10 June 2025

UK economic indicators pointed to persistent disinflation trends last week, even as uncertainty remained elevated. Bank of England ("BoE") Deputy Governor, Sarah Breeden, reinforced the case for policy easing, noting inflationary pressures are fading and labour market risks warrant caution. Several Monetary Policy Committee members echoed this sentiment in parliamentary appearances, with Swati Dhingra flagging downside risks to growth and Catherine Mann warning of tensions between rate cuts and quantitative tightening. The final composite Purchasing Managers' Index (“PMI”) in May improved to 50.3, led by a rebound in services, but backlogs declined and cost pressures persisted. The Confederation of British Industry’s (“CBI”) private sector growth indicator slipped to a two-year low, and BoE’s Decision Maker Panel survey saw little movement in inflation expectations.

Chancellor Rachel Reeves faced intensifying fiscal pressures ahead of the 11th June spending review. Reports highlighted a potential £60 billion funding shortfall, with departments such as policing and housing bracing for cuts. While Reeves reaffirmed her commitment to her fiscal rules, the International Monetary Fund and the Organisation for Economic Co-operation and Development (“OECD”) raised concerns over limited fiscal headroom and urged refinements to ensure policy flexibility. Reeves is expected to redirect focus towards long-term investment, with £15 billion earmarked for infrastructure and transport outside London. Meanwhile, Labour's reversal on welfare spending, including reinstating winter fuel payments, has prompted speculation around future tax increases, though Reeves ruled out hikes to VAT, income tax and employer national insurance contributions. Efforts to mitigate Trump’s steel tariffs included renewed trade talks and diplomatic engagements, while the government also announced measures to reduce planning delays for small developers as part of its housing pledge.

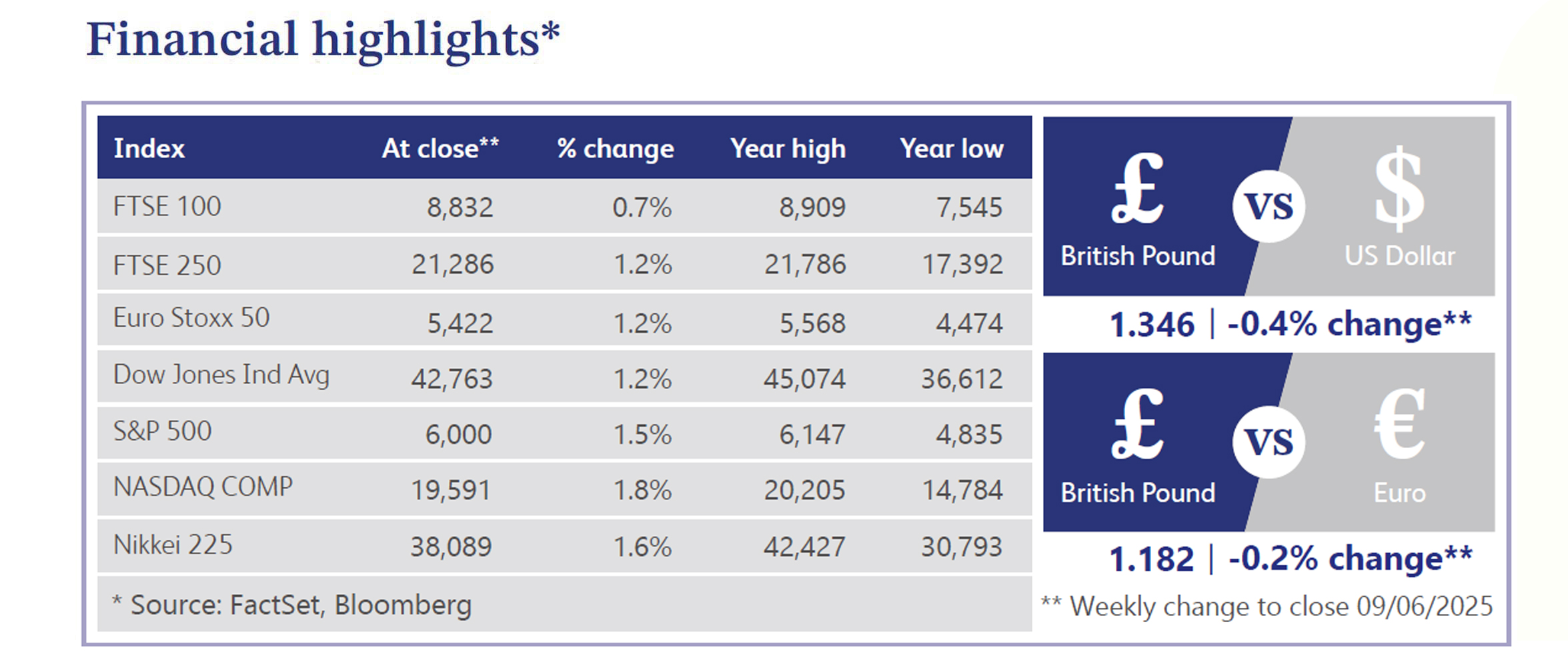

UK capital markets showed mixed performance amid cautious investor sentiment. Bond market scrutiny remains high, with Reeves’ spending plans viewed through the lens of post-Kwarteng credibility. Equity fund inflows dropped sharply to £525 million in May, per Calastone, though UK assets saw improved sentiment. Pension reform announcements dominated headlines, as Reeves confirmed plans to consolidate small schemes into £25 billion "megafunds" and require at least 5% of assets to be invested in UK private markets. Meanwhile, in the US, the S&P 500 extended gains, buoyed by Nvidia-led tech optimism and softening economic data. Treasury yields were volatile but ended lower after a dovish May Nonfarm Payrolls report, which showed slower wage growth and a tick down in participation. Trade dominated headlines as Trump’s tariff decisions, EU backlash, and renewed China talks injected fresh uncertainty. Fed commentary leaned dovish, while artificial intelligence-linked equities and oil prices supported broader risk sentiment.

