25 November 2025

UK markets faced a difficult week as incoming data highlighted a loss of economic momentum ahead of this week’s Budget. The UK flash Purchasing Managers' Index (“PMI”) for November fell to a two-month low, with a slowdown in the services sector outweighing a modest recovery in manufacturing, signalling quarterly growth of just 0.1%. Retail sales fell 1.1% month-on-month, the first decline since May, while consumer confidence weakened sharply, with both GfK and British Retail Consortium (“BRC”) surveys showing significant deterioration. Inflation eased to 3.6% in October after three months at 3.8%, while core inflation softened to 3.4%, aligning with Bank of England (“BoE”) expectations. Pay settlements rose to 3.3%, the highest level this year, adding to cost pressures, while hawkish Monetary Policy Committee (“MPC”) members warned that policymakers cannot be complacent, highlighting ongoing upside risks.

Fiscal uncertainty dominated the political landscape as Chancellor Rachel Reeves navigates a challenging path ahead of Wednesday’s Budget. Reports suggested a potential raid on bank profits despite earlier assurances, reflecting a shift in tone following the government’s U-turn on income tax plans. Reeves also faced criticism over leaks and pressure from Labour MPs to soften proposed taxes on high-value homes, while exploring targeted protections for small businesses and the self-employed. Estimates of a £30 billion fiscal consolidation underscored the scale of the challenge, leaving investors cautious over the credibility of planned revenue measures. Warnings from gambling firms about potential job cuts if taxed heavily, alongside criticism from former BoE economist Andy Haldane about the delayed Budget fuelling speculation, heightened political and market tensions.

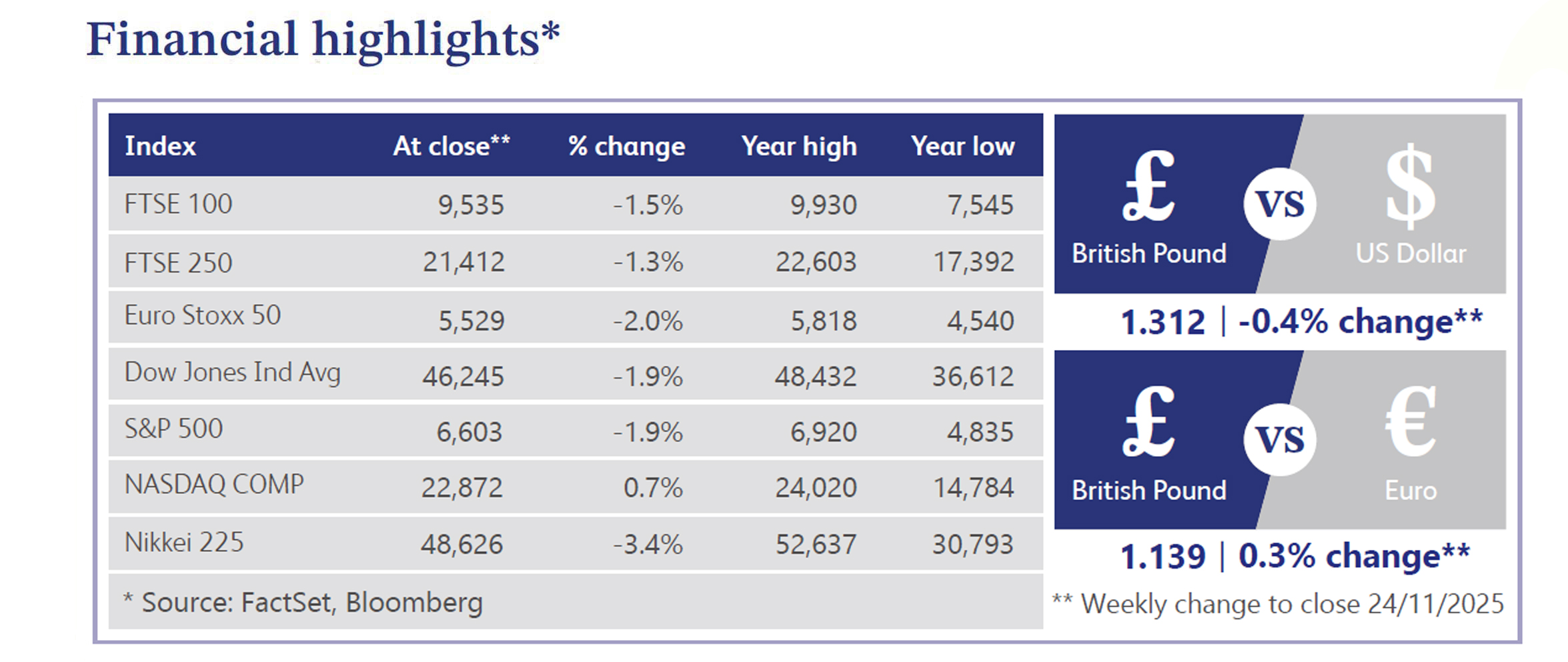

The UK market responded negatively last week, with the FTSE 100 falling 1.5% to remain up 20.7% year-to-date, while the FTSE 250 dropped 1.3%. Sterling weakened to USD 1.31 from 1.32. Bond markets reflected growing concern, with Franklin Templeton warning that investors could force a second Budget if fiscal measures disappoint. Gilt issuance is expected to rise by £9 billion to around £308 billion, marking the highest total since 2021. UK investors continued withdrawing funds from domestic equities at a record pace, while London’s planned IPO revival faces a capital shortfall after years of persistent outflows and lower pension allocations to domestic stocks.

