15 April 2025

Last week was marked by turmoil, as global trade tensions and market volatility drove a sharp shift in UK interest rate expectations. Investors are now pricing in up to four Bank of England (“BoE”) rate cuts this year, with a 0.25% move likely in May and nearly 0.9% of easing by year-end. Former BoE officials called for bold action, including a 0.5% cut or even an emergency meeting. The BoE flagged financial stability risks from global fragmentation, while deputy governors flagged growth headwinds from US tariffs. UK growth forecasts for 2025 were slashed to 0.8%, and confidence remained fragile despite February’s surprise 0.5% Gross Domestic Product (“GDP”) rise. Labour market data showed a rise in candidate availability and soft wage pressures. Consumer sentiment flatlined, and retail footfall declined due to Easter timing and global uncertainty. Inflation implications remained unclear, further complicating the BoE’s policy outlook.

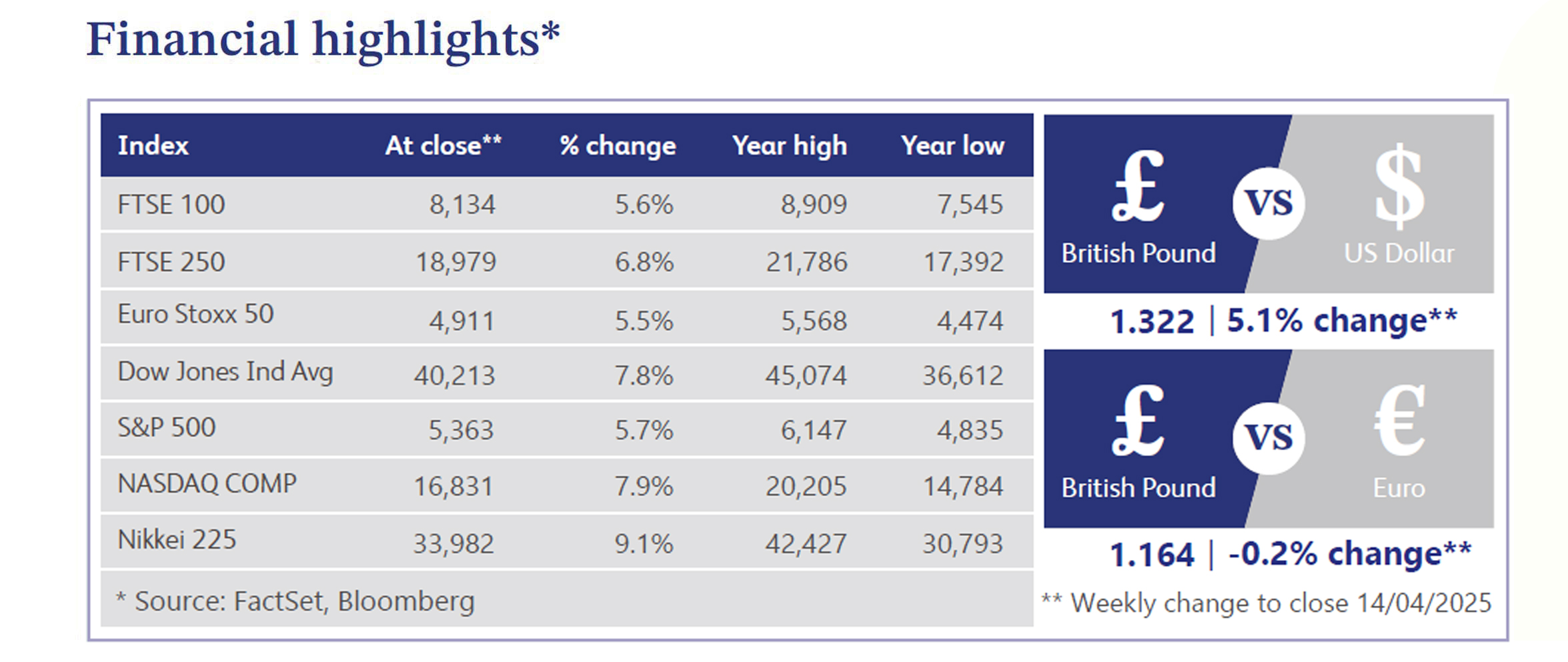

UK markets experienced a volatile week shaped by global shocks, investor flows and persistent uncertainty. According to Calastone, UK investors added £1.38 billion to equity markets in March, marking the strongest month of the year. Barclays upgraded the FTSE 100 to ‘overweight’, highlighting its defensive characteristics and resilience in stagflationary conditions. However, they remained cautious on the FTSE 250, citing weak domestic sentiment. While the FTSE 100 rallied after President Trump paused tariffs for 90 days, posting its biggest jump since 2020, the index remained down approximately 5% over the past month.

On the other hand, UK gilt yields fell in tandem with US Treasuries, but long-term borrowing costs still hit their highest levels since 1998 due to US market spillovers. Meanwhile, the UK Initial Public Offering (“IPO”) market stalled, with just £74.7 million raised in the first quarter, a 74% year-on-year decline. Private equity activity also plummeted, reaching pandemic-era lows, with deal volume and value both sharply down. With nearly a third of UK pension assets linked to US markets and corporate bond distress rising, investor caution remains high. The broader outlook is clouded by trade policy uncertainty and fragile domestic recovery prospects.

US equities rebounded sharply last week, reversing the prior week’s slump amid extreme volatility. The S&P 500 surged 9.5% on Wednesday alone - the best single-day gain in years - after briefly nearing bear-market territory earlier in the week. A key catalyst was President Trump’s surprise 90-day pause on new reciprocal tariffs, which eased investor fears, though tensions with China escalated as both sides raised tariffs to 125%. Tech, semiconductors and insurers led the rally, while homebuilders, pharma, energy and China-exposed stocks lagged. The VIX Index spiked above 50 before retreating. Treasury yields climbed sharply, with the 10 years and 30 years both up over 0.4%, steepening the curve. Gold soared nearly 7%, hitting a record high, while the dollar slumped 3%, its worst week since 2022. Crude oil declined for a second week. Economic data was mixed, with soft inflation prints offset by weaker consumer sentiment.

