4 August 2020

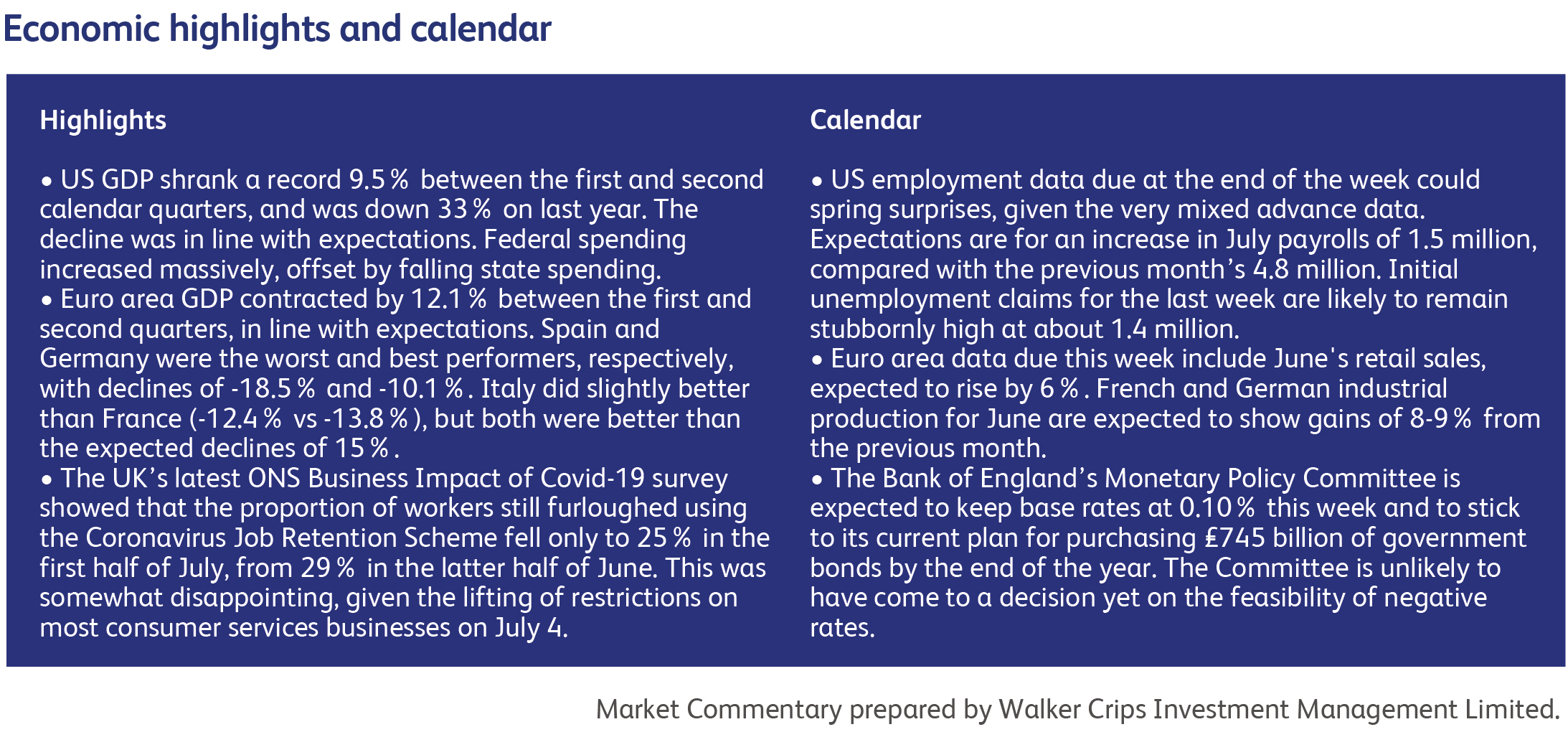

The US is lurching between medical, economic and political crises. Though expected, the drop in economic growth in the second quarter was the worst on record, and the number of people claiming unemployment benefits last week rose by 900,000 to a total of 17 million. The nascent economic recovery is being undermined by the resurgence of the virus across much of the country. Though third-quarter GDP growth should show a sharp initial rebound, speculation is growing that the US economy may even be shrinking again as a result of renewed lockdowns and job losses. Investors are becoming unsettled because crucial economic lifelines, such as the extra $600 in weekly unemployment benefits, are expiring, and lawmakers have made little progress in negotiating a replacement stimulus package. Democrats having proposed a package totalling $3 trillion in government spending, which would surely satisfy investors. Republican counterproposals, which currently total about $1 trillion in spending, would involve a reduction in unemployment benefits that could slow the economic rebound.

