21 October 2025

The UK economy presents a mixed outlook as the Bank of England (“BoE”) remains cautious about inflation persistence. Monetary Policy Committee (“MPC”) member Catherine Mann warned of clear upside risks to inflation and advocated maintaining tight policy, while fellow MPC member Megan Greene argued closer EU ties could boost productivity and ease price pressures. Chief Economist Huw Pill signalled a slower pace of easing amid uncertain shocks, and Governor Andrew Bailey faced scrutiny over policy direction at global meetings. Economic data were uneven, with unemployment rising to 4.8% and wage growth easing slightly, while gross domestic product rose 0.1% in August. Retail sales and consumer sentiment softened as household costs remained high, and grocery inflation accelerated to 5.2%. Business confidence weakened amid rising costs and potential tax hikes.

The UK’s fiscal outlook remained in sharp focus ahead of the November budget, with Chancellor Rachel Reeves signalling higher taxes and spending restraint to rebuild fiscal headroom. Reports suggest tax rises will target wealthy individuals and assets while protecting working families. The Institute for Fiscal Studies (“IFS”) cautioned against a “half-baked dash for revenue,” warning poorly designed taxes could harm productivity. The IFS proposed a one-off wealth tax as a more efficient alternative, though concerns persist about the flight of capital. Reeves also plans reforms to accelerate planning approvals and boost investment, including pension fund partnerships to support UK growth. Meanwhile, the International Monetary Fund and BoE warned against premature rate cuts amid persistent inflation and labour market weakness.

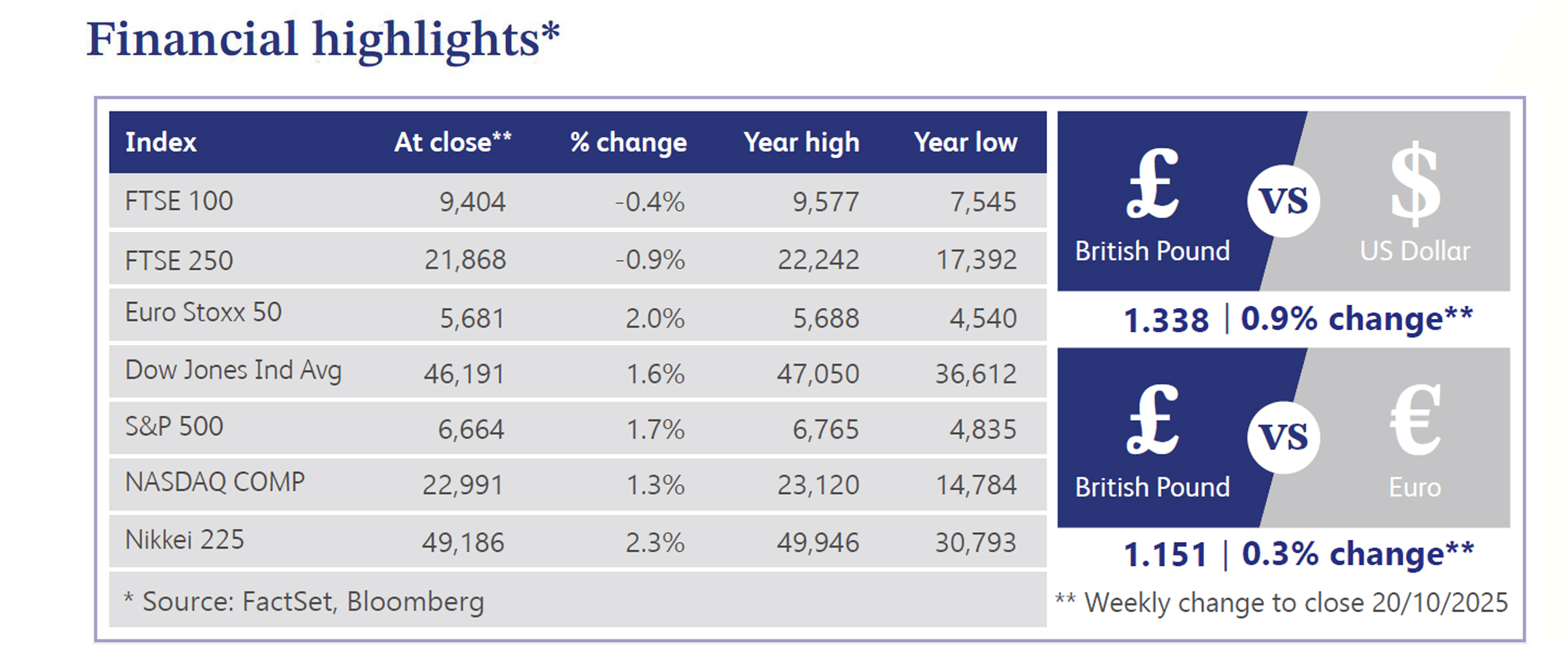

UK markets saw notable developments ahead of the November budget. UK Chancellor Reeves aims to restore investor confidence by building a stronger fiscal buffer, with gilt yields falling below 4.5% as bond sentiment improves. The Financial Times reported pension giant Border to Coast warned against forced pooling of local authority pension assets, citing risks to local accountability and investment flexibility. Meanwhile, Britain is courting major Australian pension funds to attract overseas investment. Sterling gained support from strong inflows related to artificial intelligence (“AI”), with analysts citing the UK’s position as a leading AI investment hub.

