3 February 2026

Last week, the Bank of England's (“BoE”) weekly short-term repo allotment hit a record high of over £100 billion, marking the shift to a repo-led system, while the BoE considers tokenised assets as eligible collateral. The UK labour market softening continued, with Adzuna reporting that December job vacancies fell 15% year-on-year to a 2020 low, as rising payroll costs slowed hiring. This supports the majority view of a March rate cut, despite BoE Governor Andrew Bailey stressing the need to boost market resilience. Globally, Prime Minister Keir Starmer and President Xi agreed on a "strategic partnership," resetting UK-China relations with progress on whiskey tariffs and visa waivers, alongside cooperation on equipment used for restricting small boat crossings. Chatham House noted Beijing views the UK as a stable partner amidst US policy "disruption," with low current investment, 0.7% of UK foreign direct investment, offering significant growth potential.

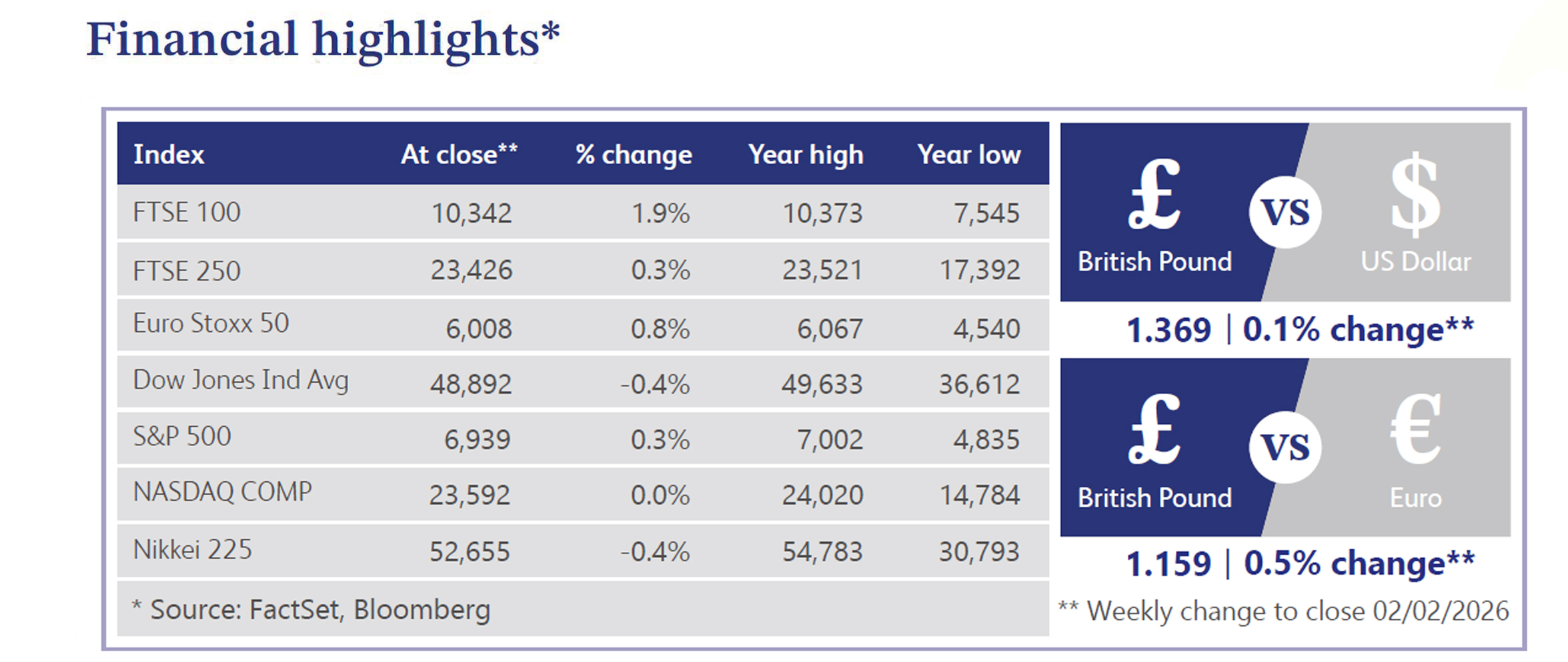

In equities, the FTSE 100 index finished the week moving up 1.9% to 10,342, maintaining a year-to-date gain of 2.94%. Despite government claims of a "golden age," Chancellor Rachel Reeves faces warnings that the City of London is at a "critical juncture." A report by TheCityUK and PwC, based on a survey of 300 market leaders, highlights the financial sector's decade of underperformance against the wider economy. The report urges accelerated reform to unlock £53 billion in extra output by 2035. Complicating revitalisation, UK pension funds are increasingly favouring private companies; unlisted equities now form nearly half their equity exposure, up from under 18% in 2020, undermining domestic market efforts. In currency markets, sterling strengthened against the US dollar, gaining 0.1% to trade at 1.369 dollars to the pound.