The Federal Reserve made no policy changes, as expected, at its latest meeting and remains committed to using its full range of tools to support the U.S. economy. The Fed acknowledged that activity and employment remain “well below” their levels at the beginning of the year. Focusing on the deterioration in real-time data, such as restaurant bookings and on-line travel-related searches, Chairman Powell said, “It looks like we’re seeing a slowdown in the rate of growth,” and noted that "The path of the economy will depend significantly on the course of the virus.” Powell asserted that, should another economic downturn materialise, the Fed has a lot of firepower left, but what else would he say?

Speaking at a Politburo meeting on economic policy, Chinese President Xi Jinping called for China to speed up its new “dual circulation” growth model with a focus on boosting local output, while drawing in foreign investment and stabilizing trade. This is thought to imply a shift away from the export-led growth model towards an economy with stronger domestic drivers of growth. It is also thought to involve strengthening China’s grip on its supply chains and reducing its reliance on foreign suppliers.

Meanwhile, China’s stockmarket is returning to levels of activity and volatility not seen since the boom and bust of 2014 and 2015. Last month, a gauge of Shanghai’s large caps had its best day in five years. Kweichow Moutai Co., the country’s largest stock, set seven new all-time highs in July before losing a record $25 billion in a day. Bullish commentary from state media may have encouraged retail traders to gear up and pile into the market. Next month, China’s ambitions for a slow bull market will be tested when stocks listed in the tech-heavy ChiNext board in Shenzhen will be allowed to rise or fall as much as 20% daily, compared with the current 10% cap. The escalation in China-US tensions makes an interesting backdrop to this speculative fervour.

The Russian Health Minister announced that a research facility in Moscow had completed clinical trials of a vaccine and is preparing to register it. Doubts remain as to whether this is a political, rather than a medical, solution. Doctors and teachers will be the first to find out: they will be the first to be vaccinated, with vaccination of the general public scheduled for October.

Analysts were shocked by oil industry earnings announcements: Exxon Mobil’s $1.1 billion second-quarter loss was the deepest in the company’s modern history and Chevron recorded its weakest performance in at least three decades. Exxon generated zero cash from operating activities during the quarter and said it experienced unfavourable mark-to-market impacts from its nascent derivatives trading operation. European oil companies, such as Royal Dutch Shell and Total, were shielded from losses by their sizeable trading operations.

Apple’s share price rose an extraordinary 10.5% in a single day on Friday, adding $180 billion to the company’s market value, after reporting gains in second quarter revenues and profits that beat expectations. The move takes Apple’s share price return for the last year to 111%; over that period, its profits have risen by approximately 12%.

Apple’s results added to a bonanza for the technology sector last week, with Amazon, Facebook and Google also announcing profits that beat expectations. Amazon’s second quarter revenues smashed expectations, rising to $89 billion versus expectations for $81 billion. Could the tech sector become a victim of its own success? Last week also saw the CEOs of four of the world’s biggest technology giants appear before a congressional subcommittee to answer wide-ranging questions about anticompetitive practices and allegations that they leveraged their powerful platforms to harm competitors.

HSBC’s shares fell after the company announced that earnings had halved to $2.6 billion for the second quarter of the year, disappointing expectations. The bank raised its estimate for 2020 loan losses to $8-13 billion, and is now looking to accelerate plans announced in February to shed 35,000 jobs. Revenue at its wealth and personal banking segment slid 12% in the period, while commercial banking saw a 14% drop. Like rival banks it enjoyed a jump in income from trading amid volatile markets, posting a 24% gain in the global markets division. HSBC’s strategy to pivot away from Europe and the US and expand its business in China faces steepening political challenges.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.