Across the Atlantic, US equities ended lower, with the S&P 500 and Nasdaq extending recent declines despite a strong Friday rebound. Momentum unwinds and renewed artificial intelligence (“AI”) scepticism weighed on big tech, particularly Microsoft (-7.4%) and Amazon (-6%), offsetting gains in Alphabet (+8.4%). Softer labour data and comments from the Federal Reserve’s John Williams revived expectations for a December rate cut, supporting risk sentiment. Treasuries firmed, the dollar strengthened, gold was flat and Bitcoin recorded its worst week since February. Economic data painted a mixed picture, with diverging PMI signals, accelerating input costs and moderate employment trends.

UK housing sentiment continued to weaken amid structural and policy uncertainties. The government’s 1.5 million homes target by 2030 is under threat from a growing shortage of council planners, with one in five expected to leave or retire within three years. Uncertainty over potential property tax changes has also stalled activity, with a Rightmove survey showing nearly 20% of prospective movers have postponed plans.

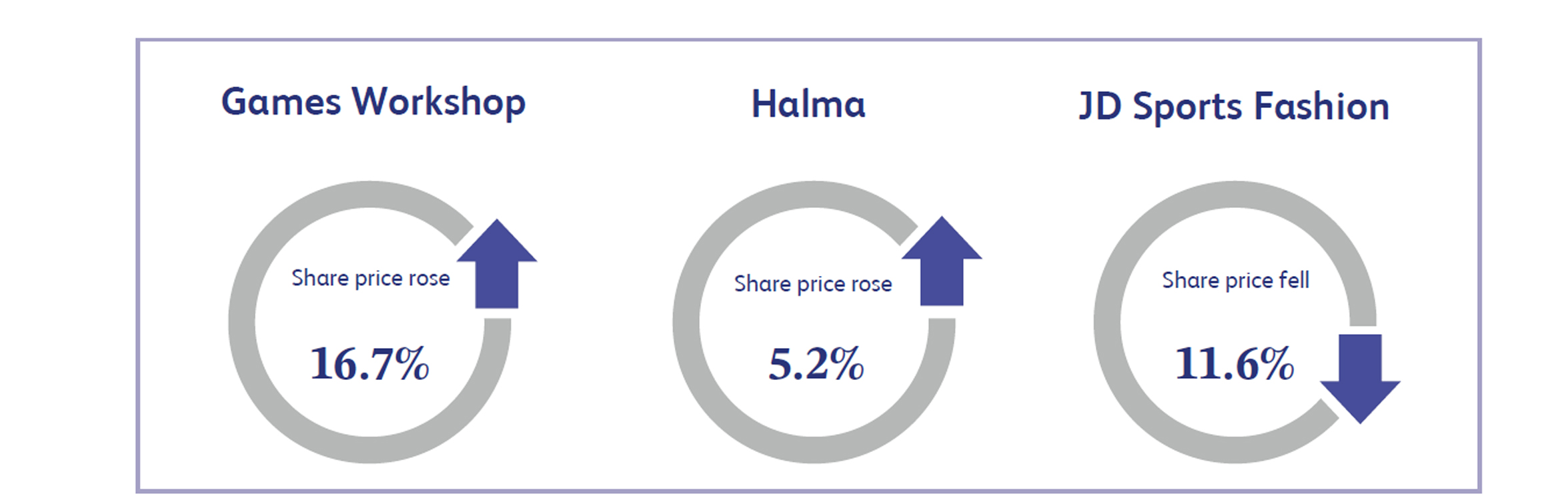

Games Workshop, the UK-based miniature war-gaming and hobby company, saw its shares surge 16.7% last week. The rally was driven by guidance indicating core revenue is expected to rise to at least £310 million, while licensing revenue is set to decline slightly to £16 million. Profit before tax is projected to increase to at least £135 million. Investor optimism was boosted by strong guidance, highlighting strong operational momentum and resilience in its core miniature and tabletop gaming business.

Halma, a global safety, environmental and health technology group, rose 5.2% following record half-year results. The company reported 15% revenue growth and a 27% increase in Earnings before Income and Tax (“EBIT”), underpinned by strong organic performance across all sectors. Margins and returns improved, and significant investments were made to support future expansion. Management upgraded full-year guidance to mid-teens revenue growth with a 22% EBIT margin. Investor confidence was reinforced by Halma’s ability to combine robust operational performance with strategic investments, demonstrating resilience and long-term growth potential in safety and environmental technologies.

JD Sports Fashion, the UK-based sportswear retailer, was the weakest performer in the FTSE 100, falling 11.6%. The decline followed the company’s update, which flagged that annual profit before tax and adjusted items is likely to come in at the lower end of market expectations. Weak economic conditions and softer consumer spending in its key markets weighed on sentiment, with third quarter like-for-like sales down 1.7%. JD Sports took a cautious, pragmatic stance on its full year 2026 outlook ahead of its critical fourth quarter trading period. Investor concern over macroeconomic headwinds and muted near-term growth prospects drove the sharp pullback.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management' own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.