21 July 2020

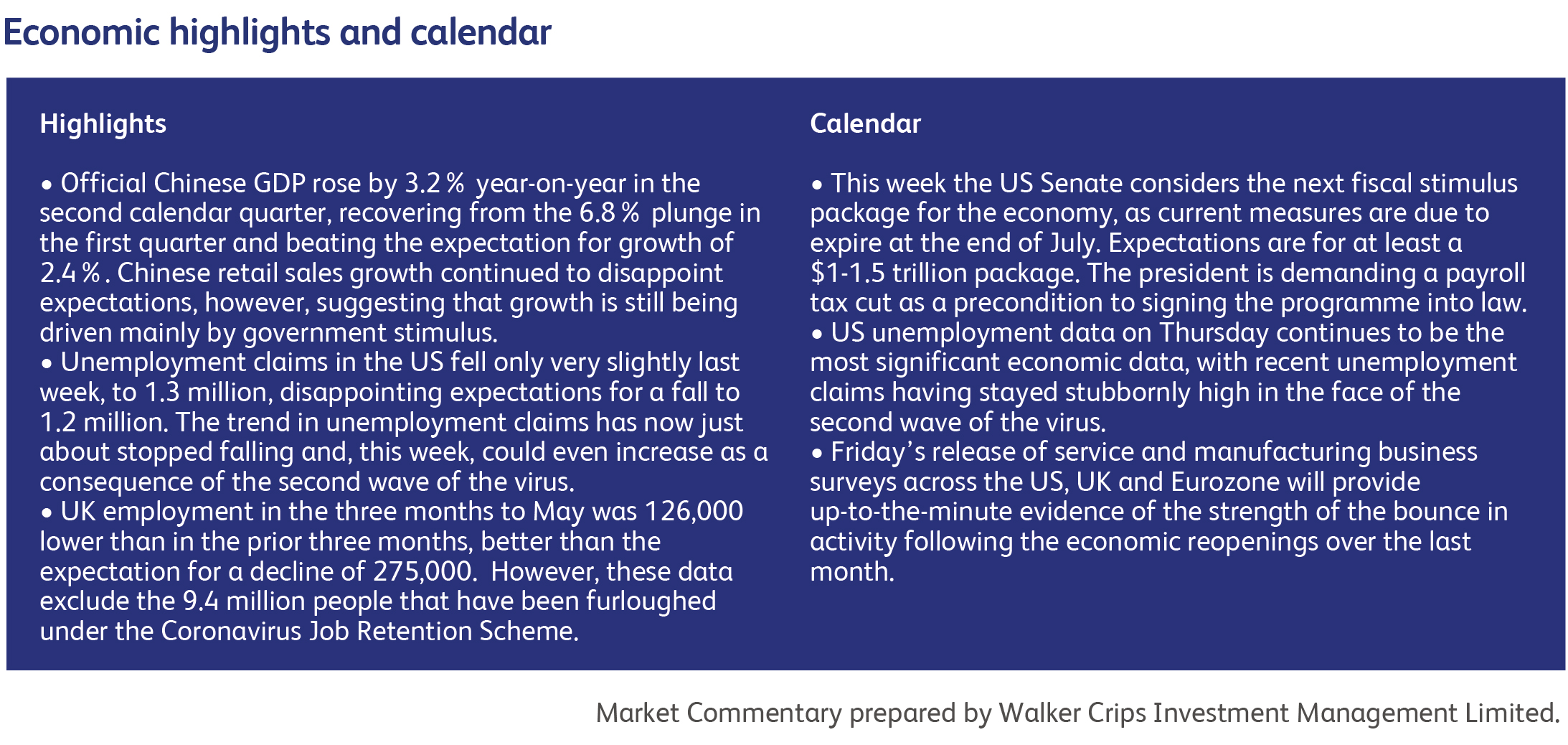

In a volatile Monday trading session the Dow Jones Industrial Average Index rallied late to claw up 0.03%, while the Nasdaq Composite Index, driven by a strong day for large-cap tech giants like Amazon finished 2.5% up. Stocks started the week on unsure footing as attention focused on businesses’ fading outlook and the hurdles facing fresh stimulus packages as increasing coronavirus infection levels threaten to stall the economic recovery. But, optimism on a coronavirus vaccine appears to have helped the markets mood. Globally over 606,000 people have died from the coronavirus pandemic so far, with more than 140,000 deaths being in the US and the numbers still continuing to climb – particularly in the US. Increasingly investors and economists are taking the view that any healthy recovery in the global economy will depend on authorities’ success in containing new outbreaks.

