22 April 2025

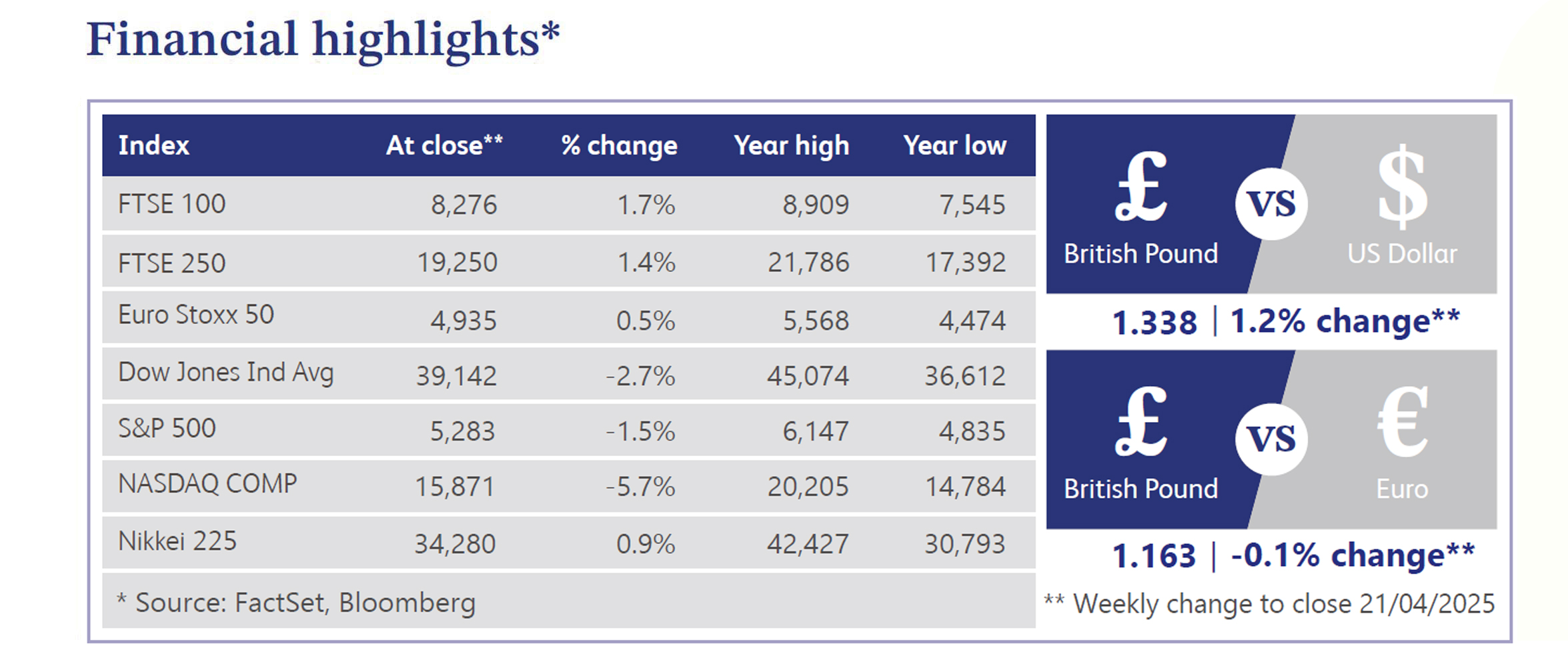

Last week, the UK economy grappled with escalating global trade tensions. UK inflation eased more than expected in March, with headline Consumer Price Index (“CPI”) falling to 2.6% from 2.8%, fuelling expectations of a Bank of England (“BoE”) interest rate cut in May. Core and services inflation also edged lower, reinforcing the view that monetary policy may soon shift. Economists noted tariffs might prove disinflationary, especially with weaker domestic growth. Markets are now almost fully pricing in three rate cuts this year. However, policymakers face uncertainty, with BoE policymaker Megan Greene highlighting the unpredictable impact of US tariffs and dollar weakness on UK inflation. Labour market signals remained mixed: claimant count rose and payrolled employment fell, but job postings climbed 3.3%, business sentiment weakened, CFOs grew defensive and the Institute of Chartered Accountants in England and Wales (“ICAEW”) confidence turned negative.

UK fiscal strategy faced a pivotal moment last week as trade deal hopes with the US gained momentum. US Vice President Vance said negotiations were progressing well, with a deal potentially finalised within three weeks. Talks have so far centred on tech and artificial intelligence (“AI”) but could broaden to food and pharmaceuticals. However, the UK’s bid to align more closely with EU standards - particularly on food and carbon - may complicate US negotiations. Concerns also escalated over proposed US tariffs on pharmaceuticals, which could severely impact UK drugmakers. Domestically, PM Starmer’s deepening EU alignment, including carbon levies, risks clashing with Washington’s "America First" stance. Meanwhile, Labour MPs called for parliamentary oversight of any UK-US trade deal, amid fears of concessions affecting sovereignty and economic security. With sensitive trade documents now labelled 'secret', the government is treading cautiously, balancing fiscal diplomacy with national interest in a tense global trade environment.

