27 January 2026

Last week, UK economic data revealed a mix of rising price pressures and surprising resilience in activity. Inflation surprised on the upside in December with the headline Consumer Price Index (“CPI”) rising to 3.4%, driven by higher airfares and tobacco duty, a development likely to instil policy caution at the Bank of England (“BoE”) next month. However, economic activity accelerated, as the January Purchasing Managers Index (“PMI”) recorded its strongest upturn since April 2024, hitting a 21-month high of 53.9, which S&P Global noted is indicative of a 0.4% quarterly growth rate. Retail sales also beat expectations with a 0.4% expansion in December, though a quarterly decline in goods purchased suggests underlying household consumption remains weak. In financial markets, gilts headed for their worst weekly performance since November amid political risk, while Vanguard announced plans to offload approximately £1.9 billion of UK shares to reduce "home bias" in its funds.

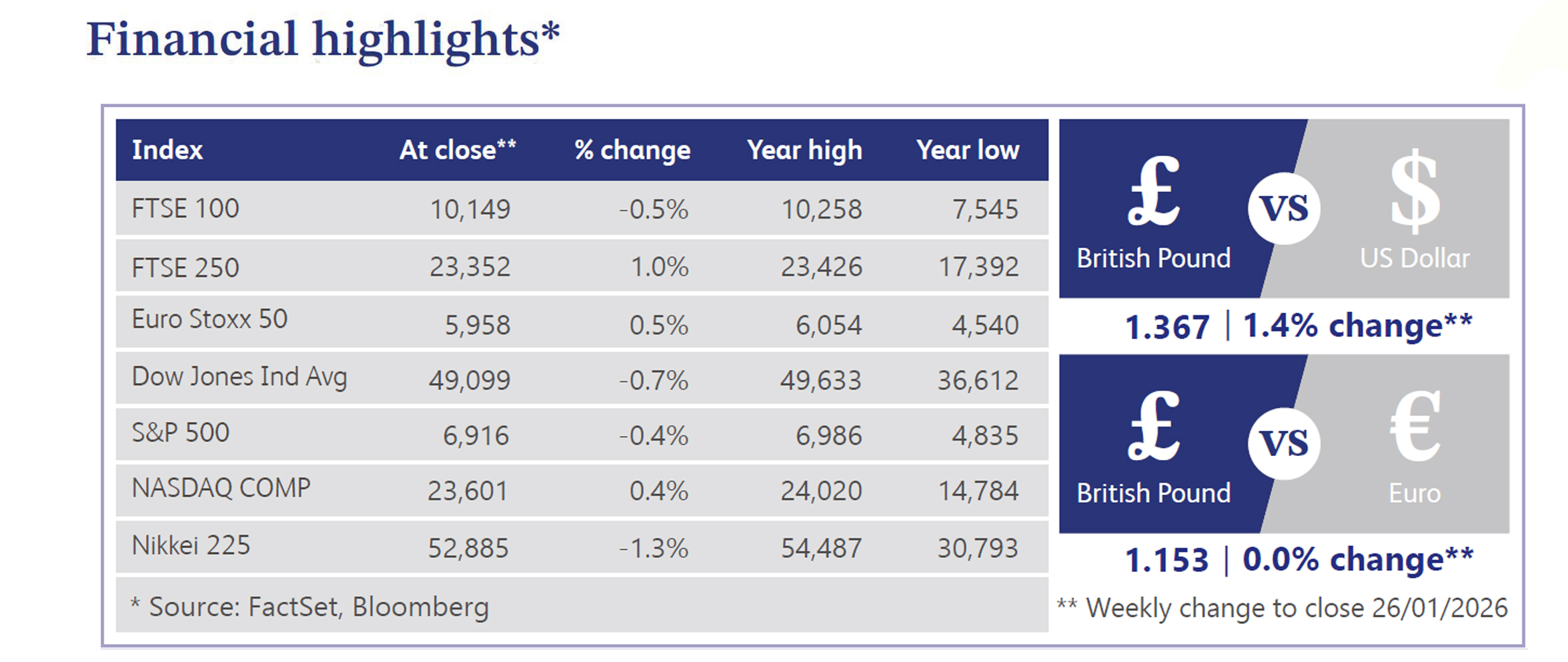

In equities, the FTSE 100 index finished down 0.5% at 10,149, though it maintained a year-to-date gain of 2.14%. Among UK corporate movers, Enwell Energy rose 3% following a fourth-quarter operations update, while Watches of Switzerland gained 3% after announcing the acquisition of four new US showrooms. Babcock International also edged 0.1% higher amid a Q3 trading update and news of its Chief Executive Officer’s (“CEO’s”) upcoming retirement. Meanwhile, SSP Group fell 2.3% after its trading update, and Taylor Wimpey declined 1.6% following a downgrade. In currency markets, sterling strengthened against the US dollar, gaining 1.4% to trade at 1.367 dollars to the pound.

