11 November 2025

The Bank of England’s (“BoE”) Monetary Policy Committee delivered a narrow 5–4 vote to keep interest rates unchanged at 4%, marking one of the most finely balanced decisions in recent years. The split highlights the delicate equilibrium policymakers face amid uneven data. The BoE signalled that inflation, last recorded at 3.8% in September, has likely peaked and is now easing, keeping a December rate cut firmly on the table with markets pricing a 60–70% probability of a 0.25% reduction. Governor Andrew Bailey’s decisive vote, coupled with dovish comments acknowledging that a 3.5% terminal rate “fairly describes” his outlook, reinforced market conviction that the easing cycle could begin soon. Economic indicators were mixed with the UK Composite Purchasing Managers' Index (“PMI”) rising to 52.2, driven by services strength (52.3), while manufacturing stabilised (49.7) and construction contracted sharply (44.1).

All eyes now turn to Chancellor Rachel Reeves ahead of the 26 November Budget, where she faces a widening fiscal gap of £20–£40 billion amid an expected productivity downgrade from the Office for Budget Responsibility (“OBR”). Reeves has privately signalled plans to raise income tax by 2%, offset by an equivalent cut in National Insurance – a politically charged reshuffle shifting the burden towards pensioners and landlords. The Chancellor is also rethinking a proposal to slash the cash ISA allowance, following pushback from building societies warning of risks to mortgage funding. The government’s overarching priority is to stabilise the fiscal outlook and maintain bond market credibility, even if it means breaking key manifesto pledges.