The UK housing market slowed sharply as macroeconomic concerns and the end of the stamp duty cut dampened activity. Buyer enquiries and agreed sales weakened, while the house price balance fell to +2% in March from +20% in February, signalling growing caution and declining momentum in the property sector.

Fresnillo, a major producer of gold and silver, saw its shares surge 20.5% last week following upbeat broker upgrades and optimism around precious metal prices. Peel Hunt upgraded the stock to “add” from “hold” and raised its price target to 1,010p, citing higher projected gold and silver prices that could boost cash flows. Citigroup echoed this sentiment, lifting its target to 1,050p and forecasting steady silver output in the first quarter. While analysts noted internal growth plans remained vague, the stock’s rally was driven by macro tailwinds in commodity markets, with investors betting that extended strength in gold and silver will lift earnings.

GSK shares fell 8.7% amid rising investor fears over potential US tariffs on pharmaceutical imports. Although pharma products were not included in Trump’s latest tariff rollout, the president’s remarks to House Republicans suggested levies on drugs could be imminent. The healthcare sector was rattled, with concerns that upcoming US trade actions could disrupt global supply chains and weigh on earnings. GSK, with its substantial US exposure, bore the brunt of the sell-off as markets began pricing in regulatory risk and uncertainty over future pricing and demand in the world’s largest pharmaceutical market.

BP shares dropped 10.5% last week following a disappointing first-quarter trading update and cautious analyst revisions. RBC Capital flagged that BP’s refining and trading segments are likely to post negative earnings for a third consecutive quarter, despite minor improvements in margins and trading conditions. Analysts also projected a decline in upstream production due to asset divestments, with gas and low-carbon output expected to weaken. The company’s guidance suggested a higher-than-expected tax rate, further dimming profit outlooks. The weak update triggered a reassessment of near-term earnings potential, prompting investors to sell off shares amid broader energy market jitters.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management's own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.