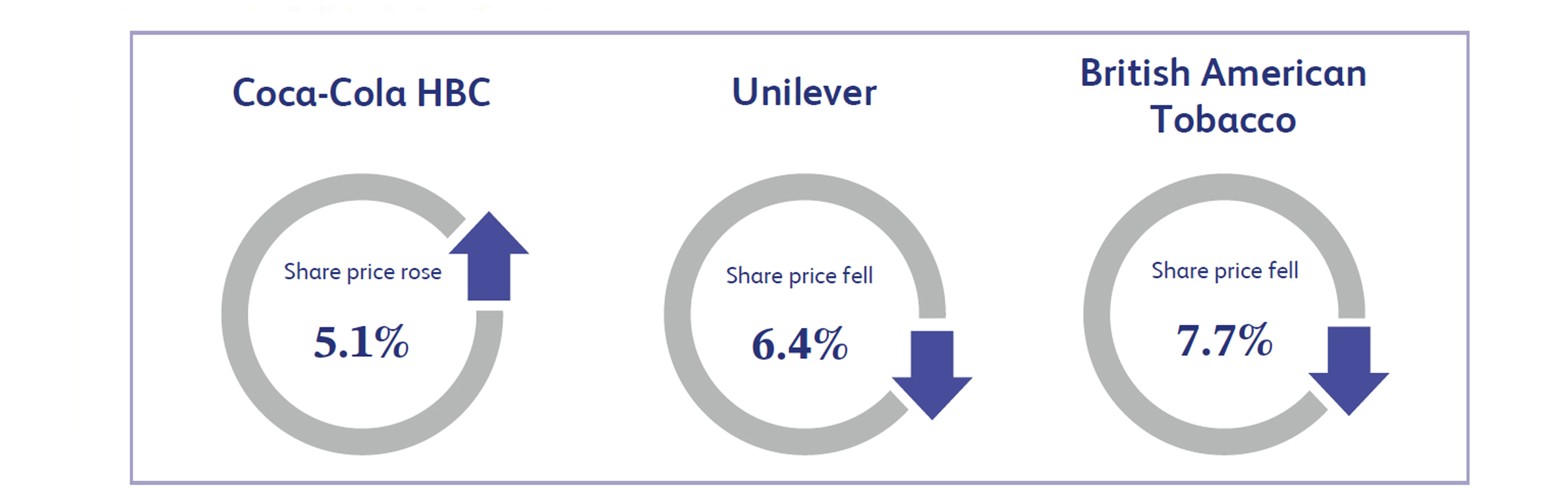

Coca-Cola HBC engages in the production, sale and distribution of non-alcoholic and ready-to-drink beverages. Its shares surged 5.1% after reporting stronger-than-expected 2024 results. Operating profit rose 12.2%, beating forecasts, whereas organic revenue growth also exceeded expectations driven by strong demand for coffee, energy drinks and ready-to-drink beverages. Investors welcomed management’s assurance that Trump’s tariffs would have minimal impact on costs. Despite challenges, including Middle East consumer boycotts and inflation in Nigeria and Egypt, the company expects 7-11% core earnings growth in 2025. Strategic moves like adjusting package sizes to counter economic pressures boosted confidence. The upbeat outlook and resilience in demand lifted the stock to record highs.

Unilever, the leading fast-moving consumer goods (FMCG) company, saw its shares fall by 6.4% as investors reacted to weaker-than-expected 2024 profits, restructuring costs and a cautious 2025 outlook. Despite solid underlying sales growth, a 10.8% profit decline and impairments weighed on sentiment. The planned spin-off of its ice cream business, though strategic, added uncertainty. Analysts flagged a slow start to 2025, with subdued market growth and rising costs. While Unilever reaffirmed its sales growth target, concerns over near-term performance and potential earnings downgrades for the first half of 2025 pressured the stock. The announcement of a €1.5 billion buyback and dividend hike failed to offset broader worries about profitability and execution risks.

British American Tobacco, manufacturer and distributor of tobacco products, dropped 7.7% after reporting a 5.2% revenue decline for 2024, missing analyst expectations. While adjusted earnings per share increased slightly at constant exchange rates, overall profits fell due to a significant provision for a proposed $7.72 billion settlement in Canada. This added uncertainty, especially with objections from some parties to the settlement. Despite reaffirming its long-term growth targets of 3-5% revenue and 4-6% adjusted profit growth by 2026, the company's disappointing preliminary results and legal challenges overshadowed investor confidence. The announcement of a £900 million buyback failed to alleviate concerns.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management's own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.