Major US indices ended last week higher as easing US-China trade tensions and solid corporate earnings boosted sentiment. Technology and cyclical sectors outperformed, while financials lagged on weaker insurer and regional bank results. Treasury yields fell, with the 2-year hitting a 3-year low, and gold surged 5.8% to record highs amid dollar weakness. Optimism over AI growth continued after Taiwan Semiconductor Manufacturing Company and ASML Holding raised forecasts, though some analysts warned of bubble risks. Federal Reserve officials maintained a cautious tone ahead of November’s Federal Open Market Committee meeting, while economic data offered mixed signals. Markets also digested uncertainty from the ongoing US government shutdown and sparse macro releases.

UK homebuilders Barratt and Persimmon have introduced new “Help to Buy” schemes, allowing buyers in England to purchase new-build homes with a 5% deposit and a 15% equity loan, capped at £100,000. The initiative aims to improve affordability and support housing demand amid subdued market activity.

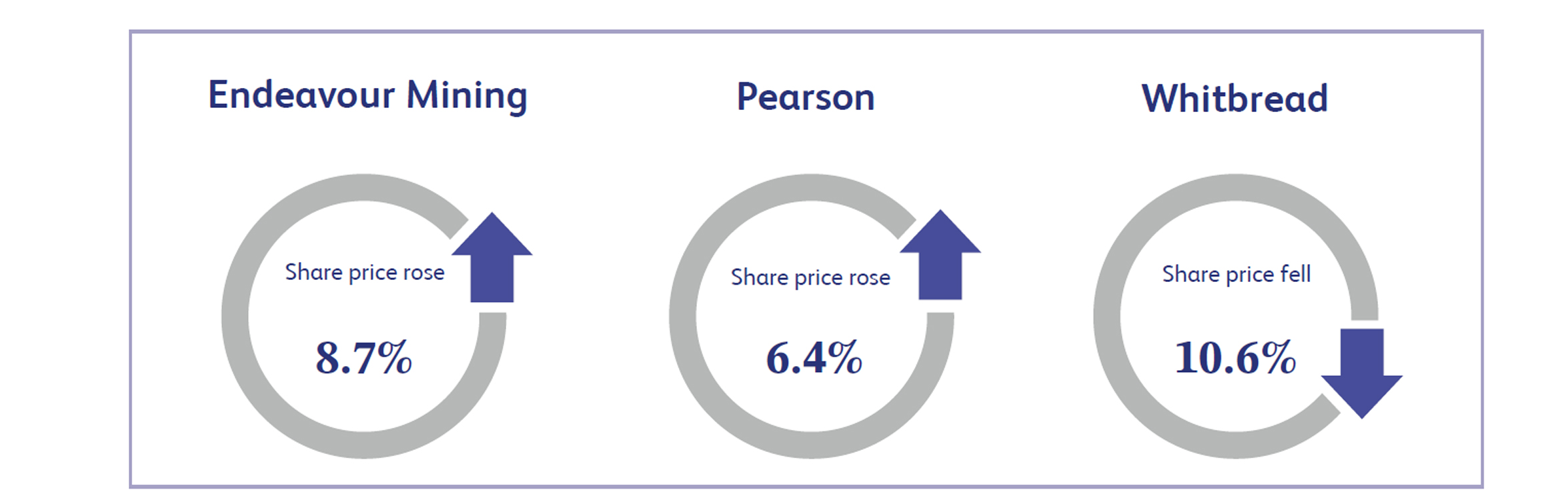

Endeavour Mining is a gold-mining company focused on producing and exploring gold projects primarily in West Africa. The company’s shares surged 8.7% last week as gold prices reached record highs, closing above $4,000 an ounce for the first time. Investors sought the precious metal as a safe-haven asset amid a weaker US dollar and concerns over escalating trade tensions following President Trump’s tariff announcements. The rally in gold boosted sentiment for miners like Endeavour, reflecting both higher commodity prices and the broader demand for defensive assets in uncertain macroeconomic conditions.

Pearson is a British education company offering assessment services, qualifications and digital learning products worldwide, with the US contributing roughly 68% of revenue. Shares rose 6.4% last week after the company reported a 4% acceleration in underlying sales growth for the third quarter, driven by a 13% increase in virtual learning enrolments for 2025/26. Strength in assessment, qualifications and a return to growth in English language learning further supported the rally. CEO Omar Abbosh highlighted the growing US investor base and Pearson’s expansion plans in the US, reinforcing confidence in the company’s long-term growth and innovation strategy.

Whitbread is a UK hospitality group operating Premier Inn hotels and restaurant brands. The company’s shares fell 10.6% last week as it cut guidance for its German operations and reported lower half-year profits. Adjusted pretax profit declined to £315.6 million from £340.4 million, with overall revenue falling to £1.54 billion. Weak demand in Germany prompted a reduction in full-year profit guidance for the business. Despite resilience in the UK Premier Inn segment, the earnings miss and guidance downgrade weighed on sentiment, highlighting challenges from consumer confidence, soft food and beverage sales, and slower-than-expected international expansion.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management' own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.