Major American businesses Coca-Cola, Lockheed Martin, United Airlines Holdings and others report earnings this week and will offer their perspective on operations for the rest of the year. According to analysts polled by FactSet, the 500 largest public companies in the US are projected to report a 44% drop in earnings for the second quarter when sweeping lockdown orders ended a decade long economic boom. The resurgence of the virus in many states across the US is dashing hopes for a quick recovery and executives across major industries including travel and leisure, who were bracing for a disruption measured in months, are now thinking in terms of years. They are turning furloughs into permanent layoffs, downsizing production indefinitely and de-emphasising their core businesses.

Attention is also moving to the likelihood of more stimulus measures to bolster the economies in both Europe and the US. Approximately 25 million Americans are set to lose $600 a week each in federal unemployment benefits at the end of the month, which could have a major impact on the revival in consumer spending. When Congress returns to Washington this week to consider another coronavirus relief bill, it is one of the most difficult issues they face, as many people view the payments as a lifeline, and analysts say the $15 billion a week in federal spending has provided crucial support to the wounded US economy. However, critics argue that the money, paid on top of regular state jobless benefits, discourages some Americans from returning to work as businesses try to reopen, thus holding back the recovery.

While in Europe negotiations among leaders for a €1.8 trillion ($2.06 trillion) recovery plan dragged into a fourth day on Monday, leading to heated exchanges and fears of a breakdown. On Friday morning EU leaders had started their first face-to-face summit in five months, hoping to agree a multiyear budget plan pitched at over €1 trillion and a €750 billion economic recovery plan. But, after three days of talks, EU leaders still hadn’t agreed the size of the final plan, how much of it should be available in grants and some of the conditions attached. In an unprecedented step, the recovery plan would be funded by the European Commission, raising hundreds of billions of euros of common debt in the markets, with the intention to prop up the economies worst hit by coronavirus, like Greece, Spain and Italy, without sending their already high debt levels further and thereby allowing them to increase spending now. However, rifts between a group of countries led by the Netherlands, who wanted to limit handouts, and France, Germany and southern countries who want to maintain the proposed €500 billion in grants, proved too strong to bridge on time. (Update: EU leaders agreed on €1.8 trillion ($2.06 trillion) deal in the early hours of Tuesday morning).

The American multinational energy corporation Chevron has agreed to a $5 billion takeover of Noble Energy. The all-stock takeover would be the largest oil-patch tie-up since the coronavirus pandemic shocked the industry. Based in Houston, Noble is an independent oil and gas producer with US and international operations, and including Noble's sizable debt load, the takeover deal would be valued at roughly $13 billion.

Adevinta, a Norwegian company, has agreed to buy eBay's global classified-advertising business in a $9.2 billion cash and stock deal. Adevinta Chief Executive Rolv Erik Ryssdal said "With the acquisition of eBay Classifieds Group, Adevinta becomes the largest online classifieds company globally, with a unique portfolio of leading marketplace brands". eBay's classified-ad unit produced $1.1 billion in revenues last year and primarily operates in Canada, parts of Europe, Africa, Australia and Mexico. Its platforms allow users to post goods and services in their local communities.

The Walt Disney Company has fired ABC News Executive Barbara Fedida after she was placed on leave last month following accusations of racially insensitive comments. An independent investigation confirmed allegations she made insensitive remarks and racial slurs about colleagues, supposedly using terms like "pick cotton", "low rent" and asked which employee would most likely be an "active shooter". She was one of the most powerful executives in television news.

US retailer Walmart has relaunched the planned sale of a majority stake in its UK grocery-store chain Asda Group Ltd. Walmart had put the process on ice in April to focus its attention on managing operations through the coronavirus pandemic. The Asda business was valued at around $9 billion in 2018.

Co-founder and former executive chairman of Alibaba Group Jack Ma's Ant Group Co. plans dual IPOs in Shanghai and Hong Kong. The Chinese technology and financial-services giant's combined offering could be one of the largest in history. It owns the popular mobile-payments network Alipay.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.