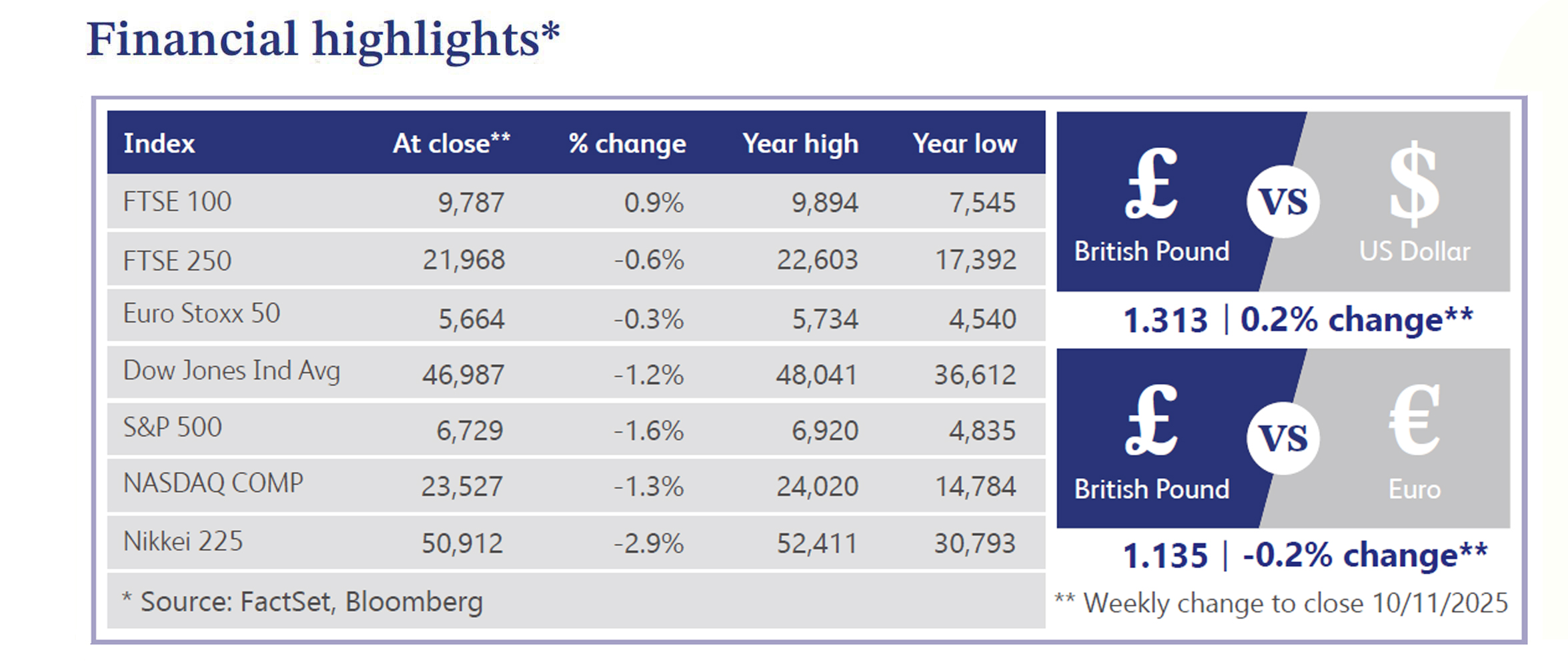

UK markets reflected a cautious tone. The FTSE 100 gained 0.9%, while the FTSE 250 declined 0.6%, pressured by fiscal concerns and weak corporate sentiment. Gilt yields rose, with the 10-year benchmark touching 4.46% as investors priced in persistent fiscal risks. Sterling traded flat at $1.31 but weakened against the euro to €1.14, with volatility expected to intensify as the budget approaches.

Across the Atlantic, US equities were mixed following three consecutive weeks of gains. The Nasdaq suffered its worst week since April, weighed down by losses in the “Magnificent Seven,” with Nvidia (-7%), Tesla (-5.9%), and Meta (-4.1%) leading declines amid renewed artificial intelligence (“AI”) valuation concerns. The Federal Reserve cut rates by 0.25% and ended quantitative tightening, though Chair Jerome Powell tempered expectations of further near-term easing. Treasury yields rose to 4.09%, while the dollar softened modestly, especially against the yen. Despite weaker market breadth, banks, airlines and energy stocks outperformed. Gold steadied near $4,000/oz, while WTI crude fell 2%, its sixth decline in eight weeks. Bitcoin futures tumbled 8.3%, briefly dipping below $100,000 for the first time since June.

UK housing data painted a similarly divided picture. Halifax reported record-high average prices in October, while Nationwide’s data suggested moderation. Mortgage approvals remained steady, yet Zoopla noted the first annual fall in new sales in two years, particularly for high-end properties in southern England. Savills now sees “no real growth” until after the next election as uncertainty over potential property tax changes keeps buyers cautious.

Airtel Africa, a leading telecommunications and mobile money services provider operating across 14 African markets, extended its rally last week, rising 6.87%. The momentum followed the prior week’s 21.3% surge driven by robust half-year results showing net profits up five-fold to $376 million, alongside an 11% rise in customers and a 9% dividend increase. Investor optimism was further boosted after Deutsche Bank raised its target price, citing sustained revenue growth and the potential IPO of its mobile money arm in 2026, underscoring strong long-term value creation prospects.

InterContinental Hotels Group, a global hospitality company operating brands such as Holiday Inn and Crowne Plaza, gained 5.94% last week amid continued strength following its upbeat third quarter trading update. The group reported 1.4% year-to-date RevPAR (“Revenue Per Available Room”) growth, led by a 2.8% rise in Europe, the Middle East and Africa, reflecting resilient demand despite macro headwinds. Investor confidence was lifted by management’s confirmation of $1.1 billion in planned shareholder returns for 2025, including a $900 million buyback. Additionally, JPMorgan upgraded IHG to “overweight,” highlighting its strong brand portfolio, expanding development pipeline, and solid capital discipline as key performance drivers.

Rightmove, the UK’s largest online property portal, was the FTSE 100’s worst performer, plunging 14.13% after issuing a disappointing trading update. While the firm reaffirmed its 2025 guidance, it forecast slower operating profit growth of 3–5% for 2026, citing higher costs from a new AI and technology investment programme aimed at overhauling its platform. Although the new CEO framed the plan as crucial for long-term competitiveness, markets focused on short-term margin pressure, triggering a sharp sell-off that sent the shares to a 52-week low as investors reassessed near-term profitability.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management' own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.