Across the Atlantic, data supported a resilient economic narrative as initial jobless claims fell to 200,000 and January consumer sentiment reached its highest level since August. Despite this, US equities were mostly lower this week: the Dow Jones Industrial Average fell 0.7%, the S&P 500 declined 0.4%, whilst the Nasdaq gained 0.4%. The small-cap Russell 2000 also finished lower with a 0.32% decline. Big tech was mostly higher, with Meta rising 6.2% and Nvidia gaining 0.8%, while Amazon rose 2.1% as it noted tariff costs creeping into prices. Macro sentiment was dampened by Federal Reserve (“Fed”) independence concerns and solid economic data, leading markets to price in just 41 basis points of rate cuts through year-end. Elsewhere, Treasuries were little changed, the Dollar Index fell 1.9%, and gold rallied 8.4% to a fresh record. Investors also navigated heightened geopolitical tensions focused on Greenland and Iran, alongside weakness in the banking sector.

Turning to the property sector, experts warn that budget-related headwinds are set to persist, dampening hopes for a quick recovery. Despite the absence of the worst-feared tax hikes in November, lingering uncertainty over future tax policy is likely to keep activity subdued and price growth modest at low single digits through 2026. Prime London markets remain particularly sensitive, with wealthy sellers holding off on listings until there is greater clarity, suggesting a slower recovery for high-end properties.

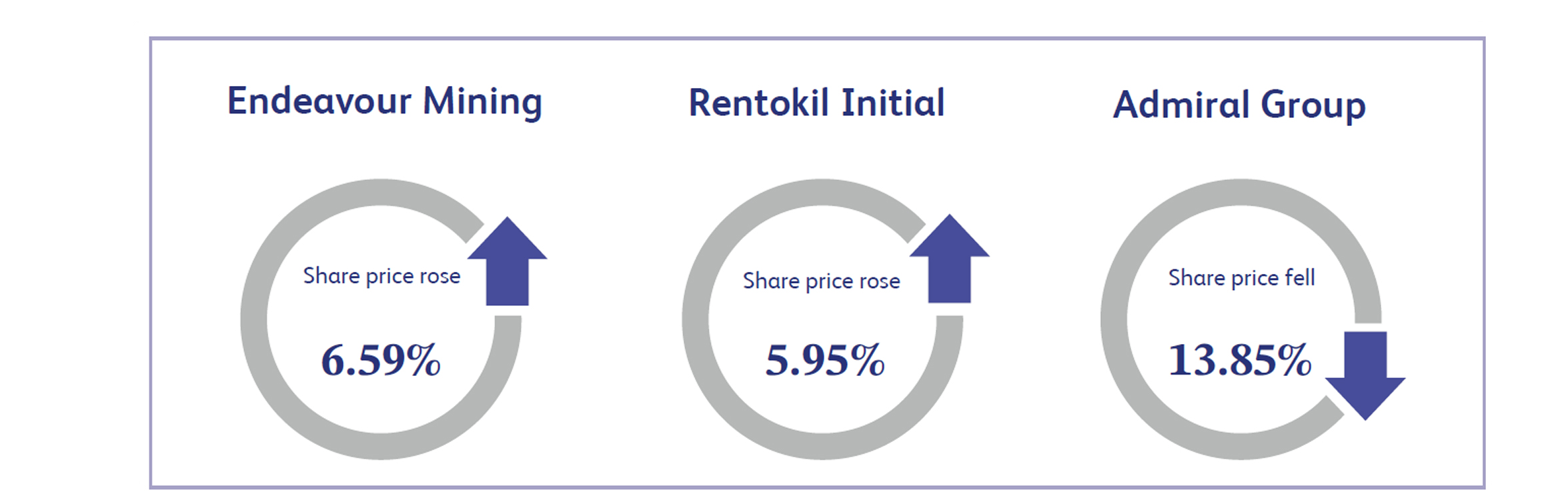

Endeavour Mining was a standout performer last week, with shares in the company rising 6.59%. The company’s shares surged, driven by renewed investor confidence in the precious metals sector as gold prices hit fresh record highs. This significant share price movement also reflected the company's strong operational performance and positive outlook, further solidifying its position in the market. Market updates highlighted precious metals miners as key outperformers, positioning the firm as a prime beneficiary of the solid inflows into safe-haven assets triggered by geopolitical tensions and persistent inflationary concerns.

Rentokil Initial was the second-strongest performer over the week, as its shares rose 5.95%. The global leader in pest control and hygiene services saw its shares rally as investors favoured its defensive qualities and highly recurring revenue model. In a week when UK inflation surprised to the upside, the company's resilient demand profile and perceived pricing power appeared to offer an attractive hedge against cost pressures. This solid performance underscores the market's appetite for established industrial leaders capable of delivering steady growth despite the mixed macroeconomic backdrop.

Admiral Group was the worst performer for the week, suffering a steep decline of 13.85%. The insurer was hit hard by renewed fears over inflation, after UK services prices surprised to the upside, suggesting a more persistent level of price pressure in the economy. With the broader insurance sector already lagging, investors grew concerned that this stickiness in price pressure would squeeze underwriting margins beyond previous expectations. This macro-driven anxiety overshadowed the company's usual defensive qualities, leaving it exposed as the wider European insurance index faced its own struggles. The surprise inflation data prompted a sharp re-evaluation of risk within the insurance sector, with Admiral bearing the brunt of the selling pressure.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management's own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.