Across the Atlantic, economic signals were mixed as January consumer confidence fell to its lowest headline level since 2014, though initial jobless claims remained muted. US equities were mostly lower: the Dow Jones Industrial Average declined 0.4%, the Nasdaq was little changed, the small-cap Russell 2000 dropped 2.08%, while the S&P 500 managed a 0.3% gain. Big tech was stronger overall, with Meta rising 8.8% and Apple gaining 4.6% on strong iPhone 17 demand, though Microsoft slid 7.7% on underwhelming cloud growth. Macro sentiment focused on the Federal Reserve (“Fed”) as President Trump nominated Kevin Warsh as the next Chair, while the Federal Open Market Committee (“FOMC”) held rates steady as anticipated. Elsewhere, treasuries were mixed as the curve steepened, the Dollar Index fell 0.5%, and gold dropped 4.7% despite hitting record levels earlier in the week. WTI crude oil rallied 7.3% amid rising concerns regarding potential action against Iran, while banks were among the outperforming sectors.

Turning to the property sector, activity appears to be cooling as BoE data revealed December mortgage approvals fell to a multi-month low of 61,010, likely dampened by lingering budget uncertainty. While Housing Minister Matthew Pennycook predicted long-term price declines driven by aggressive supply-side reforms, investor confidence faces immediate friction from a planned £250 cap on ground rents, even as developers turn to novel strategies like acquiring "airspace" above London rooftops to boost inventory.

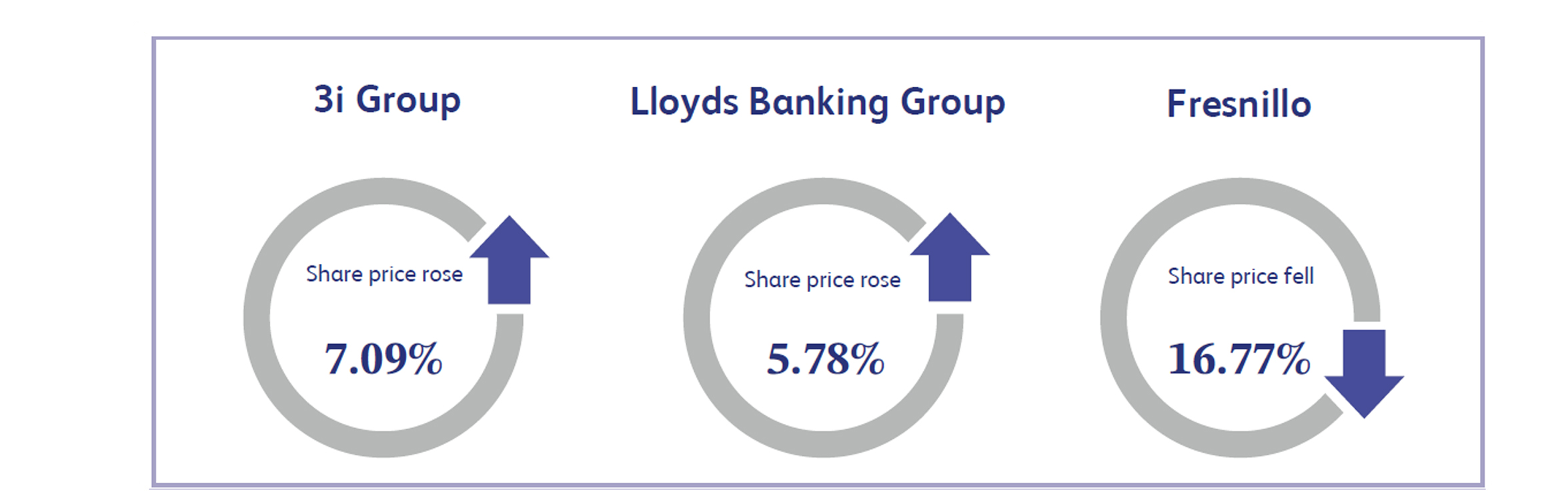

3i Group, a leading international investment manager focused on private equity and infrastructure, was the week's standout performer, advancing 7.09% as it benefited from structural shifts in asset allocation. Sentiment towards the sector was buoyed by reports that UK pension funds are increasingly prioritising private companies, with unlisted equities now comprising nearly half of their equity exposure, a trend that validates 3i's business model despite the broader "shunning" of London-listed stocks. Further supporting the stock, Citigroup’s UK head noted that the deal pipeline is the strongest it has been in years, signalling a resurgence in transaction activity that directly benefits private capital allocators.

Lloyds Banking Group, the major UK bank, rallied 5.78%, significantly outperforming the wider European banking sector, which rose 1.65%. The catalyst was the lender’s announcement of a share buyback programme of up to £1.75 billion, a major capital return that pleased investors. This shareholder-friendly move helped offset the bank's own somewhat gloomier economic data, which revealed that while trading prospects remain resilient, overall business confidence eased in January and economic optimism fell to its lowest level since April 2025.

Fresnillo, a precious metals mining company and the world's largest primary silver producer, was the worst performer of the week, plummeting 16.77% as it was caught directly in a historic crash in precious metals markets. The miner faced intense selling pressure after silver prices collapsed 22.5% for the week, suffering their worst single-day drawdown since 1980, while gold also retreated 4.7% from record highs. The extreme volatility and sudden reversal in spot prices forced a sharp re-pricing of the sector, leaving Fresnillo to bear the brunt of the sell-off.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management's own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.