US equities ended mostly lower last week, as trade tensions and hawkish Federal Reserve (“Fed”) rhetoric eclipsed earlier gains. While market breadth was positive - reflected in the equal-weight S&P ETF rising 0.42% - major indices like the S&P 500 and Nasdaq declined for the third week. Big tech underperformed, led by NVIDIA (-8.5%) following a $5.5 billion charge linked to new US export restrictions on AI chips to China. Broader weakness was seen in semiconductors, software, apparel and healthcare. In contrast, energy, utilities, REITs and banks posted gains. Geopolitical and trade developments drove market sentiment. The US hiked proposed tariffs on Chinese imports to 245%, prompting Beijing to vow retaliation. Fed Chair Powell warned tariffs could exert persistent inflationary pressure and dampen growth, further clouding the outlook. Treasury yields fell, steepening the curve, and expectations of near-term rate cuts diminished. Meanwhile, gold (+4.7%) and WTI crude (+6.2%) surged, underscoring growing investor risk aversion amid policy and geopolitical uncertainty.

The UK mortgage market saw a notable expansion in low-deposit products, with the number of 5% and 10% deposit deals reaching their highest level since the 2008 financial crisis. The increased availability reflects lender confidence and improving market liquidity, though borrowing costs remain elevated. However, momentum may moderate as the BoE’s first quarter credit survey showed secured lending demand rose but is expected to plateau in the second quarter.

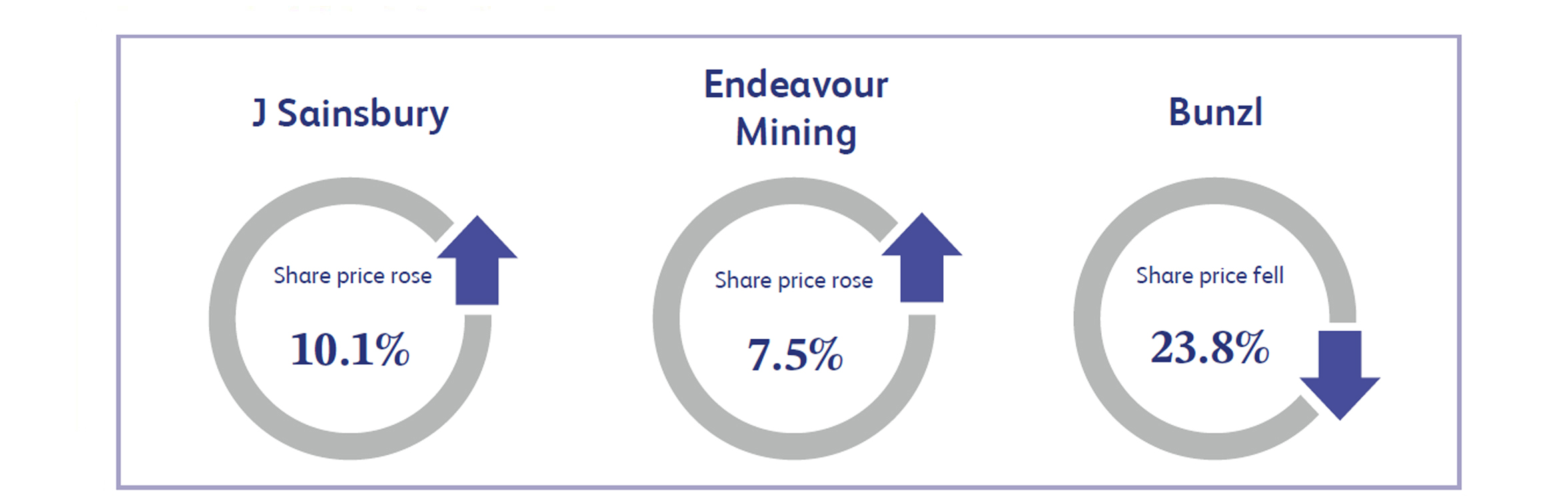

J Sainsbury, the UK supermarket chain, saw its shares surge 10.1% after a strong fiscal year (“FY”) 2025 performance, with profit rising to £242 million from £137 million and earnings per share (“EPS”) nearly doubling. Revenue climbed to £32.81 billion, and the final dividend was raised to 9.7p, with a £250 million special dividend and £200 million buyback also announced. Though FY26 guidance was conservative, analysts viewed this as prudent amid competitive dynamics. Operational resilience, robust earnings and shareholder-friendly policies boosted sentiment despite flat near-term forecasts.

Endeavour Mining, a West Africa-focused gold producer, gained 7.5% last week, supported by rising gold prices and upbeat broker sentiment. Jefferies reaffirmed a "Buy" rating and lifted its price target, citing stronger-than-expected cash flows amid a bullish outlook for gold. Other analysts echoed this view, forecasting stable production and better earnings potential. While clarity on internal growth plans remains limited, macroeconomic tailwinds - especially persistent inflation concerns and rising demand for safe-haven assets - underpinned investor interest. The stock's advance reflects optimism that elevated gold prices will meaningfully improve profitability and free cash flow generation.

Bunzl, a global distributor of non-food consumables, saw its shares slump 23.8% following weak first-quarter results and a profit warning. The company reported revenue softness and margin compression in its key North American segment, which accounts for over half its income. Decentralisation efforts hindered responsiveness to pricing pressures, and own-brand growth slowed. Management paused the buyback programme and revised guidance, expecting margins below 8% versus 8.3% in 2024. Barclays noted the impact of reinvestment needs, which caused deleveraging. Although corrective measures are underway, investors reacted sharply to near-term headwinds and uncertain macro conditions, pushing shares to a four-year low.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management's own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.