UK housing momentum strengthened in May, with Rightmove reporting the busiest month in over three years and sales up 6% year-on-year. Nationwide house prices rose 3.5% annually, though Halifax showed a 0.4% monthly decline, suggesting regional variation. Despite a drop in BoE mortgage approvals, demand remained robust. Analysts highlight that relaxed mortgage rules could boost prices by 7.5% over five years. Zoopla expects 5% more sales and 2% price growth in 2025.

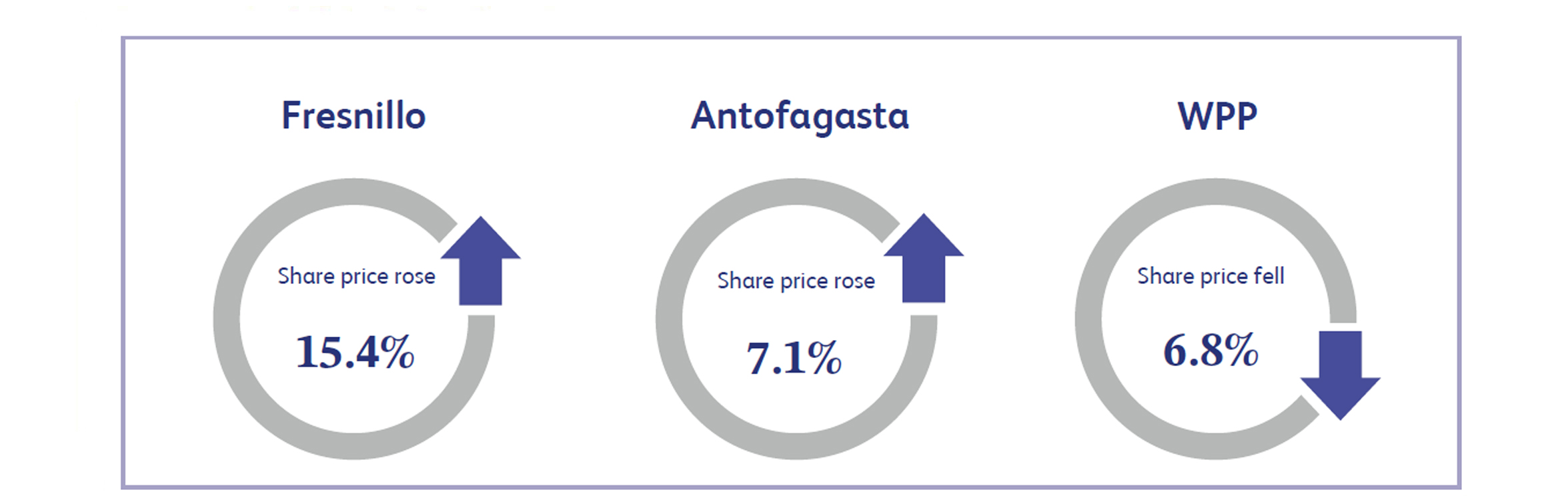

Fresnillo, a major gold and silver producer, rallied 15.4% last week, reaching a new post-COVID high amid renewed global growth concerns. The rebound was fuelled by a broad recovery in mining stocks and rising precious metal prices, with gold gaining as investors sought safe-haven assets amid persistent geopolitical uncertainty. UK investors appeared willing to look past US trade tensions, focusing instead on improved sentiment in commodity markets. Fresnillo benefited from its leverage to gold prices, which remain sensitive to inflation, and global risk sentiment further boosted by signs of resilience in physical demand.

Antofagasta, a Chilean copper miner, gained 7.1% as copper prices rose following upbeat sentiment around the US - China trade relations. A social media post by President Trump indicating a call with President Xi Jinping raised hopes of de-escalation, boosting confidence in China’s industrial demand. With China being the world’s largest copper consumer, any signs of trade stability or policy support positively impact the metal’s outlook. Antofagasta tracked copper’s move closely, with LME copper nearing $9,810/t during the week. Broader commodity optimism and Antofagasta’s exposure to Chinese demand made it a key beneficiary of the shift in market tone.

WPP, a global advertising and communications group, fell 6.8% following the announcement that Chief Executive Officer Mark Read will step down after a challenging seven-year tenure. The stock has halved in value under his leadership, reflecting structural headwinds in traditional advertising, increased competition, and geographic exposure to slowing economies. Investor sentiment was further dampened by Read’s comments on continued client caution amid tariff uncertainty, suggesting subdued marketing budgets. With no clear successor announced and market volatility persisting, the leadership change added to uncertainty over WPP’s strategic direction and its ability to adapt to the evolving digital advertising landscape.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management's own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.